Over the years, Singapore has successfully fostered the development of a striving fintech ecosystem, leveraging its historical financial, technological and regulatory strengths. Today, Singapore is one of the Southeast Asia’s fintech leaders and is home to a vast community of fintech innovators that have chosen the nation as their gateway to the broader Association of Southeast Asian Nations (ASEAN) region.

As Singapore’s journey into fintech continues to mature, it’s now shifting towards the “scale-up” phase of growth, a new report by consulting firm PwC in collaboration with the Singapore Fintech Association (SFA) says, a development that’s occurring on the back of successful milestones achieved over the past few years, including the public listing of super-app Grab and successful homegrown fintech companies expanding internationally.

The report, which draws on a survey of 52 fintech companies in Singapore, seeks to provide an overview of the industry and explore players’ sentiment on the future of fintech in Singapore.

The research found that after years of promoting the startup aspect of fintech, Singapore’s fintech sector is entering another stage of development. Homegrown companies are expanding rapidly, aggressively entering new markets across ASEAN, Asia-Pacific (APAC) and globally.

Most of the surveyed companies with business in Singapore also operated in other ASEAN markets, the research found, a strong indicator that the country continues to serve as a base for accessing the rest of Southeast Asia. Additionally, all firms surveyed reported operating in at least one other market or region.

Industry players were asked about their sentiment on the Singapore’s fintech industry for the years forward, to which the vast majority (more than 70%) showed optimism and shared their expectation of faster growth and more opportunities coming up over the next three to five years.

