Singaporeans View Digital Technology as Critical to Support Longevity

by Fintech News Singapore October 28, 2022In the face of increasing life expectancy, Singaporeans are confident that personal health and financial technologies will play a critical role in helping them manage their lives, a new study commissioned by Prudential Singapore and conducted by Economist Impact found.

The survey, which polled 800 of Singapore’s residents between 25 and 65 to understand how they are using modern technologies to manage different aspects of their life as they age, found that more than half of respondents (54%) viewed mobile devices and apps as essential tools in preparing for rising longevity.

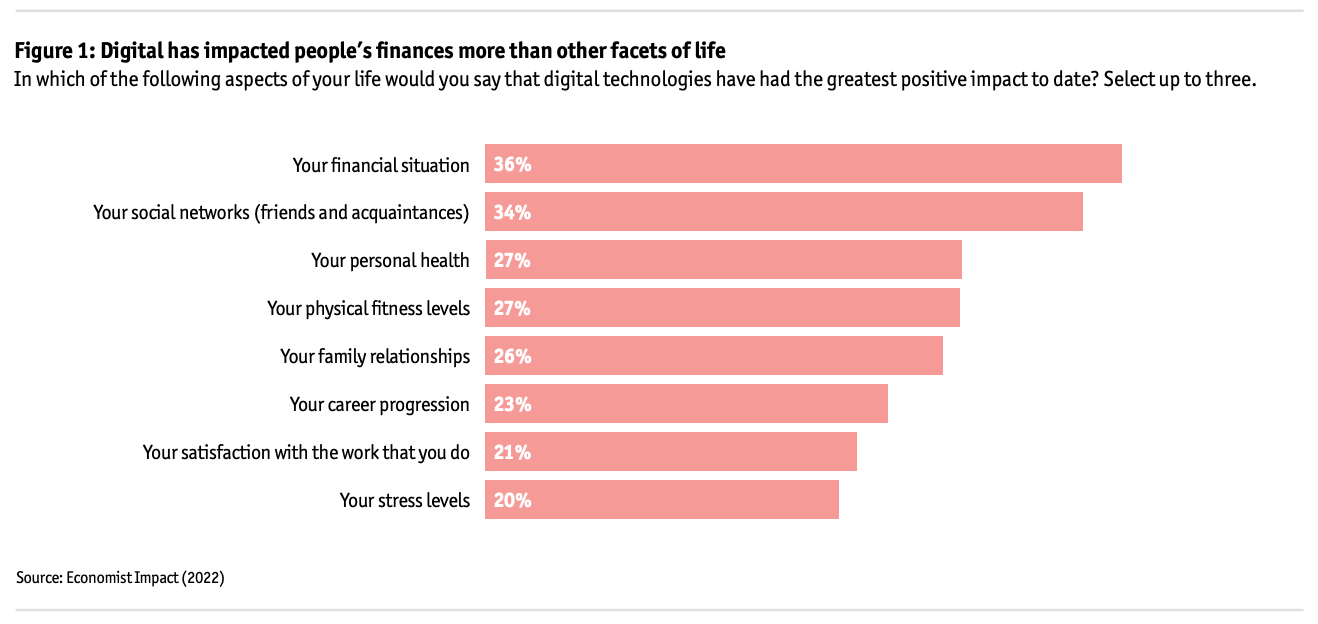

Of those using technology to manage their well-being, 36% said that digital tools have had the greatest positive impact on their financial situation, a figure that stood at 27% for personal health.

Digital has impacted people’s finances more than other facets of life, Source: Economist Impact (2022)

These perceptions come as Singaporeans are growing more confident in their ability to live to 100, despite the global health crisis and economic headwinds.

42% of respondents said they were well prepared for rising longevity from a health and wellness perspective, up from 31% in 2021. 54% responded in the affirmative from a financial health perspective, up from 29% in 2021.

Singapore, a country with 5.5 million people, has one of the fastest aging populations in the world. It is estimated that by 2030, one in four people will be aged over 65 years.

