Fintech Sees Strong Growth in South East Asia as COVID-19 Skyrockets Digital Adoption

by Fintech News Singapore November 19, 2020Despite COVID-19 headwinds, Southeast Asia’s digital economy has remained strong and resilient, adding 40 million people into the online space this year.

Owing to the surge in digital adoption by customers and businesses, usage of digital financial services has jumped significantly this year, according to the e-Conomy SEA 2020 report by Google, Temasek and Bain & Company.

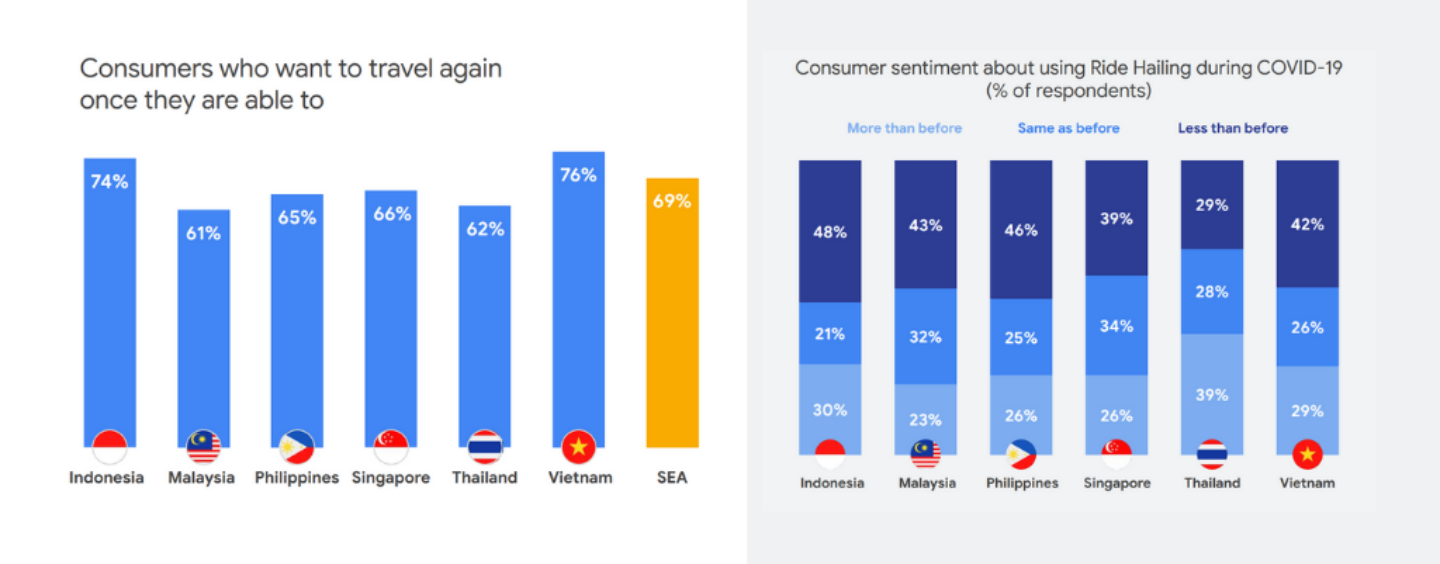

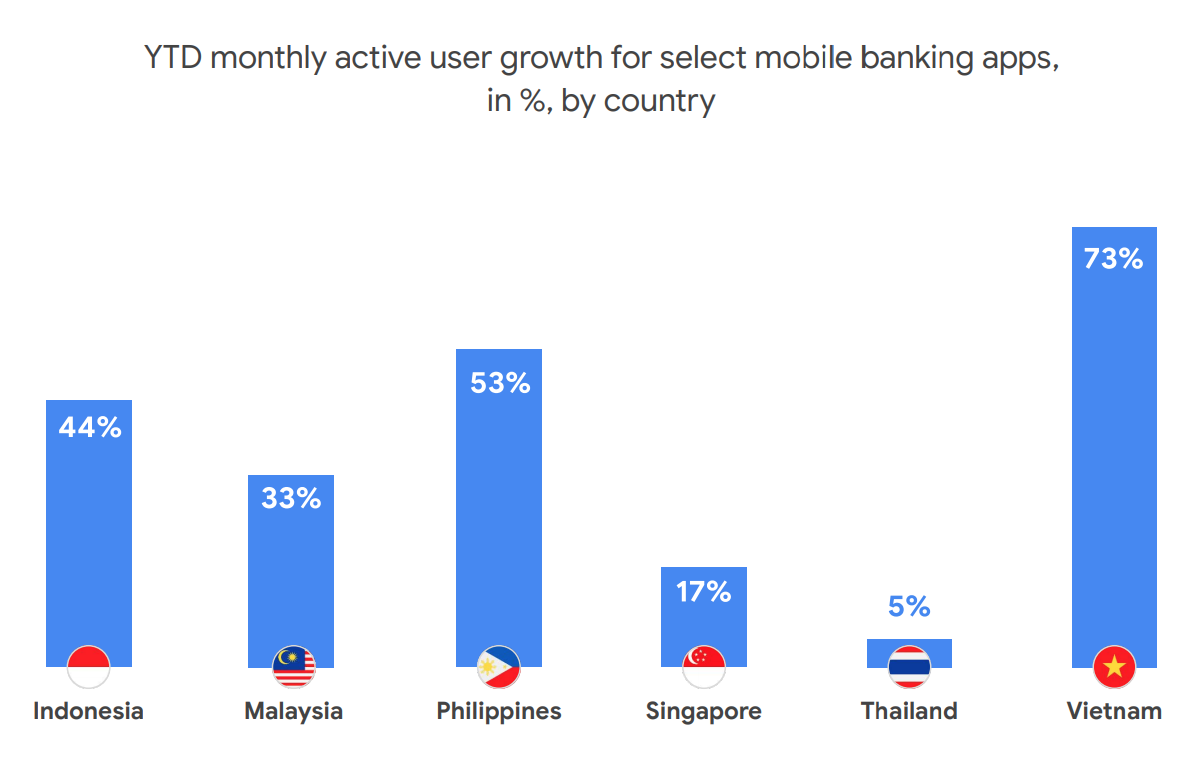

