Since the beginning of the pandemic, webinars and online events have become a quick and effective way for professionals to build their knowledge and keep up with industry developments.

Although governments and businesses have since removed some physical restrictions, these online events have maintained their popularity as businesses realized they are now able to reach a broader audience.

For fintech entrepreneurs, professionals and investors located in Asia, we’ve compiled a list of the top upcoming webinars to watch live. These virtual events are meant to help viewers learn about some of the hottest fintech trends and biggest opportunities out there.

Alibaba Cloud Day Philippines: Fintech Summit 2022

June 21, 2022, 14:00 (GMT +8)

The Philippines has been at the forefront of the global Fintech industry, as it thrives more than ever, concurrently with the rise of game-changer platforms and trends, and ever-changing industry policies and compliance. According to Statista, Filipino users will skyrocket up to 58M by 2026, just for Digital Payments alone.

Join the Alibaba Cloud Day Philippines: Fintech Summit 2022 to learn the latest policies, trends, challenges in the industry, as well as the Alibaba Cloud’s Fintech Roadmap which can help your organization to accelerate the digital transformation.

Register Here: https://ph.alibabacloud.com/

Alibaba Cloud Fintech Online Day Hong Kong 2022

June 16, 2022, 2:30 PM – 5:00 PM (GMT +8)

From the emerging trend in NFT, metaverse and web3.0 to the innovative financial technology and regulatory challenges, Fintech Online Day Hong Kong 2022 will bring you the best practices of Fintech and Regtech and how Alibaba Cloud Fintech Roadmap helps both traditional financial institutions and Fintechs to adapt to the changes of future.

Register Here: Alibaba Cloud Fintech Online Day Hong Kong 2022

Digital Identity: New Realities for Financial Services in 2022

June 9, 2022, 11:00 (GMT +8)

At the heart of the digital revolution for the financial services industry is digital identity. From creating seamless customer experiences to battling cybersecurity threats, getting your digital identity strategy right is crucial.

However, getting digital identity right is no easy task, in this panel industry practitioners will deep dive into the latest practices, trends and developments.

- Evolution of digital identity in Asia

- The role of digital identity in shaping customer experience across all channels

- Securing customer data and privacy

Panelists:

- Felimy Greene, COO/Global Head of Onboarding, Standard Chartered Bank

- Kendrick Lee, Director, National Digital Identity, Government Technology Agency of Singapore

- Arsalaan (Oz) Ahmed, Chief Executive Officer, Al Rajhi Bank Malaysia

- Ajay Biyani, Regional Vice President, ForgeRock

Moderator:

Vincent Fong, Chief Editor, Fintech News Network

Register here: https://fintechnews.sg/

Accelerate Bootcamp Demo Day

June 03, 2022, 18:30 – 20:00 pm (GMT+8)

Accelerate is a 100-day bootcamp focused on driving and accelerating the growth of high-potential startups in Brunei.

The bootcamp was held over 100 days, to equip startups with key capabilities through curated workshops and masterclasses, dedicated coaching and mentorship, and networking sessions to scale across the region.

As the finale of the bootcamp, the demo day will take place on June 03, 2022 from 18:30-20:00 (GMT+8), in which the cohort of startups representing sectors including food and beverage (F&B), fintech, retail and more, will be pitching online to receive further support for their growth and potentially forge partnerships with other industry stakeholders.

Rise Presents: Decoding Buy Now, Pay Later

June 02, 2022, 16:30 – 17:30 (IST)

How we shopped yesterday is not how we shop today; how we spent yesterday is not how we spend today, because consumer behaviors and spending patterns have changed drastically over the years, with massive shifts in the way consumers transact. This paradigm shift has in turn seen the rise of buy now, pay later (BNPL).

On June 02, 2022, Rise India will be hosting a panel discussion exploring the booming BNPL sector. Participant will get to hear from Industry experts as they decode the hot emerging trend in fintech of BNPL. This session will look at the reasons for the momentous rise of BNPL in India and explore how it’s going to play out in the future.

Panelists:

- Taranjit Singh Jaswal, MD & Head of Corporate Banking, Barclays India;

- Vikram Pandya, Director, Fintech, SP Jain School of Global Management;

- Nalin Agrawal, Co-Founder & CEO, Snapmint;

- Balu Ramachandran, Chief Business Officer, Simpl; and

- Yashoraj Tyagi, CBO & CTO, CASHe.

SOSV Chinaccelerator 21 Demo Day Livestream

May 25, 2022, 15:00 – 18:30 (GMT +8)

On May 25, 2022, SOSV Chinaccelerator will be hosting a virtual demo day, showcasing the eight breakthrough startups from Asia, Middle East and North Africa (MENA), Pakistan, as well as Latin America (LatAm), that took part in the program’s 21st edition.

Operating in quick commerce, healthcare, mobility, entertainment and fintech, the startups chosen for this cohort are changing the way we shop, play and dine while eliminating billion-dollar inefficiencies in traditional industries.

