Travel Insurance Represents Massive Opportunities for Insurtech as The World Reopens

by Rebecca Oi December 15, 2022Insurtech startups in the Southeast Asian region are capitalising on the heightened need that consumers now have for travel coverage, even as the majority of countries globally relax travelling restrictions in earnest.

In the recent past, this sort of travel coverage would be viewed as an optional product that people purchase when they may be traveling somewhere with a dubious safety record. But following the recent global health crisis, adequate travel insurance is now viewed as an absolute essential before travelling.

Travellers often lament the protection afforded to them by their insurance providers, not to mention the troublesome and lengthy process of claims.

Capitalising on this, many insurtech companies in the region are focusing on providing innovative, digital-first insurance products and services that cater to the specific needs and preferences of consumers in the region.

These products and services often use advanced technologies such as artificial intelligence and data analytics to offer more personalised, convenient, and affordable insurance options.

Insurtech in Singapore, Indonesia and Thailand

According to a report, Singapore has one of Asia’s biggest concentrations of insurtech start-ups, with over 80 companies in the island state. The market is expected to grow annually by nine percent (CAGR 2021 to 2026). The Singapore government is also supportive of the insurtech industry, with initiatives such as the Sandbox Express program.

The Indonesian insurance market is highly fragmented, with many small and medium-sized companies competing for customers. According to the data published by the General Insurance Association of Indonesia (AAUI), all insurers have recorded a 20 percent increase in their half-yearly turnover. Traditional insurers are partnering with insurtechs to diversify distribution channels to capture business growth.

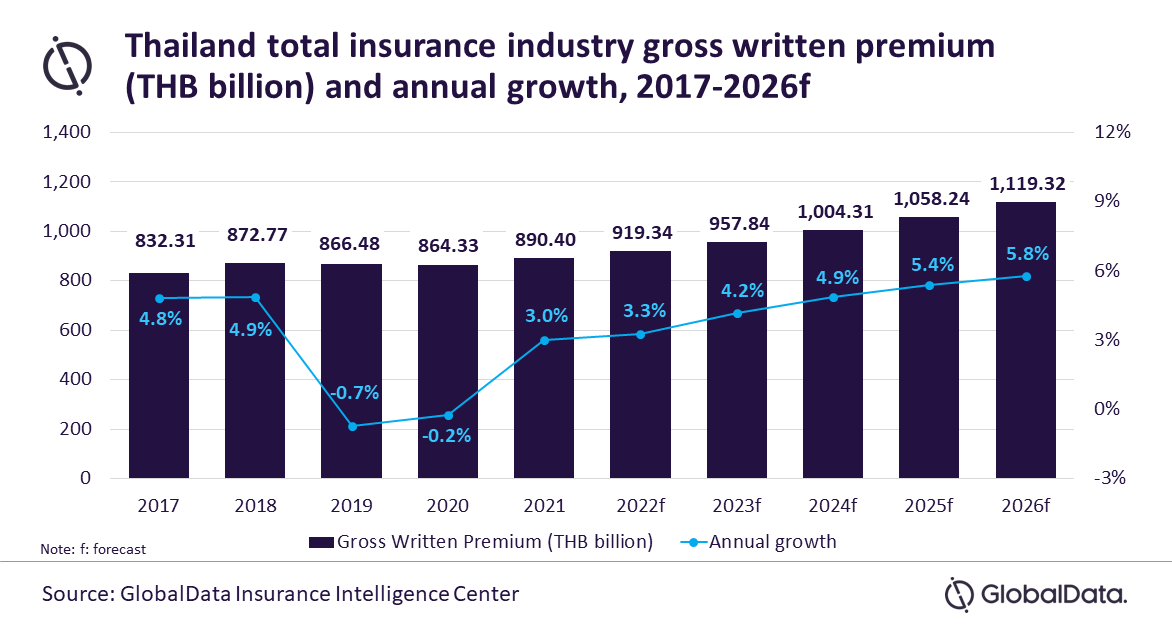

Meanwhile, Thailand’s insurance industry is forecasted to reach US$36.1 billion by 2026, according to a GlobalData estimate. Insurtech is embedded in the country’s Fourth Insurance Development Plan (IDP 4) for 2021 to 2025 to ensure that the industry can adapt to the new environment.