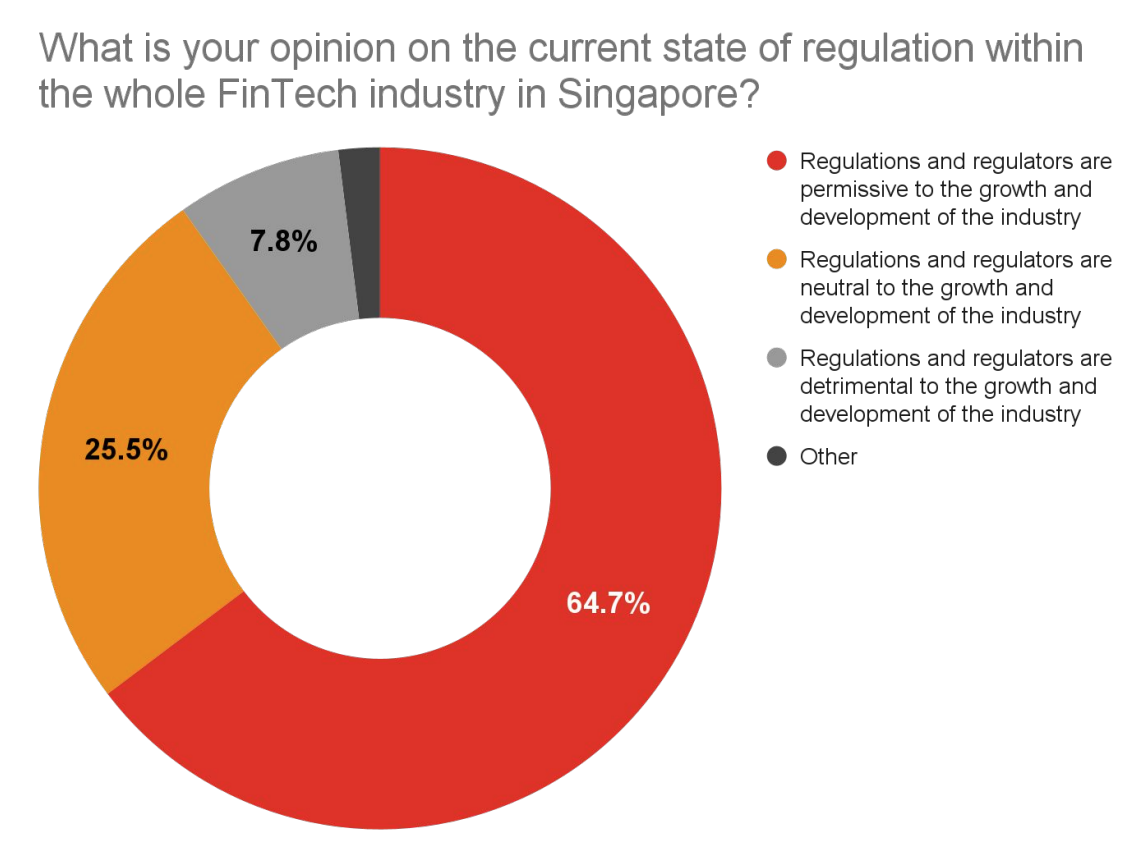

Singapore’s regulatory environment has been and will continue to be an important factor behind the success of the country’s fintech industry, respondents indicated. Nearly two-thirds of the companies polled believe that state authorities peruse a permissive approach, a sentiment that’s shared by both Singapore-headquartered firms and overseas-headquartered companies, the survey found.

Singapore fintech companies’ opinion on the current state of regulation within the local fintech industry, Source: Fintech’s state of play, PwC, Singapore Fintech Association, 2022

