Advances in digital innovations and cutting-edge technologies as well as evolving customer preferences are creating the need for digital agility in the insurance sector.

Insurtech, a subset of fintech that refers to the use of technology innovations to squeeze out savings and efficiency from the current insurance industry model, has received significant traction in recent years with companies in the space raising US$2.3 billion in 2017, according to EY’s Global Insurance Trends Analysis 2018.

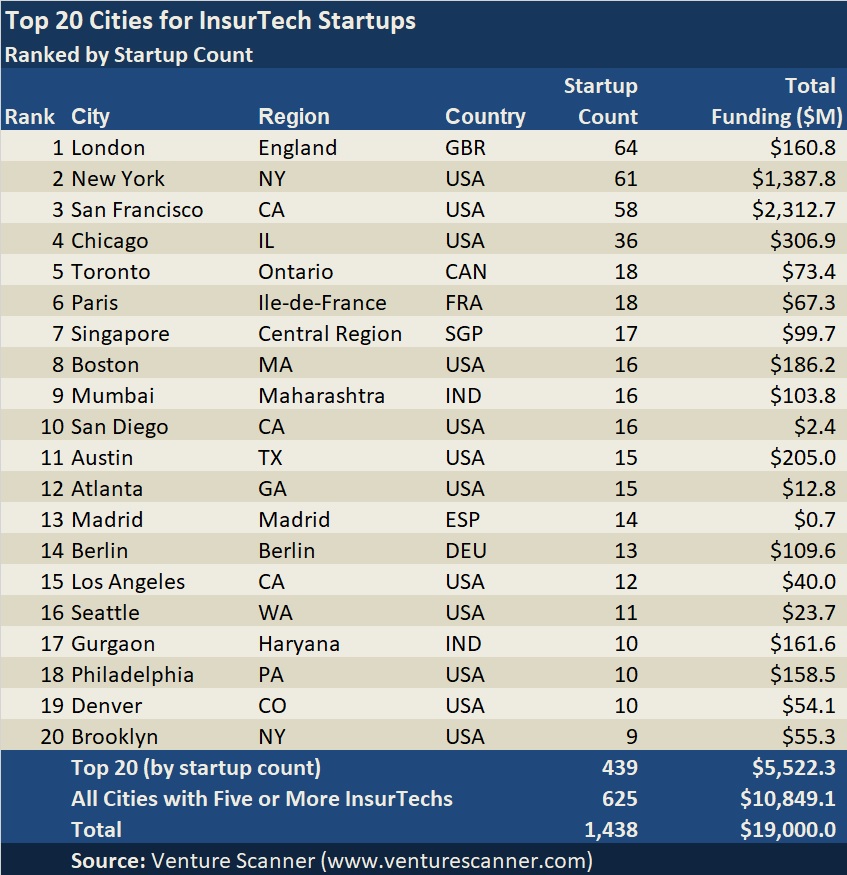

According to an analysis by Venture Scanner, there are approximately 1,500 insurtech startups around the world, most of which are based in the US.

Insurtech in Asia

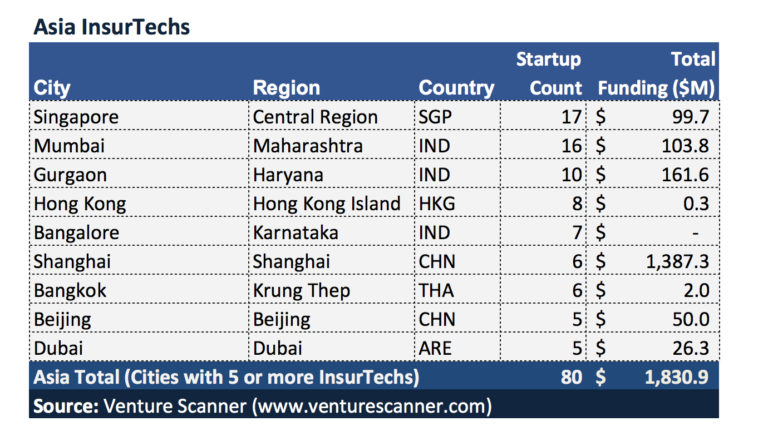

Compared to North America and Europe, the insurtech ecosystem in Asia is relatively small with about 100 startups.