Usage of mobile banking apps rose across all Southeast Asian markets with Vietnam, the Philippines and Indonesia recording the strongest growth rates in monthly active users.

YTD monthly active user growth, Source: AppAnnie: includes iOS and Google Play, Jan 1 – Sep 31 2020 vs previous period, via e-Conomy SEA 2020, by Google, Temasek and Bain & Company

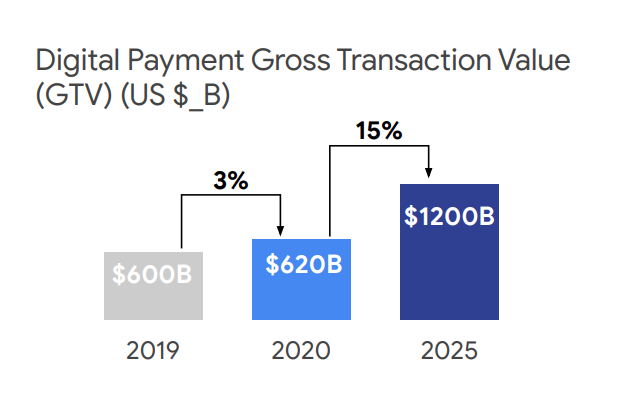

Digital payments grew 3% this year, rising from US$600 billion in 2019 to US$620 billion in 2020. This comes on the back of declining cash usage and rising adoption of e-wallets.

Digital Payment Gross Transaction Value, Source: Bain Analysis, via e-Conomy SEA 2020, by Google, Temasek and Bain & Company

