Accenture Fintech APAC Study: Fintech Investment to Quadruple in 2015

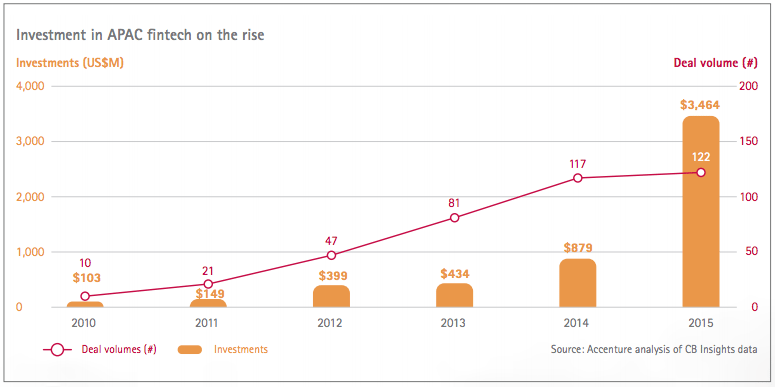

by Fintech News Singapore November 11, 2015Fintech investment in Asia-Pacific has been on the rise. In the first nine months of 2015, there had been 122 deals totalling a record of US$3.4 billion injected in the sector, according to a new report from Accenture.

Entitled ‘Fintech Investment in Asia-Pacific set to at least quadruple in 2015,’ the report is based on Accenture’s analysis of fintech investment-data from CB Insights, and aims to examine current fintech investments and predict future investment patterns.

“The rapid increase of fintech investments in Asia-Pacific does not surprise us,” said Jon Allaway, senior managing director of Accenture Financial Services in ASEAN and executive sponsor of the FinTech Innovation Lab AsiaPacific.

“In 2015, the majority of the financial services industry — globally — began to embrace the potential of fintech in a big way. At Accenture, we felt the impact in Asia where startups and clients from Tokyo to Jakarta contacted us to talk more about fintech.”

According to Allaway, the increase of fintech investments in the region is due to the convergence of two trends. He explained:

“Venture capitalists are clearly signaling fintech is a growth opportunity and simultaneously financial services companies are waking up to the vast opportunities created by the current wave of fintech.”

Payments and lending have been the two segments with the largest number of investment deals this year – 40% and 25% respectively.

The report also noted that the value of deals has increased significantly due to larger investments in and from China.

These deals include investments from Alibaba Group Holding and its subsidiary Ant Financial Services Group into Paytm, an Indian mobile payment and commerce platform, as well as fundraising efforts by Ping An Insurance Group venture Lufax, which has been developing multiple alternative financing and investment platforms, including peer-to-peer and business-to-customer platforms.

According to Beat Monnerat, senior managing director at Accenture and the company’s Financial Services lead in Asia Pacific, major non-traditional financial services firms have been investing in Chinese fintech startups over the past year.

Monnerat said:

“The increasing deal size should serve as a wake-up call to financial services companies in China and across Asia-Pacific that if they do not offer truly useful, customer-friendly digital solutions, competitors will step into the breach not just on the retail front but also in commercial transactions.”

Accenture further advices banks to keep an eye on startups from three particular segments: blockchain, cloud and cybersecurity.

The consultancy firm forecasts that blockchain technology will increasingly be a focus for startups, banks and investors.

“As a stand-alone technology, blockchain could help banks, credit card companies and clearinghouses collaborate to create safer, faster accounting and optimize capital use by reducing counterparty risk and transaction latency,” it claims.

Alongside blockchain tech, cloud and cybersecurity are the two other segments that are expected to attract more and more investments.

“As cloud adoption gains momentum, banks are beginning to identify which data can be hosted in the public cloud and which data should be maintained in a private cloud,” the firm said.

“Banks can satisfy regulators by keeping sensitive customer data more securely in a private cloud, while still taking advantage of the efficiency, flexibility, on-demand capabilities and lower costs cloud can offer. This creates opportunities for fintech startups to develop new services tailored around the cloud.”

Image credit: Gold coins, Shutterstock.com.