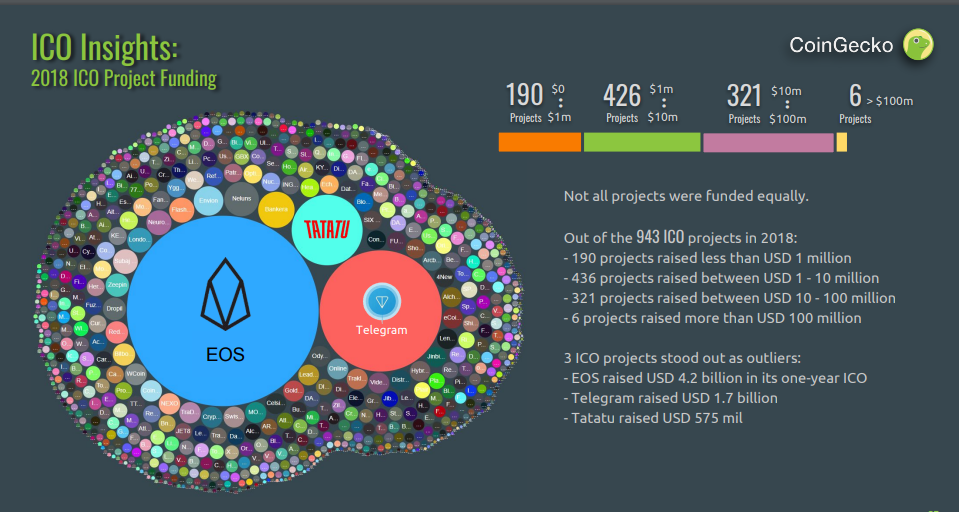

Despite the cold sting of the crypto winter ICOs and STOs remain popular method of fundraising, a report by PWC indicated that in 2018 alone 1134 ICOs and STOs were completed around the world — double the amount 2017.

Image Credit: Coingecko

The of the largest instances seen last year were of course from EOS and Telegram which raised a combined US$ 5.9 billion.

Since ICOs and STOs are clearly here to stay we feel it will be worthwhile to take a look at what regulators in Asia are doing in response to this.

Artwork by Fintech News Singapore

ICO Regulation Singapore – Regulated

In November 2018, the Monetary Authority of Singapore (MAS) issued an update to its guide to ICOs.

The paper provides general guidance on the application of the securities laws administered by the authority in relation to offers or issues of digital tokens in Singapore, and elaborates on applicable anti-money laundering (AML) and countering financing of terrorism (CFT) requirements.

ICO Regulation Philippines – In Progress

The Philippines Securities and Exchange Commission (PSEC) has postponed the release of its final rules on ICOs, which were meant to be released by the end of 2018.

The move was made following requests by different shareholders for more time to study the draft ICO rules.

ICO Regulation Indonesia – Not Regulated

While Indonesia’s securities watchdog (Bappebti) introduced new rules for trading of digital assets, they have stated it does not apply to ICOs.

Currently there are still no clear regulation on ICOs.

ICO Regulation Malaysia – Regulated

ICO regulation has been gazetted into federal law, however the specifics of the framework is still undergoing public consultation process.

ICO Regulation Thailand – Regulated

The Thai Securities and Exchange Commission (SEC) has already approved the first ICO portal. ICO portals in Thailand acts as a conduit to the regulators to help perform due diligence and KYC processes.

ICO Regulation China – Banned

China remains firm on their ban for both ICOs and STOs with their officials clearly stating that they are illegal. The People’s Bank of China have also specifically singled out foreign ICOs targeting Chinese nationals.

ICO Regulation India – Not Regulated

India reportedly is in no rush to regulate ICOs or cryptocurrencies in general. They did however state that they would be in favour of regulating instead of criminalising it.

ICO Regulation Japan – Regulated

Japan accepts virtual money as money and has a set of rules applicable for ICO but the country’s financial authorities will bring further order.

In December 2018, Japanese media outlet JIJI Press reported that the Financial Services Agency had been working on introducing new regulations which would not only impact ICOs but also limit Japanese citizens in their investment into ICOs generally.

ICO Regulation South Korea – Banned

Earlier this year, the South Korea government updated its stance on ICOs after conducting a three-month investigation that found that many companies had bypassed its ICO ban and conducted token sales overseas.

The government said in January that it would maintain its ICO ban, stating that ICO investments were a “high risk” activity.

South Korea banned domestic ICOs in 2017.

ICO Regulation Hong Kong – Regulated

While China has outright banned ICOs, Hong Kong’s status as an autonomous region allows it to take a different stance. ICOs are regulated in Hong Kong but the regulators are moving to tighten the regulations.

ICO Regulation Taiwan – In Progress

Taiwan’s financial services commission is currently drafting its ICO regulations and its is scheduled publish its draft in June 2019.