Around the world, banks are reconsidering their trade finance business model, viewing digitalization as one of the most important trends that will shape the industry in the coming years, according to a new survey.

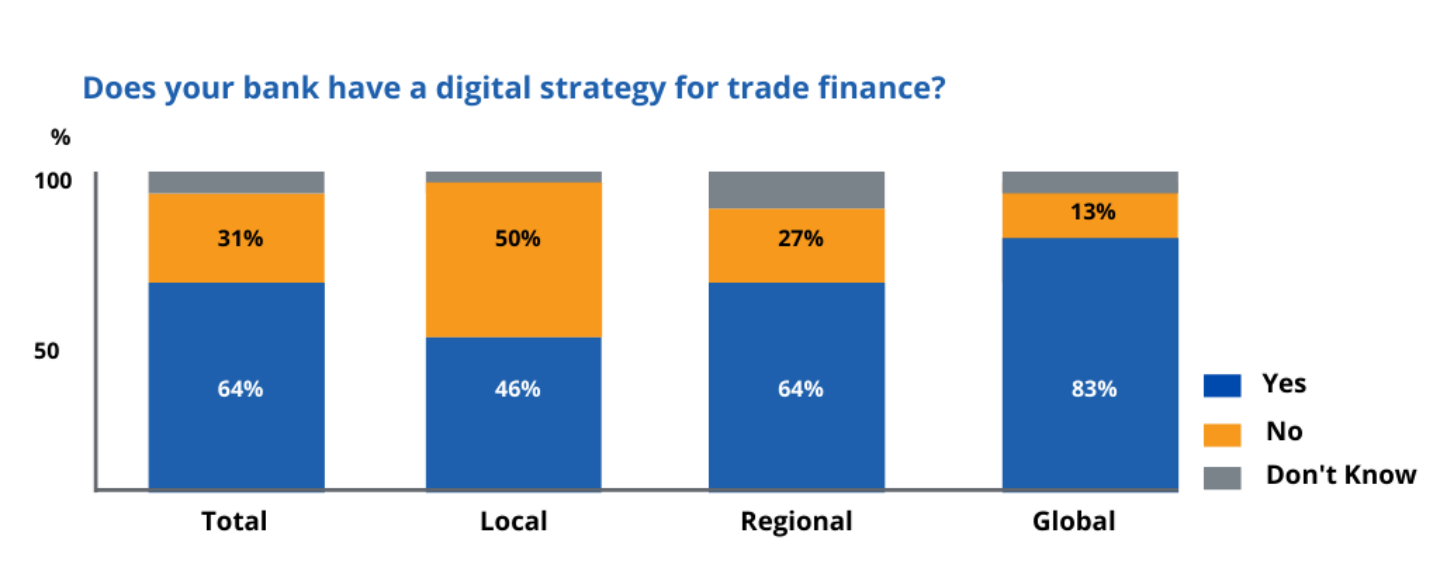

The International Chamber of Commerce (ICC) released in July a report that shares findings from its 11th annual Global Survey on Trade Finance. The survey’s results show that banks are turning to technology to modernize their trade finance business, with 77% of the 346 banking respondents considering transitioning to digital as a way to grow their business.

What options are your bank considering for its trade finance model? Source: 2020 Global Survey on Trade Finance, International Chamber of Commerce, July 2020

