Technological developments have accelerated the transformation of financial services, leading to the explosion of digital banks worldwide. In Singapore, the entry of digital banks into the local financial system is driving economic innovation and enhancing financial inclusion, according to a new feature titled ‘Financial Stability Implications of Digital Banks’ released by the Monetary Authority of Singapore (MAS).

The MAS has been a critical motivator of Singapore’s developing digital banking scene. It has granted licenses to consolidated groups for digital full banks (DFBs), which accept deposits and offers banking services for retail and non-retail customers, and digital wholesale banks (DWBs), which take deposits and provide banking to SMEs and other non-retail segments.

The central bank and financial regulator provisioned digital banking licenses in 2020 to Grab and Singtel’s GXS Bank (DFB), Sea Limited’s MariBank (DFB), Ant Group-backed ANEXT Bank (DWB) and Green Link Digital Bank (DWB) backed by Greenland Financial Holdings and NTUC and Standard Chartered’s Trust Bank which operates under StanChart’s new Significantly Rooted Foreign Bank (SFRB) categorisation

These new entrants pose challenges for traditional banks that are struggling to keep up with the pace of change. But as digital banks are still a relatively new international concept, there are significant prudential and financial stability risks that come with them.

How might digital banking impact risks in the banking sector?

The digitalisation of the banking sector, driven by ever-changing customer expectations and needs, has resulted in the emergence of new service providers. This has led to various consumer benefits, but it has also created new risks for banks – both incumbents and new entrants.

The MAS feature reported that the increased competition could erode market power, decrease profit margins, and reduce franchise value. This could lead to banks taking on more risk to remain competitive.

In particular, traditional banks have been under pressure and may lend to riskier borrowers to boost profits and protect the market share. This increased risk-taking can negatively affect the banking sector, including higher levels of bad debts and defaults, leading to a loss of confidence in the banking system.

Digital banks may also engage in predatory practices to build market share in their initial years (e.g., by offering preferential pricing and paying unsustainably high interest to attract deposits).

In addition, digital banks are more accessible to younger individuals with lower incomes and credit scores, granting them primarily unsecured loans. Consequently, these emerging players’ asset quality may be lower than that of traditional banks.

Meanwhile, IDC’s research found that 86 percent of Asia-Pacific financial institutions still have payment technology infrastructures that need to be better equipped for the ongoing shifts in consumer preferences. That puts the region’s SGD276.79 billion-valued (US$201 billion) payments revenue at risk by 2030.

MAS estimates that Singapore customers will in all likelihood persist with their current bank for their primary account, citing a 2019 survey by PwC.

“While incumbents and new entrants may target the same customer segments, digital banks remain a relatively new concept in Singapore’s banking landscape, and customers may hence be inclined to adopt a “wait and see” approach before banking fully with a digital bank,” said MAS.

The sunnier side of digital banking

Still, digital banking continues to gain momentum, with an estimated 203 million people using digital banking services in 2022, and projected to reach 216.8 million by 2025.

The MAS feature found that digital banks can complement the offerings of traditional banks to meet the needs of currently underserved individuals and businesses.

A study found that nearly three-quarters (74 percent) of Southeast Asian adults are either unbanked or underbanked. The regional countries with the highest merged rates of unbanked and underbanked are Vietnam (79 percent), the Philippines (78 percent), and Indonesia (77 percent) — astronomical figures for one of the world’s the world’s fastest-growing regions.

This huge gap allows opportunity for digital banks to leverage data and technology, creating new processes and channels to deliver problem-solving financial products and services. This innovative use of data and technology can help reduce costs and improve customer access.

Micro-SMEs are another underserved segment where digital banks can make inroads, and they need access to solid advisory and banking services, which can help them grow. They play an essential role in many economies, contributing to 85 percent of Southeast Asian employment, nearly half (44.8 percent} of GDPs, and 18 percent of national exports.

Promoting sustainable competition in Singapore

In order to ensure that the banking sector promotes sustainable competition, MAS has put in place measures for licensing digital banks in Singapore.

As part of these efforts, MAS previously defined a set of guidelines on the application process and prudential requirements for digital banks. These guidelines aim to level the playing field between digital and incumbent banks, and promote a sustainable and competitive banking sector in Singapore.

First, Singapore’s digital bank applicants must demonstrate sustainable business models, so that competition is not value-destructive. Secondly, digital banks must demonstrate matching prudential criteria (including capital and liquidity requirements) as existing banks.

Third, MAS will phase in the permissible activities of fully digital banks using a three-stage process that aims to minimise risks to retail depositors while mitigating the risks of emerging, disruptive business models.

Using these standards, MAS will assess the performance of the digital full bank (including considering the strength of its internal controls, compliance track record, customer management ability, and sustainability of business performance, among others), and progressively lift the restrictions as the requirements are met.

