Korea Financial Authority Strengthen Ties With Singapore as Fintechs Eye Global Expansion

by Fintech News Singapore June 16, 2016Often perceived as the latest phase in the ongoing digital revolution, fintech has attracted much interest from governments from around the world as none wants to pass on the multi-trillion-dollar opportunity.

Image: Downtown Seoul and the Han River by Vincent St. Thomas, via Shutterstock.com

South Korea is no exception. Last year, the country’s financial regulator unveiled new rulings to push digital banking. The detailed plan, announced in June 2015 by the Financial Services Commission (FSC), aims at allowing private companies to launch online-only banks domestically and provide them with the ability to hold up to a 50% stake.

The announcement was made a few months after the FSC established Fintech Center of Korea. Led by Donghwan Kim, head of the Electronic Finance Division at the FSC, and Yunjin Kim, head of the IT & Financial Information Protection Department at the Financial Supervisory Service (FSS), Fintech Center intends to catalyze fintech innovation by supporting domestic startups and companies. The organization provides various resources and financial support to fintech ventures.

Another ruling was announced on Tuesday this week by the Ministry of Strategy and Finance. The authority said it will submit revisions to the Foreign Exchange Transaction Act to the National Assembly in September to allow fintech companies to provide foreign exchange services without the need of relying on traditional banks. The move aims at providing these ventures with greater autonomy in making transactions.

Things are moving in South Korea as regulators are working towards adapting the regulatory framework to allow for fintech innovation and foster the domestic startup scene, and structuring the community to enable better cooperation between governmental agencies and startups.

As South Korean regulators are gearing up for the fintech revolution, local ventures are looking to take their homegrown products overseas.

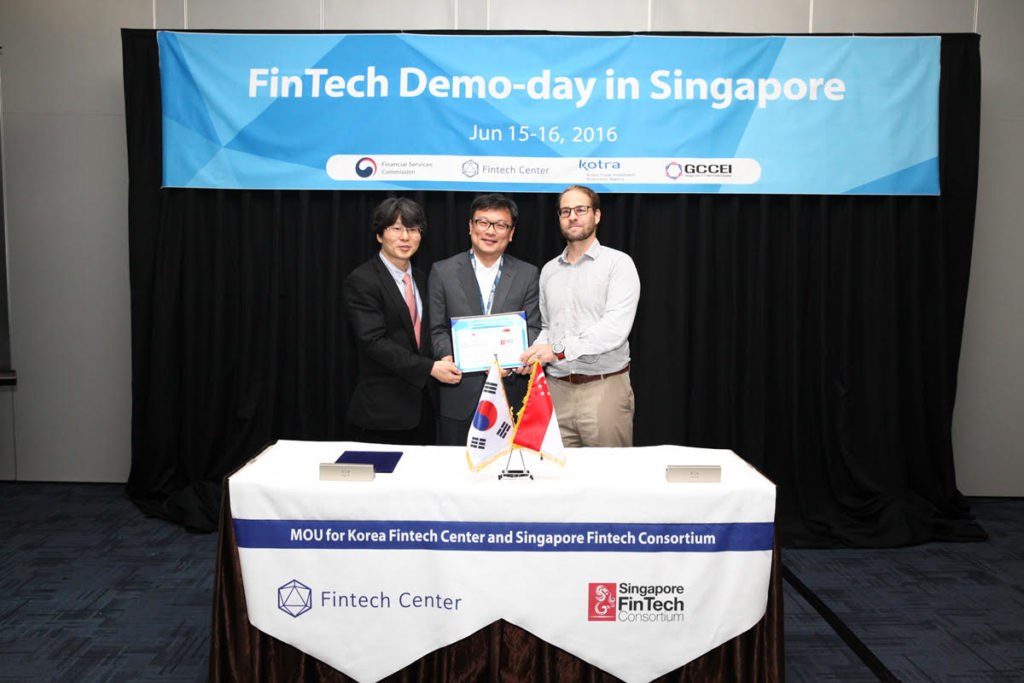

Yesterday, Fintech Center of Korea signed a memorandum of understanding (MOU) with Singapore Fintech Consortium to strengthen business ties and boost collaboration between fintech ventures from both countries.

(From left to right) Yu-shin Jeong, Chairman of Fintech Center; Hak-kyun Kim, Standing Commissioner of the Financial Services Commission of Korea; Gerben Visser, Co-founder and Managing Partner of the Singapore Fintech Consortium. (Source : Fintech Center)

Based on the MOU, the two organizations committed to exchange information on their respective fintech ecosystems and regulatory systems, but also connect one another with potential business partners.

The announcement was made during Fintech Center’s “Fintech Demo Day in Singapore,” held at the Fintech Korea Hall at Echelon Asia Summit 2016, Asia’s largest annual tech and business startup event.

Visser and Jeong in the discussion meeting at Echelon Asia 2016. (Source: Fintech Center)

The two-day summit, which ends later today, was the opportunity for a number of big brands in the industry to announce their latest products and updates. Notably, Standard Chartered Korea Bank (SC Korea) introduced and launched its Mobility Platform in Singapore. The service is essentially a mobile financial channel that allows SC Korea bankers to directly reach out local merchants who can request deposit, loan or card issuance via a mobile device.

Mobility Platform was introduced in 2012 as a response to the emerging digital finance trend, according to Park Jong-bok, president and CEO of SC Korea.

The Echelon Asia Summit was also the opportunity for Fintech Center to introduce 11 homegrown fintech startups, which, according to the FSC, attracted much interest from Singaporean businesses for potential funding.

These startups are:

- Paycock: a payment solution using innovative technologies to prevent fraud and risk of leak of information;

- FM Soft: a developer of securities trading software;

- KTB Solution: a cybersecurity company providing authentication systems, devices and other security products;

- O2O CM: a service to provide and issue coupons or name cards based on patterns displayed on smartphone screens;

- BSMIT: an individually-optimized portfolio operation service applying deep learning and artificial intelligence engines to a robo-advisor;

- Fintech Magic: a product by SHS providing mobile payments solutions via wired and wireless communications infrastructure;

- Power Voice: a solution that recognizes speakers based on voice patterns;

- Irisys: a company providing USB or OTP-based IT security solutions for user authentication and access control systems using iris authentication technologies;

- Korbit: a blockchain startup providing a white label solution for financial markets;

- JY Tech: a payment system allowing for automatic issuance of check cards and bio-marker data;

- ForCS: the developer of OZ e-form digital document solution that enables paperless contracts for the insurance, banking and medical industries.

Following Fintech Demo Day in Singapore, Fintech Center said it plan to hold similar event in the UK, the USA and China to support Korean fintech companies in their expansion into foreign markets.

Featured image: Korean Pavilion set up in the Singapore Expo for Fintech Demo-day in Singapore and Echelon Asia Summit 2016 (Source : Fintech Center)

No Comments so far

Jump into a conversationNo Comments Yet!

You can be the one to start a conversation.