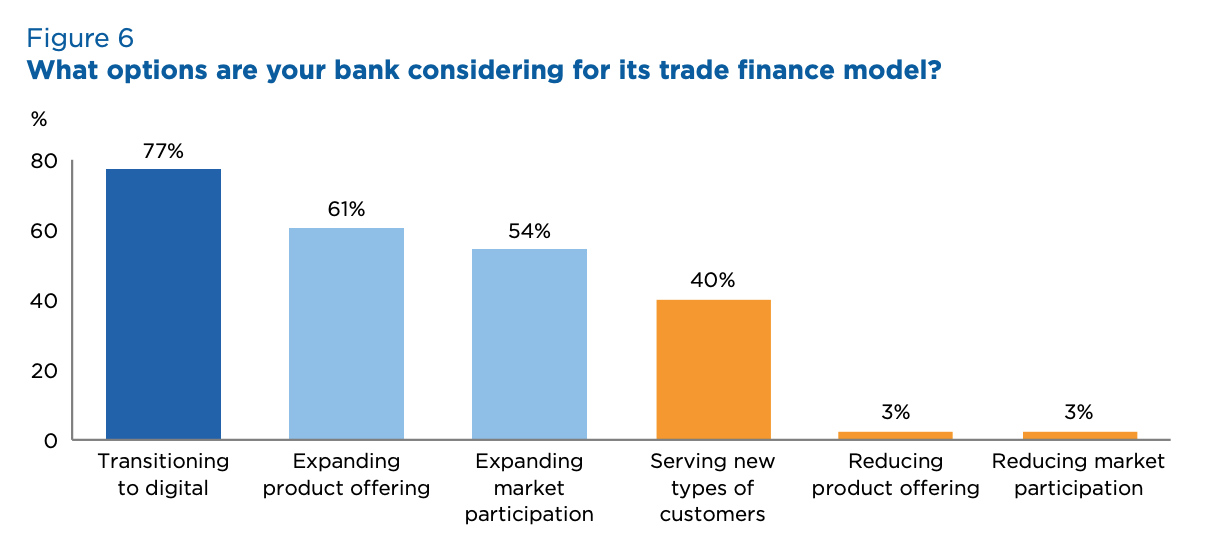

Banks are optimistic about the prospect of technology in the field, with 84% of them citing digital solutions and platforms as either an immediate or near-future priority (one to three years).

Priority areas of development and strategic focus for banks, Source: 2020 Global Survey on Trade Finance, International Chamber of Commerce, July 2020