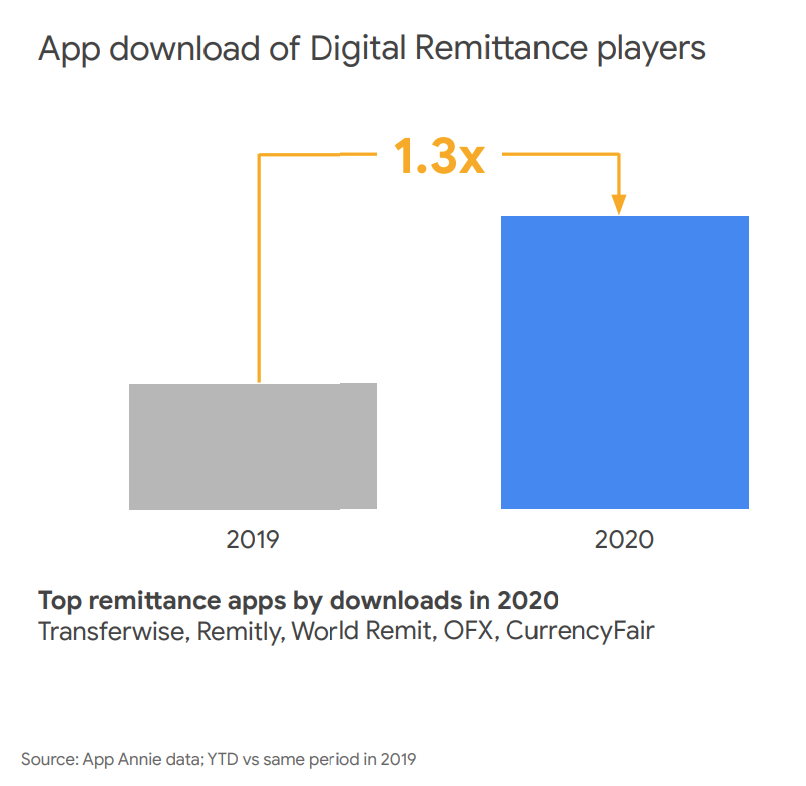

But COVID-19 has not just given mobile banking and digital payments a boost, the public health crisis has also pushed for greater adoption of digital remittances, online investment and online insurance purchases.

With physical movements restricted, online remittances jumped by nearly 2x, the study found, and app downloads of digital remittances players such as TransferWise, Remitly and World Remit, surged 1.3x.

App download of Digital Remittance players, Source: App Annie data: YTD vs same period in 2019, via e-Conomy SEA 2020, by Google, Temasek and Bain & Company

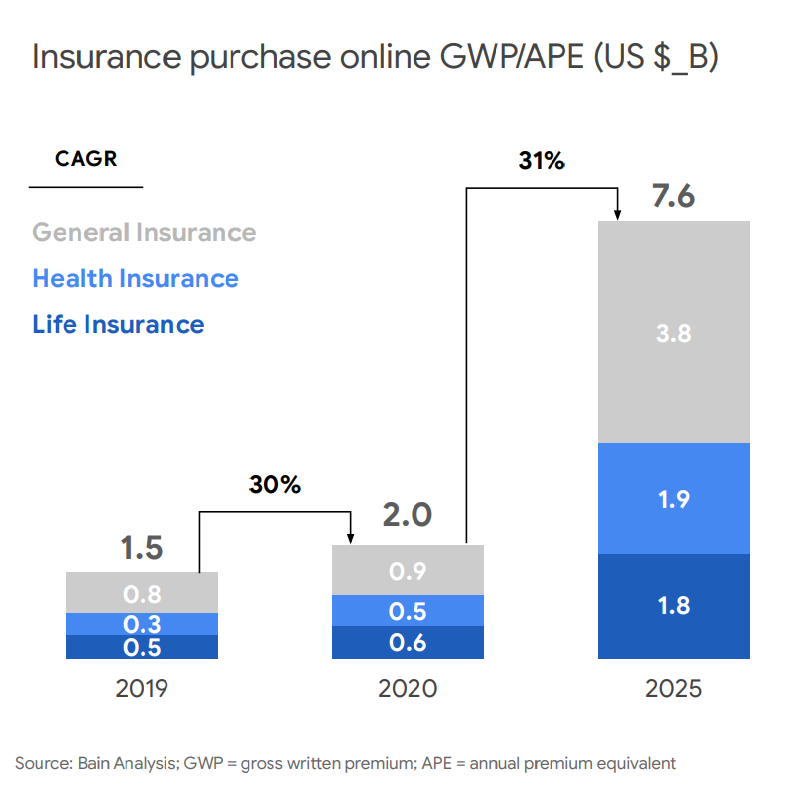

Amid the pandemic, demand for life and health insurance coverage also rose. With traditional channels disrupted by social distancing measures, insurance purchases moved online. Online insurance purchase increased 30% to US$2 billion this year, and is expected to reach US$7.6 billion by 2025.

Insurance purchase online, Source: Bain Analysis, via e-Conomy SEA 2020, by Google, Temasek and Bain & Company

