Singapore Fintech Talent Report 2022 Finds Demand Still Outpacing Supply

by Fintech News Singapore November 8, 2022The Singapore Fintech Association (SFA) and Accenture Singapore have launched the Singapore Fintech Talent Report in conjunction with the Singapore Fintech Festival 2022.

Despite the uncertain macroeconomic environment of 2022, Singapore’s fintech industry continues to grow as does its demand for the right talent.

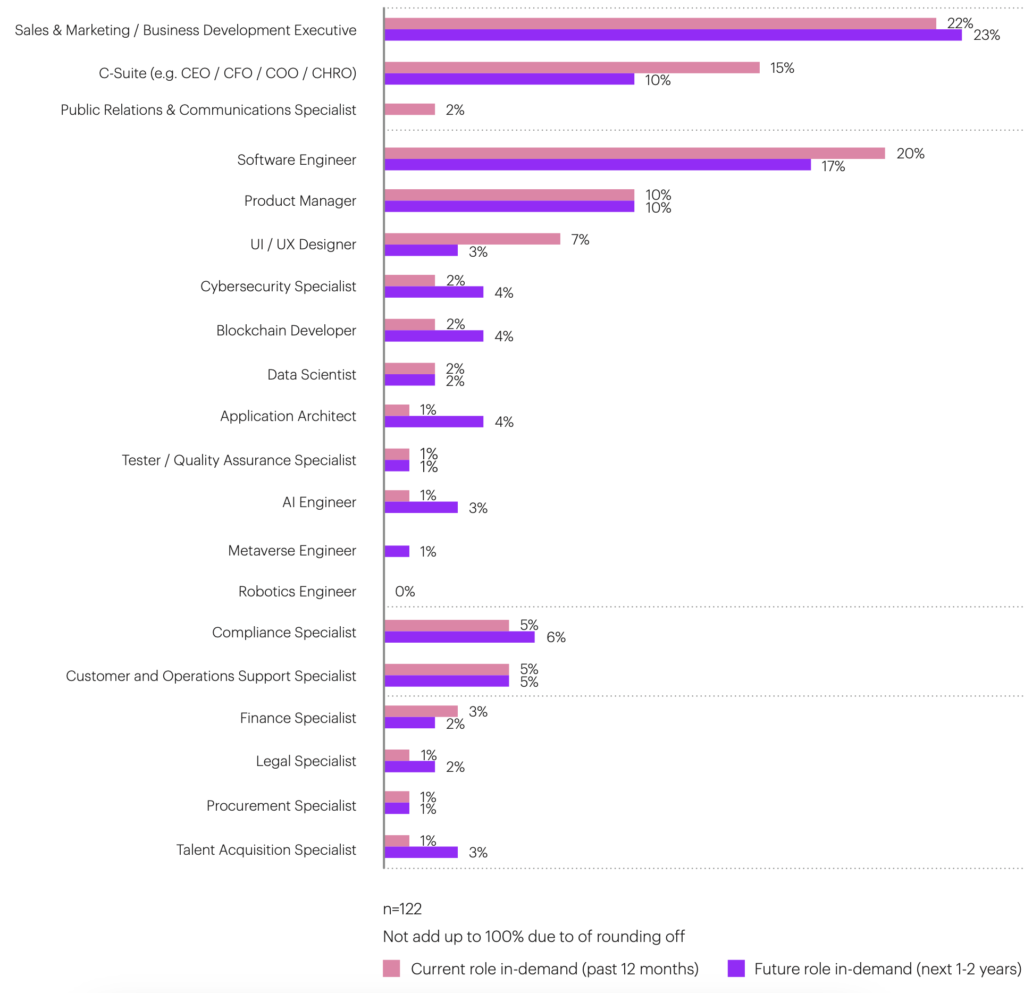

The most sought-after fintech roles in the last 12 months and in the next 1-2 years are those in sales and marketing / business development. Source: Singapore Fintech Talent Report 2022, Singapore Fintech Association (SFA) and Accenture Singapore.

