How Singapore is Helping its Fintech Stay Afloat During the COVID-19 Crisis

by Fintech News Singapore June 9, 2020In Southeast Asia, Singapore has been leading the way when it comes to fintech innovation. As of late 2019, the city state was home to more than 600 fintech firms, which had attracted over half of total funding for the region for that year.

To help the sector stay afloat amid the COVID-19 pandemic, the Monetary Authority of Singapore (MAS) has launched two major support packages.

The first, announced on April 8, 2020, is a S$125 million COVID-19 care package for the financial and fintech sectors. The package aims to support the sectors in facing the immediate challenges from the COVID-19 health crisis by helping them support their workers, enhance operational readiness and resilience, accelerate digitalization and boost capabilities.

COVID-19 Fintech Care Package Infographic, Source: Monetary Authority of Singapore (MAS)

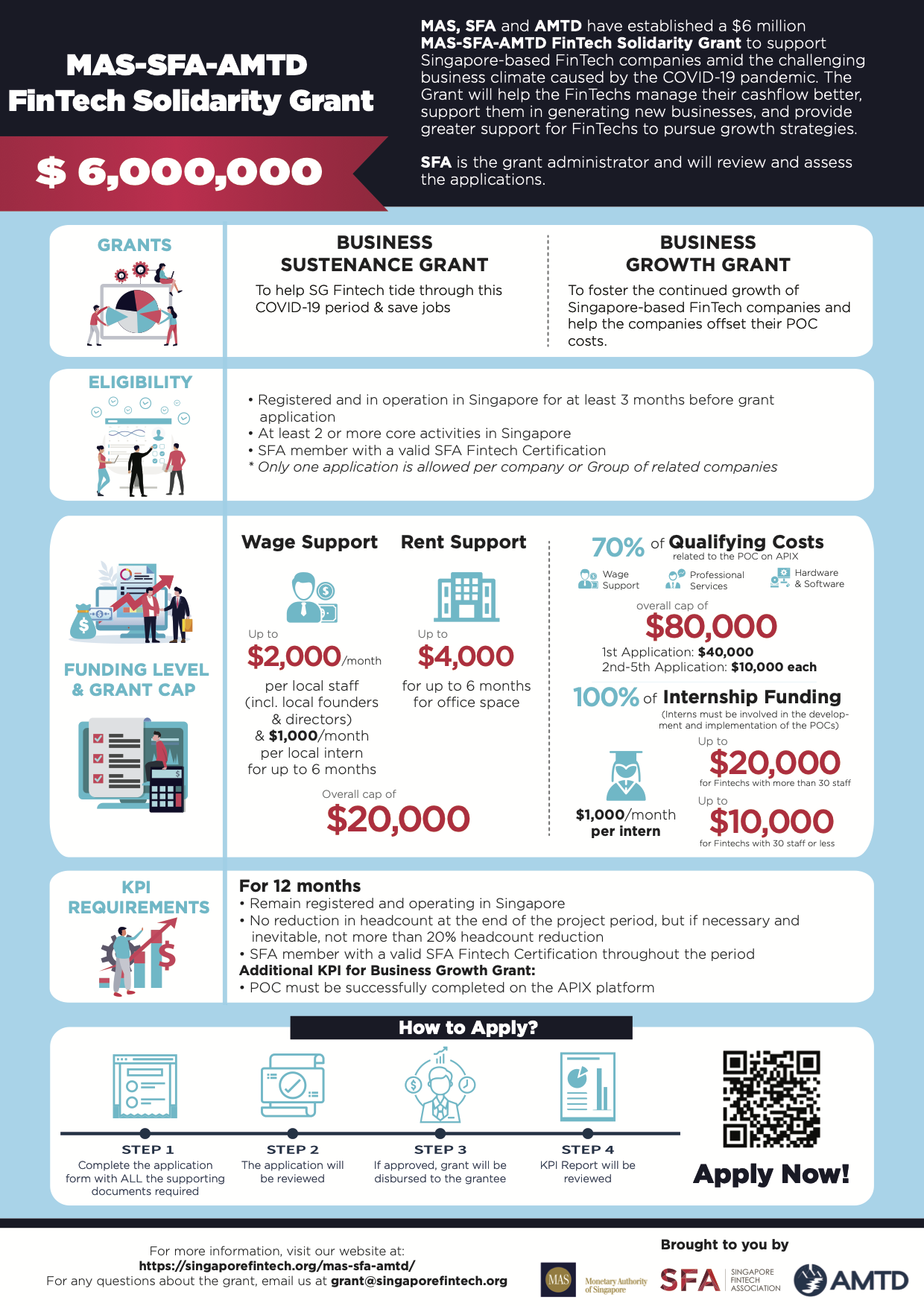

The second initiative, called the MAS-SFA-AMTD Fintech Solidarity Grant, was launched on May 13, 2020, by MAS, the Singapore Fintech Association (SFA) and AMTD Foundation (AMTD).

The S$6 million grant seeks to support Singapore-based fintech firms in these uncertain times, with a particular focus on helping them manage their cashflow, generate new businesses, and pursue growth strategies.

MAS-SFA-AMTD Fintech Solidarity Grant Infographic, Source: Monetary Authority of Singapore (MAS)

In addition to these two major programs that involve MAS, several industry participants have launched their own initiatives to support the sector.

For the Singaporean fintech companies out there, the following are some of the support packages available at the moment segmented into three main categories.

Workforce training and manpower costs support

- For fintechs and financial institutions, the Training Allowance Grant (TAG) is offering a S$15 allowance per training hour for employees’ completion of IBF-accredited or recognized courses.

- Under the Jobs Support Scheme (JSS), employers are provided with a 75% wage subsidy for the first S$4,600 of April and May salaries (and 25% for subsequent months).

- Under the MAS-SFA-AMTD Fintech Solidarity Grant, the Business Sustenance Grant (BSG) provides wage support up to S$2,000/month for every local employee including founders and directors, up to a total BSG grant cap of S$20,000.

- To support recent graduates, SGUnited Traineeships Programme is providing 80% co-funding of training allowance for recent graduates from ITE, Polytechnics and Universities.

