UOB Ties up With Visa’s New API to Simplify Digital Payments

by Fintech News Singapore September 30, 2020United Overseas Bank (UOB) has teamed up with Visa to tap its new application programming interface (API), claiming to be the first bank in the world to do so. This partnership will enable customers to add their Visa credit and debit cards securely into popular apps using UOB Mighty, without the need for a physical card.

The bank has built an ecosystem with partners such as Fave, Fitbit Pay, Grab, Shopee, Singapore Airlines, SP Group and Visa to simplify the way in which their customers make digital payments and redeem rewards points.

Kunal Chatterjee, Visa Country Manager for Singapore and Brunei, said,

Kunal Chatterjee

“UOB is our first partner globally to launch our token push provisioning API with Fitbit Pay. UOB Visa cardholders can now add their payment credentials via a secure Visa token to Fitbit Pay directly using UOB Mighty, removing the need to manually register their payment credentials with the merchant.”

This means that customers no longer need to key in their 16 digit card number, expiry date and card security code manually or if they are a new customer, to wait for their credit and debit cards to be delivered to them before they can make purchases using their card.

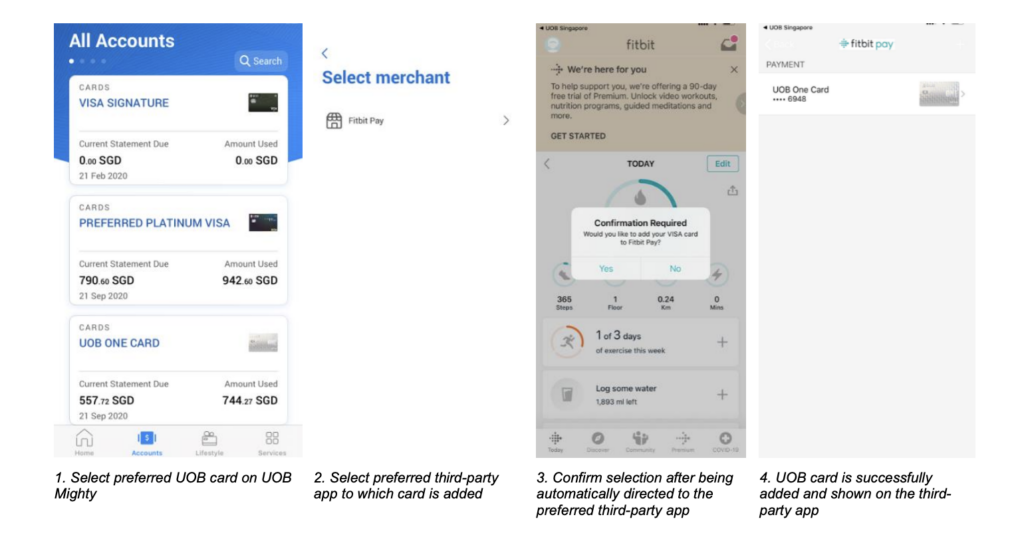

All the bank’s credit and debit cards will be reflected in the UOB Mighty app once the application has been approved. UOB customers simply need to log into the bank’s app and choose the card that they would like to add into their preferred third-party app.

Customers are then automatically directed to the selected app to confirm. The entire process is said to take seconds on the mobile phone.

UOB customers can now add their Visa credit and debit cards securely into popular apps such as Fitbit Pay using UOB Mighty app

Ms Jacquelyn Tan, Head of Group Personal Financial Services, UOB said,

Jacquelyn Tan

“At UOB we are obsessed with making the banking experience frictionless for customers by integrating digital services into the customer’s purchasing journey, such as the ability to provision their virtual credit and debit cards instantly for payment and to redeem rewards instantly on our partners’ apps. To do so, we tap our extensive ecosystem of like-minded partners including Fitbit Pay, Singapore Airlines, SP Group and Visa as well as technological capabilities such as APIs – both our own and our partners.”