India’s Insurtech Scene Sees Record Breaking Year for Funding

by Fintech News Singapore May 10, 20222021 was a record-breaking year for India’s insurtech industry which saw equity funding volume more than double and two startup reaching unicorn status.

Moving forward, the industry is set to grow even more, on the back of supportive initiatives and rising demand among new customer segments, according to a new report by the Boston Consulting Group and the India Insurtech Association.

The report, titled India Insurtech Landscape and Trends, looks at the growth the industry witnessed in 2021 and identifies the current trends in the sector. According to the paper, India’s insurtech industry recorded strong growth in 2021, driven by a dynamic funding landscape and propelled by the country’s key characteristics, including its low penetration rate of insurance products.

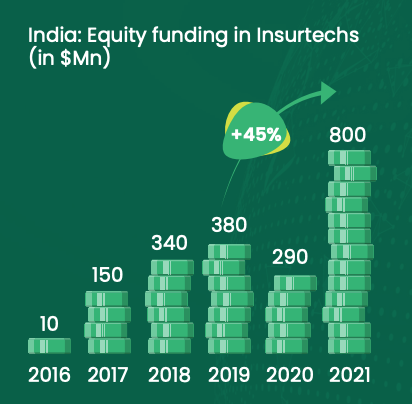

In 2021, Indian insurtech companies raised a total of US$800 million in equity funding. This is more than 2019 (US$380 million) and 2020 (US$290 million) funding sums combined.

India: Equity funding in Insurtechs (in $Mn), Source: India Insurtech Landscape and Trends, BCG/India Insurtech Association, April 2022

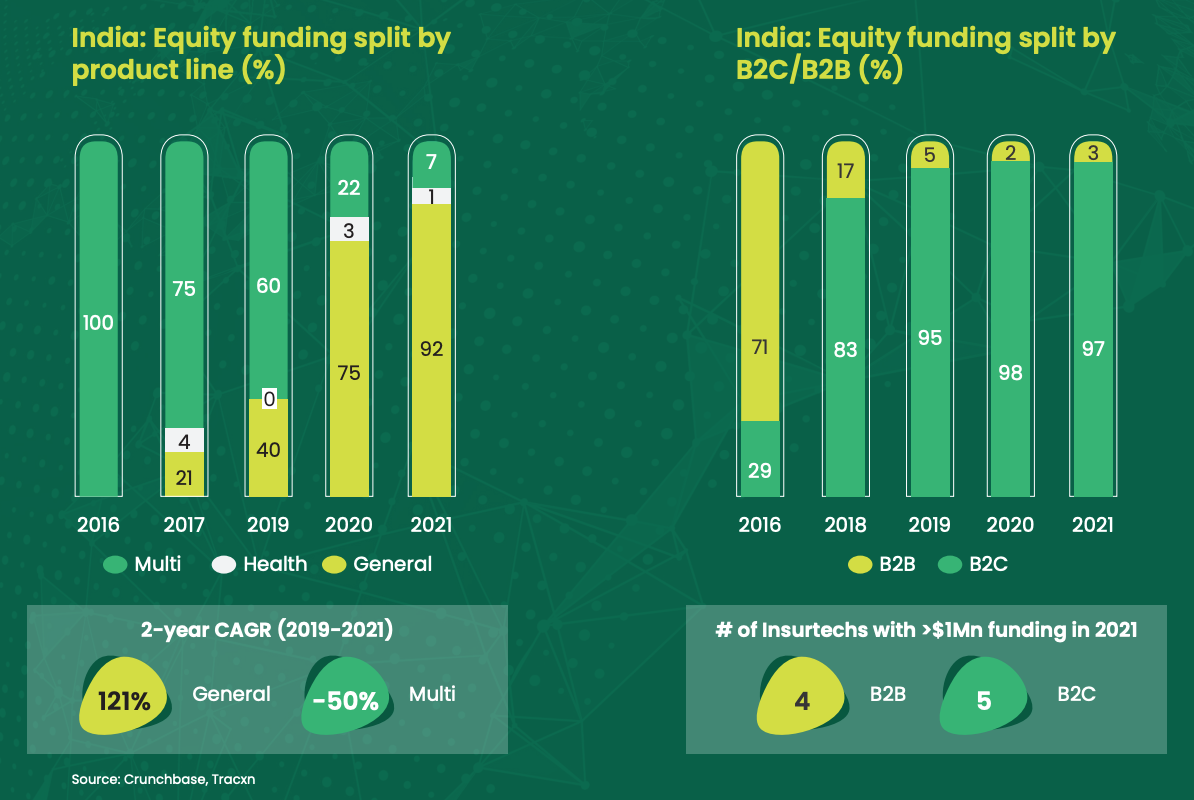

The momentum was led by insurtech companies providing general insurance or non-life, and operating under a business-to-consumer (B2C) model. These categories represented 92% and 97% of 2021’s total equity funding amount, respectively.

