M-DAQ Inks Deal to Buy Wallex on the First Stop of Its Acquisition Spree

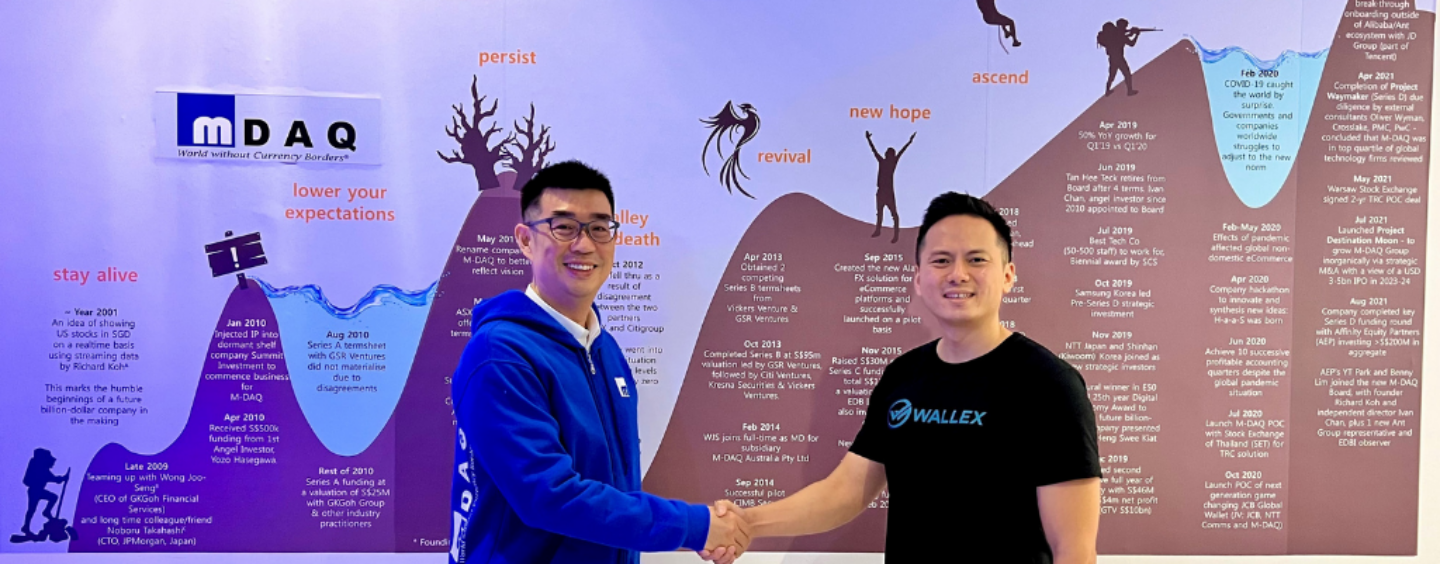

by Fintech News Singapore February 22, 2022M-DAQ, a platform that prices and trades exchange-traded products in a multitude of currencies, has signed an agreement to acquire Wallex, a B2B cross-border payments provider with licenses in Hong Kong, Indonesia, and Singapore.

In addition to the amount paid for the full acquisition, M-DAQ will also be injecting fresh working capital to accelerate Wallex’s business.

The combined entity is expected to process in the excess of S$15 billion (US$11 billion) of Gross Transaction Value this year.

Wallex will continue as an independently operated business and brand, with Hiro Kiga, Co-Founder and COO, appointed as the new CEO.

Through Wallex, M-DAQ’s clients can utilise versatile electronic tools for funds transfers through its existing currency corridors, further improving reporting accuracy and regulatory reporting requirements.

Meanwhile, Wallex’s customers can enhance their FX experience through the M-DAQ proprietary solution, Aladdin, that can provide guaranteed FX rates and achieve more competitive pricing through the aggregation and algorithmic capabilities that M-DAQ offers.

Richard Koh

Richard Koh, Founder and Group CEO of M-DAQ said,

“We are excited to welcome Wallex into the M-DAQ Group to strengthen our footprint in the payments space by reaching a wider range of SMEs and their customers as we look to provide additional value and cost reductions to their businesses.

Both organisations will continue with their aggressive hiring to scale further.”

Hiro Kiga

Hiro Kiga, Co-founder and CEO of Wallex said,

“At Wallex, we have always strived to deliver the most cost-efficient, fast, and secure payment solutions for global businesses.

The combination of Wallex’s network and M-DAQ’s fintech expertise will enable us to deliver greater value to empower businesses across borders.”

The acquisition is the first of a series for M-DAQ, as it embarks on a global growth plan to capture market opportunities and expand its downstream reach in the value chain.

The company added that it is investing in building an ecosystem that complements the core FX business.

In this instance, M-DAQ will be the upstream FX provider to supply Wallex with the necessary liquidity it needs to run its core payments business.

This B2B2b2C business model is an ecosystem of businesses that complements each other, reduces duplication, increases efficiency, and ultimately reduces transaction costs for the end clients, as economies of scale are materialised.