The Singapore Fintech Talent Report 2022 found that demand for fintech talent still outpaced supply with the majority of fintech companies (72%) expecting sector growth to continue accelerating.

Most (95%) of the fintech companies surveyed expect an increase in their workforce over the next one to two years as compared to 2021 (84%).

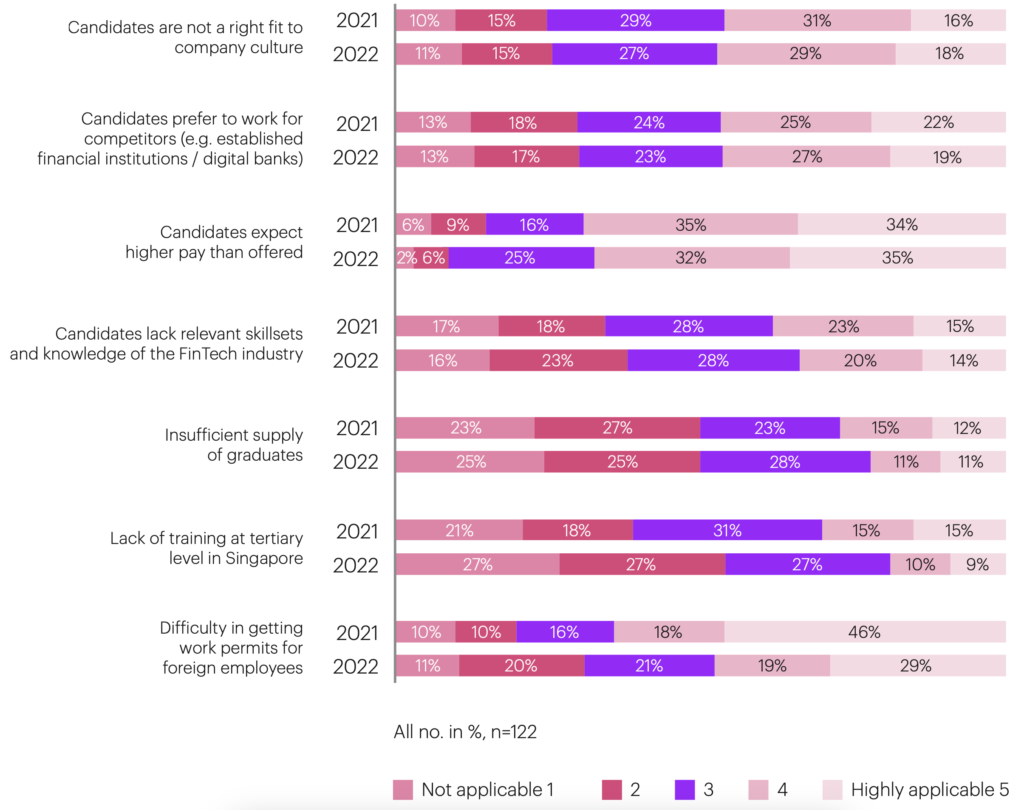

However, the talent gap is intensified by several factors including compensation (67%), work permits for foreign employees (48%), company culture (47%), and competition (46%).

With a relatively small pool of talent available in Singapore, the demand for fintech talent continues to outpace local supply and is further intensified by several factors. Source: Singapore Fintech Talent Report 2022, Singapore Fintech Association (SFA) and Accenture Singapore.