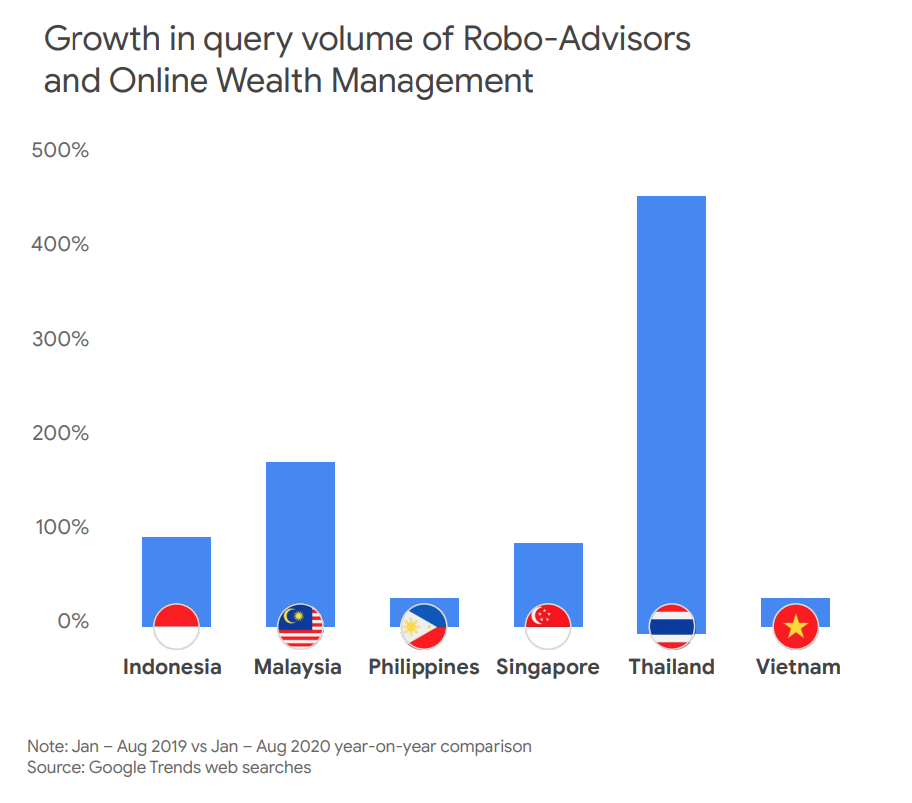

Online investment, a rather nascent industry in Southeast Asia, has also gained significant traction amid COVID-19. Query volume of robo-advisors and online wealth management grew across all Southeast Asian countries, with Thailand and Malaysia seeing the strongest growth, the report says.

Growth in query volume of Robo-Advisors and Online Wealth Management, Source: Google Trends web searches, via e-Conomy SEA 2020, by Google, Temasek and Bain & Company

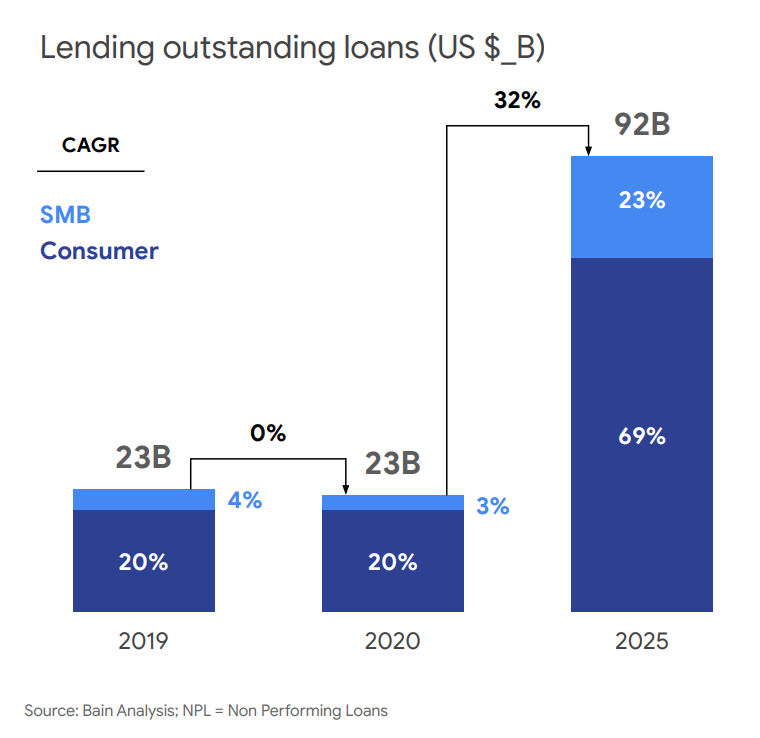

In online lending, while volumes had remained unchanged between 2019 and 2020, the report projects a 32% increase to US$92 billion in 2025.

