Traditional Insurance Companies Forced By Insurtech To Innovate In 2017

by Kai Kiat January 11, 2017The insurance industry had given us amenities that we take for granted today. For instance, the fire station is the invention of insurance companies. After the Great Fire of London, insurance companies built the modern fire stations to fight fires against buildings which they insured. Over time, they pooled their resources together to form the London Fire Brigade in 1865.

In 1862, the insurance companies forced the English authorities to upgrade their fire legislation which bore fruit in 1867. These efforts reduced the frequencies of fire and saved countless lives and properties. Today, the tables are turned. Insurance companies are forced by the advent of technology to upgrade the value which they bring to their clients.

Traditional Insurance Companies Forced By Insurtech To Innovate In 2017

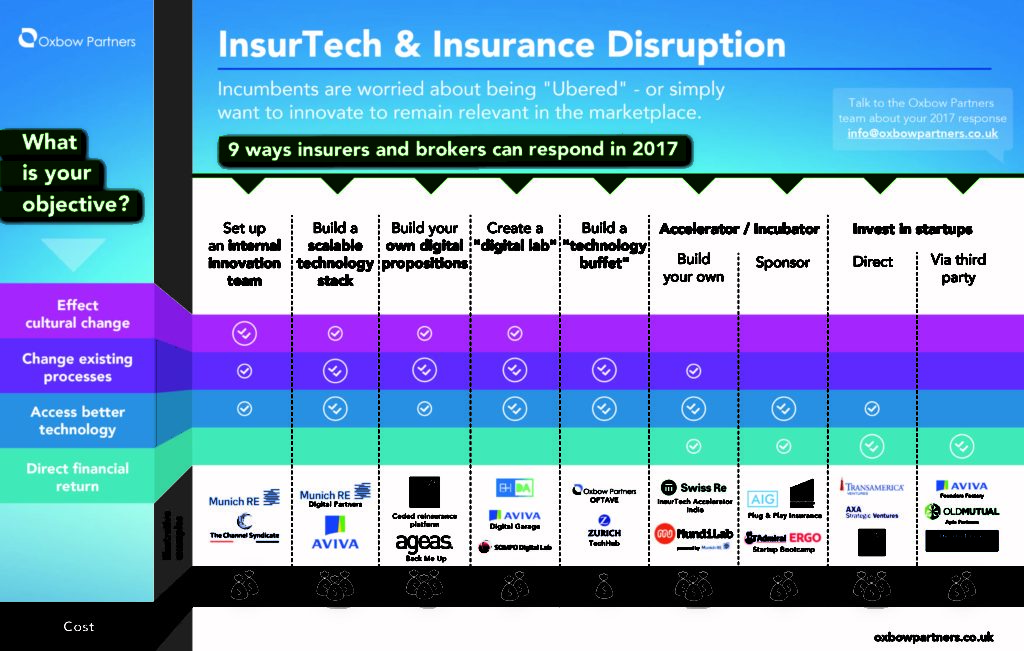

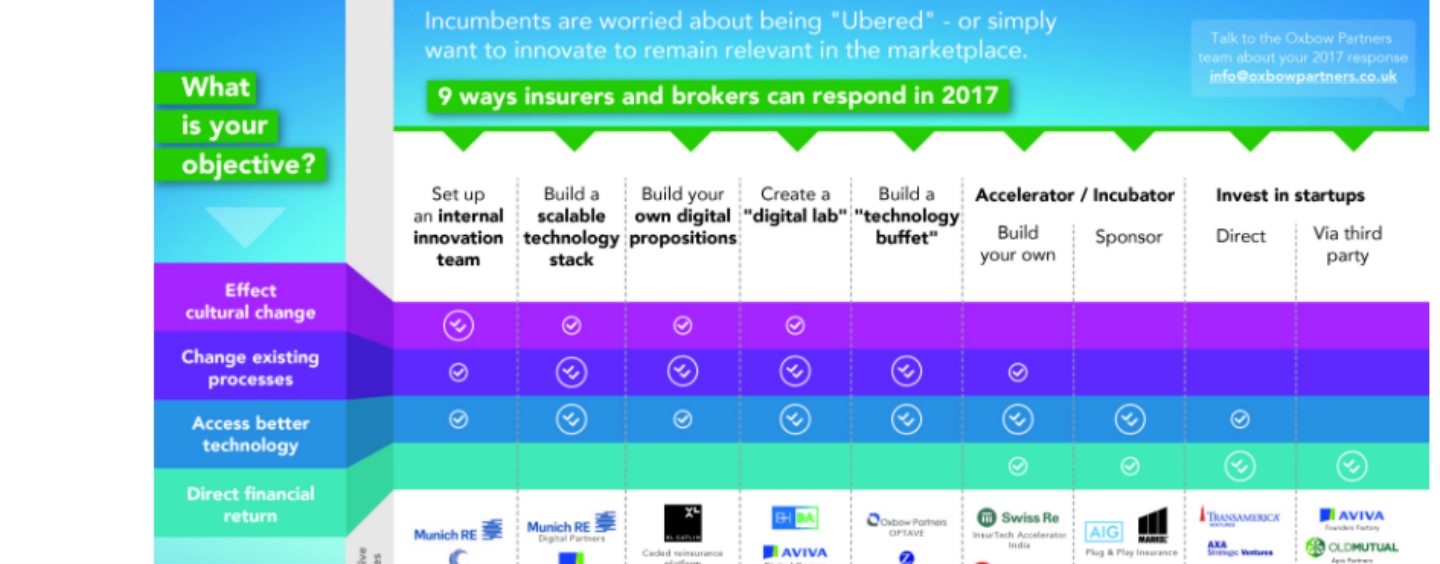

Consultancy firm, Oxbow Partners, noted the 9 different ways which insurance companies can add value in 2017. Different established insurance companies had chosen these paths for 4 different objectives.

Source: Oxbow Partners

Traditional insurance companies are forced to innovate because the smaller and more nimble insurtech companies had reached the tipping point in 2016. If they don’t adapt to the new environment, it is clear that they are going out of business.

For those who are not familiar, insurtech companies combine technology to address consumer pain points and aim to deliver insurance faster and cheaper. As such, they post a major existential threat to traditional insurance companies such as Aviva.

Easiest Approach – Investing In Startups

The hands-off approach is one of the methods for traditional insurance companies to hedge against the insurtech. They have the one resource which insurtech startups lack: money. By pumping money into insurtech, they become the co-owner and can share the success of these startup.

They can also avoid the mess of having to change culture internally, change existing process and access better technology to benefit financially. As this is the easiest option, most established insurance companies would include in it their arsenal. They can do it directly with corporate venture capital or indirectly through external venture capital firms.

Slightly Harder Approach – Invest In Incubators and Accelerators