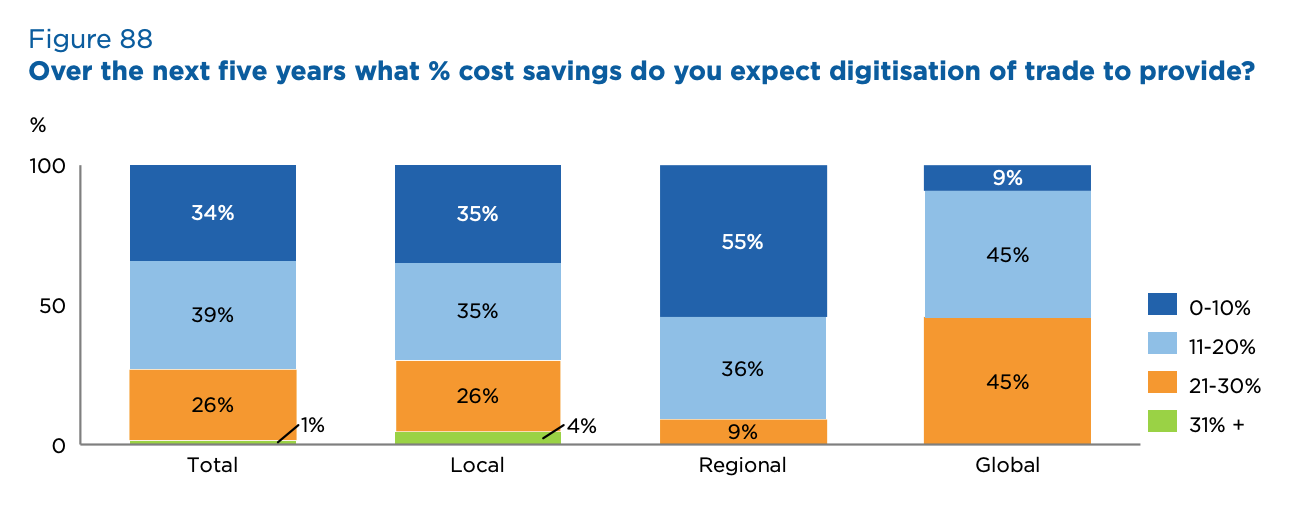

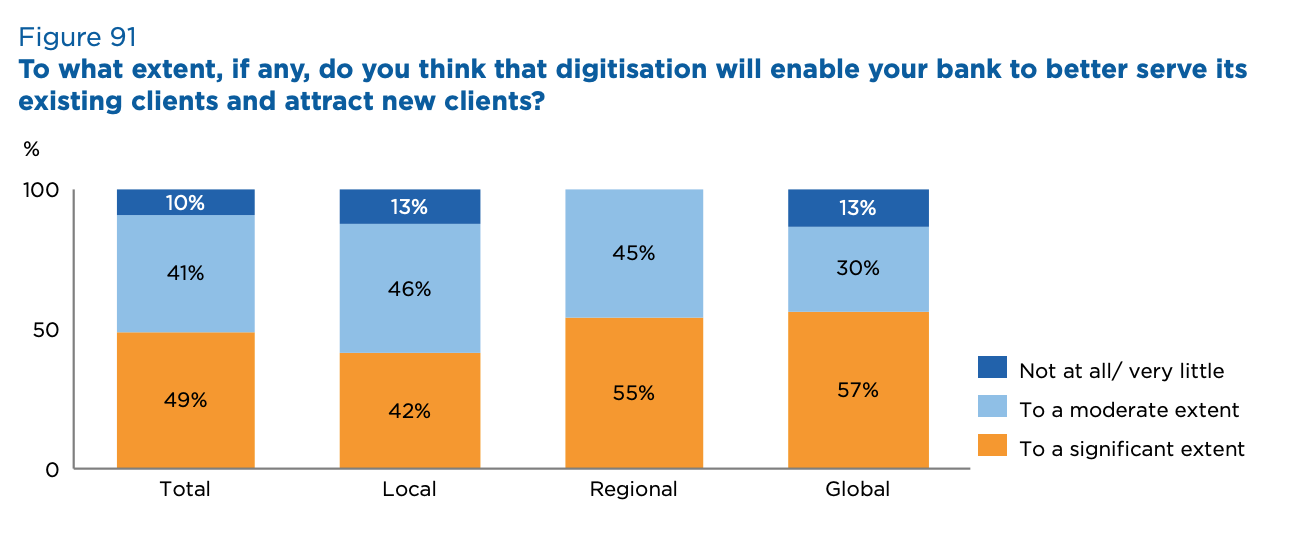

Looking ahead, 66% expect at least 10% in cost savings from digitization over the next five years, and 90% are confident that digitalization will allow them to better serve customers to a moderate or significant extend.

Over the next five years what % cost savings do you expect digitisation of trade to provide? Source: 2020 Global Survey on Trade Finance, International Chamber of Commerce, July 2020

To what extent, if any, do you think that digitisation will enable your bank to better serve its existing clients and attract new clients? Source: 2020 Global Survey on Trade Finance, International Chamber of Commerce, July 2020

