FlexM Raised SGD 1.25 Million – Complete Mobile Solution For Financial Inclusion, Remittance and Electronic Payroll In Southeast Asia

by Fintech News Singapore November 15, 2016With a mission to bank the unbanked and under-banked populations, the fintech company FlexM has successfully raised first round seed funding of SGD 1.25 Million. FlexM is quickly addressing the salary, payment and remittance needs of migrant and foreign domestic workers in Southeast Asia. The company officially entered the Singaporean market in September 2016, with an innovative virtual wallet that acts like a bank account and is specifically designed for smartphones.

“FlexM is working towards the financial inclusion of migrant and foreign domestic workers, while providing both commercial and private employers, the option to electronically pay salaries, securely, efficiently and with proof of payment.” said FlexM CEO and founder, Rune W Nilsson. Now workers can transfer funds directly to their families back in their home-countries from their smartphone at lower costs.

To better support the Asian Market, FlexM signed a strategic partnership with the award-winning fintech company, MatchMove Pte. Ltd. The Asian market consists of a population with over 100 million unbanked or under-banked people who have frequent access to smartphones. And it is quite common for migrant and foreign domestic workers living in developed cities such as Singapore and Hong Kong to encounter a variety of financial challenges, like even gaining a local bank account.

These financial challenges of the workers result in payroll difficulties for their employers as well, like having to pay employees in cash with an unsubstantiated proof of payment.

“Workers spend long hours every weekend queuing up to send money home and their families have to go to cash collection centres to receive this money. These existing remittance options are expensive and time consuming.

FlexM provides a solution for both senders and receivers, by moving the process to your smartphone and enabling cross-border, wallet-to-wallet money transfers with lower transaction and remittance rates.”, said FlexM COO and co-founder, Naveed Weldon. With the FlexM solution, members have access to their funds – anywhere, anytime.

INNOVATION

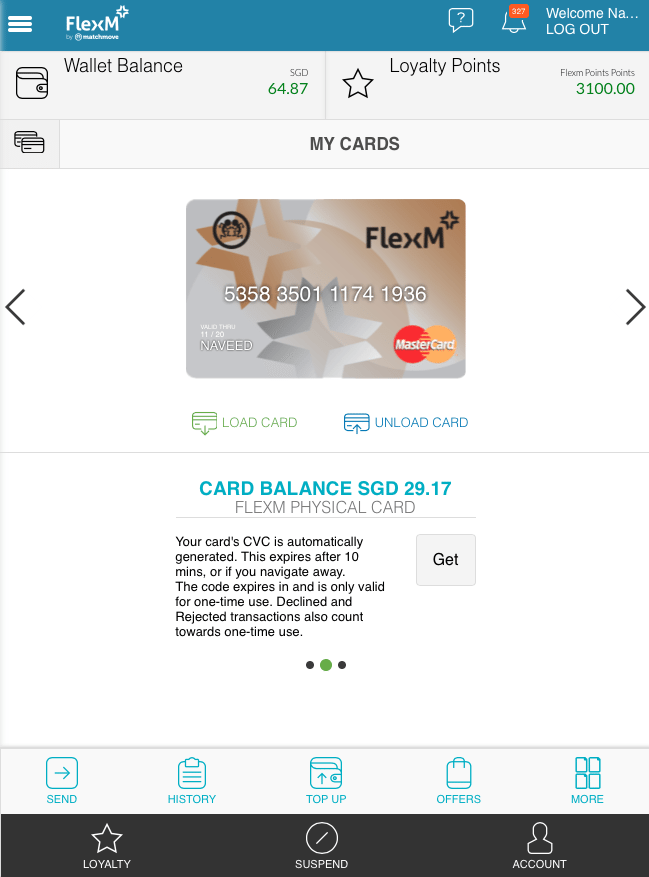

After signing-up, every FlexM member receives a virtual wallet that comes with the convenience and flexibility of a virtual MasterCard for safe online shopping and up to four physical pre-paid MasterCards that can be used around the world.

The virtual MasterCard provides greater financial security. Unlike other credit cards, the 3-digit Card Verification Code (CVC) is dynamic and changes for every purchase and expires after 10 minutes. Having multiple pre-paid MasterCards provides convenient money management solutions for families as well. Parents can give cards to their children, upload weekly or monthly allowances, and monitor their children’s pocket money expenditure in real-time with just a few clicks on the smartphone.

This pre-paid MasterCard can be used around the world and offers effortless tap and go payment and easy top-up and cash-out options. In Singapore, members can top-up their MasterCard at FlexM centres in Lucky Plaza and City Plaza or at over 600 selected NPN merchants.

The FlexM payroll solution also enables employers to create virtual wallet accounts and effortlessly top-up employee salaries, while providing an essential proof of payment. This helps save administrative time and cost for companies with large workforce and high turnover. FlexM is offering the software to companies free of charge during the initial launch period.

SIGN UP

Employers or foreign workers can sign-up at www.flexm.sg or download the FLEXM APP. All that is required is a Identification Card, proof of local address, email address and a mobile number. No minimum account balance is required and there are no annual or hidden fees. After signing-up, please visit a FlexM centre in Singapore’s Lucky Plaza or City Plaza for face-to-face verification and to receive your physical MasterCards.

FLexM Centre

Migrant workers such as live in helpers, nurses, industrial workers in construction, cleaning & security, oil & gas, ship crews, shipyards construction, food & beverage industry workers – to name a few, can now have the convenience and flexibility of the FlexM financial solution in the palm of their hand as long as they have a smartphone.

Furthermore, corporate employers of foreign workers can access a free bulk payroll service online for real-time secure payments of commissions and salaries, to multiple or to individual employees, with an administration portal, history and analytics. Enrollment for the corporate virtual wallet service takes minutes and can be set-up via Internet by an authorized company administration representative.

THE TEAM

FlexM’s CEO and founder Rune W Nilsson’s vision was to create an easy, convenient and affordable corridor of remittance between Asian countries, with local currencies. He has spent the last ten years leading successful startups, most recently as a Vice President for Prego Prepaid Solution.

FlexM’s COO and Co-founder Naveed Weldon is a seasoned banker with 14 years of experience across Asia and the Middle East. At Standard Chartered, he was the Global Head of Sales Implementation where he designed a market disruptive payroll-segment banking model.

FlexM’s CTIO and Co-founder Georg Dokken is an experienced professional with a diverse background in fintech, Internet, search, analysis, project launch and management.

FlexM’s CMO Benjamin Howes is an all-round marketing, communications and brand management professional, with over 12 years of progressive experience in Asia, most recently at Samsung Electronics Global HQ in Korea.