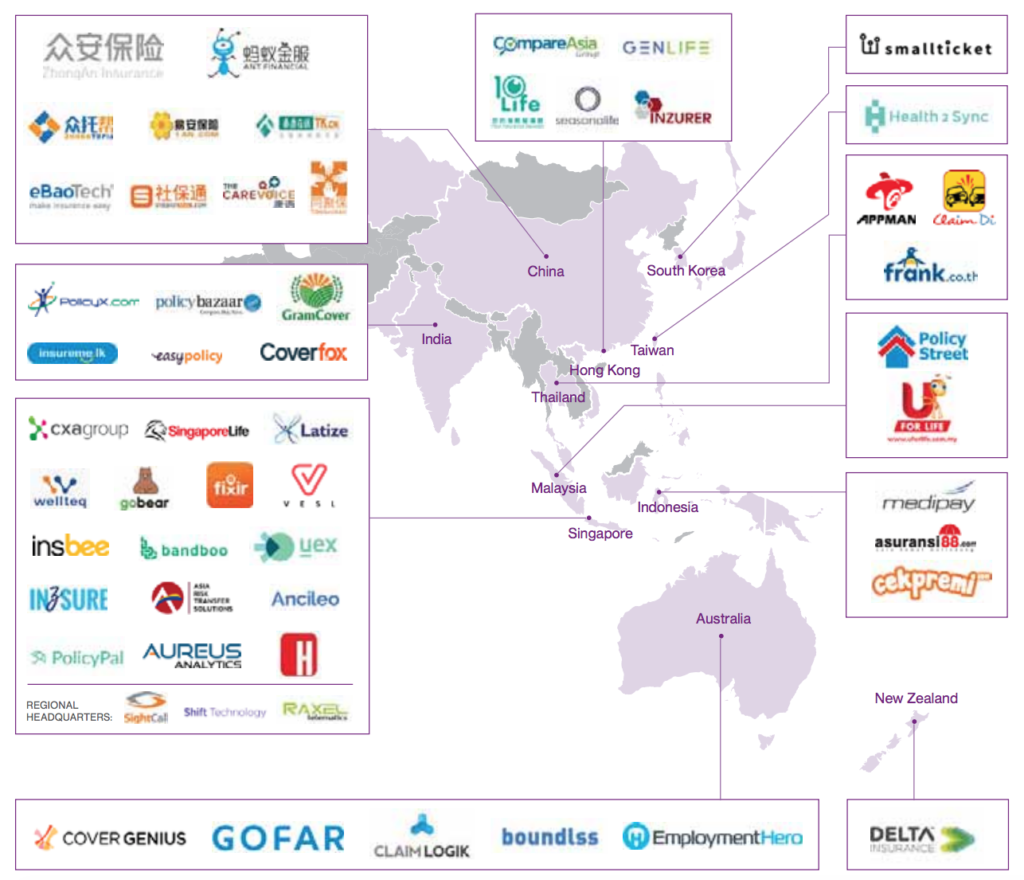

Activity in the region is predominantly centered on Singapore, India and China, but Malaysia, Indonesia, Thailand and Vietnam have also recently made regulatory provisions to allow for the development and growth of local insurtechs, according to a report by Willis Towers Watson, a global multinational risk management, insurance brokerage and advisory company.

Insurtech Asia Map, Insurtech Asia Association, Oct. 2017

With about 20 companies, Singapore is the region’s largest insurtech hub. Singapore insurtech companies include GoBear, an insurance plans and financial products comparison platform, PolicyPal, an insurance mobile app, Bandboo, a peer-to-peer online platform for people to form communities to co-insure one another, and Singapore Life, a digital insurer specializing in life and health products, specifically for high-net-worth individuals.

Singapore is followed by the Indian cities of Mumbai and Gurgaon, which combine 26 insurtech companies including Coverfox, one of the country’s largest insurtech platforms for insurance products, and PolicyBazaar, an insurance web aggregator and comparison platform.