Disparities and challenges in tech adoption

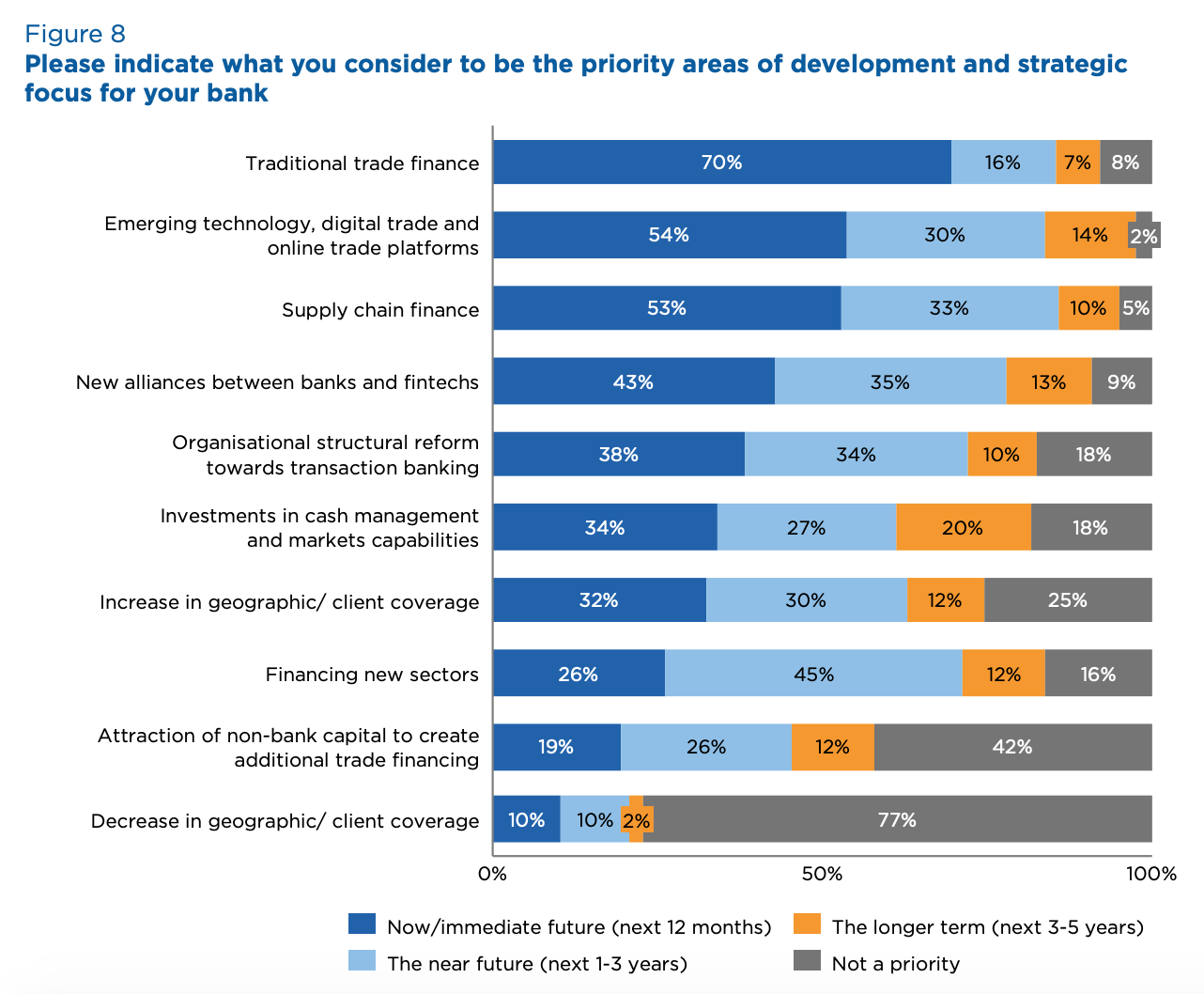

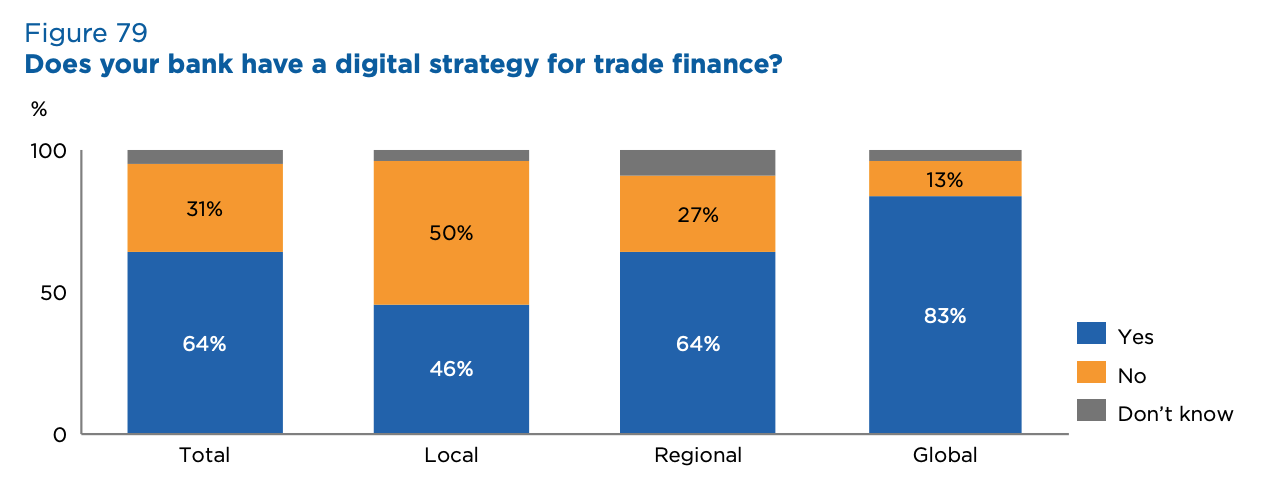

Despite the optimism, the survey’s results show a clear divide between banks. While 83% of global banks indicated that they had a digital strategy for trade finance, only 46% of local banks had one, showcasing that smaller banks with limited resources are struggling to keep up.

