APAC Has a Huge Appetite for Banking as a Service, Finastra Research Shows

by Fintech News Singapore March 29, 2022Financial services software and cloud solutions provider Finastra’s research found that APAC’s appetite for Banking as a Service (BaaS) exceeds that of EMEA and the Americas.

The report found that 88% of senior executives across APAC in a number of sectors (including banking, healthcare, retail and technology) said they are already implementing BaaS solutions or are planning to, compared with 80% in EMEA and 87% in the Americas.

The research “Banking as a Service: Outlook 2022 | Paving the way for Embedded Finance” canvassed the opinions of 1,600 senior industry executives, exploring the opportunities presented by Banking as a Service (BaaS).

Other key findings

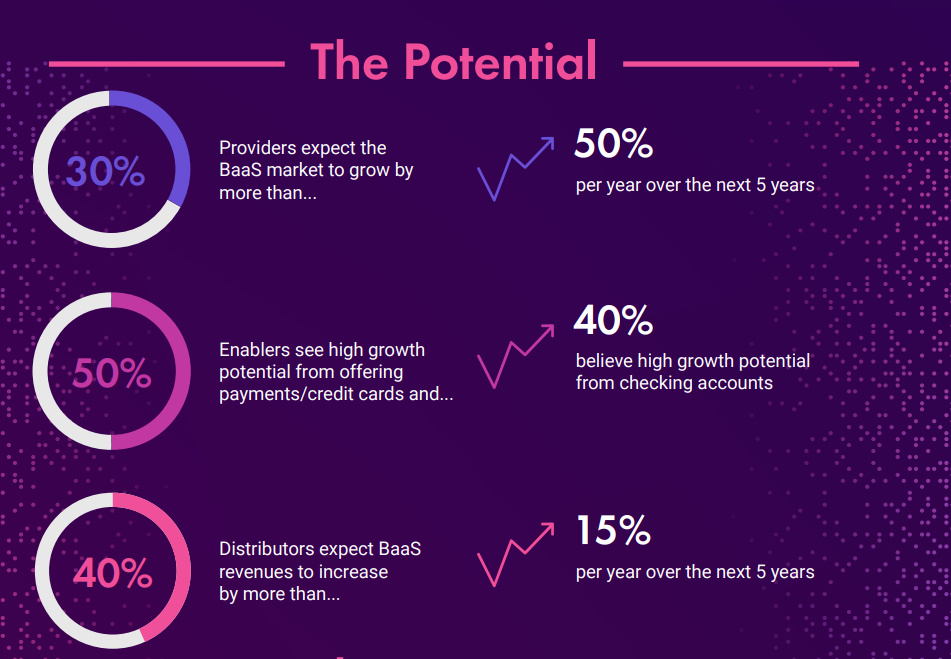

Globally, more than 80% of regulated financial services providers expect the overall BaaS market to grow. Of these, 30% expect it to grow by more than 50% per year over the next five years.