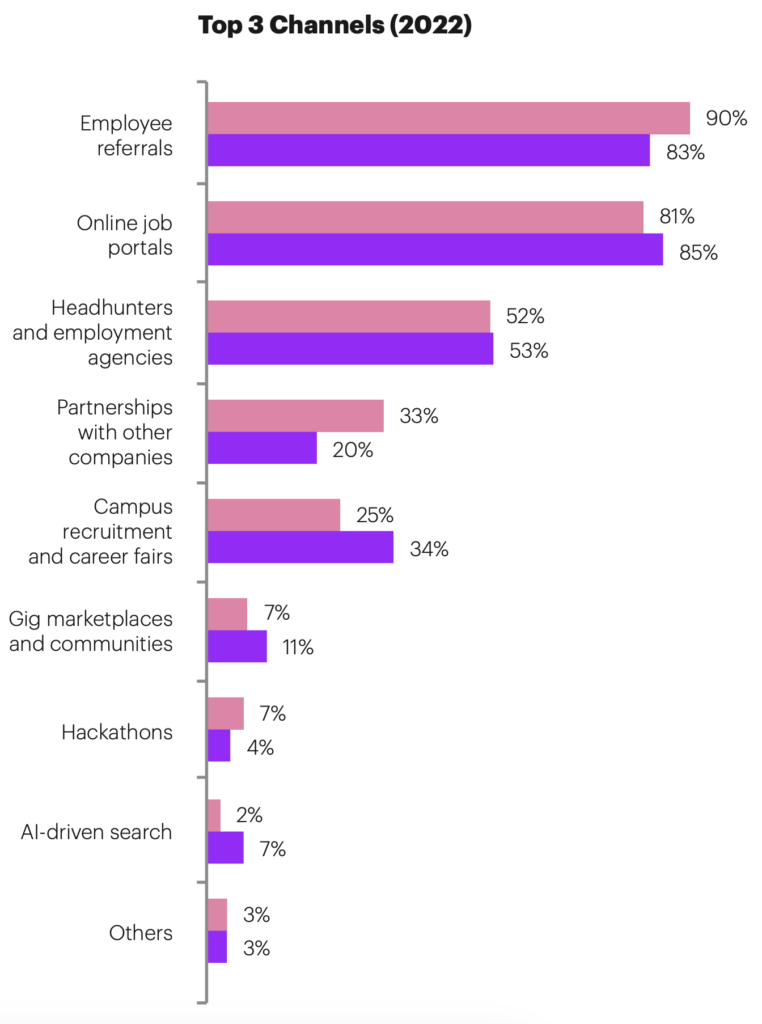

In terms of recruitment, the top three channels used by fintech companies to source talent are employee referrals (90%), online job portals (81%), and headhunters and employment agencies (52%).

Campus recruitment and career fairs are currently underutilised and fintech companies surveyed indicate that utilisation is expected to rise by 11% in 2021 and 9% in 2022 respectively.

Fintech companies are also increasingly tapping on partnerships with other companies as a channel for recruitment with 33% in 2022, up from 20% in 2021.

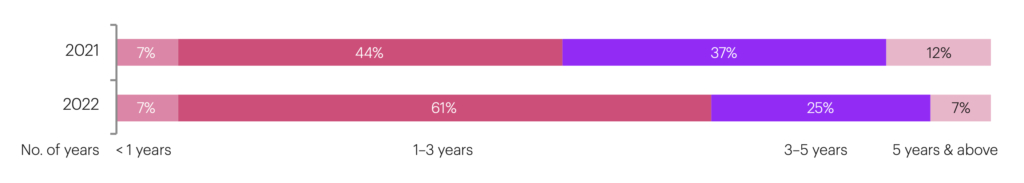

While there is a slightly higher tenure duration for more mature companies, the average employee stay is between 1-3 years. Source: Singapore Fintech Talent Report 2022, Singapore Fintech Association (SFA) and Accenture Singapore.

Survey results reveal that the majority (61%) of fintech companies have their employees stay an average of 1-3 years as compared to 44% in 2021, indicating a decrease in average employee tenure.

Attrition rate has gone up in the past year, with 42% of companies experiencing an attrition rate of between 10-20% in 2022, an 11% increase as compared to 31% in 2021.

Employee referrals (90%), online job portals (81%) and headhunters and employment agencies (52%) are the top three channels used by fintechs to source talent. Source: Singapore Fintech Talent Report 2022, Singapore Fintech Association (SFA) and Accenture Singapore.