Singapore incumbent banks’ response to digital banking

The inability to keep pace with the changing customer behavior and needs is putting pressure on incumbents to re-examine their business models, operating models, and customer engagement strategies. Many have embarked on digital transformation programs to better cater to their customers who are going digital.

They have been increasingly agile, partnering with fintechs to deliver more customised solutions in their local markets, while many launch digital banks in overseas markets too. An example is DBS Bank which launched Digibank in India in 2016 before expanding to Indonesia.

This includes leveraging a lower-cost operating model to acquire customers and adopting more customer-centric approaches by integrating financial choices with traditionally non-financial needs.

Continued investments in such initiatives will enable incumbent banks to compete against digital rivals in terms of customer experience and the quality of financial products and services.

What next: Assessing the impact on financial stability

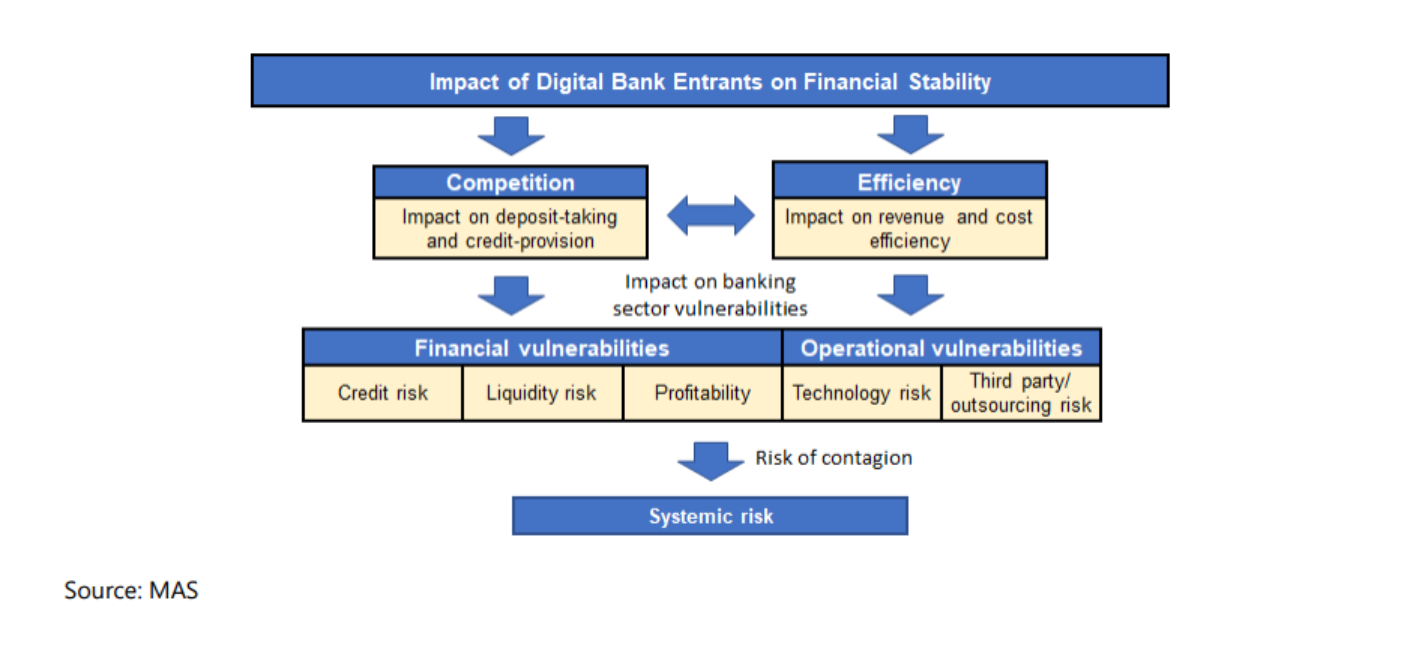

In Singapore, MAS has been closely monitoring the developments of the new digital banks and their impact on financial stability. An impact assessment framework was formulated to study the impact of new digital entrants on the banking system and on overall financial stability.

The framework consists of two stages. The first stage assesses the potential benefits and risks through two channels of impact on the banking system: competition and efficiency.

The second stage considers the implications of competition and efficiency for financial and operational vulnerabilities. This comprises risks in credit, profitability, third-party/outsourcing, liquidity, and profitability.

While the new digital banks’ operations are still nascent, MAS is already seeing some early indicators of the potential implications on financial stability.

The need for more data and information also poses constraints. As the new digital banks gain traction, MAS will ramp up the monitoring of the indicators identified above, which can be used for future quantitative analysis of the health and stability of the financial sector.