Covid19

Going Contactless in the Light of COVID

The current pandemic situation across the world is known to many by the back of their hands. There is no doubt that major cities at this stage, some at lockdown and while others are slowly reopening up their economies, are

Read MoreAssessing the Resilience of SMEs Through the Current Economic Recession

The COVID-19 pandemic has proved to be the perfect trigger to the current economic recession, but the global economy was already weak and debt levels were at all times high. When we published our annual report on the “Defaults and

Read MoreThe Financial Situation of Asia After Corona

When the coronavirus first emerged in the region of Asia in January, many predicted that it would have a damaging impact on the region’s economies and potentially trigger a recession. However, few would have anticipated that coronavirus would evolve into

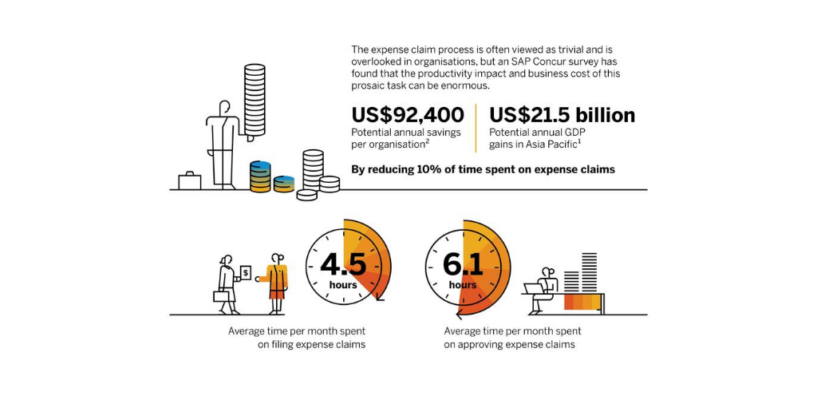

Read MoreSingaporean Businesses Slow in Embracing Finance Transformation, SAP’s Survey Finds

Despite widespread adoption of remote working and digital transformation, finance transformation is still lagging amongst Singaporean businesses, resulting in companies losing US$340 million (S$473 million) annually to inefficiencies and manual processes, according to a new study commissioned by SAP Concur.

Read MoreSteps to Go Cashless With UQPay as We Overcome COVID

As we embark on the second of the three-phased approach to resume economic activities safely, many businesses in Singapore are still expected to experience significant challenges due to the series of restrictive measures and health advisories implemented to ensure the

Read MoreSingSaver Finds More Boomers Shifting to Digital Banking Post COVID-19

The COVID-19 outbreak has prompted Singaporeans to embrace more digital services when taking charge of their finances – and this is a shift that the majority believe will stick post-pandemic, a survey by personal finance website SingSaver found. Conducted in

Read MoreFinancial Fitness and Digital Banking in the Times of COVID-19

The COVID-19 pandemic is forcing consumers to turn to digital channels. Now more than ever, banks must accelerate their digital transformation and focus on delivering tools their customers need for financial self-help, according to a new report by Meniga. In

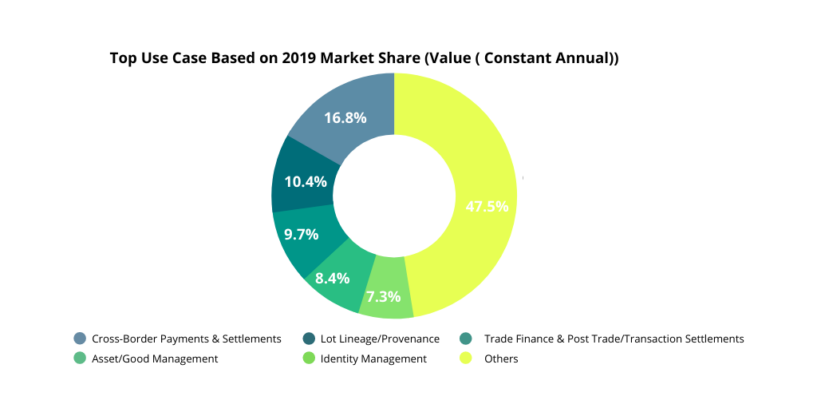

Read MoreIDC Reports Worldwide Blockchain Spending to Slow Down to US$ 4.3 Billion in 2020

According to the April update of the IDC Worldwide Blockchain Spending Guide Worldwide and Asia Pacific blockchain spend will decline in 2020 as compared to the pre-COVID-19 forecast scenario. The report captures data from all Asia Pacific countries except Japan.

Read MoreB2B Forex Tech Provider Koku Targets Southeast’s Non-Bank Financial Institutions

COVID-19 continues to spread around the planet with now more than 7.3 million reported cases, including over 416,000 deaths, according to the latest data from the Johns Hopkins University. In Southeast Asia, Singapore has one of the highest infection tallies,

Read MoreOCBC’s Virtual Wealth Advisory Service Sees 45% in Sales During Circuit Breaker

On 18 April 2020, with the Circuit Breaker period still in effect, OCBC Bank took the highly-regulated wealth advisory process – a complex face-to-face process involving over 50 pages of documents and a comprehensive Financial Needs Analysis (FNA) – online.

Read More