- Additionally, Startup Talent Factory is offering up to S$12,000 salary subsidy grant for new and existing poly grad hires.

Support for operational costs

- For fintechs, the Digital Acceleration Grant, under the MAS Financial Sector Technology and Innovation (FSTI), provides 80% funding support (capped at S$120,000) help them adopt digital solutions to improve productivity, increase efficiency, enhance operational resilience, manage risks better, and/or serve customers better.

- MAS and IBF has also increased course fee subsidies to 90% for local employees attending accredited or recognized courses under the IBF-Standards Scheme (IBF-STS) and Financial Training Scheme (FTS).

- Under BSG, fintechs can receive S$4,000 in funding for up to 6 months of rent support.

- Fintech hub Bridge+ is offering a 50% discount for new leases for fintechs.

- 80RR, another fintech hub, is providing temporary rental relief for existing tenants (on case-by-case basis).

Accessing business opportunities

- API Exchange (APIX), a cross-border, open-architecture API marketplace and sandbox platform for collaboration between fintechs and financial institutions, is providing all Singapore-based fintechs 6 months free access. APIX is an initiative of the ASEAN Financial Innovation Network (AFIN), a non-profit organization established in 2018 by the ASEAN Bankers Association (ABA), the International Finance Corporation (IFC), and MAS.

- MAS is working with the SFA on a new digital self-assessment framework for MAS’ Outsourcing and TRM Guidelines hosted on APIX. By completing the self-assessment, fintech firms will be able to provide a first-level assurance to financial institutions about the quality of their solutions.

- For smaller financial institutions (no more than 200 employees), the Digital Acceleration Grant is giving them access to two tracks called the Institution Projects track and the Industry Pilots track that support them in adopting fintech solutions.

Support for proof-of-concept (POC) projects

- Under the Business Growth Grant (BGG), part of the MAS-SFA-AMTD Fintech Solidarity Grant, fintechs can receive up to S$40,000 for their first POC with financial institutions on APIX, and S$10,000 for each subsequent POC. The grant is capped at S$80,000 per firm.

- BGG also supports 100% of salaries of undergraduate interns (Singapore citizens and permanent residents) involved in the implementation of the POCs, capped at S$1,000/month per intern.

- Finally, the POC Grant, part of the MAS FSTI scheme, provides 70% funding support for experimentation, development and dissemination of nascent innovative technologies in the financial services sector.