Travellers favouring travel providers and agents

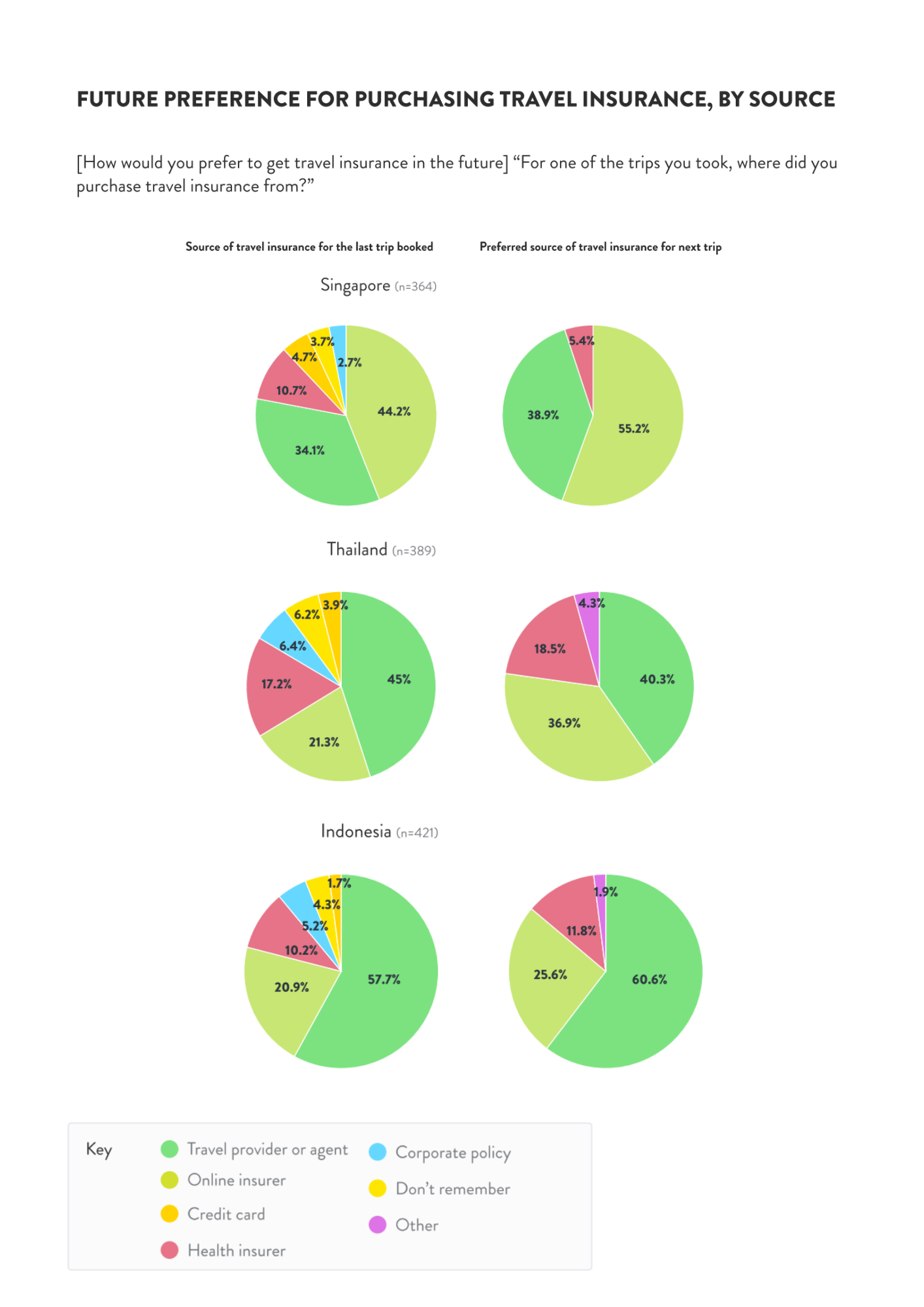

Research has shown that 44.2 percent of travellers from Singapore bought their insurance through an online insurer for their last trip.

In contrast, 45 percent from Thailand and 57.7 percent from Indonesia purchased via travel providers or agents. Singapore travellers would also switch to travel providers, with 39.6 percent exploring this option, whereas Thailand (45 percent) and Indonesia (60.6 percent) would still go through travel providers.

Cover Genius’ senior vice-president for partnerships, Asia-Pacific, Barney Pierce, said that this indicates the majority across Southeast Asia prefer to purchase travel insurance directly from their travel provider or agent for their next trip. This can only be achieved with embedded protection throughout their booking experience.

That being said, there are several reasons why people in these countries may prefer to buy insurance through traditional insurance providers rather than insurtech companies.

For example, some people may be more familiar with and comfortable with traditional insurance providers and may prefer to purchase insurance from companies they know and trust.

Additionally, some people may be hesitant to try new and unfamiliar technology and prefer to stick with tried-and-tested methods for purchasing insurance. Finally, certain insurance products or services may only be available through traditional insurance providers, which could also influence people’s decisions about where to buy insurance.