When the starts-up had grown to the stage where they are worthy of an investment, they had shown some level of success. Thus, they are priced higher. The other way is to incubate start-ups from their inception and gain a portion of their company for virtually nothing.

In exchange, the incubator had to provide the necessary resources (e.g. working space, mentors, etc) and the insurance company can keep its pulse on the latest innovation. Alternatively, insurance companies can also set up accelerators for companies had shown traction but not sufficient for investing.

Both are more expensive than direct investments into startups as they are more upfront cost with longer investment period before results are seen. They have to endure higher failure rates and compete against other incubators and accelerators in the market. Hence, this is the slightly harder approach.

Most Difficult Approach – Transform Your Company Internally

As with most established companies, inertia is a major problem. It is a feat of leadership to convince employees that they have to change their way of working when everything seems to be working well. Even after they are convinced, it is a totally different issue to implement it. This makes it the most difficult approach.

The relatively easier way is to buy technology products from external vendors. They have readily made solutions (e.g. Technology buffets) to implement into systems. The challenge is to choose the right system and to implement it properly.

Otherwise, incumbents can choose to build their own systems by creating innovation centres, build their own technology and digital proposition with their own digital labs. Innovation centres identify the required solution and budget has to be set aside for the technology building. A development framework has to be in place to transform ideas into reality. Digital labs are built to insulate the technologist and managers from the workload of daily routine.

Conclusion

The incumbents are now in the process of innovation which should benefit consumers. Will they combine their efforts like how they did it for fire bridges in 1865? The bigger question would be whether they will be successful.

If they are not able to innovate successfully, they will create the space for a startup to rise like how Google came to dominate the search engine sector. The stakes are high and we will see who will emerge victorious in the years ahead.