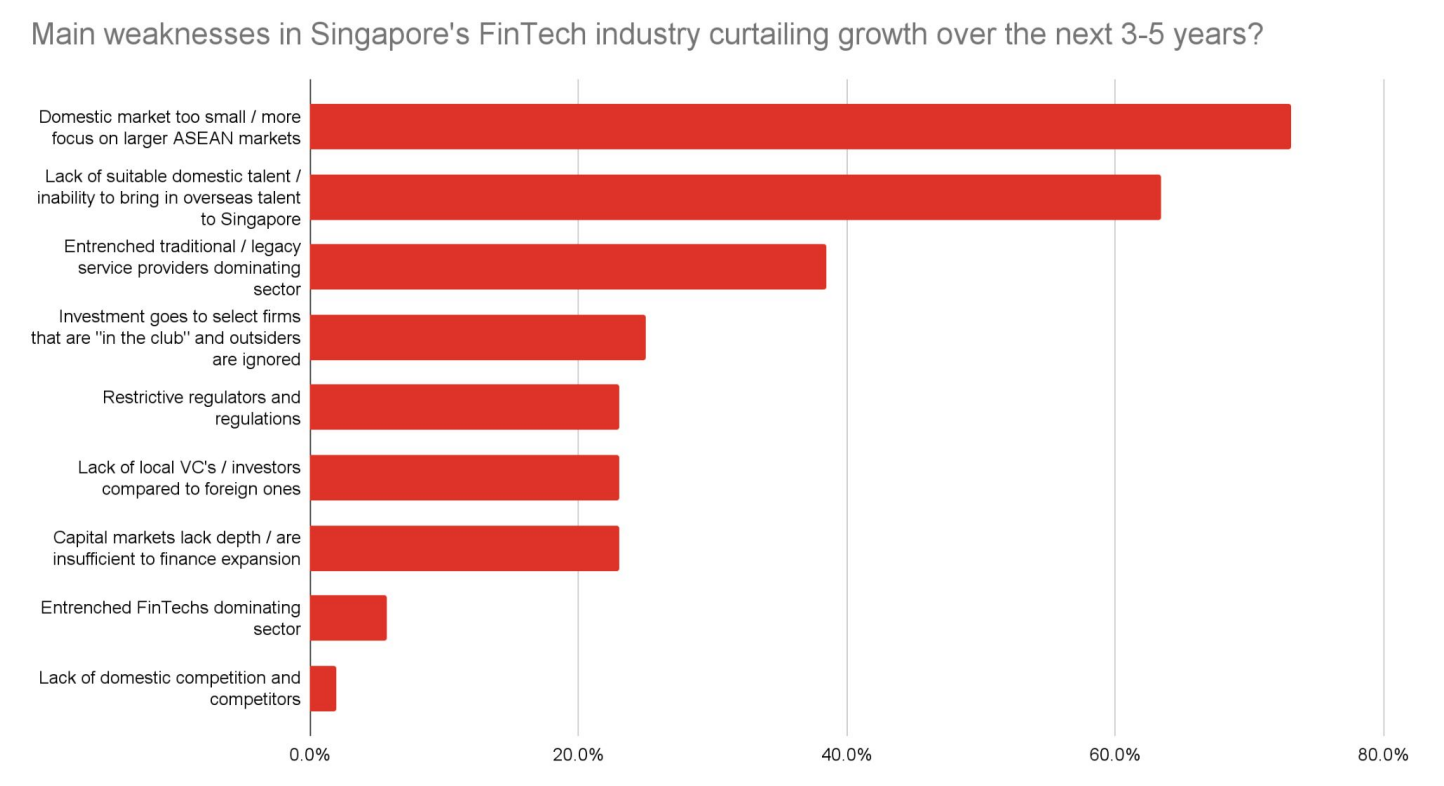

Respondents, however, also shared what they believed to be Singapore’s biggest weaknesses, citing, in particular, the country’s relatively small size (>70%), talent shortage and challenges in bringing in professionals from overseas (>60%), and the well-established financial sector (>35%).

Main weaknesses in Singapore’s fintech industry curtailing growth over the next 3-5 years, Source: Fintech’s state of play, PwC, Singapore Fintech Association, 2022