Factors considered when purchasing travel insurance coverage

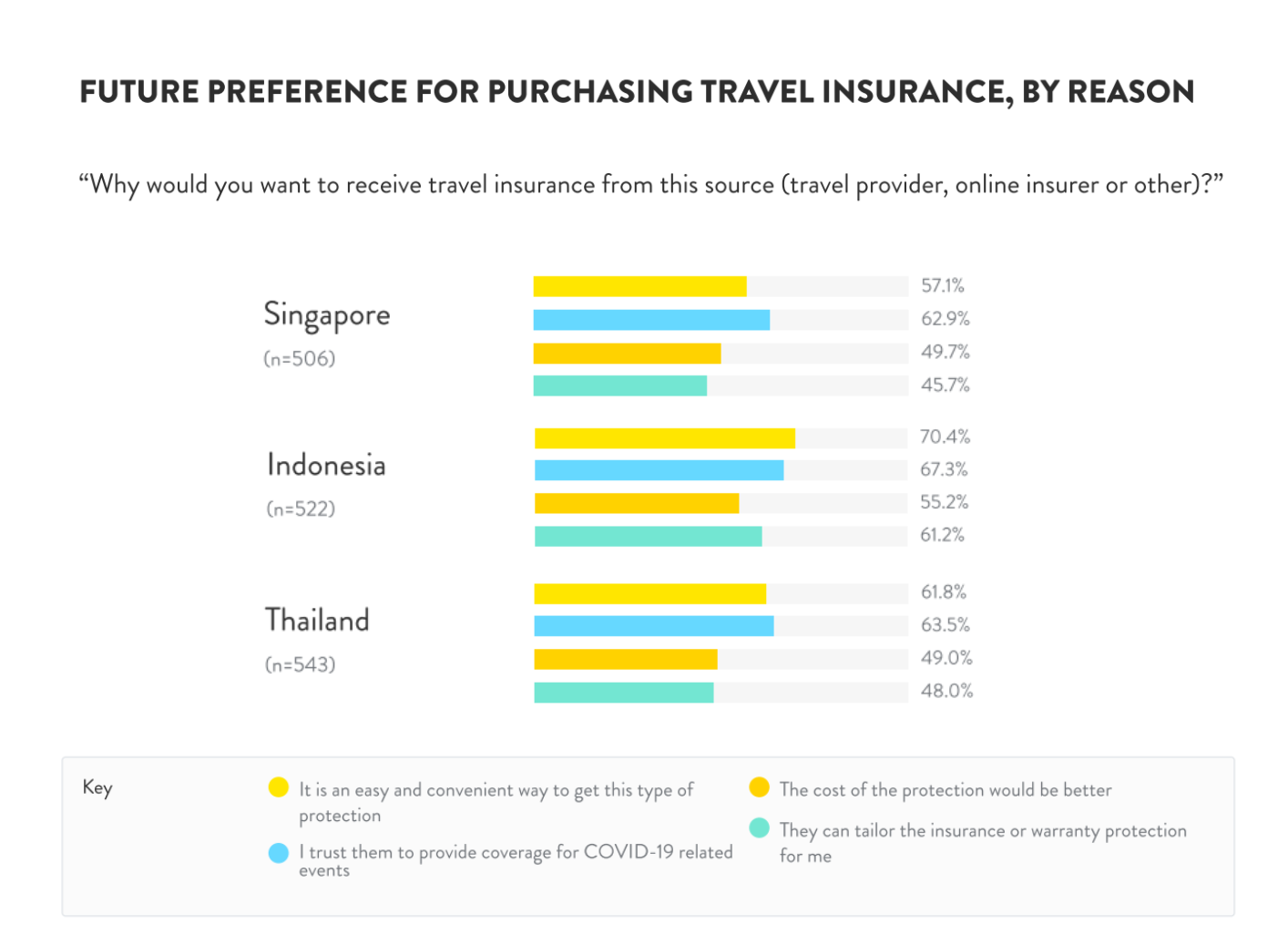

Singaporeans rank trust as the number one factor when purchasing travel insurance, followed by the convenience of obtaining the cost of protection.

This is why many are drawn to the exclusive travel insurance promo, which offers both reliability and ease of access.

Similar to the expectations of Singaporeans’, Thais also have the same ranking, whereas Indonesians place convenience as the most important factor, followed by trust.

Indonesians also want the flexibility to customise insurance or warranty protection, with this factor coming in third place.

All three Southeast Asia countries in the research have a zero to negative net promoter score (NPS) for online insurers regarding the claiming experiences, with credit cards scoring negatives across the board.

Travel providers scored a positive in Thailand but still failed to meet expectations for Singaporeans and Indonesian travellers, registering negatives in these two countries.

This indicates the overall dissatisfaction with travel insurance in the region.

Post-covid travel insurance

With the ever-present possibility of contracting covid, a travel insurance plan that includes COVID-19 coverage is an absolute must, according to Alan Wong, a financial service director at Prudential and an authorised agent of AIG Singapore. Supporting Wong’s opinion is Chandramogan s/o Gunasakaran, an executive senior financial planner with Great Eastern Singapore.

“There could be a case where a person could be down due to COVID-19 and might need to cancel, postpone the trip or suffer some travel disruption either before, during, or after the trip. For such situations, insurance companies will reimburse based on the sub-limit of (the) plan for expenses incurred during these situations,” said Chandramogan.

Therefore, there is a role for insurtech to deliver insurance to thousands of travellers through access to more personalized and tailored insurance products and services based on their specific needs and preferences, including coverage for pandemic-related risks and disruptions.