They are:

- Esports XO, India’s esports software-as-a-service (SaaS) platform that enables game publishers and brands to launch custom tournaments;

- LorryZ, MENA-Pakistan’s freight network that connects cargo owners with trucking companies for on-demand transportation solutions;

- Major Map, an artificial intelligence (AI) solution for students in South Korea to find the most suitable colleges and majors;

- Mi Doc Online, LatAm’s app for video consultations with trusted medical professionals anywhere in the world;

- MoveIt, a fleet-management solution to Pakistan’s intra-city logistics problems;

- Smartbite, a tech-enabled business-to-business (B2B) solutions for corporate catering, trusted by Southeast Asia’s biggest multinational corporations;

- Trikl, Pakistan’s personal-finance app for Millennials to save, invest, and play to earn; and

- InstaWorld, a quick-commerce solution to optimize last-mile deliveries in Pakistan.

Chinaccelerator is a startup development program for enterprise-tech and consumer-tech, with over 240 corporate partners and 100 million consumers in its ecosystem. The program is part of SOSV, a US venture capital fund with US$1.2 billion in assets under management and over 1,120 portfolio companies as of April 2022.

SOSV’s Internet portfolio includes crypto-product trading platform BitMEX, Google-backed AI English pronunciation assistant ELSA; Samsung-backed video publisher Flickstree; APAC’s online tutoring platform Snapask; and China’s luxury brand management group Ushopal.

NFT | Fintech | Metaverse Series: You Are Your Own Bank

May 25, 2022, 15:00 – 17:00 (GMT +8)

Decentralized finance (DeFi) is a multi-billion-dollar movement involving several intermingled concepts. At its core, it is blockchain-based and uses an immutable, trustless computer network that verifies transactions without human intervention. Most of the Ethereum-based decentralized exchange (DEX), which allows people to swap tokens that run on the Ethereum network.

Individuals can also earn money on the platform by providing liquidity by locking up tokens they own; others can then borrow the tokens and pay interest to the liquidity providers. All of this is using smart contract code without human intervention.

During this webinar, hosted by the Hong Kong Wireless Technology Industry Association, experts from ONC Lawyers, Hoplite Technology and Clema Risk Solutions, will explore the opportunities as well as legal issues and security with DeFi.

Speakers:

- Dominic Wai, Partner, ONC Lawyers;

- Antony Ma, CEO and Founder, Hoplite Technology Limited; and

- Laurent Charlier, Managing Director, Clema Risk Solutions.

Moderator: Donald Chan, Vice Chairman, Hong Kong Wireless Technology Industry Association

How to Build a Bank That Filipinos Love

May 25, 2022, 11:00 (GMT +8)

Let’s face it, consumers aren’t excited about banking products the same way we are.

In order for banks to get ahead of its competitors, they need to help their customers get ahead of life.

In this webinar, hosted by the Fintech News Network, experts from RCBC, Philippines National Bank, Tyme and Backbase, will explore how Filipino banks can leverage digital technologies to stand out from the rest and become the bank that customers truly love.

Topics covered will include:

- Rethinking customers engagement in the digital age;

- Designing the right customer journey; and

- Delivering hyper personalized experiences and solutions.

Panelists:

- Eugene S. Acevedo, President and CEO, RCBC

- Paolo Eugenio J. Baltao, SVP and Special Assistant to the President on Digital Bank Initiative, Philippine National Bank

- Rachel Freeman, Chief Growth Officer, Tyme

- Riddhi Dutta, Regional Head for ASEAN & South Asia, Backbase

Register here: Fintechnews.ph

Fintech Adoption in Indonesia: Patterns, Constraints and Enablers

May 24 2022, 10:00 – 11:30 (GMT +7)

The COVID-19 pandemic has arguably increased the usage of digital technology, leading to accelerated changes in consumers’ behaviors as more people choose to perform certain types of economic activities through online platforms. Fintech is thus increasingly seen as the preferred platform for engaging financial services in recent years.

Furthermore, the rise of new fintech startups within Indonesia has also brought about new innovations and stabilized the various technologies as well as business processes in the fintech field.

However, the rapid uptake and development of fintech have also led to various positive and negative social and psychological implications for users, ranging from increased literacy to cyberphobia.

This webinar will share the key findings from an online survey on Indonesians’ experiences and perceptions of fintech tools, conducted in the Greater Jakarta area from November to December 2021. The possible impacts of fintech usage, as well as their considerations for fintech adoption among end-users, will also be discussed in this webinar.

Speakers:

- Astrid Meilasari-Sugiana, Senior Lecturer at Universitas Bakrie’s Political Science Department; and

- Siwage Dharma Negara, Senior Fellow and Co-Coordinator of the Indonesia Studies Programme at ISEAS – Yusof Ishak Institute.

