The insurance industry is undergoing a shift in the way it operates in order to satisfy a new generation of customers – the millennial market. Millennials are demanding more high-tech processes when it comes to insurance, looking for digital interaction at all touch points. Insurance providers are rushing to adopt technology in all aspects of their operations in order to attract millennial customers and keep them engaged.

Article From: Eugene Chng, Director of Regional Sales, APAC at Hyland, creator of OnBase

Spending Power Potential

Millennials, also known as Generation Y, will have more spending power than any previous generation in Asia, with an estimated US$6 trillion in disposable income by 2020, according to Accenture. But despite this major shift in generational spending, millennials remain the most under-insured generation. This is partly because many are choosing to delay major life milestones such as starting a family, or purchasing a home and a car, when compared to older generations.

From Pixabay

Nonetheless, millennials present a major opportunity as a market for insurers if they can attract these customers using the tech-based channels that this group is comfortable with for all aspects of life, from banking to shopping and socialising. According to Capgemini and Efma’s 2016 annual World Insurance Report, Gen Y customers show a higher overall tendency to engage through the newer digital channels of mobile and social media. They interact with their insurers up to 2.5 times more than other customers on social media and over two times more using the internet via their mobile phones.

This may be why traditional insurance providers find themselves losing market share to newer entrants who are changing the insurance landscape by investing in a digital strategy, and a fresh approach using retail, online search and social media to attract this new generation of customers. Traditional insurers will need to move quickly if they are to hold on to market share in the millennial age.

Winning The Trust of Millennials

From Pixabay

According to a 2015 finding by Pew Research Center, millennials are increasingly detached from institutions and are distrustful of established financial brands in particular. Due to their reliance on technology in almost every aspect of day to day life, millennials want access to information at their fingertips – online and on their mobile devices. They feel very comfortable trusting the online user experience technology over face-to-face relationship, and are more likely to do their own research or turn to their social network for help in making financial decisions, rather than simply trusting that their insurance broker knows what is best for them.

Insurers who have traditionally focused on the regulatory environment above marketing and customer engagement will need to shift their thinking and their way of operating. If they can do so, they stand to benefit not only from appealing to the millennial market, but other customers as well.

Better Service Starts With Technology

All generations stand to benefit from the introduction of customer-centric technologies. Insurers can minimise the risk of disruption by creating innovation from within – relying on the right technologies to control operating expenses, increase efficiency, and most importantly, provide high level of customer service required to retain customers.

An example is OnBase, an enterprise information platform that helps to create insurance effeciencies that are not only appealing but can be accessed across a number of channels. All customer information entering the system is digitised at the earliest opportunity and made accessible to other relevant areas of the business, so up-to-date information on, for example, a claim submitted through an online form or app, can be viewed by an operator answering a phone call from the same customer the same day.

The most advanced and ambitious insurers are using mobile platforms to create such differentiation, particularly by developing smooth, effective and reliable claims systems that customers have confidence in and are happy to use. Those looking to meet the challenge posed by the new market entrants will have to adopt such measures and innovate, against companies highly experienced in online design and strategy.

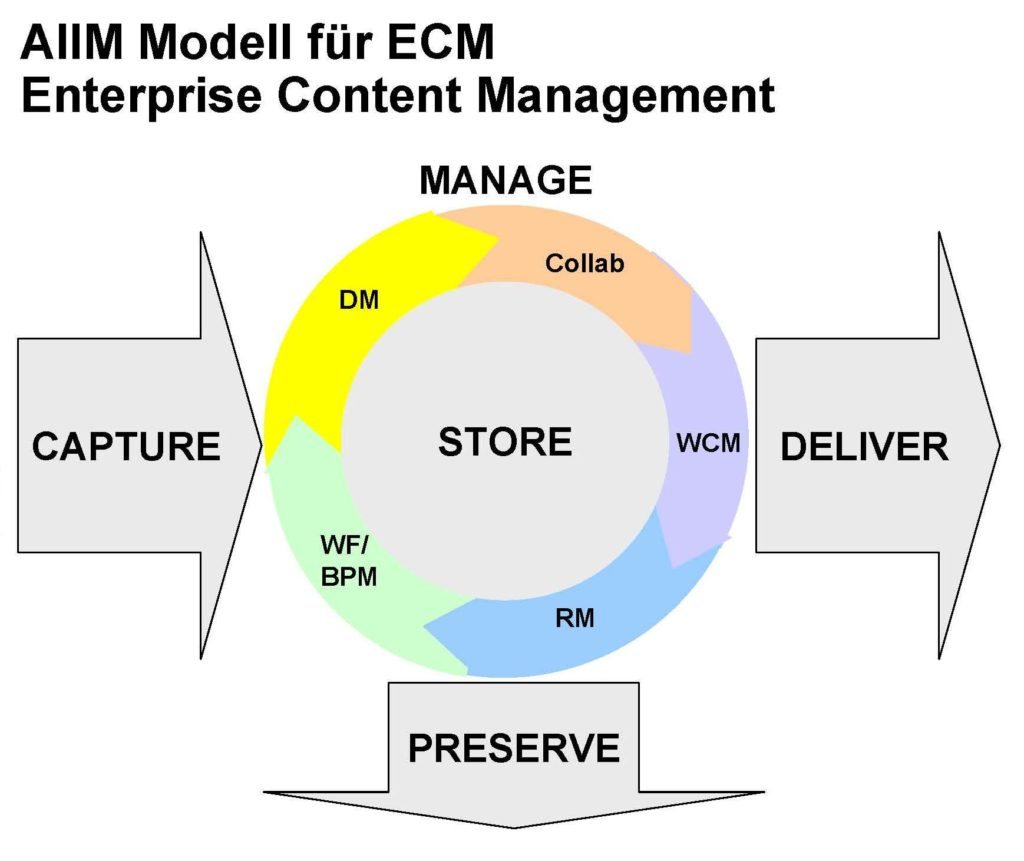

From Wikipedia

But an enterprise information platform can offer further, deeper advantages that can help companies rebuild margins and profitability at the same time as improving customer satisfaction. By bringing all functions and interactions on to a single repository, enterprise content management (ECM) functionality can be used to manage and automate the flow of work across the entire insurance enterprise. This is particularly useful when it comes to managing the claims process, which is not only time-consuming and costly, but can also make or break an insurer’s relationship with its customers.

This work process management function of ECM identifies and automates the tasks involved in taking a customer contact – such as a claim – and resolving it to the customer’s satisfaction. The goal is a minimum of human intervention – ideally, a staff member will only have to intervene if a query falls outside the normal parameters of a customer-facing business process.

Even in cases where regular human input may be required, an automated system can ensure tasks are completed efficiently, on time and within a set range of parameters. For many customers now used to ordering and getting what they want on their smartphone, this is the desired way of interacting with a firm to maximise convenience.

Standardisation, Simplification, Integration

Both customers and insurers benefit from greater standardisation, simplification and integration into a wider digital and automated environment. While the chief attraction of work process management for investors may well be its ability to drive down costs, a more consistent outcome of decision-making and faster claims processes are equally desirable effects.

Every well-handled claim has a good chance of generating positive customer loyalty and, with a bit of luck, a good review. But a badly handled claim guarantees a customer will not return and bad company reviews are almost a certainty. Therefore, incumbents cannot afford to slip up if they are to avoid being displaced by new entrants free from reputational baggage.

By adopting technology-driven processes, insurers can ensure they appeal to the important millennial group as well as customers of all generations. In the long-run, going digital not only helps improve efficiency and overall profit margins, but insurers can better create differentiation through targeted engagement and deliver superior service for their customers.