Australian Central Bank Set to Launch CBDC Live Pilot in a Few Months

by Fintech News Singapore March 2, 2023The Reserve Bank of Australia (RBA) will be launching its live central bank digital currency (CBDC) pilot in the next few months.

The central bank has been collaborating with the Digital Finance Cooperative Research Centre (DFCRC) on a research project to explore potential use cases and economic benefits of a CBDC.

The project involves selected industry participants demonstrating potential use cases for a CBDC using a limited-scale pilot CBDC that is a real digital claim on the Reserve Bank.

The project received a large number of use case submissions from a range of industry participants.

A range of criteria were considered in selecting the use cases to participate in the pilot, including the potential to provide insights into the possible benefits of a CBDC.

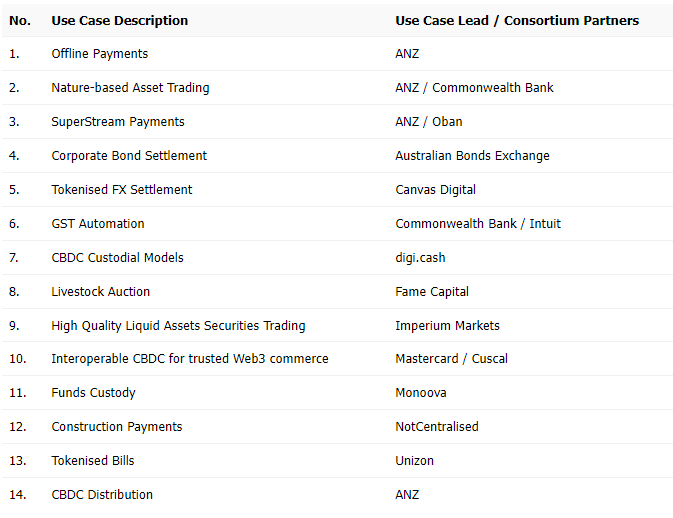

Use cases from several major financial institutions such as ANZ, Commonwealth Bank and more have been selected to be a part of the live pilot.

Selected Use Cases and Providers Source: Reserve Bank of Australia

A report on the project is expected to be published around the middle of the year.

Brad Jones

Brad Jones, Assistant Governor (Financial System) at the RBA said,

“We are delighted with the enthusiastic engagement by industry in this important research project. It has also been encouraging that the use case providers that have been invited to participate in the pilot span a wide range of entities in the Australian financial system, from smaller fintechs to large financial institutions.

The pilot and broader research study that will be conducted in parallel will serve two ends – it will contribute to hands-on learning by industry, and it will add to policy makers’ understanding of how a CBDC could potentially benefit the Australian financial system and economy.”

Dilip Rao

Dilip Rao, Program Director – CBDC with the DFCRC said,

“The variety of use cases proposed covers a range of problems that could potentially be addressed by CBDC, including some that involve the use of CBDC for atomic settlement of transactions in tokenised assets.

The process of validating use cases with industry participants and regulators will inform further research into design considerations for a CBDC that could potentially play a role in a tokenised economy.”