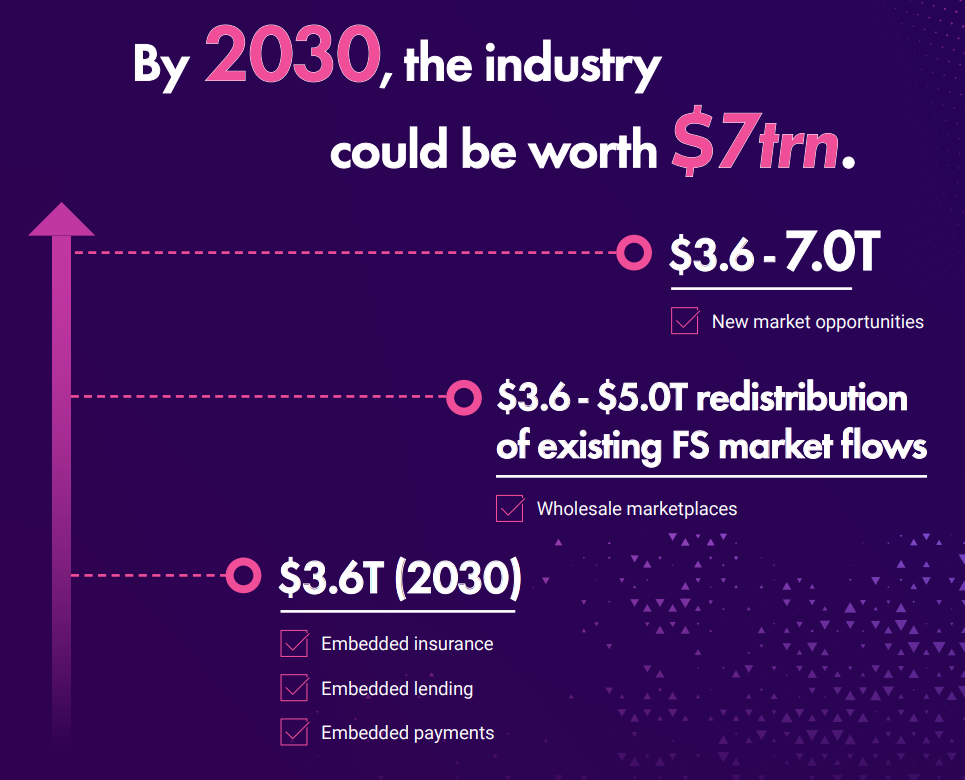

BaaS represents a US$7 trillion opportunity – distributors, including retailers, e-commerce firms and other consumer brands, are migrating towards BaaS solutions and expect overall growth to exceed 70% per year over the next three years globally.

The report found that 60-70% of distributors want to increase their spending on financial partnerships (including BaaS).

Additionally, over 46% of APAC distributors – the consumer brands that supply embedded financial products to consumers at the point of need – currently offer, or plan to offer, credit cards to their customers using BaaS, with other popular offerings including savings accounts (41%) and payment cards (38%).

Distributors are spending US$10-$50 million per year on financial products and service partnerships across APAC – a high level of spending which is expected to be sustained throughout 2022.

Angus Ross

Angus Ross, Chief Revenue Officer, Banking as a Service at Finastra said,

“There’s no doubt that BaaS is an incredibly exciting opportunity for the entire financial services ecosystem. Financial institutions can reach a greater number of customers at significantly lower cost, while distributor brands can open up new lines of revenue and build deeper relationships with their customers.

It’s clear from our research that consumers (retail or corporate) are changing where they source financial services and shifting to non-bank channels. This trend will only accelerate as integrating regulated products into the customer journey becomes as simple as creating a social media account.”

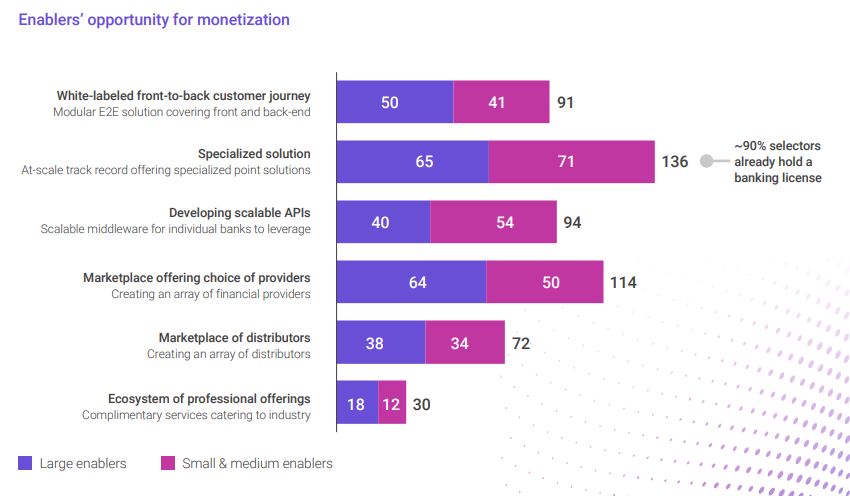

Finastra’s research also assessed the monetisation strategies of distributors, enablers and providers in BaaS, and explored the importance of partnerships.

All respondents were in favor of a transition to a platform and marketplace model, where a greater range of niche solutions at competitive prices can be sourced by end customers.

Finastra’s research shows that financial services providers need four key capabilities to work with distributors and enablers and to monetise BaaS.

From a technology perspective, these include; an open API platform; an integrated data and analytics platform; and specialised digital solutions to seamlessly integrate customer journeys,

From a product perspective, providers need dynamic and compelling offerings to entice customers.