With Britain Done, Can Revolut Convince Asians to Try Neo-Banks?

by Fintech News Singapore February 14, 2019Founded in 2015, Revolut is one of Britain’s fastest-growing fintech players, now valued at US$1.7 billion, serving its Apple-levels cult following of 2.8 million users across 28 markets in Europe.

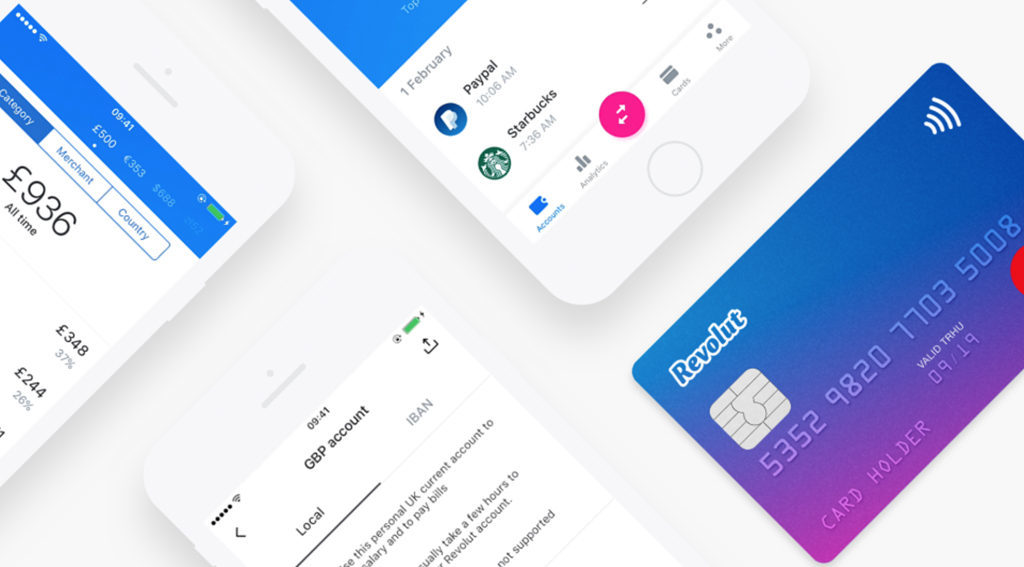

Revolut claim to fame is a payments card that offers radically lower fees when spending overseas. With a funding, the company introduced more and more additional features, from insurance, investing, cryptocurrency trading and current accounts, all accompanied with analytics of one’s financial activity with the platform.

The company has been described as trying to be “a bank by the back door”, and lately are trading TransferWise as competitors for the likes of Monzo and N26 (which has incidentally lapped Revolut for valuation).

Now the company has expressed interest in expanding into regions outside of Europe. With an Asia Pacific office parked in Singapore which implies bigger ambitions than just the stated Singapore, India and Japan, and 100,000 customers on the waiting list from Asian regions, can this challenger bank replicate their success in Asia?

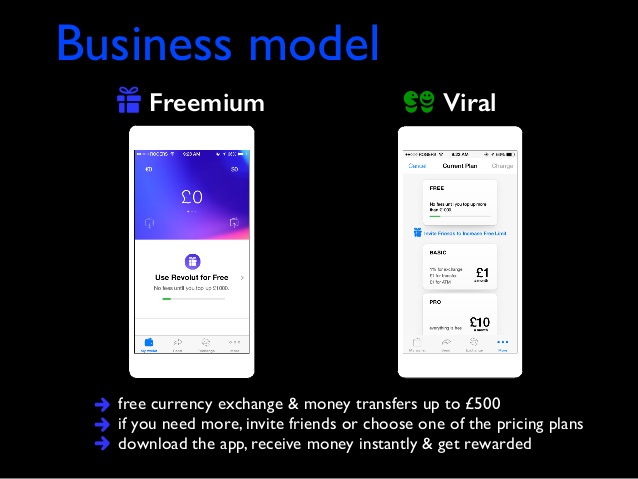

A Freemium Bank

A slide from Revolut’s old pitch deck.

The secret sauce to their success in the UK is probably its freemium business model, where the company will offer more features based on paid tiers. Naturally this means that the company will burn a lot of cash in the beginning. Thus, it’s no surprise that the company just announced that it has broken even just February last year, just as it was gearing up for regional expansion, and still not profitable yet.

Offering freemiums will certainly increase a neo-bank’s users in sheer numbers, and allow for even the most reticent users to at least give it a shot at first. Many regions here, like Singapore is already familiar with the concept of e-payments and mobile wallets, so Revolut might get at least a decent foothold with their core offering, as Singaporeans take an average of 5.2 trips in a year.

Regions in Southeast Asia and India are known as fertile breeding grounds for fintech, with its high mobile phone penetration and a thirst for financial services that are accessible and cost-effective: both characteristics of Revolut.

Meanwhile Revolut was drawn to Japan thanks to archaic banking models there that the company seeks to disrupt.

Moving Quick to Stay Ahead of Local Competition

Unlike its progress in Europe, Revolut will be ready to launch in Asia with many of its secretly-a-bank features fully-loaded: as long as it’s sifted through regulatory filters first.

Learning from past mistakes, Revolut teamed up with a London-based regtech company to help their expansion plans. The company has also set up a dedicated in-house global licensing team to aid international expansions.

This is all in the spirit of quick expansions, which CEO Nikolay Storonsky claims could be their winning ticket to staying ahead of local competition like Alibaba and Line.

“Our big advantage is that we are not afraid of expanding outside, while Asian companies are much more conservative,” Nikolay said in an interview with the Nikkei Asian Review.

“Be as fast as possible and always stay ahead of the competition. You always have to have in the pipeline certain things no one knows about, and when they copy you, you are doing new things.”

The CEO continued to say they prefer to launch fast, and with a strategy of building partnerships, like with the aforementioned regtech and one with Rakuten that would allow them to launch without having to obtain a banking license, Nikolay definitely puts his money where his mouth is.

And with VC funding behind their backs, the not-yet-profitable company is ready to bleed more money to ensure that they gain a significant slice of the market share.

Marketing Could be Their Breaking Point

Revolut, and fellow neo-banks Monzo, N26 are known for intelligent marketing, and the way we look at it, Revolut branding themselves a travel companion has served as a fantastic introduction to its British users.

A normal user might not be too keen on the idea of a fully-digital bank, but if they are instead told that it is an app to make travel exchanges cheaper, then that’s something infinitely more palatable and interesting. As far as we can tell, while their global reputation is that of a challenger bank, Revolut will still be introducing themselves in the same way to Japan and Singapore: cheaper multi-currency exchanges.

Revolut is also great at building hype. Their waiting lists come to mind, as frequent stars of headlines regarding them, as it would drive curiosity as to what is so great about them by those not in-the-know.

In fact, the Revolut cult that was built in the UK was also built via reputation; banking on social proof as a driver of consumer adoption by building product in ways that drive consumers to tell their loved ones about it.

Featured image via Revolut