Singtel and SCB’s Dash Seeks to Reinvent How Singaporeans Pay, Save and Borrow Money

by Fintech News Singapore November 4, 2015Released in June 2014, Dash is a mobile banking service from Singapore Telecommunications Ltd. (Singtel) and Standard Chartered Bank (SCB) that aims to reinvent the way Singaporeans access, save and borrow money, make payments and purchase insurance.

Essentially, Dash consists in four mobile commerce and banking solutions that are accessible through a mobile app currently available for Android and iOS smartphones: Dash Pay, Dash Easy, Dash Advance and Dash Abroad.

According to Allen Lew, Singtel’s CEO Group Digital Life, Dash is aimed at providing a solution that suits the lifestyle needs and habits of the mobile Internet generation “who are used to downloading information and content on the go.”

“By bringing together players in the banking, telecommunications and retail sectors, we are able to deliver a differentiating experience for consumers in terms of convenience, ease of use and accessibility,” Lew said in a release.

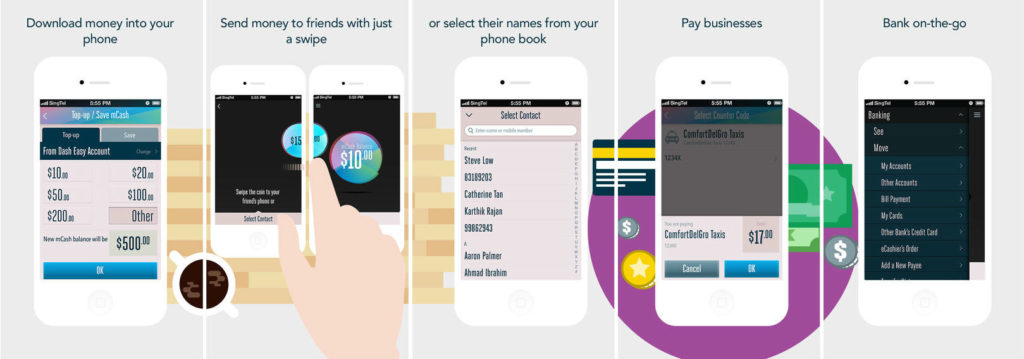

Dash iPhone Screenshots – Image credit: itunes.apple.com.

What is it and how does it work?

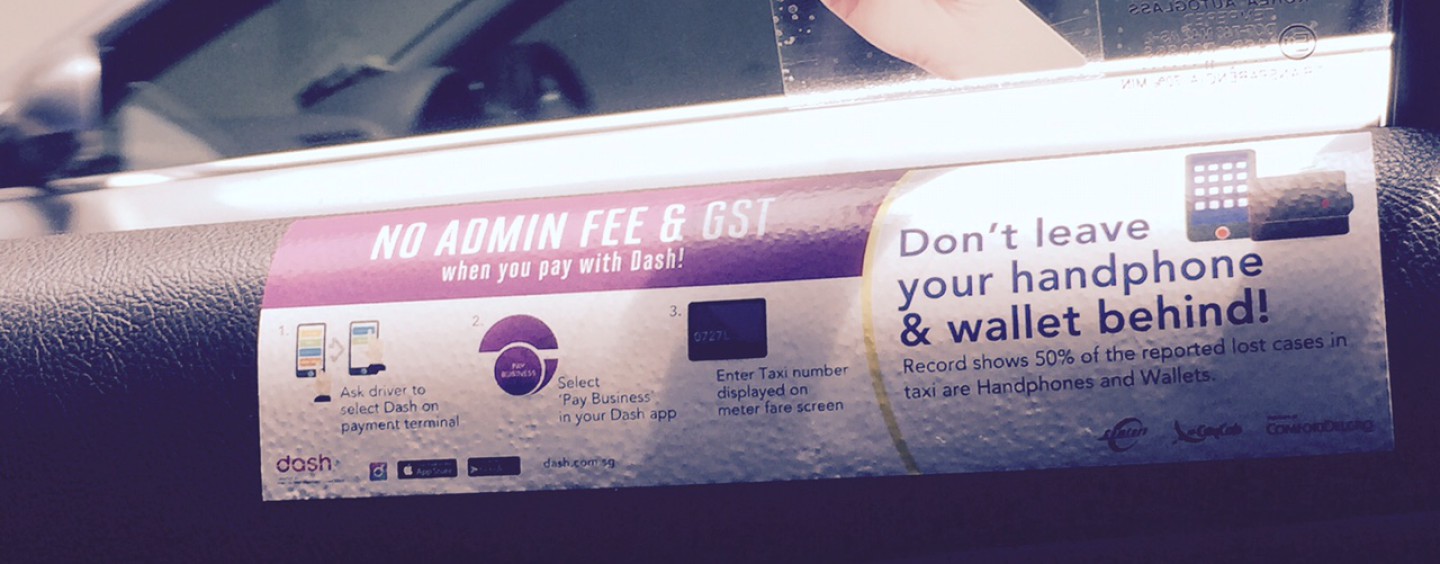

Dash Pay is a mobile cash (mCash) account that lets consumers pay businesses using their mobile phone without any admin fee. Users can top up their digital wallet via online banking, standing instruction or GIRO.

The service currently supports up to 20,000 locations in Singapore ranging from retail and convenience stores, to food and beverages outlets and taxis.

These businesses include 7-Eleven, ACE Insurance, ComfortDelGro Taxi, Food Republic, KFC, Koi Cafe, Pizza Hut, Prime Taxi, Singtel canteen and lobby cafe, Singtel Shop, SMRT Taxi, Sodexo, Spinelli, Watsons, WingTai Retail, and most recently Lazada.SG.

To make a payment, you simply need to open the Dash app, login using your phone number and PIN code, tap on “Pay Business,” select the business you want pay by entering the Counter Code, enter the amount, and confirm.

Paying a friend is that simple as well. Instead of choosing “Pay Business,” you tap on “Pay Friend” and enter the amount you want to send. Then you have two options: you can either choose the contact from your phone book or swipe across from your screen to your friend’s mobile phone screen.

Here’s a short demo clip for the sake of clarity:

Dash Easy on the other hand is a savings account offered by SCB linked to a mCash account delivered by Singtel. Customers can “download cash” into their mobile phones instantly to pay merchants and friends without the need to go to an ATM, as well as earn 0.5% base interest p.a.

To setup an account, you need to enter your personal details and take a picture of the front and back of your National Registration Identity Card. The bank then needs to verify your information details, which can take up to three days. When everything is set, you get your Standard Chartered Dash Easy Savings Account and receive a new ATM card, the Dash Easy ATM, and account number.

Dash Advance is a personal loan facility provided by SCB which you can apply through your mobile phone.

Finally, Dash Abroad is a travel insurance product, underwritten by ACE Insurance Limited. The basic plan costs as low as S$20 per trip and includes coverage for overseas medical expense (up to S$50,000), accidental death and disablement (up to S$100,000) and emergency medical evacuation (up to S$100,000).

Dash currently has the largest mobile merchant networks in Singapore, and has recently been enhanced with new features including Samsung Fingerprint Scanner and Apple Touch ID authentication.