BCG and ADDX Project Asset Tokenisation to Grow Into US$16 Trillion Opportunity by 2030

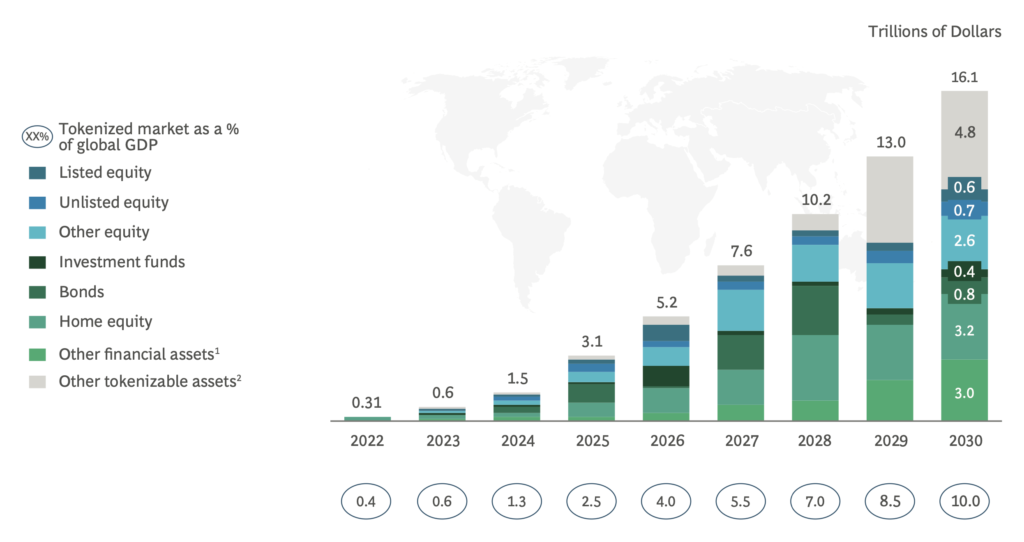

by Fintech News Singapore September 13, 2022A new report by the Boston Consulting Group (BCG) and digital exchange ADDX forecasts that asset tokenization will expand into a US$16.1 trillion business opportunity by 2030.

Tokenization of global illiquid assets estimated to be a $16 Trillion business opportunity by 2030

Asset tokenization refers to the creation of tokens on a blockchain to represent an asset to facilitate more efficient transactions.

Historically, many of the world’s assets have been held in illiquid formats, with past studies estimating the share of illiquid assets at more than 50% of overall assets.

Tokenization creates liquidity by making it easier for the assets to be distributed and traded among investors.

Assets being fractionalized and tokenized on platforms such as ADDX can reduce minimum investment sizes from millions of dollars to just thousands of dollars.

Globally, growth in tokenized assets is expected in real estate, equities, bonds and investment funds, as well as less traditional assets such as car fleets and patents.

With a 50-fold increase predicted between 2022 and 2030, from US$310 billion to US$16.1 trillion, tokenized assets are expected to make up 10% of global GDP by the end of the decade.

Sumit Kumar

Sumit Kumar, Managing Director and Partner, BCG South East Asia, said:

“This report projects that even using a conservative methodology, asset tokenization would be a US$16.1 trillion business opportunity by 2030. In a best-case scenario, that estimate goes up to US$68 trillion.”

Oi-Yee Choo

Oi-Yee Choo, CEO, ADDX, said:

“Recognizing assets for what they are truly worth should translate into more investments and better capital allocation, which will in turn generate economic growth and jobs. The real winner here is the real economy.”