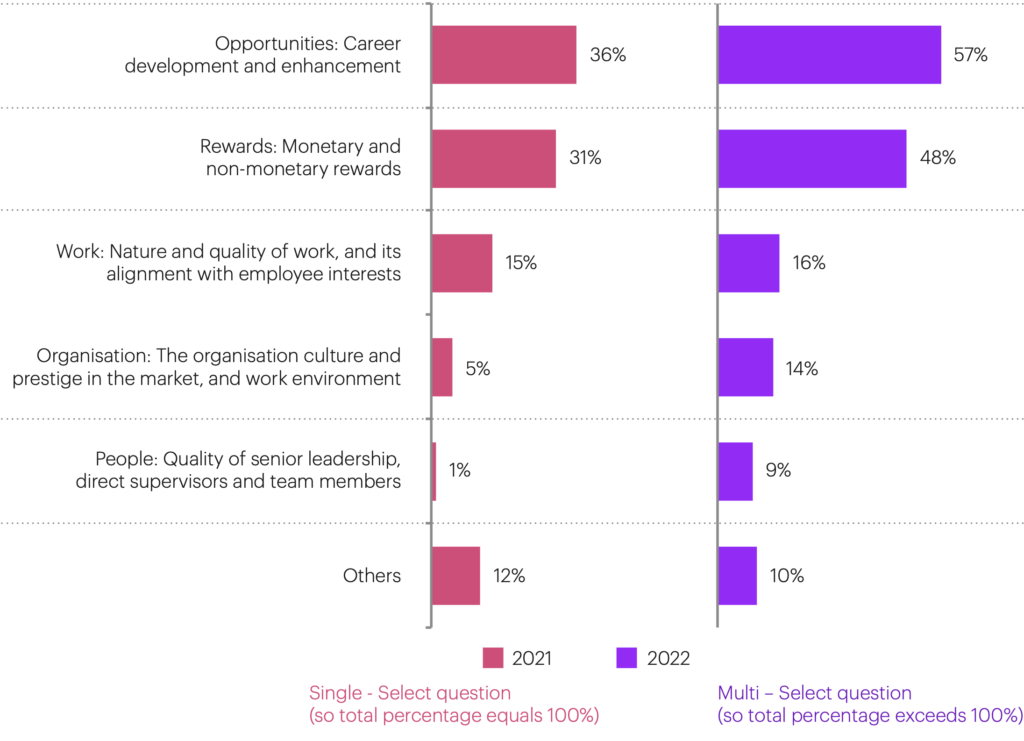

Similar to 2021, limited career development and enhancement as well as insufficient monetary and non-monetary rewards remain the top two reasons why employees are leaving fintech companies in 2022.

Many fintech companies continue to have insufficient investment in learning and development. 50% of these companies spend less than $500 on learning and development per employee, as compared to 28% in 2021.

While potential candidates look to join fintechs for opportunities to develop and enhance their careers, they leave for the same reasons, indicating they may not be getting the continued growth they desire. Source: Singapore Fintech Talent Report 2022, Singapore Fintech Association (SFA) and Accenture Singapore.

A critical part of talent development is performance management. Most fintech companies employ some form of a structured approach to performance management.

The most utilised practices for setting and measuring goals include KPIs (58%) and OKRs (49%), formal approaches such as regular, continuous feedback (84%), and manager calibration through discussions (55%).

Shadab Taiyabi

“As we brace for a challenging and uncertain year ahead, fintech leaders will need to prioritise the talent agenda and invest in the right talent in order to drive business growth,”

said Shadab Taiyabi, President of Singapore Fintech Association.

Nesan Govender

“In Singapore alone, 6000 new jobs are expected to be created in the next two years within the fintech industry. Talent development needs to be the core of fintechs’ strategic agenda,”

said Nesan Govender, Talent & Organisation lead, Southeast at Accenture.