Tag "regulation"

Here Are All The Licensed Crypto Services Providers in Singapore

On January 14, 2019, the Singapore Parliament passed its comprehensive Payment Services Act (PS Act), replacing the former Payment Systems Oversight Act and Money-Changing and Remittance Businesses Act to broaden the scope of regulated payment activities to include emerging trends

Read MoreSingapore, China, & Cambodia Lead the Pack in CBDC Development

In Asia, central banks and monetary authorities are rushing to develop and deploy central bank digital currencies (CBDCs), a technology that they believe is central to their transition to a digital economy, a new report by the Asian Development Bank

Read MoreIndia Neobanking Sector Poised for 50.5% Annual Growth Through 2025

India’s neobanking market has been growing at a fast pace, driven by rapid change in technology, growing levels of Internet and smartphone penetration and supportive government initiatives. Accounting and consulting firm Grant Thornton estimates that the Indian neobanking market was

Read MoreWhat Are The Biggest Challenges Stalling The Growth of Vietnam’s Startup Ecosystem?

Vietnam’s startup sector has grown tremendously over the past years, driven by increased venture capital (VC) activity, favorable government policies and a youthful and motivated community of entrepreneurs looking to bring the domestic startup sector to the next level. But

Read MoreOpen Banking in Asia Pacific: Market-Led vs Regulator-Led Approaches

Open banking is steadily making its way into Asia-Pacific (APAC), and though the industry remains largely nascent compared with pioneers like to European Union, adoption is increasing at a stable pace, enabled by new regulatory frameworks and market-led initiatives. A

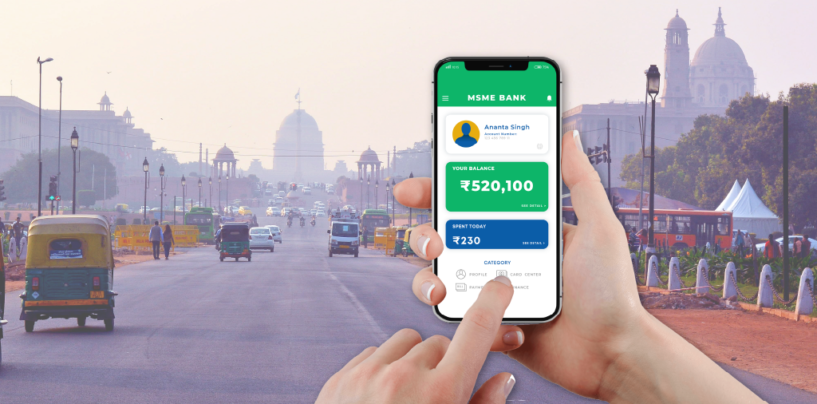

Read MoreIndia Bets on Digital Banking to Improve MSME Access to Finance

India, a world leader in digital payments and fintech innovation, is entering the next phase of its digital finance transformation, now eyeing the prospects of digital banking to address the credit gap faced by micro, small and medium-sized enterprises (MSMEs).

Read MoreVietnam’s Banking Execs Call for Open Banking Framework

In Vietnam, although financial institutions have realised the potential of open banking to enable more inclusive and accessible financial services, a patchy legal framework is hampering their efforts to join the data revolution. Praising the opportunities brought about data sharing,

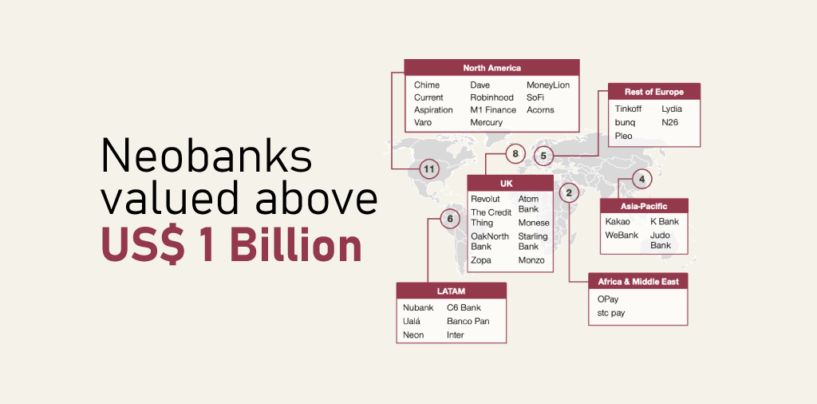

Read MoreLess Than 5% of the World’s 400 Neobanks are Profitable

Neobanking has been one of the most talked-about fintech segments of the past decade, a buzzing industry that’s seen an average of 68 new ventures being launched each year since 2017, data from consulting firm Simon-Kucher show. But despite the

Read MoreHere’s How India Will Start Regulating Crypto Related Ads Starting April

The Advertising Standards Council of India (ASCI) has released guidelines for the promotion of cryptocurrency and virtual assets related services, prohibiting advertisers to use certain words that may lure consumers into thinking that these services are regulated, and requiring them

Read MoreSingapore Tightens Regulatory Grip on Crypto

Singapore has long been praised for being a forward-thinking, progressive jurisdiction that supports technology and innovation. This has enticed a horde of cryptocurrency and blockchain startups to set up shop in the nation, lured by its seemingly openness to the

Read More