FinTech innovations could add 150 million new Islamic Banking Customers by 2021

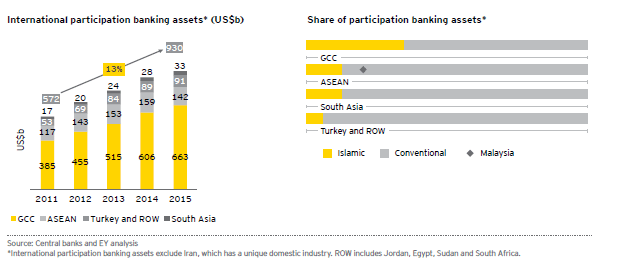

by Fintech News Singapore December 7, 2016According to EY’s Banking in emerging markets report, the assets of global participation banking (also known as Islamic banking) reached US$924b in 2015, with growth rates declining across all regions compared to previous years.

The GCC region’s share of participation banking increased to 72%, as the size of assets in the Association of Southeast Asian Nations (ASEAN) countries declined during 2015.

Saudi Arabia, the UAE and Malaysia are the three largest participation banking markets, in terms of assets, representing 34.2%, 17.2%, 13.3% of the global market share respectively.

Gordon Bennie, MENA Financial Services Leader, EY, says: “Today, more than two billion adults still do not have a bank account. There are also more than 200 million micro, small and medium size businesses with unmet financing needs. The demand for a responsible, Sharia-compliant financial system is huge. There is also a wealth of business opportunities offered by FinTech innovations for participation banks, particularly in emerging markets.”

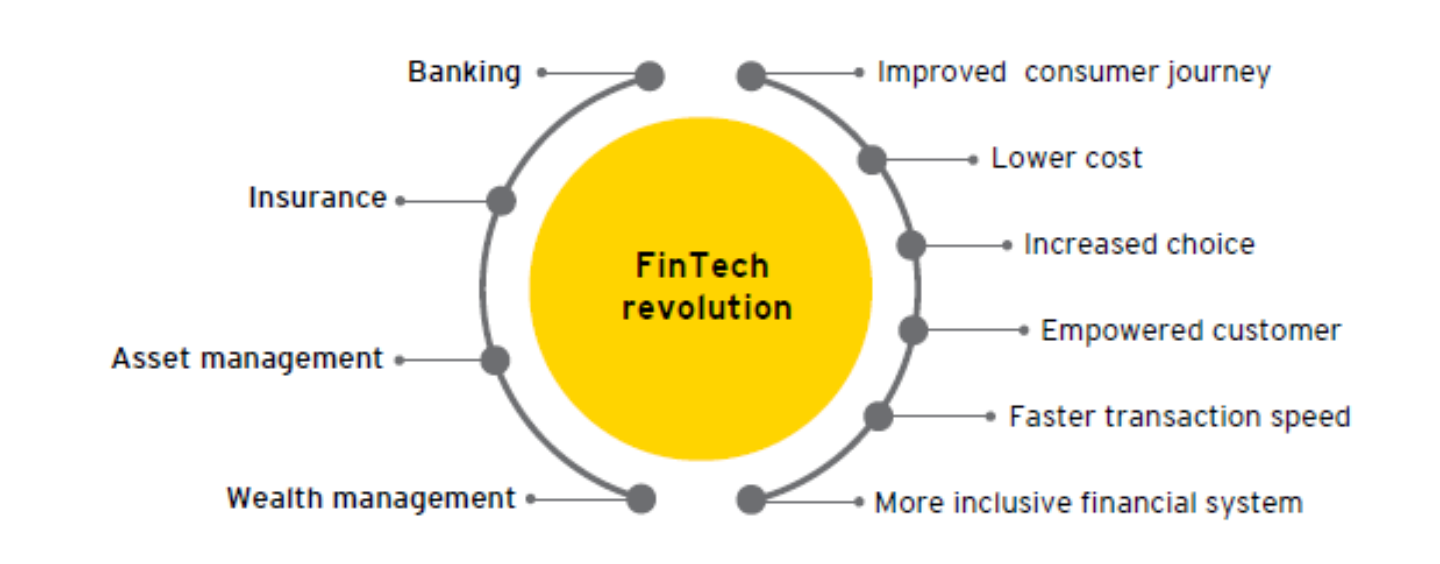

FinTech opportunities for participation banks

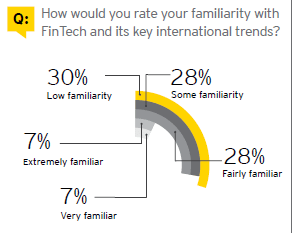

In the GCC region, FinTech innovations have the ability to enhance market access and profitability of banks, dramatically. A starting point for participation banks is to activate a bold strategy for the finance function – inclusive of advanced data analytics, robotic process automation, the cloud, artificial intelligence and block-chain.

Ashar Nazim, Partner, Global Islamic Banking Center, EY, says: “The fact that almost one-third of the US$3t global Sharia-compliant assets are either reported as ‘informal or ‘best estimates’ demonstrates the limitation of participation banks in making sound strategic decisions. CFOs need reliable information and we are seeing a strong desire to improve data management and analytics at participation banks through FinTech innovations.”

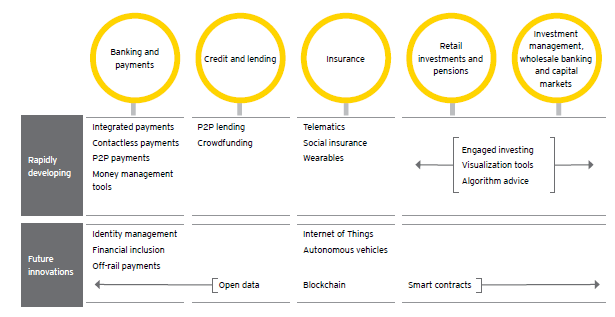

Some of the key areas of FinTech innovations that are relevant for participation banks include: SME and peer-to-peer lending platforms, payment related innovations such as person-to-person payments, digital authentication and digital wealth management.

“There has been a clear evolution for CFOs from having the primary role of analyzing historical data to one whose focus will be providing forward-looking insights. In-memory computing and big data are the clear direction forward, with predictive analytics being a key driver of these changes. Given that there is more FinTech innovation going on outside of the banks than inside, the opportunity is for participation banks to win through collaboration. The bank of the future could be a consolidation of FinTech boutiques under a single brand,” comments Ashar.

If banks were to consolidate with Fintech companies, it could propel participation banks to become mainstream across 20 promising markets by 2021, up from five markets today, representing a jump from 100 million customers to 250 million customers over the same period.

Digital-only bank for millennials

The millennial generation has a clear preference for conducting their financial services on an end-to-end digital platform. Using FinTech innovations, banks worldwide are stepping forward to offer digital-only banking services to meet the differentiated needs of this customer segment.

Digital-only banking could become a significant client segment for participation banks. There is a case for participation banks to evaluate collaborative ventures with FinTech firms to launch digital-only banks in their respective countries.

“The adoption of FinTech innovations is not an option, but an absolute imperative for participation banks to continue to gain market share. Consumer technology penetration (mobile phone, tablet, laptop) in the GCC region is now comparable with that of consumers in most developed countries.

Based on their familiarity and use of consumer technology, their behavior patterns are modifying, with increased expectation to interact with banks using digital channels. Participation banks cannot realistically expect to gain sustainable future growth in their market share if they lag behind their conventional counterparts in digital transformation through the use of FinTech innovations,” concludes Ashar.