Does your bank have a digital strategy for trade finance? Source: 2020 Global Survey on Trade Finance, International Chamber of Commerce, July 2020

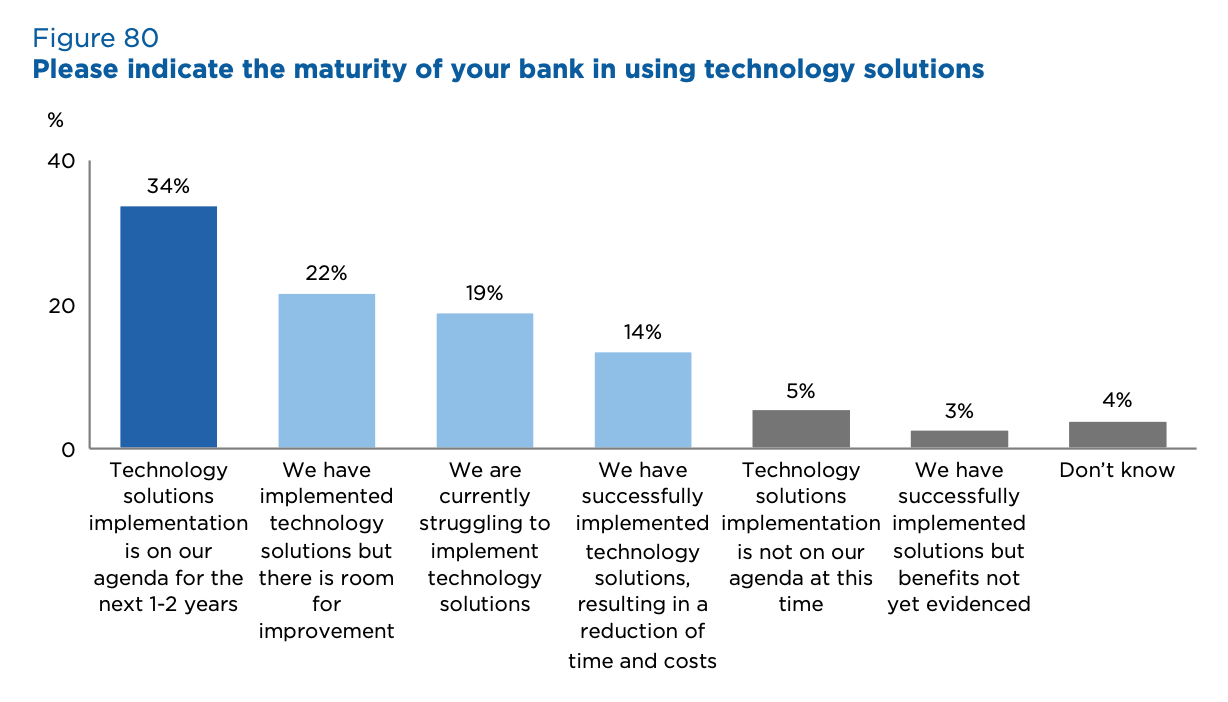

Another key finding from the survey is that digitalization of trade finance might be more difficult than it seems, with 19% of respondents stating they were struggling to implement technology solutions.

