According a 19 May report by Bain & Company, the number of digital consumers in the region has increased by 50 oercent to 200 million. This has helped the region’s internet economy balloon to more than $50 billion, the report added.

With the huge potential in the market, Southeast Asia has emerged has a key target among major players from the US and China. Local players are also gaining a competitive edge, according to the report Digital Acceleration in Southeast Asia: Navigating Tectonic Shifts.

“We have seen monumental digital growth in Southeast Asia over the past year, but what is even more interesting is how these businesses are competing with very different business models, inspired by both China and the US players,” said Florian Hoppe, co-lead in Bain’s Digital Practice in Asia Pacific and a lead author of the report.

“The challenge that lies ahead is whether these companies can navigate what is still a highly fragmented market to stay head of the competition,” he added.

Social media dominates digital consumer market

Bain’s latest research, which includes a survey of 2,400 consumers in six major Southeast Asian countries (Singapore, Malaysia, Thailand, Indonesia, Philippines, and Vietnam), estimates that 230 million individuals in Southeast Asia are now ‘online engaged consumers,’ meaning they have at least researched products or services online.

Another 300 million have a smartphone, due in part to a wave of lower-priced phones, which is helping to boost connectivity across the region, as is the focus on mobile – not fixed – broadband. In Indonesia, for example, 48 times the number of users are connected to mobile vs. fixed broadband.

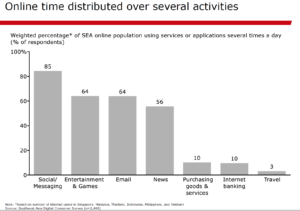

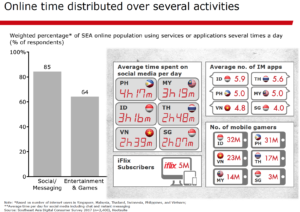

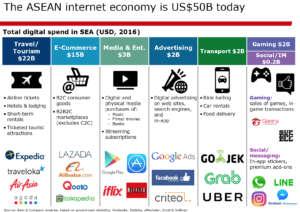

While travel and tourism in Southeast Asia represents the largest piece of the region’s digital market (US$22 billion) – followed by e-commerce (US$15 billion) – the survey revealed that most consumers use digital for social use and entertainment. Notably, social media and messaging are used several times a day by 85 percent of users across ASEAN-6, with social media playing a central role in Southeast Asia’s digital spending.

According to Bain, at least 90 percent of survey respondents across every country except Singapore said they made a purchase using social media or said they were influenced by it. As such, social is fast becoming a robust channel in its own right as users rely on it to find products, interact with sellers and ultimately make a purchase.

Emergence of local players

Even as Southeast Asia’s digital ecosystem continues to grow and mature, there remains immense opportunity. The combination of fast growing digital users with a fragmented market, means that local players are successfully competing and gaining an edge on global names in certain sectors.

While the impact of this acceleration in Southeast Asia is advantageous for start-ups and online brands, it is having a different and adverse effect on the real-world economy. From mall shopping to cinemas and taxis to travel agencies, it is clear that digital has taken a toll on certain industries.

Bain has identified three ways these companies can get ahead of the digital wave:

- Rapid innovation to create new products and services using digital technologies and ways of working

- Tech-enabled transformation to change how customers experience a product or service, and leveraging technology to gain an edge in operations

- Reinvention of internal functional capabilitiesto adapt to and leverage a digital world

“Southeast Asia has become a proving ground for digitally native companies as well as traditional companies looking to tap into the digital market,” said Sebastien Lamy, an expert in Bain’s Digital Practice and co-author of the report.

“We have seen many companies succeed here, but an almost equal number succumb to the pressures and challenges of a still maturing market. Those that can develop and implement a strategy focused on adaptability, flexibility and reinvention are likely to come out on top.”

Featured image via Pixabay