The Digital Ecosystems That Will Help Indonesia Reach 80% Financial Inclusion

by Fintech News Singapore December 17, 2019The Southeast Asia Internet Economy Report 2019 by Google, Temasek, and Bain & Company predicts that Indonesia’s digital economy will more than triple to US$133 billion in 2025, driven largely by increasing acceptance by its more than 260 million population. In the four years between 2015 and 2019, the number of internet users in the archipelago rose from 92 million to a whopping 150 million.

By Kaspar Situmorang*

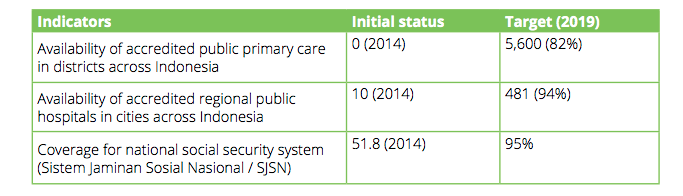

Rather than becoming a victim of disruption, traditional banks in Indonesia must evolve digitally if they hope to continue to be a driver of the Indonesian economy. The opportunity here for banks sits in propelling basic financial inclusion, as less than half of all Indonesians still do not have a proper bank account.

With hundreds of thousands of apps across different digital ecosystems already available in the country, Indonesia’s big banks would be foolish to try to reinvent the wheel with similar apps or services. Instead, both the government of Indonesia and the central bank have encouraged traditional banks to undertake digital transformation initiatives and adopt open banking.

This sounds excellent in theory, but where to start? While there are many important digital ecosystems that the formal financial sector should look to tap, expert stakeholders like to discuss two in particular that are already demonstrating massive contributions to the local digital economy, as well as one other that has clear and significant untapped potential.

Fintech and e-commerce

Source: fintechnews.sg

In August 2017, President Joko Widodo launched the e-commerce roadmap which continues to introduce regulations for technology and offers solutions to problems that face e-commerce expansion, including logistics, cybersecurity, taxation, human resource development, and consumer protection.

On the payments end, that same year the central bank went ahead and launched the National Payments Gateway (or GPN), a shared payments infrastructure on a nationally-integrated electronic channel. As of August 2018, 60 banks were connected to the GPN.

Bank Indonesia also aims to standardize open banking and initiate the development of a national database for creating a unified national payment system by 2025.

The country’s big banks need to learn from the government’s play book by unleashing their own application programming interfaces (APIs) and open banking initiatives from their own systems. This is particularly true in the fintech space, where thousands of apps offer niche services to different parts of the ecosystem.

Indonesia’s traditional banks have a golden opportunity to provide a platform for local fintech players to develop further while ensuring protection of data and alleviating cybersecurity concerns. An open banking platform will see traditional banks help niche players reduce technical costs for instance, if it shares its know-your-customer (KYC) metrics or loan affordability metrics in an API.

On the e-commerce end, bigger players like Tokopedia, Bukalapak, and Lazada Indonesia are wading into the payments space, whether via integration of fintech startups or by rolling out their own services. Bukalapak teamed up with online lenders Amartha, Modalku, and PohonDana to provide loan facilities for its “kiosk partners.”

In a 2017 report,McKinsey noted that the growth in e-commerce offers financial service providers opportunities in two key areas: non-cash transactions, as consumers migrate to digital payments; and lending, especially to smaller enterprises.

Via API and open banking, traditional banks can tap into this ecosystem to offer micro, small, and midsized business loans based on creditworthiness tied to a merchant’s e-commerce records. At the same time, e-marketplaces can outsource KYC and credit management services to banks and offer merchants lower interest rates.

Transport and logistics

This ecosystem involves thousands of startups that provide ride-hailing, courier, trucking, and warehousing services across more than 17,000 islands that make up Indonesia’s 5 million square kilometer area.

The Ministry of Industry has taken the lead in creating Indonesia’s Logistics 4.0 platform, based on blockchain, cloud, big data, and the Internet of Things technologies. This digital transformation is expected to reduce the nation’s logistics costs, which currently account for 24% of local GDP. The government hopes to see this reduced to 13.5% in the industrial sector, inevitably with more competition.