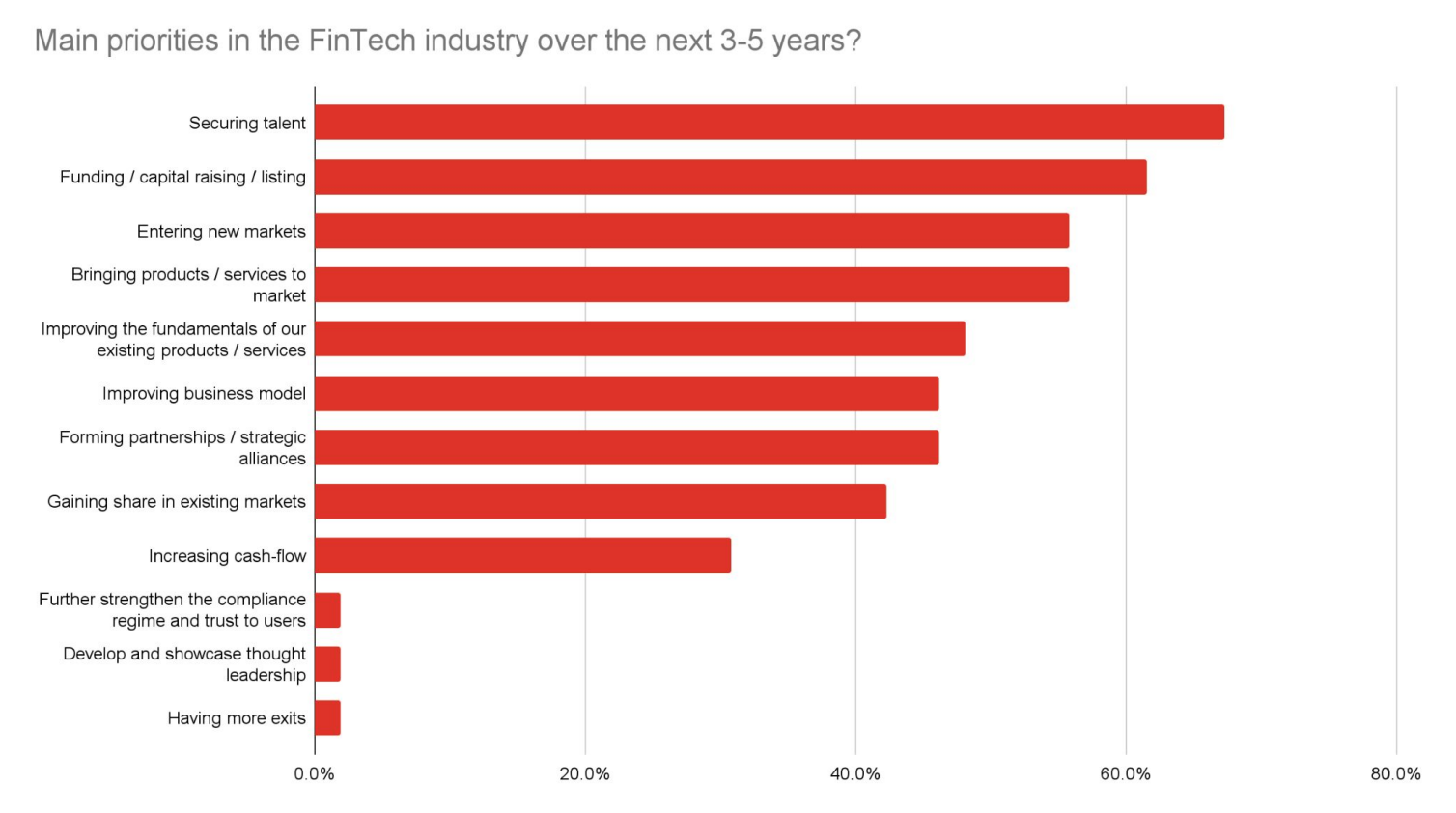

Reflective of the challenges industry participants identified, the respondents named sourcing and retention of talent as their organization’s priority in the next three to five years (>65%).

The growth of Singapore’s fintech sector and opportunities in the wider region are also reflected in the areas of focus industry participants will be concentrating on in the coming years. More than 60% of respondents said they will focus on securing funding over the next three to five years, over 55% said they will be entering new markets, and more than 55% said they will bring new products and services to the market.

Main priorities in the fintech industry over the next three to five years, Source: Fintech’s state of play, PwC, Singapore Fintech Association, 2022

Singapore’s fintech sector

Like the rest of the world, fintech funding in Singapore slumped this year, with 138 deals recorded in the first quarters of 2022, totaling US$2.12 billion. The sum represents a 80% drop from 2021’s US$10.49 billion.

