DeFi Industry Shows Resilience In Spite of Crypto Market Slump

by Fintech News Singapore January 26, 2023Despite an ongoing crypto winter, the global decentralized finance (DeFi) market has remained strong and resilient, maintaining its dynamism with sustained venture capital (VC) funding activity, increased user adoption, and encouraging signs of institutional interest, a new report by HashKey Capital says.

The 2022 DeFi Ecosystem Landscape Report, released by the crypto fund in December 2022, looks at the current state of the DeFi industry and shares the outlook for 2023.

According to the report, 2022 saw significant growth in the ecosystem of financial applications being developed in smart contracts. Companies put the brakes on marketing spends to instead focus on building and improving their products, the report notes, focusing on enhancing user experience and user interface.

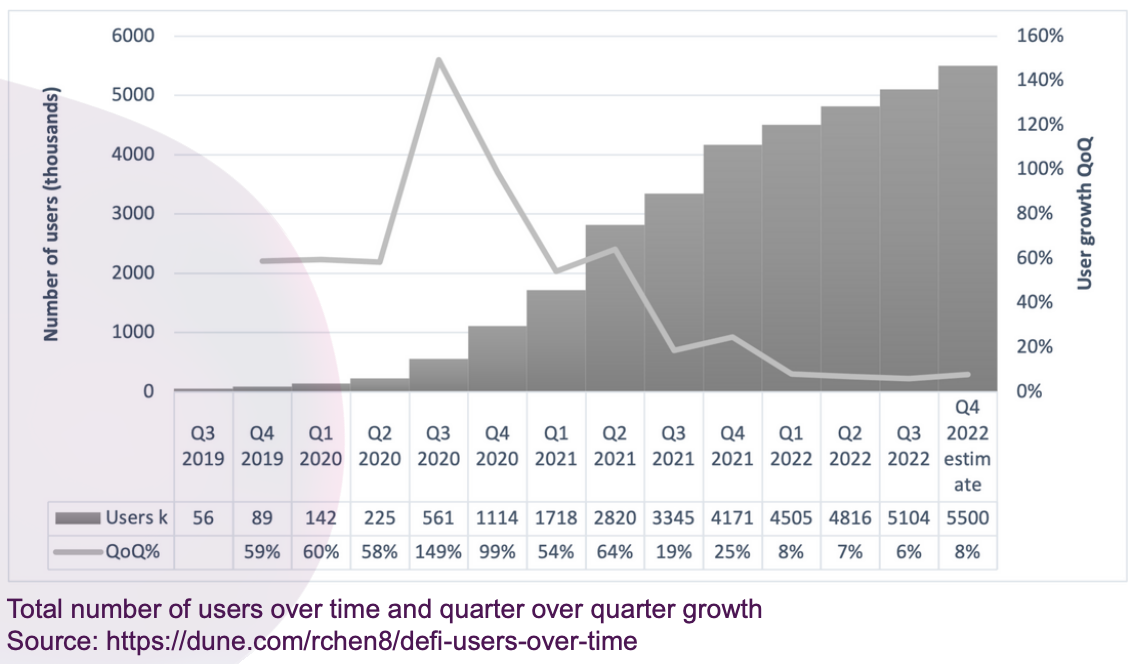

At the same time, user adoption of DeFi continued to rise, increasing 31% in 2022 and surpassing the 5 million user wallet milestone in Q3, it says.

Total number of users over time and quarter over quarter growth, Source: rchen8/Dune, via 2022 DeFi Ecosystem Landscape Report, HashKey Capital, 2022

This growth came amid sustained support from investors in the sector. These poured more than US$14 billion into 725 crypto projects in the first half of 2022, among which many DeFi-related initiatives, the report says.

This is in contrast to the global startup funding downturn observed last year. Data from CB Insights show that in the first three quarters of 2022, tech startups secured a total of US$329.2 billion in funding, a sum which represents a 27% decline from what was raised during the same period the previous year (US$452.2 billion).

User adoption of DeFi increased in 2022 also thanks to the large companies that embraced crypto that year, the report notes. Instagram, for example, introduced a non-fungible token (NFT) feature in Q2 2022 and is now planning to add new capabilities such as enabling users to create their own NFTs and sell them directly to fans.

Reddit says its users have opened over 2.5 million crypto wallets since its introduced its NFT marketplace in July. And Twitter is rumored to be working on integrating a crypto wallet.

Bridging DeFi and traditional finance

2022 also saw some encouraging signs of institutional interest in DeFi, the report notes, as evidenced by the growing number of pilot projects and DeFi initiatives unveiled by incumbents over the past year or so.

Huntingdon Valley Bank, a Pennsylvania chartered bank, got approved in July for a US$100 million loan on MakerDAO, a DeFi lending protocol; Project Guardian, an initiative spearheaded by the Monetary Authority of Singapore (MAS) focused on exploring the potential of DeFi and digital assets, completed its first live trades in November; and Dutch bank ING is reportedly exploring DeFi peer-to-peer (P2P) lending.

Amid growing interest in DeFi from the traditional finance sector, HashKey Capital predicts that new products and use cases will continue to emerge in 2023, citing as an example the launch in September 2022 of Compound Treasure, a tool that enables institutions to access the Compound DeFi protocol in a permissioned manner. These DeFi solutions will be designed for institutional use, allowing banks to meet their regulatory-compliance obligations, the report says.

Moving into 2023, HashKey Capital expects to see “real institutional adoption” with growing involvement of traditional finance in DeFi as infrastructures improve and evolve to accommodate these organizations’ need.

The firm also projects a convergence of the NFT and DeFi spaces, potentially helping further fuel DeFi adoption. Currently, the NFT industry is a multi-billion-dollar market that has significantly helped improve crypto awareness and adoption, the report notes. That market can leverage DeFi to unlock its liquidity, it says, helping accelerate the tokenization of real-world assets as NFTs.

The crypto market has undergone a significant downturn since late-2021. Over the past year, about US$2 trillion have been wiped out of the market. Total market capitalization currently stands at US$800 billion, down more than 70% from US$2.9 trillion in November 2021, data from Coinmarketcap show.