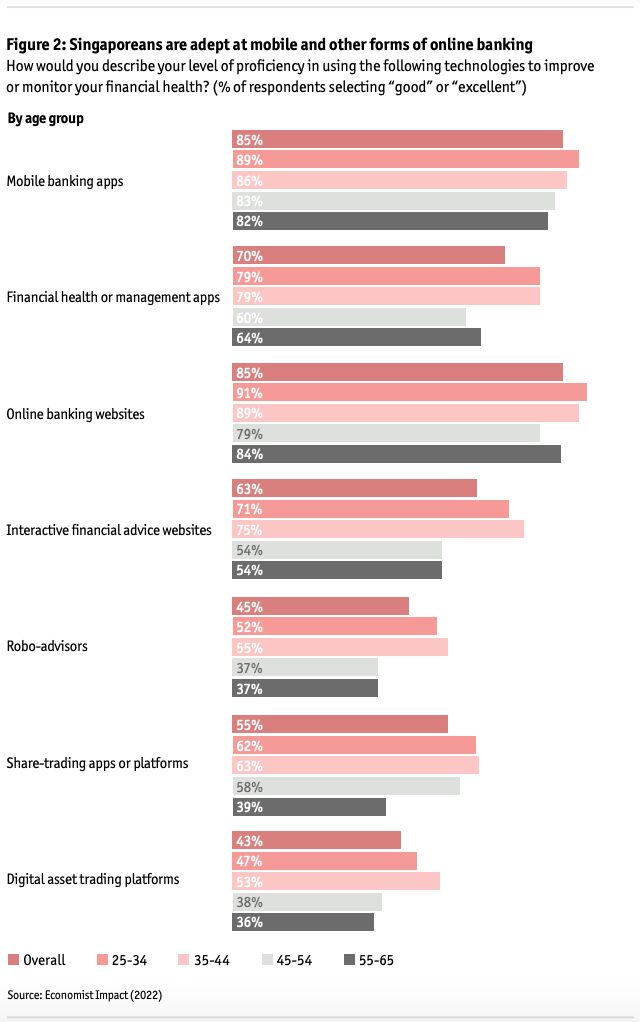

Singaporeans are proficient in using digital tools

Overall, the study found high levels of proficiency among consumers in using digital tools to improve and monitor both their personal and financial health, with large majorities of respondents indicated being well able to use mobile banking apps and financial management websites and apps.

85% of respondents said that they were skilled at using both mobile banking apps and online banking websites, and 70% said they were very proficient in using financial management apps.

Proficiency, however, was found to be lower for niche financial tools, including robo-advisors, share-trading apps, and crypto platforms.

Singaporeans are adept at mobile and other forms of online banking, Source: Economist Impact (2022)

