Digital Technologies And Fintechs to Drive Financial Inclusion in Asia

by Fintech News Singapore October 10, 2016With an estimated 2 billion adults and 200 million micro, small and midsize businesses (MSMEs) worldwide considered as unbanked or underbanked, financial inclusion has emerged as a critical development challenge and an opportunity for fintechs.

The unbanked are those who are not served by a bank or similar financial institution. Along with the underbanked, they may rely on alternative financial services for their financial needs, where these are available.

Asia and Africa have the highest rates of unbanked population. These populations represent 21% of China’s total population, 47% in India and 64% in Indonesia.

In Southeast Asia, there are 642 million financial excluded adults and 39 million MSMEs that are underserved or unserved by credit services, according to McKinsey and Company.

In Southeast Asia, there are 642 million financial excluded adults and 39 million MSMEs that are underserved or unserved by credit services, according to McKinsey and Company.

In emerging economies, most people and small businesses do not fully participate in the formal financial system: they mostly transact in cash, often have no safe way to save or invest money, and have no access to credit beyond informal lenders and personal networks.

Emerging markets’ young “tech-savvy” populations as well as the growing Internet and mobile penetrations, have made these locations the perfect fit for fintechs and other providers that are leveraging digital platforms and mobile technologies to offer financial services.

In a new report, titled ‘Digital Finance For All: Powering Inclusive Growth in Emerging Economies,’ McKinsey Global Institute points out three ways in which digital technologies can offer “transformational solutions.” These solutions have the potential to transform the economic prospects of emerging economies and benefit individuals, businesses and governments.

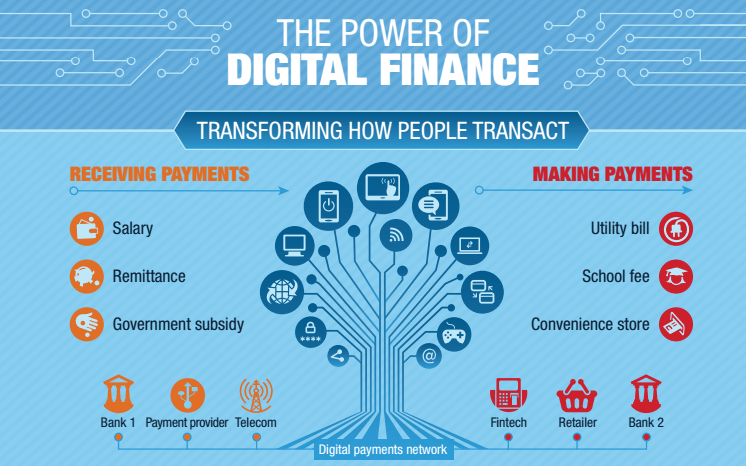

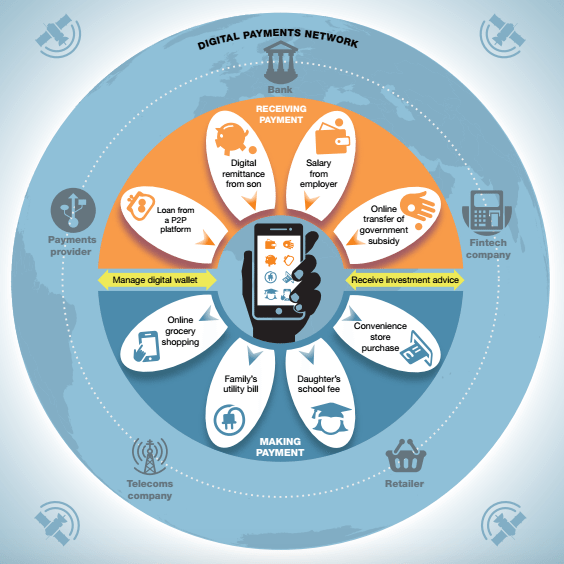

First, digital finance solutions can expand customers’ access and the reach of providers. An example is mobile phones, which have allowed for the development and growth of mobile-money accounts as well as mobile-based remittance services in countries such as Kenya, Tanzania and Uganda.

A relevant example is M-Pesa, a popular mobile finance platform in Kenya and Tanzania widely known for bringing financial services to millions of previously unbanked and unbankable individuals.

In China, Ant Financial‘s Alipay is the country’s leading online payment platform with some 270 million monthly active mobile users who are making an average of 80 million transactions everyday.

Secondly, digital technologies, notably mobile payments and relevant technologies, have the potential to lower the cost of providing financial services by 80 to 90%, the report claims, transforming the economics for providers and making it profitable for the first time to serve poorer and more remote consumers. Ultimately, this would lead to lower prices for users, both individuals and businesses.

Finally, digital technologies allow for new business models, expanded services to customers and potential new revenue streams to providers.

“Every step toward full digitization of financial services helps reduce costs, making it profitable for providers to serve a much larger range of customers,” the report says.

“As the network of digital payment users grows, economies of scale drive down costs, and even more people are able to join. These powerful network effects are an opportunity and a challenge—an opportunity because once there are sufficient people active in a financial system, they drive accelerating growth; a challenge because providers need to create a broad spectrum of products to get customers to use them actively.”

The firm estimates that digital finance could potentially provide access to financial services for 1.6 billion people in emerging markets and increase the volume of loans extended to individuals and businesses by US$2.1 trillion.

Digital financial could boost annual GDP of all emerging economies by US$3.7 trillion by 2025 with nearly two-thirds of the increase coming from raised productivity of financial and non-financial businesses and governments as a result of digital payments.

“Businesses and government leaders will need to make a concerted effort to secure these potential benefits,” the report advises.

“Three building blocks are required: widespread mobile and digital infrastructure, a dynamic business environment for financial services, and digital finance products that meet the needs of individuals and small businesses in ways that are superior to the informal financial tools they use today.”

Featured image: Hand holding smartphone by ESB Professional, via Shutterstock.com.