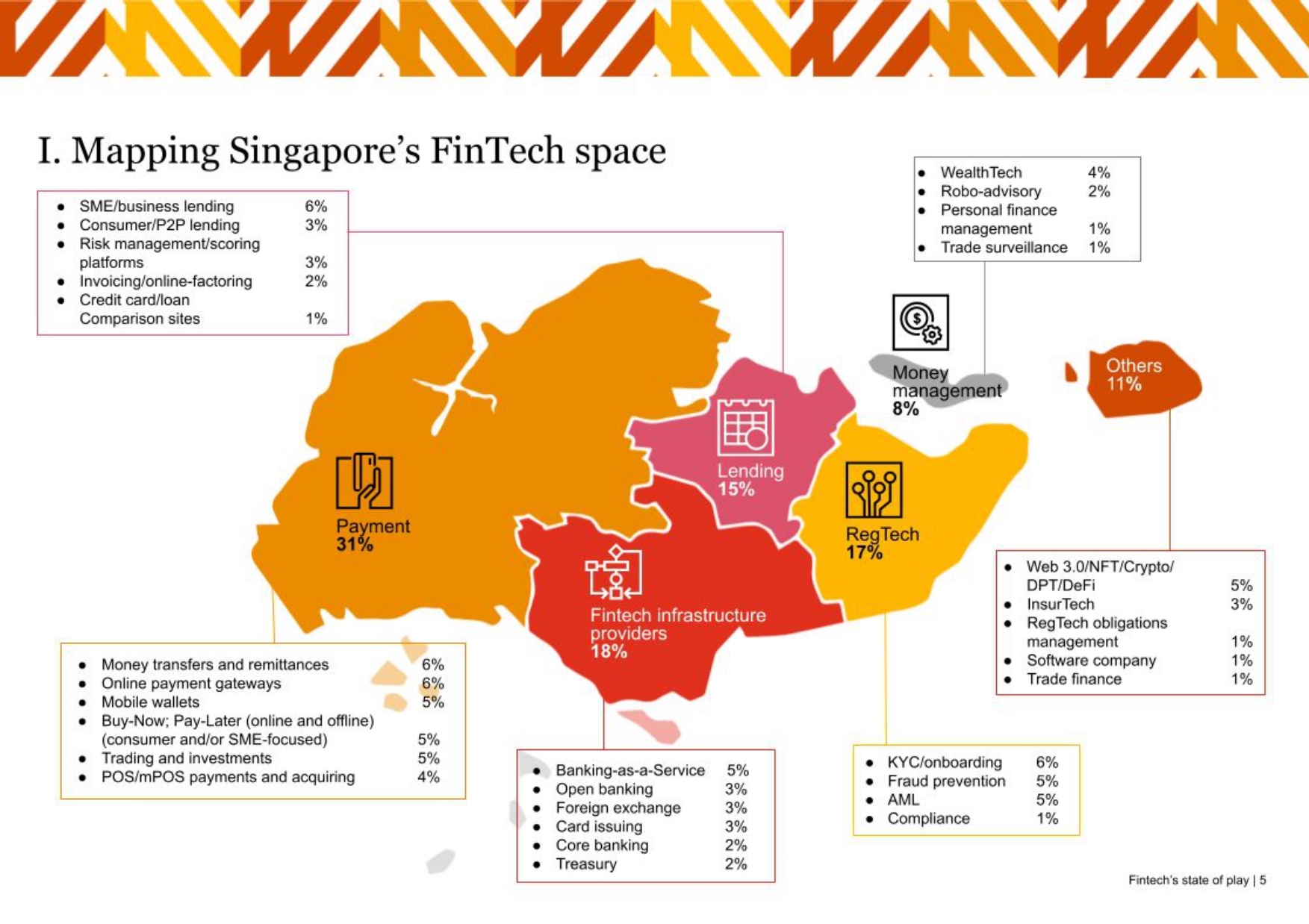

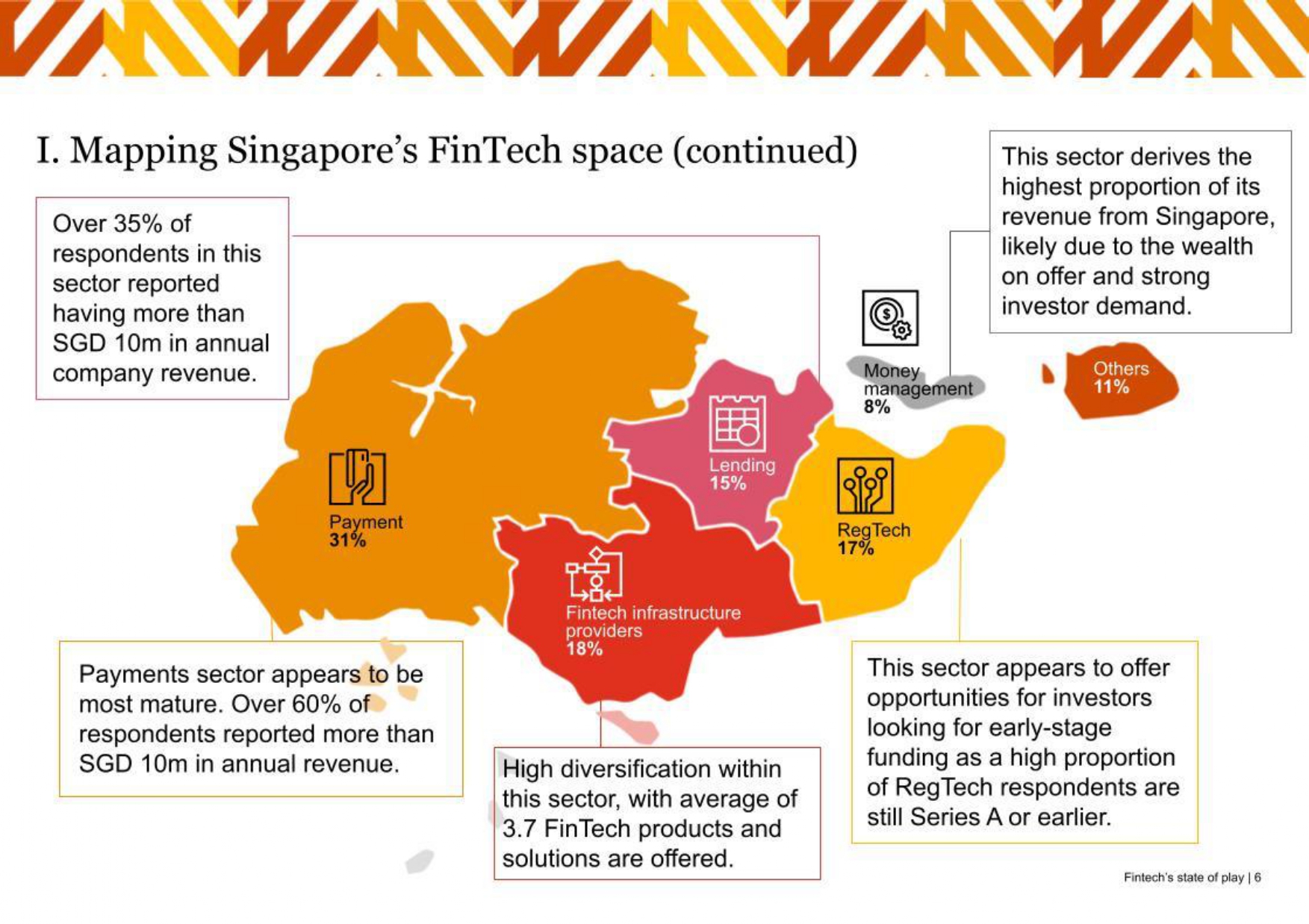

A look at Singapore’s fintech sector reveals that the country has surpassed the 1,000 threshold with regard to the number of fintech firms operating in its jurisdiction. Payment remains the largest sector, accounting for 31% of all fintech companies in Singapore. Payment is followed by fintech infrastructure providers (18%), regtech (17%) and lending (15%).

Singapore’s fintech space, Source: Fintech’s state of play, PwC, Singapore Fintech Association, 2022

Payment is also the most mature fintech segment, with over 60% of the respondents polled reporting more than S$10 million in annual revenue. Lending is also a maturing space, with over 35% of respondents in this category reporting more than S$10 million in annual revenue.

The fintech infrastructure providers category is a sector with high diversification. On average, each provider offers 3.7 different fintech products and solutions, the research found.

Regtech, meanwhile, appears to offer considerable opportunities for investors looking for early-stage funding, given that a high proportion of regtech respondents were found to still be in the Series A stage or earlier, the report says.

Mapping Singapore’s fintech industry, Source: Fintech’s state of play, PwC, Singapore Fintech Association, 2022

The years to come are expected to see greater development in Singapore’s fintech industry. For one, the country has started seeing the launch of its first digital-only banks. Second, online payments and embedded financial solutions have picked up steam on the back of booming e-commerce activity and soaring real-time payment usage.

Buy now, pay later (BNPL) is another emerging trend, the report notes. In 2021, BNPL transactions reached S$440 million. A 2021 research found that about one in five Singaporeans had tried BNPL services.