Singapore Fintech Funding Hits 3-Year High at US$2.14B, Payments Takes the Spotlight

by Fintech News Singapore September 7, 2022Fintech funding in Singapore hit a three-year high in the first half of 2022 (H1’22) with US$2.14 billion, though still less than the US$2.51 billion recorded in the second half of 2021 (H2’21), according to KPMG’s Pulse of Fintech H1’22 report.

However, funding rose by 64 percent from US$1.31 billion when compared to the first half of 2021 (H1’21).

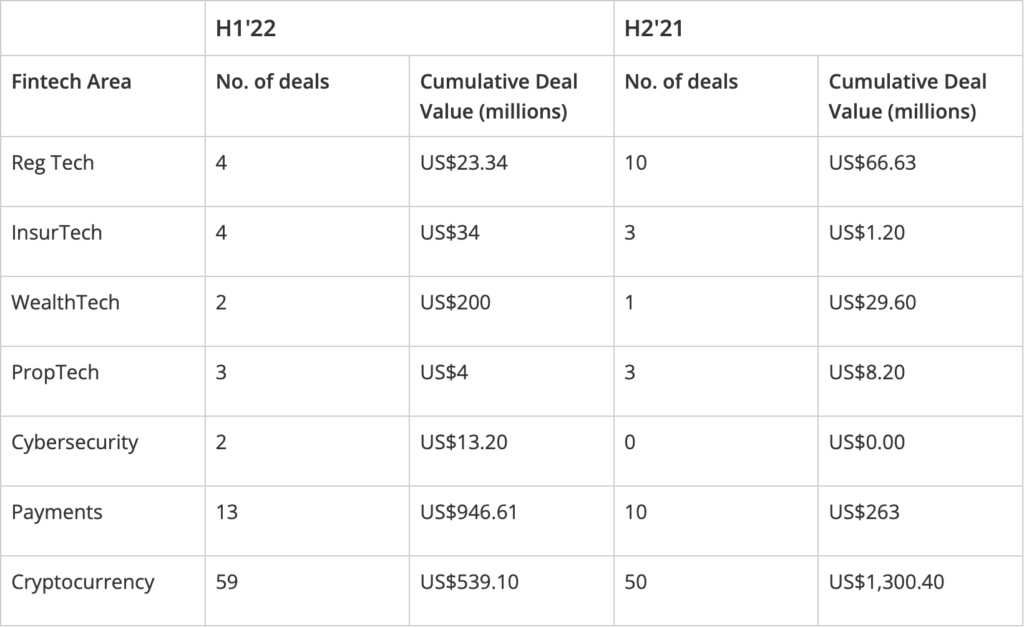

H1’22 also saw a modest increase in the number of fintech deals funded across payments, cryptocurrencies, insurtech, wealthtech and cybersecurity as compared to H2’21.

Singapore’s fintech deals in H1’22 and H2’21

The half-yearly drop in Singapore was mirrored globally with investments in fintech lowered from US$111.2 billion across 3,372 deals in H2’21 to $107.8 billion across 2,980 deals in H1’22.

More crypto deals but smaller deal sizes

Cryptocurrency funding in Singapore dipped by more than half from US$1.3 billion in H2’21 to US$539.1 million in H1’22 – this comes after record crypto investment inflows in 2021.

Crypto attracted smaller deal sizes but a larger number of deals with a significant amount of startup funding with two thirds of this coming from seed and early-stage VC funding.

The crypto space also saw a small amount of consolidation with seven exit or merger deals.

Regtech also saw a drop in funding from US$66.63 million in H2’21 to US$23.34 million in H1’22.

Payments took the spotlight

Investors chose to channel funds into payments – an area that has been demonstrating stable growth and developments, alongside more cross-border initiatives being forged.

Hence, cumulative deal value for payments in Singapore close to tripled from US$263 million in H2’21 to US$946.61 million in H1’22.

Venture capital funding slows

Venture capital (VC) funding in Singapore fell 30 percent in H1’22 – companies in Singapore received US$1.38 million in funding in 107 transactions compared to US$1.97 million with 103 transactions in H2’21.

VC investment was spread throughout the region, including a US$690 million raise by Singapore-based Coda Payments, a US$300 million raise by Indonesia-based Xendit, and US$270 million and US$237 million raises by India-based fintechs Stashfin and Oxyzo.

Anton Ruddenklau

“2021 was a banner year for the fintech market globally, which makes the first half of 2022 seem slow by comparison. With valuations coming under pressure, fintech investors are going to enhance their focus on cash flow, revenue growth, and profitability – which could make it more difficult for some fintechs to raise funds.

M&A activity, however, could see an uptick as struggling fintechs look to sell rather than holding a downround, corporate and PE investors move to take advantage of better pricing, and well-capitalized fintechs look to take out the competition.”

said Anton Ruddenklau, Global Head of Financial Services Innovation and Fintech, KPMG International.