India’s Fintechs Are Ramping up on Acquisitions and International Expansions

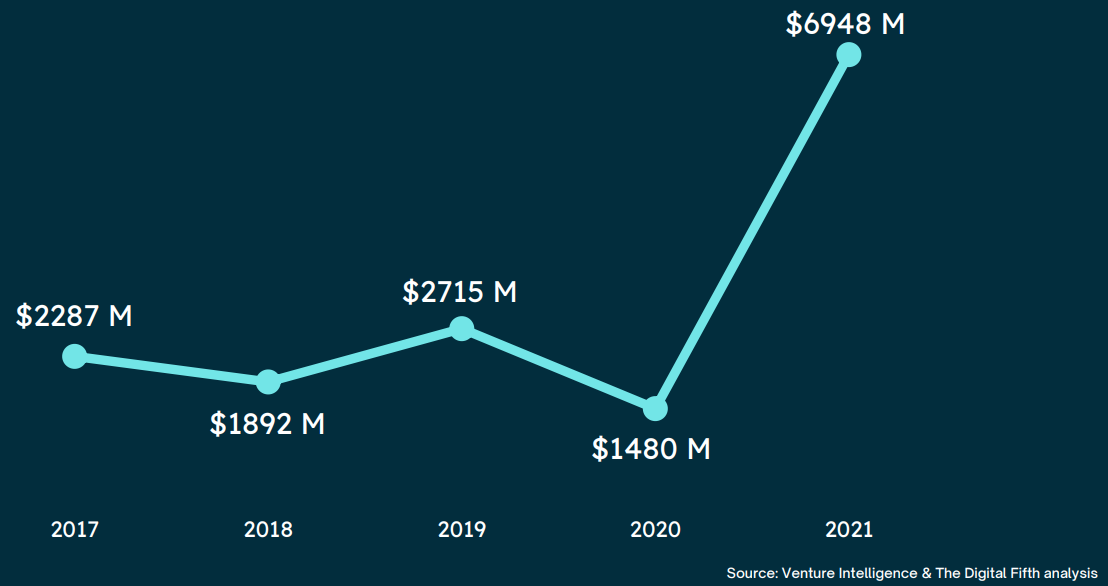

by Fintech News Singapore February 21, 20222021 was a blockbuster year for global fintech funding, exits and unicorn minting, a trend that was also observed in the Indian fintech landscape where players raised a new record of US$6.9 billion, new data released by the Digital Fifth, a fintech consulting and advisory firm in India, show.

