SoCash Sees Participation from Vertex Ventures in its US$ 6 Million Series B Round

by Fintech News Singapore July 22, 2019SoCash, a Singapore based fintech announced today that it has raised US$ 6 Million in its Series B funding round led by Japan based cashed automation player Glory Ltd and participated by Standard Chartered’s SC Ventures alongside Vertex Ventures.

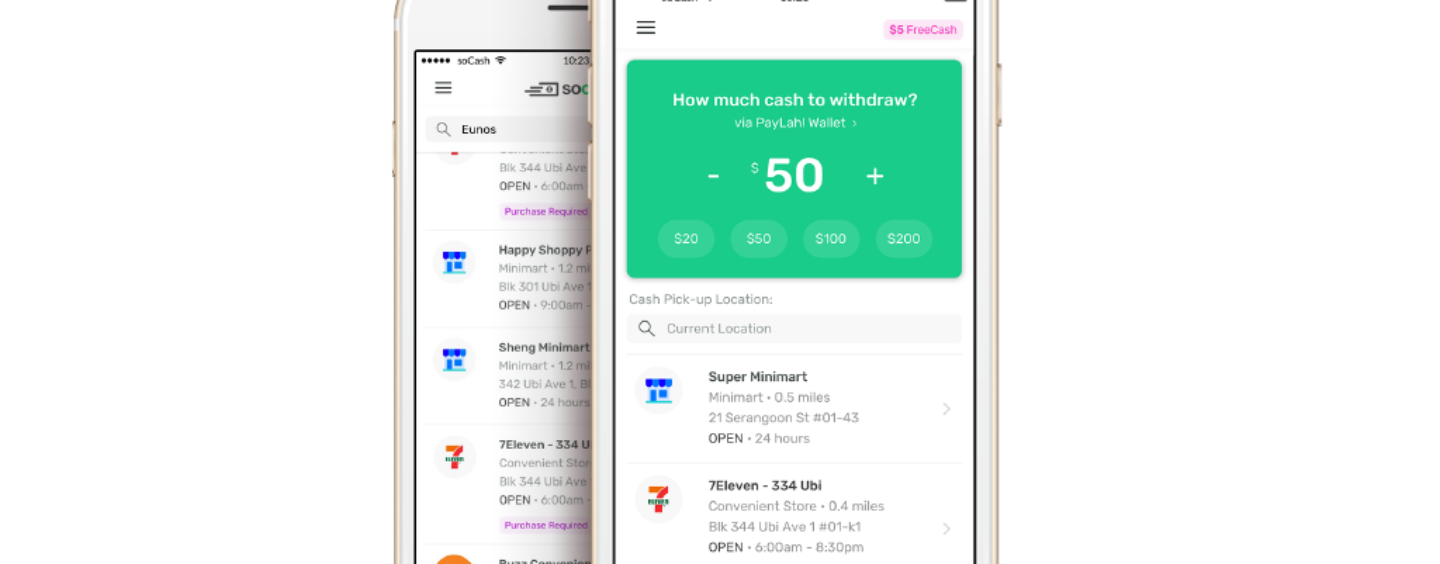

SoCash’s services enables consumers to withdraw cash and apply for loans via its mobile app at their participating partner shops.

With this fresh round of funding, SoCash is eyeing to expand its services to Indonesia, Malaysia, and Hong Kong. According to their press release, soCash has already received regulatory clearances to operate in these 3 new markets.

Their statement seem to also indicate that soCash is looking to tap into the growing trends of digital-only banks (or virtual banks as it is more popularly referred to in Hong Kong) to provide them an alternative to branches and ATMs.

Hari Sivan

“We started soCash to make cash circulation efficient; our platform has now evolved to become the only network that converts neighbourhood shops into “virtual branches”,

said Hari Sivan, Co-founder & CEO of soCash.

With the emergence of virtual banks and open banking, our network is well equipped to offer sales & distribution with flexibility and massive scale.”

SC Venture’s parent company, Standard Chartered was the first bank in Singapore to integrated soCash into its mobile banking app, SC Mobile. The start-up recently added ICBC to its list of partner banks in Singapore, which also includes Standard Chartered, DBS and POSB.

In South East Asia there seems to be growing trend to leverage convenience stores and neighborhood shops to provide banking services, with 7-Eleven doing the same in Singapore thanks to a partnership with HSBC.