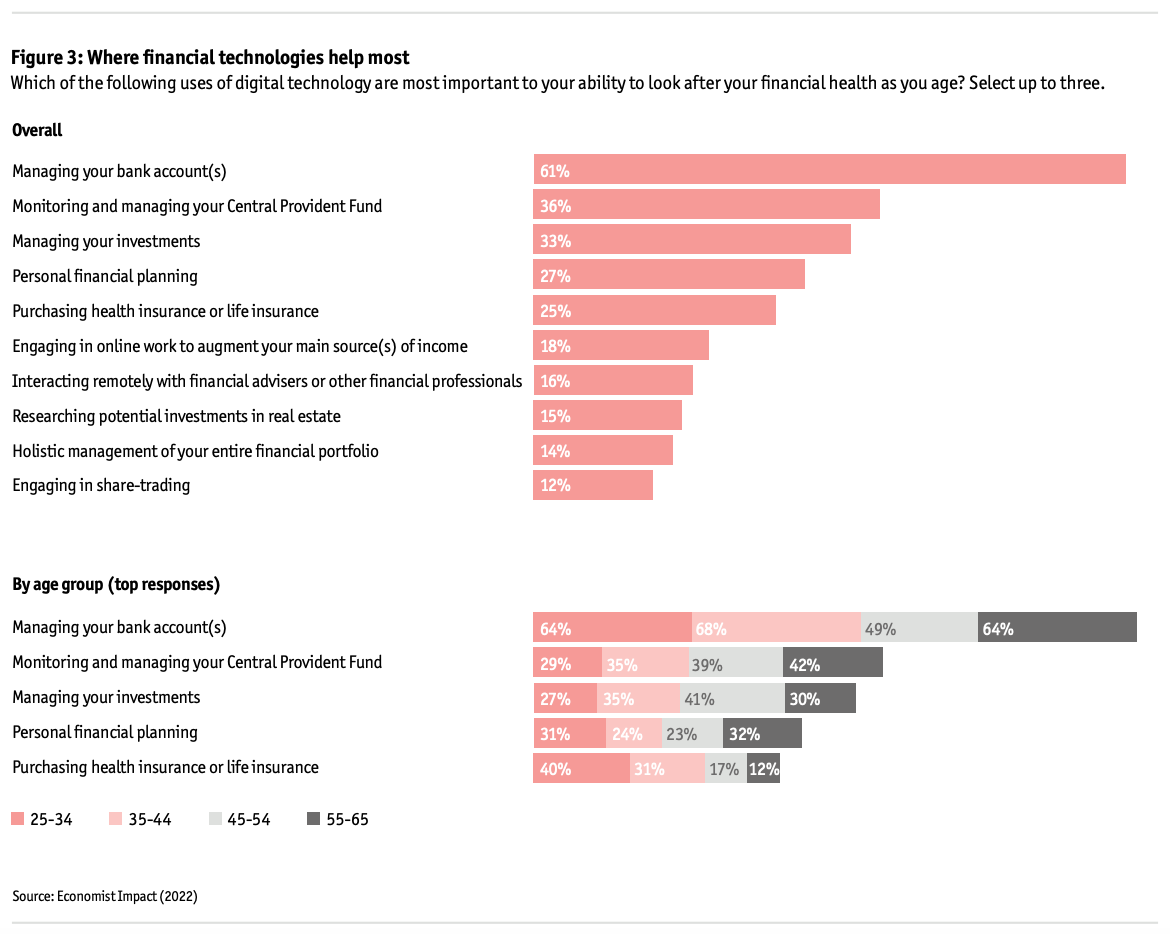

Respondents were also asked about what they believed were the most important uses of financial digital tools, of which 61% cited the ability to manage their bank accounts, followed by monitoring and managing their central provident fund (CPF), a mandatory social security savings scheme in Singapore (36%), managing their investments (33%) and personal financial planning (27%).

Where financial technologies help most, Source: Economist Impact (2022)

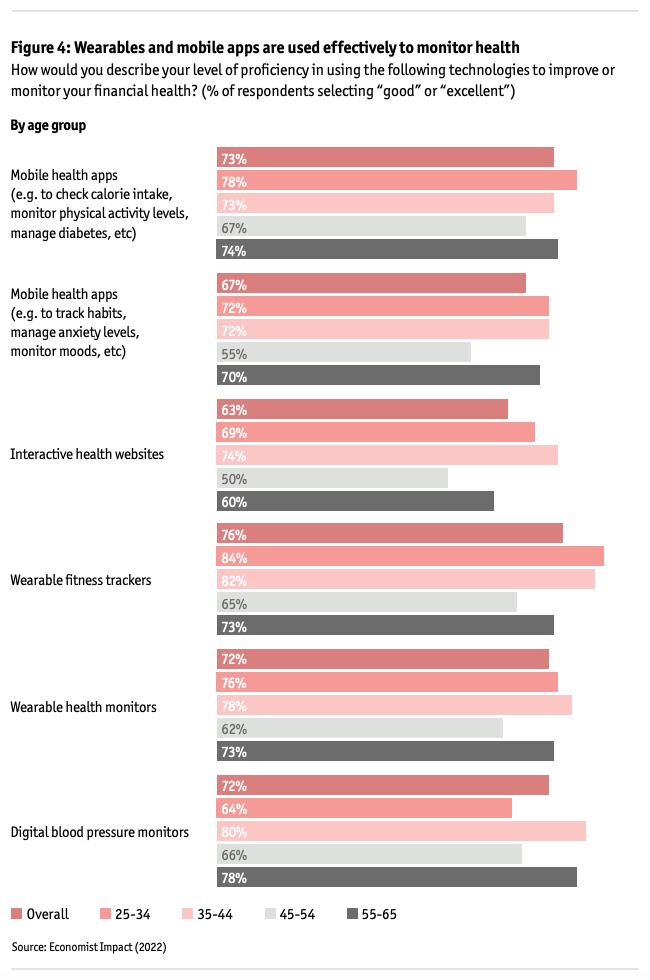

On the health front, a vast majority indicated being well versed in using technologies to monitor their health. 73% of respondents felt being proficient in using mobile apps for keeping tabs on their physical health, a figure that stood at 76% of wearable fitness trackers, 72% for wearable health monitors, and 72% for digital blood pressure monitors.