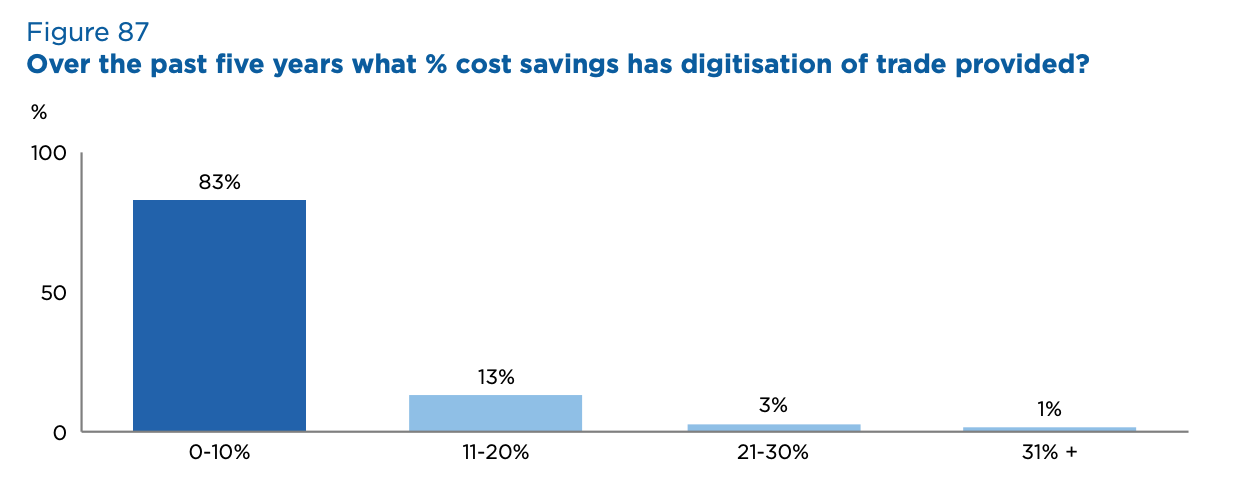

Of those that have succeeded in implementing technology solutions, 22% said that these solutions were imperfect and that there was still room for improvement. Additionally, 3% said they had not yet seen any tangible benefits from their new technology solutions, while 83% indicated only a minimal reduction of costs over the past five years due to digitization.

Please indicate the maturity of your bank in using technology solutions, Source: 2020 Global Survey on Trade Finance, International Chamber of Commerce, July 2020

Over the past five years what % cost savings has digitisation of trade provided? Source: 2020 Global Survey on Trade Finance, International Chamber of Commerce, July 2020

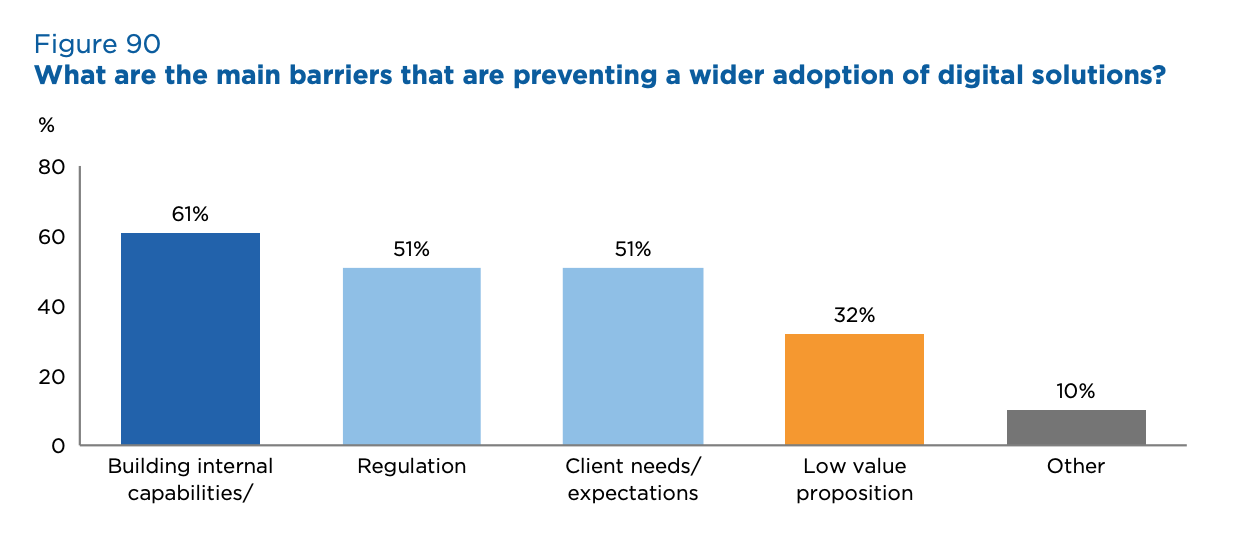

When asked about the main challenges they faced in adopting digital solutions, respondents cited building internal capabilities (61%), regulation (51%) and client needs/expectations (51%) as the main barriers.

