Bangladesh Smartphone Market Continues Double-Digit Growth in 2017

by Company Announcement March 13, 2018The Bangladesh mobile phone market continued its upward trajectory as both feature phone and smartphone categories witnessed a double-digit growth in 2017. According to the latest International Data Corporation (IDC) Quarterly Mobile Phone Tracker, a total of 34.2 million mobile phones were shipped in the country in 2017.

The smartphone market recorded a strong 20.6 percent annual growth and ended with 8.1 million shipments in 2017. However, feature phones remained the dominating category with more than two-thirds of the shipments in 2017 and a healthy 14.8 percent annual growth.

One out of the three smartphones shipped in Bangladesh was a 4G-enabled smartphone in 2017. Global and China-based vendors have already upgraded most of their devices to 4G. Whereas, local vendors still have a large base of 3G smartphones in their portfolio. As the operators have started preparing for the 4G rollout, the local vendors have also started aligning their portfolio to remain competitive in this category.

Quarter Highlights – Smartphone

2017Q4 recorded lowest smartphone shipments in the last 6 quarters. Natural calamities in the country during the third quarter of the year impacted the sell-out affecting the shipments in 2017Q4. Also, the smartphone companies started streamlining their product portfolio to next-generation technology and focus was to clean the existing inventory from the channels in the last quarter of 2017.

All this resulted in a sharp decline of 28 percent quarter-over-quarter and 19 percent year-over-year in 2017Q4.

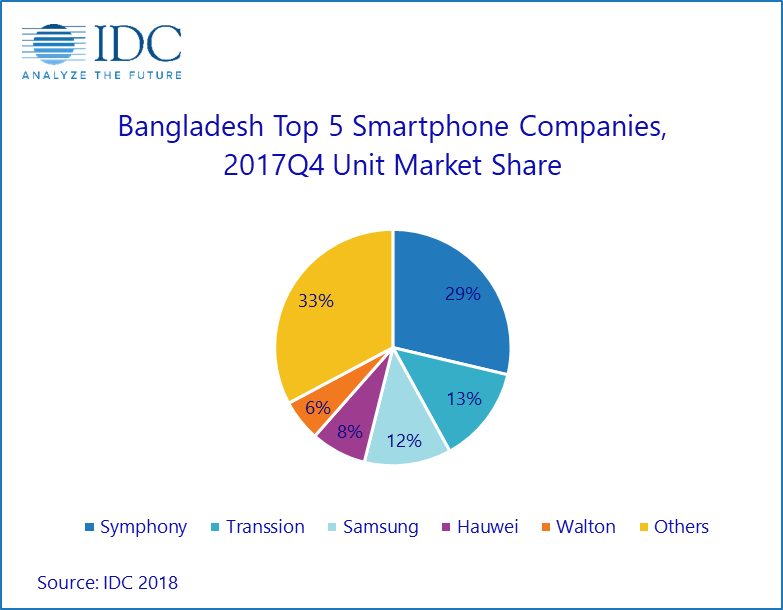

China-based companies continued to strengthen their foothold in the country with a collective share of 33 percent in 2017Q4 from a mere 19 percent in 2016Q4. The local companies started facing heat as their share slipped to 43 percent in 2017Q4 from 64 percent a year ago, though still leading the smartphone segment.

High specification product line-up, aggressive pricing and heavy marketing spend helped China-based companies to get a quick share in the Bangladesh market.

Jaipal Singh

“As the operators in Bangladesh started launching 4G services in the country, we expect 4G smartphones to overtake the 3G smartphones by the end of 2018,”

says Jaipal Singh, Senior Market Analyst, IDC India. Commenting on the competitive landscape, Singh adds

“2018 will be a crucial year for many local companies. China-based companies will continue to spend on marketing and channel expansion. Along with this, some more entrants are expected to make their entry in the country which will further intensify the competitive landscape.”

Company Highlights: Smartphone

Symphony continues to lead the smartphone market with 29 percent share in 2017Q4. However, its shipments saw a 48 percent decline year-over-year and 37 percent from the previous quarter in 2017Q4.

To counter attack the recent competition from the China-based vendors, it diversified its operations by launching an online exclusive smartphone series “INOVA”. Also, it extended its presence in the lower tier cities with a strong focus in less than US$50 segment.

Transsion replaced Samsung for 2nd position in the smartphone segment as its shipments increased by 14 percent in 2017Q4 when compared to previous quarter. It’s channel expansion in the rural areas and aggressive marketing spends were the key driving factors for its quick entry in the top 5 smartphones companies.

Samsung slipped to the third position with 12 percent market share in 2017Q4 as its shipments declined sharply from the previous quarter. However, it saw a single-digit growth when compared to the same time a year ago. It introduced the one-time screen replacement program and added bundled offerings to regain the momentum in this category.

Huawei dropped to the fourth position as its shipments declined by 37 percent from the previous quarter as other China-based companies started aggresively pushing devices in the same price bands . In the last quarter of 2017, it extended its product portfolio with two new launches. However, Y3II remains the top-selling model for Huawei.

Walton slipped to the fifth position with 6% market share in 2017Q4. It saw a sharp 52 percent decline from the previous quarter as the company started revamping its product portfolio to meet the new demand which is expected to come from the 4G upgrade.

Featured image via Pixabay