In terms of funding, it is Shanghai’s insurtech companies that have raised the most funding with US$1.3 billion (including Zhong An’s US$936.9 million funding prior to its US$1.5 billion IPO in September 2017). Besides established insurtech companies, Shanghai has also witnessed an increasing number of new players being established such as CareVoice, China’s first review-based social platform for healthcare, and Ins For Renascence (IFR), which raised around RMB100 million (US$14.5 million) in its series A earlier this month.

As one of the largest underdeveloped insurance markets globally, Asia is perceived as a rising insurtech hub and a key growth region with demand forecast to boom, according to Willis Towers Watson.

Due to the relatively limited suite of current products in the market and the region’s high rate of e-commerce penetration, it is believed that Asia may have the fewest barriers to the successful implementation of emerging technologies in the insurance industry, the report says.

While Asia may be in its infancy of financial development, the region could effectively serve as an incubator for insurtech that ultimately end up transforming more developed markets currently controlled by traditional incumbents, it predicts.

Bigtechs enter the insurance business

Another key trend in the insurance industry is the growing threat coming from bigtechs such as Amazon, and Google. These are taking slow, deliberate steps towards establishing a presence in the insurance industry by leveraging their strong reputation for superior customer experience. In China, tech giants such as Alibaba and Tencent are forcefully expanding into insurance and have all been actively acquiring shares of existing insurance companies and co-funding new insurtech companies.

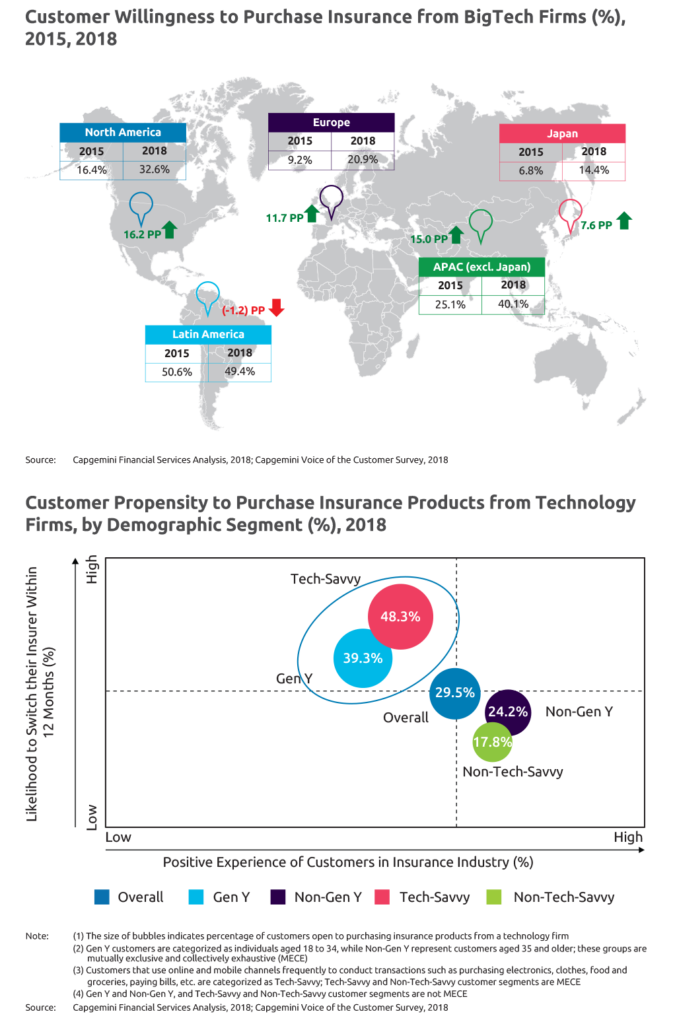

And the bigtech threat is real: according to the annual World Insurance Report by Capgemini and EFMA, 29.5% of customers globally would buy insurance products from bigtechs if available.

But it is customers in developing regions such as Asia and Latin American who are more likely to buy from bigtechs. 49.4% of customers in Latin America, and 40.1% in Asia-Pacific (excluding Japan) said they would consider doing so.

Unsurprisingly, digitally-enabled services and solutions are also appealing to the Gen Y and tech-savvy segments. 32.4% of tech-savvy and 25.4% of Gen Y even said they were willing to share personal data with bigtechs for personalized services.

Featured image: Singapore, Pxhere.com.