What are the main barriers that are preventing a wider adoption of digital solutions? Source: 2020 Global Survey on Trade Finance, International Chamber of Commerce, July 2020

Blockchain adoption in trade finance

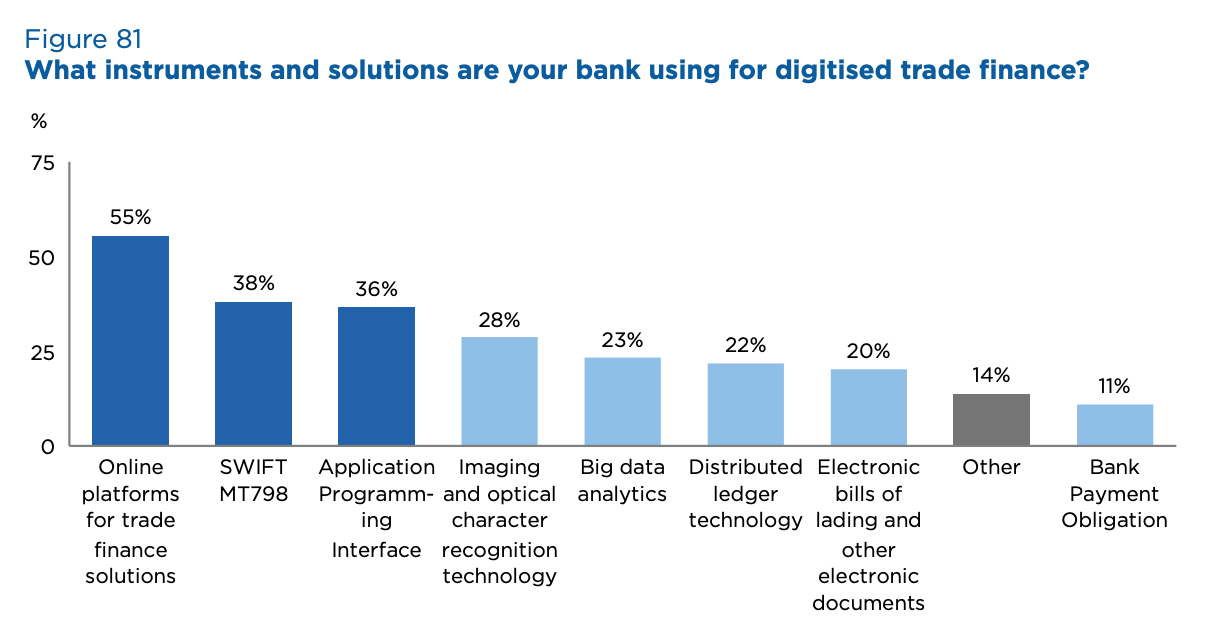

Of the various digital trade technologies looked at in the survey, the most common implemented by banks was an online platform for trade finance (55%). Other instruments and solutions used include SWIFT MT798 (38%) and APIs (36%).

Despite the frenzy surrounding the potential of blockchain in trade finance, only 22% of respondents indicated that their banks were integrating distributed ledger technology (DLT)- based solutions in their trade finance operations, implying that DLT might still be only applied to pilot transactions and proofs of concept (PoCs).

What instruments and solutions are your bank using for digitised trade finance? Source: 2020 Global Survey on Trade Finance, International Chamber of Commerce, July 2020

Over the past couple of years, industry participants have been actively exploring the use of blockchain to modernize trade finance, forming numerous consortia including we.trade, which is owned by IBM and 12 banks including Deutsche Bank, HSBC and UBS, eTradeConnect, formed by 12 Asian banks, and Marco Polo, a joint undertaking between tech firms TradeIX and R3, and banks such as Commerzbank, Bank of America and BNY Mellon.

Most recently, Singapore’s DBS joined blockchain trade finance network Contour, formerly known as Voltron. In July, the bank completed its second transaction on the Contour network.

In China, blockchain-backed trade finance has already been widely used with around 170 banks having already joined the State Administration of Foreign Exchange’s blockchain-based trade finance platform, the South China Morning Post reported in March.

As part of the ICC survey, respondents were also asked about the impact of COVID-19 on trade and trade finance. Most reported a 0-10% decrease in trade flows Q1 2020. Banks expect an even more significant decline in trade flows for the full year, with the majority foreseeing at least a 20–30% decline from original forecasts.