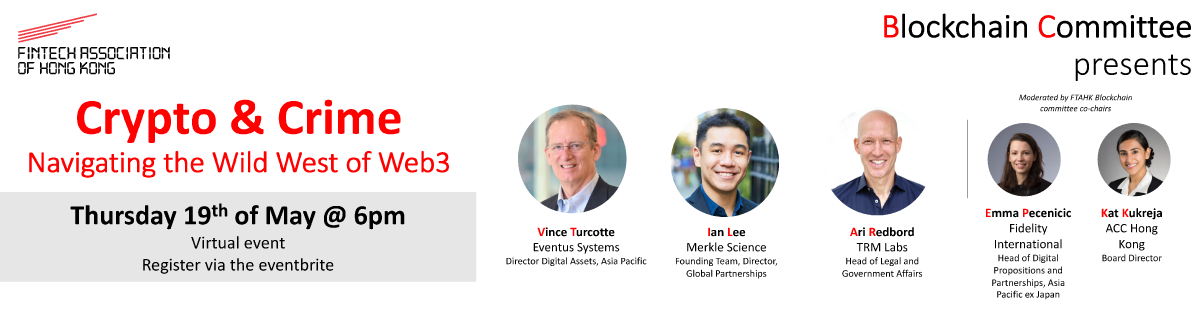

FTAHK Blockchain Committee Presents: Crypto and Crime

May 19, 2022, 18:00 PM – 19:00 (GMT +8)

FTAHK’s Blockchain Committee will be hosting its monthly meeting on May 19, 2022, delving into the dangers of cybercrime in the emerging crypto asset industry.

The webinar will feature Vince Turcotte, Director Digital Assets Asia Pacific, Eventus Systems; Ian Lee, Founding Team, Director, Global Partnerships, Merkle Science; and Ari Redbord, Head of Legal and Government Affairs, TRM Labs.

The panel discussion will be moderated by Emma Pecenicic, Head of Digital Propositions and Partnerships, APAC ex Japan at Fidelity International, and Kat Kukreja, Board Director at ACC Hong Kong.

Market Sentiment Update: What Q1 2022 can tell us about the second half of the year and beyond

May 19, 2022, 14:00 (GMT +8)

According to data from the Deals Barometer, startups in China and India have raised over US$12 billion in Q1 2022, and in Southeast Asia, the figure stands north of US$5 billion.

However, even as the threat of the pandemic recedes, other risk factors are emerging: prominent among them being rising inflation, the discouraging post-IPO performance of many Asian startups, SPACs finding fewer takers, and geopolitical uncertainties.

What will the dominant themes be through the rest of 2022 and beyond? What is the outlook on listing? Will the desire to remain private for longer result in an uptick in M&A activity, and with the era of big easy money believed to be drawing to a close, how does this affect fundraising?

These are just some of the subjects that we will be addressing in DealStreetAsia’s next webinar scheduled for 14:00 SGT on May 19, 2022, Market Sentiment Update: What Q1 of 2022 can tell us about the second half of the year and beyond.

DealStreetAsia will present perspectives from private capital investors and professionals connected to the world of dealmaking to offer a data-driven view of the opportunities, and how canny investors and startups can navigate the pitfalls that almost certainly lie ahead.

Speakers:

- Conrad Tsang, Founder and Chairman, Strategic Year Holdings Limited;

- Rishika Chandan, Managing Director, Venturi Partners;

- Dimitra Taslim, VP, GGV Capital; and

- Peter McMillan, Managing Director and Head of Sales, APAC, Donnelley Financial Solutions (DFIN).

Moderator: Joji Thomas Philip, Founder and Editor-in-Chief, DealStreetAsia

FTAHK Digital Banking and Payments Committee Presents: Digital Banking Ecosystems

May 18, 2022, 19:00 – 20:00 (GMT +8)

Digital banking has to be more than simply creating faster, cheaper, or prettier services. Ecosystems extending beyond the scope of traditional banking are at the core of data-driven offerings, hyper personalization, and lifestyle propositions.

The Fintech Association of Hong Kong (FTAHK)’s Digital Banking and Payments Committee will be hosting its monthly meeting on May 18, 2022, exploring digital banking ecosystems.

During this panel discussion, moderated by Raphael Jansa, General Manager, FTAHK, and Jessica Liu, Co-chair of the Digital Banking and Payments Committee, FTAHK, Maggie Yung, Head of Digital, Customer Experiences and Ecosystems of DBS Bank; Gary Lam, CTO of Livi Bank; and Marc Entwistle, Board Member of FTAHK, will share their insights on how banks are leveraging on digital ecosystems to enhance customer experiences, acquisition and engagement.

Bringing Fintech and Startups Into AI Engagement Economy

May 18, 2022, 14:00 – 15:30 (GMT +8)

The Bringing Fintech and Startups Into AI Engagement Economy webinar, taking place on May 18, 2022, will feature top fintech experts and policymakers in Indonesia to discuss the future of Islamic fintech.

Experts representing the likes of Kneks, Princeton University, Indonesia Waof Board, LBB International, AAOIFI, Alami Group and Emstartups.ai, will share their experience and vision for Islamic fintech, Islamic crowdfunding, Halal tech, Takaful tech, Waqf Tech, and more.