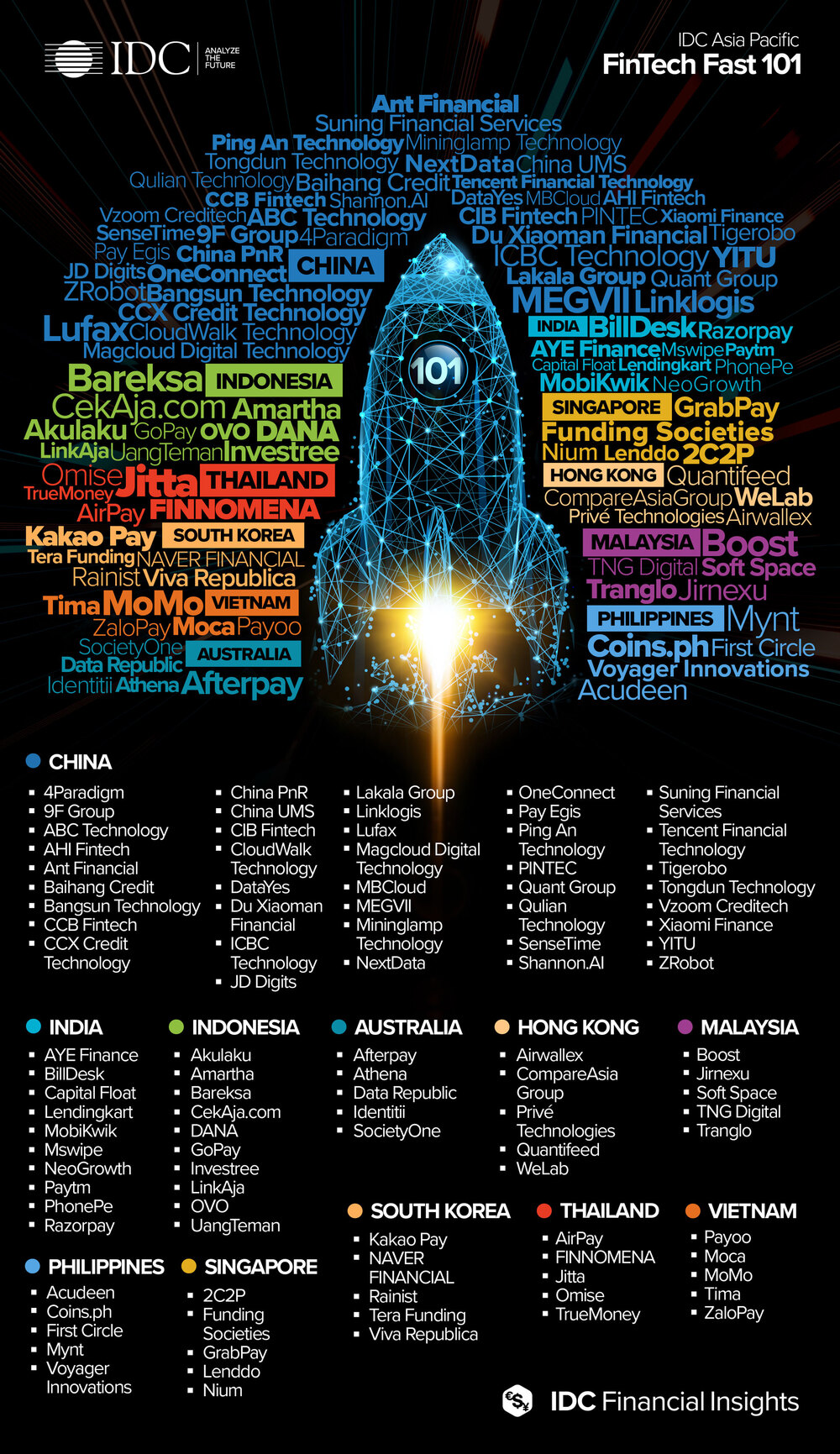

IDC Financial Insights today released the 2020 update of its FinTech Fast 101 research which details a list of fast-growing FinTechs in Asia/Pacific excluding Japan (APEJ) from 11 key markets.

IDC’s FinTech Fast 101 research refers to fast-growing fintech players based on extensive on-ground analysis of fintech players from China, India, Indonesia, Singapore, Hong Kong, Thailand, Malaysia, the Philippines, Vietnam, South Korea, and Australia.

5 Fast Growing FinTechs in Australia

AFTERPAY

Afterpay allows shoppers to buy their product today and pay it off in 4 equal fortnightly instalments.

ATHENA

Founded in 2017, Athena Home Loans is an online-only mortgage provider based in Sydney providing competitive interest rates and personalized customer service to help customers save time and money.

DATA REPUBLIC

Data Republic was founded to empower the liquidity of data by delivering technology which offers best-practice security, privacy compliance and governance controls for organizations looking to safely exchange data.

IDENTITII

identitii allows financial institutions to enrich payment messages with detailed information about actors and purpose. identitii allows banks to move away from customer level information to detailed information about each and every transaction. We think of this as the unique ‘identity’ of the transaction. It’s called ‘Know Your Transaction’ and we think it will change the way banks think about transactions.

SOCIETYONE

SocietyOne is radically changing the landscape of financial services in Australia. Since our foundation almost five years ago, we have gone from a standing start to providing more than $300 million in loans to customers.

Note: The list is arranged alphabetically. Source: IDC, 2020