India insurtech equity funding split by product line and B2C/B2B, Source: India Insurtech Landscape and Trends, BCG/India Insurtech Association, April 2022

India’s new insurtech unicorns and fast-growing startups

Booming funding activity in 2021 pushed valuations to new heights and turned two Indian insurtech companies into unicorns.

Acko reached a US$1.1 billion valuation after closing a US$225 million Series D in October. Founded in 2016, the company claims it is one of India’s first digital-native insurers and among the country’s top embedded insurance providers, having inked partnerships with top digital platforms including Amazon, MakeMyTrip, Ola, Urban Company and Bajaj Finance.

Acko, which provides motor/vehicle insurance, coverage for electronic devices, and health insurance, said at the time that it was serving over 70 million customers, clocking a run-rate of approximately US$150 million in premiums. The company said it will use the proceeds from its Series D to invest in the healthcare vertical and scale its team.

Besides Acko, and more significantly, Indian insurtech startup Digit Insurance saw its valuation almost double in a six month period, which surged to US$3.5 billion in July 2021 after closing a US$200 million round.

Founded in 2017, Digit Insurance offers health, car, bike, and travel insurance, using technology to simplify processes for customers. As of mid-2021, Digit Insurance claimed 20 million users and had processed more than 400,000 claims. In 2020, the company grew by 44%, with a total of INR 3.2 billion (US$42.9 million) in premiums recorded between April 2020 and March 2021.

Digit Insurance said it will be using the proceeds from the fundraising to continue to focus on increasing insurance penetration and enrich its portfolio.

In addition to Acko and Digit Insurance reaching a billion dollar valuation, 2021 also saw several other smaller insurtech players gain strong traction. Invictus Insurance, the operator of insurtech platform Turtlemint, raised a US$46 million Series D in March 2021. This was followed in April 2022 by a US$120 million Series E at a US$900-950 million valuation.

The company said it will be using the capital to expand into new geographies, like Southeast Asia. Recently it expanded into the Middle East.

Founded in 2015, Turtlemint is platform that helps financial advisors understand and distribute insurance to their community of customers. It claims to have onboarded 160,000 advisors so far.

RenewBuy is another Indian insurtech startup that secured funding last year, closing a US$45 million Series C in June to scale technology, add more products and expand its digital network.

RenewBuy, through its subsidiary D2C Insurance Broking, enables retail customers to buy motor, health and life insurance products with a superior end-to-end digital experience. The company claims more than 2.5 million customers across 650 cities and towns, and a network of 50,000 point-of-sale persons.

OneAssist is the third insurtech startup highlighted in the report for witnessing strong growth and receiving investment in 2021. In September, the company closed a INR 2.4 billion (US$31.4 million) Series E for the growth of and expansion of its business.

Founded in 2011, OneAssist offers accidental and liquid damage protection along with extended warranty and theft protection to electronic devices. The company operates in over 615 cities and claims 3 million customers and over 1,000 service agents on its platform.

Growth drivers

Despite the tremendous growth the sector experienced in 2021, the momentum is projected to continue this year onward, building on the emergence of new customer segments, favorable market conditions and initiatives from government bodies to support innovation and financial inclusion.

According to the report, micro, small and medium-sized enterprises (MSMEs), women and tier 2 locations will become the industry’s next growth driver.

In addition, several product segments remain largely untapped including health and life insurance where penetration rates currently stand at 35% and 3%, respectively. This leaves plenty of space for growth, the report says.

Finally, enablers including the India Stack and the upcoming National Health Stack will further provide thrust to the insurance industry, facilitating innovation and boosting adoption of insurtech.

First proposed by the government back in 2018, the National Health Stack seeks to develop the technology backbone for digital health infrastructure in India. The system will serve multiple parties with different levels of involvement, providing, for instance, digitized health records for patients, a health claims exchange for insurers, a health facility registry for doctors, a drug registry, and access to data for hospitals to consume and process.