An open banking API centered around financing or loan metrics can help apps like Kargo, a Sequoia-backed Indonesian startup which works with truck operators and third-party logistics players. Kargo can tailor an invoice financing or similar working capital loan for its shippers and warehouse merchants based on their track records and orders on the app.

On the transportation front, sharing data with transport apps like Grab and Go-Jek can give banks insights into consumer behavior so they may tailor and promote products such as fuel cards and travel credit cards directly to consumers. Grab and Go-Jek, meanwhile, can add value and increase customer loyalty via personalized rewards systems.

These apps can also offer riders and drivers added value through tailored insurtech or working capital loans based on their points (how safe they drive) and mileage covered.

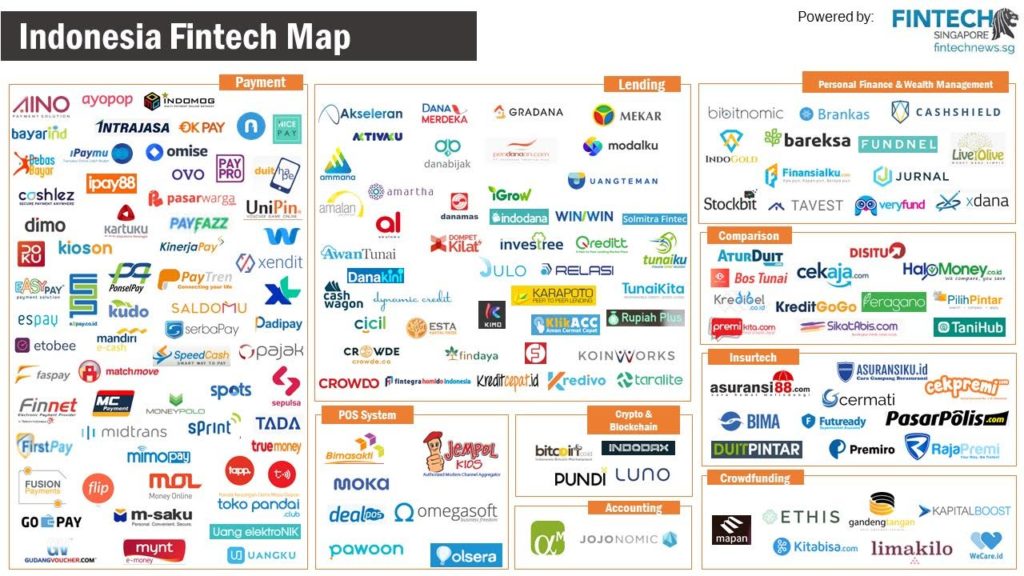

Healthcare

Within the digital healthcare ecosystem, Indonesia’s public sector is focused on payments and data management, while private sector apps concentrate on things like e-prescriptions, telemedicine, and other mobile health services.

A large part of healthcare-related time and costs are spent rationalizing hospital and patient records with insurance claims and payments. Banks, with the help of blockchain, can come in and improve the data handling process. This would create unique opportunities in the healthcare ecosystem, especially by bringing about an overall improvement in health information exchange.

With data management APIs, banks can work hand-in-hand with insurtech players like Jakarta-based Qoala to relieve hospitals and doctors from paperwork and administrative duties while building personalized health profiles of individuals. This in turn can help insurance players offer improved products and expedite the claim process through KYC practices.

Meanwhile e-prescription and e-pharmacy services like HaloDoc have a treasure trove of customer data. This data, paired with banks’ expense tracking metrics, can create personalized customer profiles which can then lead to targeted marketing of medical cards or specific insurance policies.

KPMG has defined 5 ecosystem requirements for successful open banking: application program interfaces (APIs), enabling assets, use cases, killer apps, and partnerships.

To figure out more use cases and understand how partnerships can best work, banks need to narrow down the digital ecosystems that involve the most Indonesians — both banked and unbanked — while playing to individual banks’ strengths. Only then can the goal of 80% financial inclusion in Indonesia be achieved.

Kaspar Situmorang,

Author: Kaspar Situmorang is the Executive Vice President of Bank BRI, the largest microfinance institution in the world and Indonesia’s first digital bank.

Featured image credit: Unsplash