Banks Are Increasingly Embracing Crypto As It Moves into the Mainstream

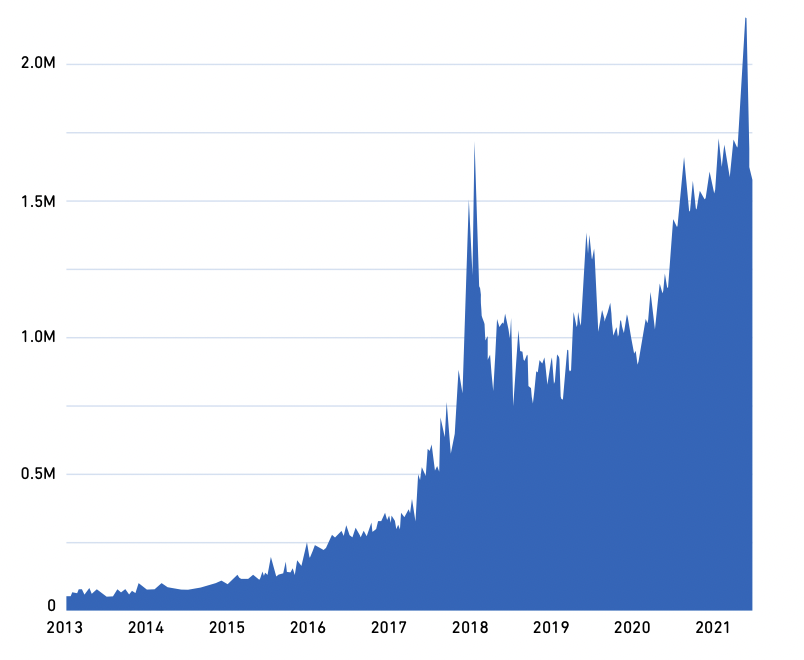

by Fintech News Singapore July 6, 2022The past year has seen cryptocurrency adoption and trading surge. Total transaction reached US$15.8 trillion in 2021, up 567% from 2020, and the number of crypto holders has increased to an estimated 300 million, indicating that digital currencies steadily moving into the mainstream, a new whitepaper by Banking Circle, a business-to-business (B2B) banking services provider, says.

The paper, looks at the state of crypto, highlighting the sector’s growth and demonstrating the increasing opportunity open to banks.

According to the report, while non-bank financial institutions (NBFIs) including crypto exchanges and specialist acquirers have embraced the move towards crypto relatively quickly, banks on the other hand have been slower to engage in the space despite having inherent advantages over NBFIs.

By the end of 2021 there were 1.5 million cryptocurrency transactions every day

Banks are directly engaged with the clearing and settlement system, putting them in the ideal position to act as the bridge between the fiat and crypto environments, the paper says.

All evidence point to a future where digital currencies are fully integrated into the financial landscape, it says, pointing to regulatory developments, advances in central bank digital currencies (CBDCs) research and deployment, and involvement of bigtechs in the space.

Regulators around the world continue to push ahead and release statements regarding future regulation of crypto. In parallel, central bank digital currencies (CBDCs) and cryptocurrencies linked to reserve currencies are growing in popularity.

To prepare for the widespread adoption of digital currencies, Banking Circle advises incumbents to start working with third parties as part of their ongoing digitalization strategy.

In particular, banks should consider establishing connectivity with crypto exchanges and wallets. By developing payment service infrastructures that seamlessly integrate with crypto services, banks can enable customers to access cryptocurrency funds held on exchanges from within their digital estate, adding value for their customers and potentially generating revenue by linking the two environments, the paper says.

In addition, banks can use blockchain and digital currencies themselves, applying these technologies to areas such as cross-border payments. Rising traction of products like Ripple’s RippleNet network is evidence of banks’ interest in harnessing technology to make international fund transfers more efficient.

RippleNet is a decentralized network that allows financial institutions to send money globally, instantly, reliably and for fractions of a penny. So far, more than 300 financial institutions have joined RippleNet, the company claims, leveraging Ripple’s technology and products for commercial use cases including e-invoicing, international supply chain payments, global currency accounts, real-time remittances and international peer-to-peer (P2P) payments.

Banks embrace crypto

These past years have seen banks rapidly embracing crypto and blockchain. Recent data from LinkedIn show that several major banks, including Deutsche Bank, Wells Fargo, Citigroup, Barclays, Credit Suisse and UBS, have been beefing up hiring for their digital asset teams, with three times as many crypto jobs on the social networking platform in 2021 than in 2015.

According to CNBC, JPMorgan currently has one of the largest crypto teams, with more than 200 employees working in its Onyx division, the unit responsible for researching and developing blockchain and digital currency products and services.

In Singapore, DBS has been amongst the earliest adopters of the technology. In August 2021, the bank publicly launched its DBS Digital Exchange (DDEx), a members-only digital asset exchange that provides corporate and institutional investors, accredited investors, and family offices who bank with DBS with access to digital assets, including security tokens and cryptocurrencies.

DDEx also offers an ecosystem for businesses to securitize real and financial assets into digital tokens for listing and trading, providing companies with access to alternative fundraising from qualified investors.

DBS says it witnessed strong traction for the first full year of operations of DDEx with over S$1 billion in trading value recorded.

In the public sector, Singapore’s central bank too has been engaging in a number of experiments and initiatives involving blockchain technology and digital currencies, exploring areas such as wholesale CBDCs, retail CBDCs and asset tokenization.

Featured image credit: Unsplash