Razorpay Latest to Achieve Unicorn Status in Asia With US$100 Million Funding Led by Sequoia, GIC

by Fintech News Singapore October 12, 2020Indian payment gateway provider Razorpay secured US$100 million in Series D financing, simultaneously achieving the major milestone of becoming the newest unicorn in India.

With this round, Razorpay welcomes their latest partner GIC, Singapore’s sovereign wealth fund to its investor base. Along with GIC, the round was co-led by Sequoia with participation from their existing investors Ribbit Capital, Tiger Global, Y-Combinator and Matrix Partners.

IDC Financial Insights had previously named Razorpay as one of the 10 fastest growing fintech companies in India in its FinTech Fast 101 research.

Razorpay serves international brands including the likes of Facebook, Google and Wikipedia, national enterprises like Jio, Zerodha and Hotstar, recent upstarts like Khatabook, OkCredit or Meesho along with a multitude of SMEs and freelancers.

Their latest payments product – Payment Button – has been their fastest growing product. Today, 2 out of 3 businesses onboarding on Razorpay are accepting digital payments for the first time.

Razorpay also claims to be the first operational neobank to become a unicorn with its RazorpayX platform. Within twelve months of its launch, RazorpayX is said to have served over 10,000 businesses – processing their payroll through Opfin, paying for expenses through Corporate Card and paying their vendors in real time, disbursing billions of dollars through the underlying payouts layer.

In addition to that, Razorpay recently launched a credit-line product, Cash Advance in a bid to help MSMEs and improve their cash flows.

Of the 42.5 million SMEs in India, 53% don’t have access to digital financial tools. Beyond this, there is a shortage of billions of dollars of credit for businesses. SME lending is among the hardest hit sectors during the pandemic, leaving businesses scrambling for financial cover in their worst time.

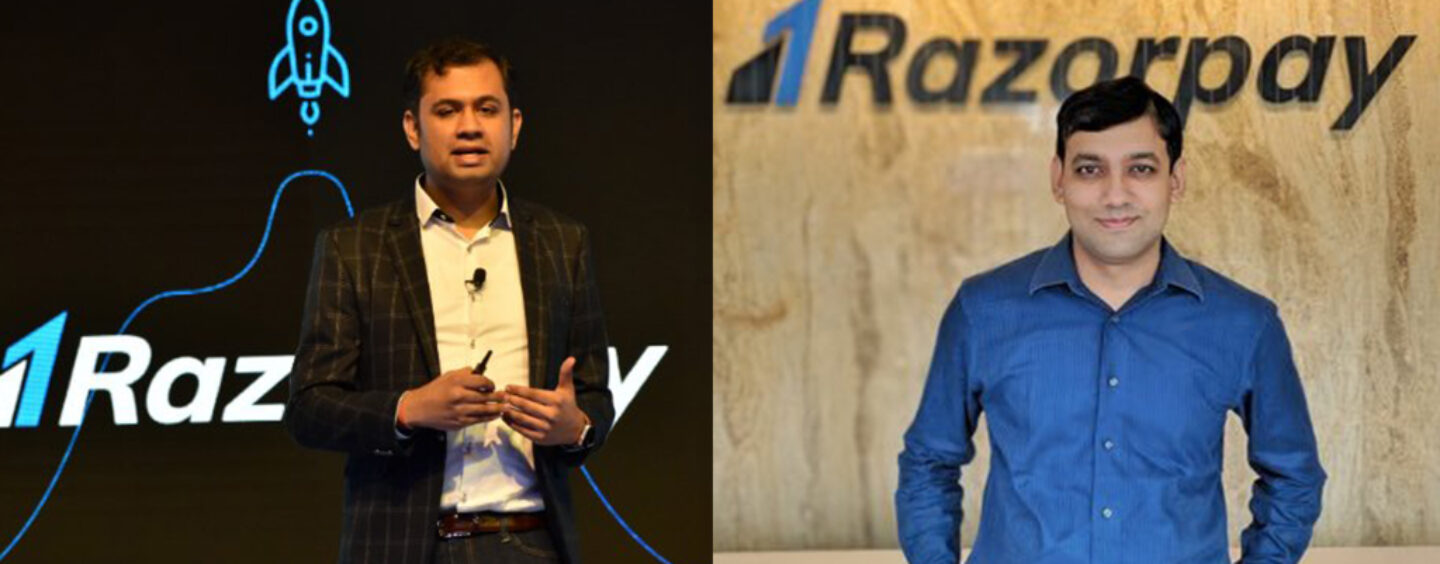

Featured image: Harshil Mathur, CEO and Co-Founder of Razorpay and Shashank Kumar, Co-founder of Razorpay