At the other end of the spectrum, the survey found proficiencies to be lower for mental health tools, with just over two-thirds (67%) of respondents indicating being good at using apps that measure stress and anxiety levels, or those that monitor moods.

Wearables and mobile apps are used effectively to monitor health, Source: Economist Impact (2022)

Results from the Economist Impact study are consistent with those of similar research on digital tools usage and adoption in the city state.

A recent survey conducted by Norwegian telco Telenor polled over 8,000 mobile Internet users in Southeast Asia and found that 92% of Singapore respondents believed their mobile usage has effectively improved their quality of life.

79% of Singaporean respondents indicated greater connectivity to friends and family as one of the ways they believed mobile usage was making a positive impact on their daily lives. 73% cited greater access to information for daily tasks, and 76% indicated increased efficiency and productivity.

On the financial side, adoption of digital banking has also been found to be rising steadily. A consumer survey conducted by Australian comparison website Finder in April 2022 found that 21% of Singaporean consumers had a digital bank account, an increase of 3 percentage points from 2021.

An additional 9% indicated planning to open a digital banking account in the coming year, showcasing consumers’ eagerness to embrace new digital offerings.

While technology adoption is undeniably on the rise, the Economist Impact survey also found that digital tools are becoming more complex, putting stress on some consumers.

Nearly half (49%) of respondents that took part in the study said that modern digital tools were getting more complicated and stressful. This figure was more than half for those aged between 35 and 44 (55%) and between 55 to 65 (52%).

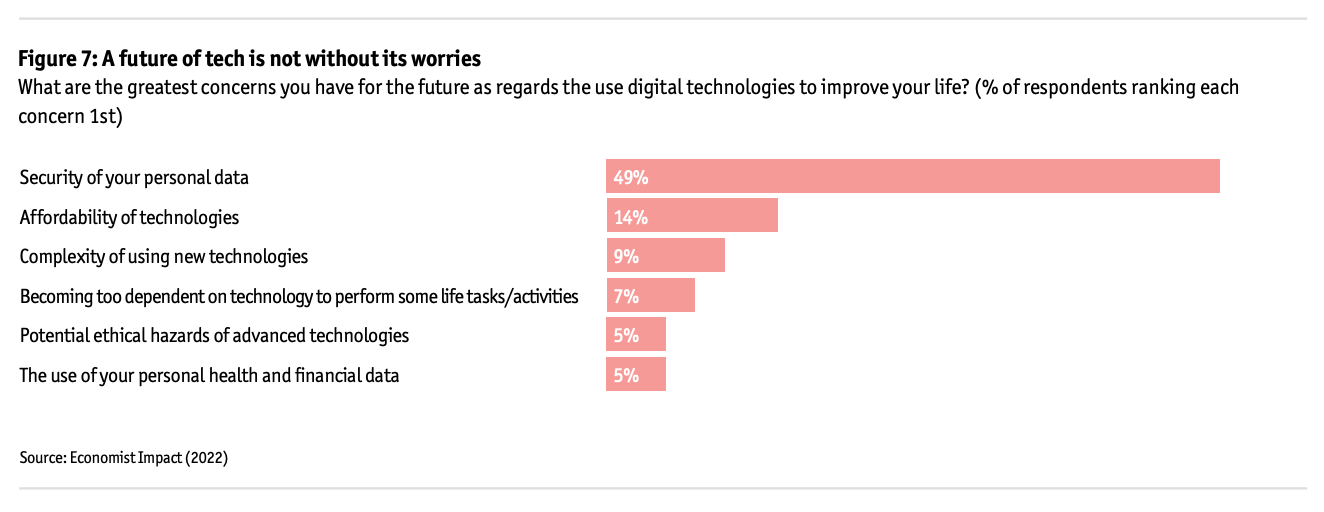

Singaporeans also showed concerns about the security of their personal data (49%), which was found to be their chief worry in using apps and digital tools, overshadowing affordability (14%), the risk of becoming too dependent (7%), and potential ethical hazards of advanced technologies (5%).

What are the greatest concerns you have for the future as regards the use digital technologies to improve your life?, Source: Economist Impact (2022)