India fintech funding over the past 5 years, Source: The Digital Fifth

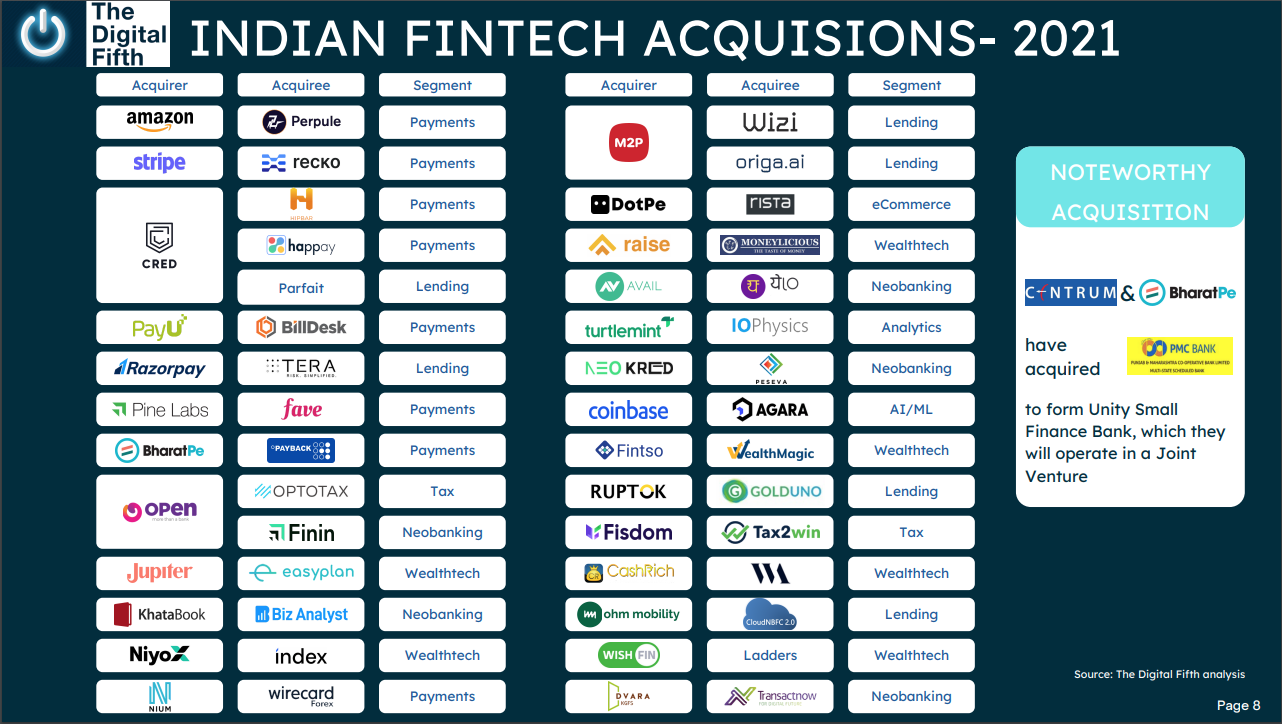

Armed with fresh funding, India’s established and well-funded startups went on acquisition sprees, snapping up smaller outfits to expand their offerings and explore new markets.

Some 30 fintech acquisitions were recorded for the year, according to the advisory firm, with Cred, Open and M2P Fintech being amongst the most prolific.

Indian fintech acquisitions – 2021, Source: The Digital Fifth

Cred, a credit card bill payments platform, and its founder Kunal Shah were the most active in 2021, announcing three buyouts last year: HipBar, a liquor delivery and payment app, Happay, a corporate expense management platform, and Parfait Finance and Investment, a non-banking finance company acquired through Shah’s Newtap Technologies outfit.

Cred, which closed three rounds of funding in 2021 totaling US$547 million. People close to the matter told the Economic Times last month that the company is making a foray into video commerce and group buying as part of its e-commerce offering under Cred Store.

Founded in 2018, Cred is a credit card payment platform that rewards its users for every transaction. The past two years have seen the startup expand its offerings to branch into lending through Cred Cash, as well as community-driven peer-to-peer (P2P) lending with Cred Mint.

M2P Fintech, formerly known as Yap, is another fintech startup that was quite active last year. The company, which provides an API platform for banking and payment products, announced two acquisitions in 2021: Wizi, a credit card sourcing startup, and Origa AI, a business-to-business (B2B) debt recovery platform aimed at borrowers, lenders, and collection agents.

The company said the acquisitions will help it strengthen the plug-and-play model of its platform and bolster its debt management stack. The deals followed a US$10 million funding round it closed in March 2021.

M2P Fintech’s acquisition spree is continuing in 2022 with the startup already announcing this month the buyout of BSG ITSOFT, a provider of core banking solutions. The company said it intends on developing a fully integrated banking and payment stack build on an API-first infrastructure.

Founded in 2014, M2P Fintech is an API infrastructure company that helps businesses connect and roll out their own branded financial products. It claims to be working with more than 500 Internet platforms and financial services providers.

Another Indian fintech startup that made two acquisitions last year is Open, a neobanking platform for small businesses. The company said last year that it was buying out Optobizz, a goods and services tax and financial automation startup, and Finin, a consumer-focused neobank.

The Optobizz deal sought to expand Open’s user base by 800,000 new customers, while the Finin deal was aimed at strengthening its enterprise business and taking it overseas, Open co-founder Anish Achuthan, said.

The company has been working on expanding to areas such as embedded finance and salary accounts for employees.

Founded in 2017, Open provides a platform that integrates all the tools needed for small businesses with a business current account. It claims around 2,000,000 small and medium-sized enterprises (SMEs) on its platform and processes over US$24 billion in gross transaction volume annually. It says it’s adding some 90,000 new customers each month.

Cred, M2P Fintech and Open weren’t the only Indian fintech companies that turned to strategic acquisitions to benefit from synergies, grow faster or tap new geographies. Last year, Pine Labs, a leading merchant platform, and Razorpay, a payment gateway, both made their first international acquisitions, targeting the Southeast Asian region.

Pine Labs acquired Malaysia-based consumer fintech platform Fave in a deal valued over US$45 million. Fave operates across Malaysia, Singapore, Indonesia and India. And Razorpay bought a majority stake in Curlec, another Malaysian fintech firm. Curlec builds solutions for recurring payments for businesses.

Moving forward, the Digital Fifth expects 2022 to see more established, well-funded Indian fintech companies acquiring foreign entities to further international expansion.

In the neobanking space, large players will continue acquiring wealthtech, lending and smaller rivals as they increasingly apply an universal approach, a trend evidenced by Open’s 2021 acquisitions, the report says.

Additional, with so many fintech companies having higher valuation than banks, a few of them may even acquire a bank if available.

Overall, 2022 should see more established Indian fintech companies going on acquisition sprees, considering that 2021 fintech funding activity was largely driven by large Series C+ rounds, which made up over 75% of total funding.