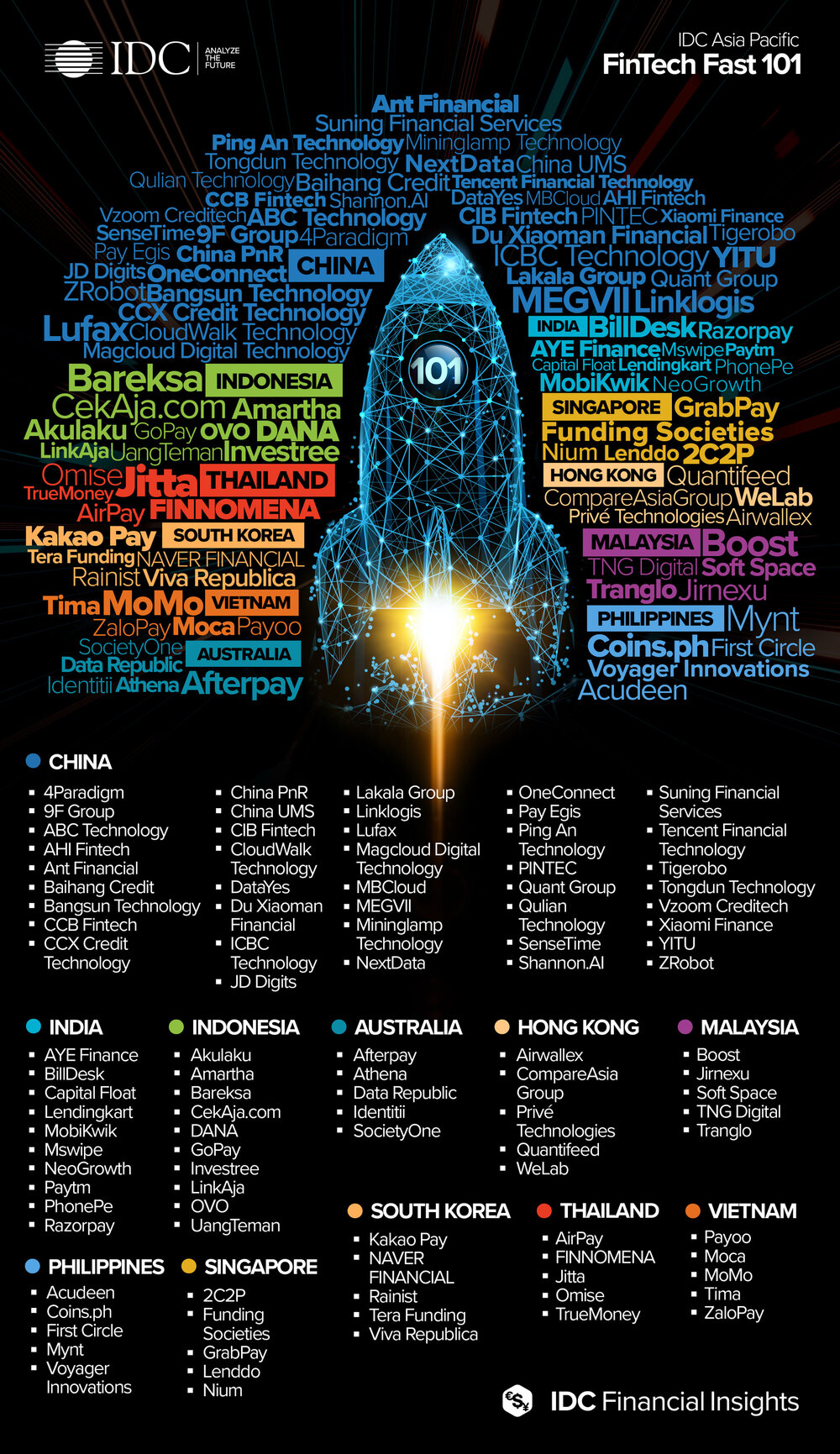

IDC Financial Insights today released the 2020 update of its FinTech Fast 101 research which details a list of fast-growing FinTechs in Asia/Pacific excluding Japan (APEJ) from 11 key markets.

IDC’s FinTech Fast 101 research refers to fast-growing fintech players based on extensive on-ground analysis of fintech players from China, India, Indonesia, Singapore, Hong Kong, Thailand, Malaysia, the Philippines, Vietnam, South Korea, and Australia.

10 Fast Growing FinTechs in India

AYE FINANCE

Headquartered in Gurgaon, Aye Finance is a new-age finance company providing business loans to small and micro enterprises across India.

BILLDESK

IndiaIdeas is an electronic presentment technology and payment services company. The Company is focused on leveraging technology to enable banks,businesses and other institutions to present invoices, statements and bills to consumers or businesses and receive payments against them. IndiaIdeas offers these services under the brand label of ‘BillDesk’.

CAPITAL FLOAT

Owned by CapFloat Financial Services, Capital Float offers specialized credit and financial loans to businesses and utilizes its own proprietary loan underwriting system to lend to potential borrowers. The company claims to have over 50,000 customers across 300 cities in India. Capital Float is among the best-funded fintech startups in India and is reportedly in talks to raise between US$100 and 150 million. In August, the company acquired Walnut, a startup providing a mobile app that helps consumers manage their finances and track spending. Walnut claims seven million downloads on Android.

LENDINGKART

Founded in 2014, Lendingkart allows entrepreneurs to easily access working capital finance options. The platform utilizes big data analysis and technology tools to create a more efficient and effective way to evaluate one’s credit worthiness. After raising US$76 million in a Series C funding round in February 2018, the company is now looking to expand its reach to over 1,200 cities across India. Like PolicyBazaar, Lendingkart was named one of the 2018 Fintech 100 Leading Global Fintech Innovators.

MOBIKWIK

Founded in 2009, MobiKwik started as a digital payment company, providing a mobile phone-based payment system and digital wallet. Since then, the startup has grown into a digital financial services platform and has a customer base of 100 million. MobiKwik began offering digital insurance on its app last month, the third big launch by the startup this year. The company aims to sell 1.5 million policies by the end of this fiscal year. MobiKwik acquired online mutual fund platform Clearfunds in October to enter the wealth management space, and recently started offering digital lending services.

MSWIPE

Mswipe is India’s largest independent mobile POS merchant acquirer & network provider. Mswipe aims to provide seamless mobile POS solutions to such merchants across India and create India’s largest financial services platform for SMEs.

NEOGROWTH

NeoGrowth Credit Pvt. Ltd., with its PAN India presence is a pioneer in SME digital lending in India.

PAYTM

Paytm is India’s largest payments company that offers multi-source and multi destination payment solutions. It offers comprehensive payment solutions to over 8 million merchants and allows consumers to make payments from any bank account to any bank account at 0% fee.

PHONEPE

PhonePe is a mobile payments app that allows you to transfer money instantly to anyone, by using just their mobile number.

RAZORPAY

Founded in 2014, Razorpay is a payment company that provides payment solutions to online merchants in India. It allows online businesses to accept, process and disburse digital payments through several payment modes like debit cards, credit cards, net banking, UPI and prepaid digital wallets. Earlier this month, Razorpay launched three new financial products and a community for Indian startups: Razorpay X (business banking), Razorpay Capital and Razorpay Flash Checkout, along with The X Club. The company claims to serve 170,000 SMEs.

Note: The list is arranged alphabetically. Source: IDC, 2020