Lending outstanding loans, Source: Bain Analysis; NPL = Non Performing Loans, via e-Conomy SEA 2020, by Google, Temasek and Bain & Company

Investors remain confident

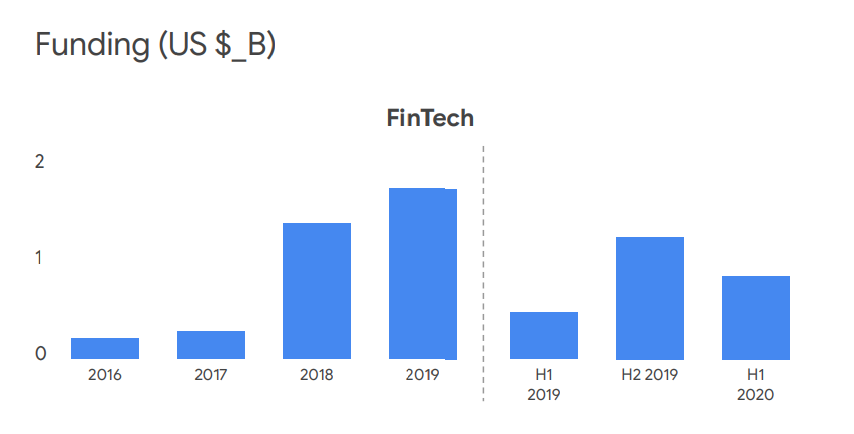

Fintech companies raised US$835 million in the first half of 2020, nearly double what was raised in H1 2019 at US$475 million. The report notes a 24% increase in the number of deals during this period.

Fintech funding, Source: Industry reports, VC partners, Bain Analysis, via e-Conomy SEA 2020, by Google, Temasek and Bain & Company

Southeast Asia’s fintech companies continued to ride the H1 2020 momentum with a number of investments being made in H2 2020. Deals include Fvndit, the operator of Vietnamese peer-to-peer (P2P) lending platform eLoan.vn, which raised US$30 million in September 2020; Silent Eight, a Singaporean regtech startup, which raised US$15 million in October 2020; and LinkAja, one of Indonesia’s largest e-wallets, which announced a US$100 million Series B just earlier this month.

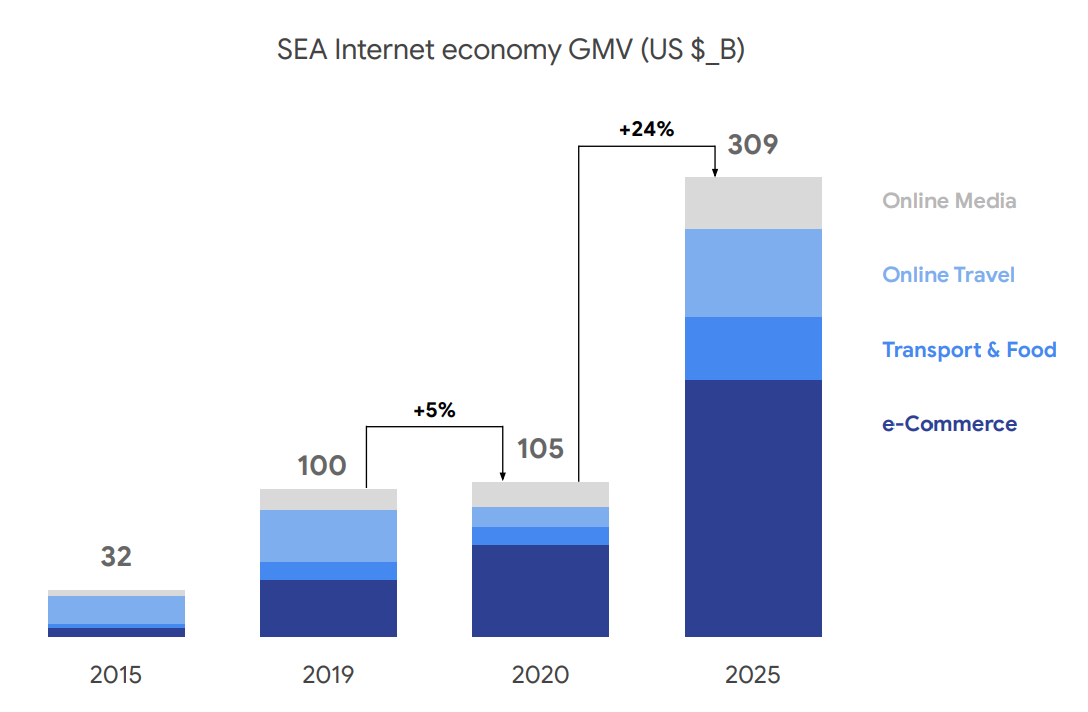

Southeast Asia’s digital economy continued to see strong growth in 2020, hitting US$100 billion. E-commerce has emerged as the biggest vertical growing 63% to reach US$62 billion in 2020.

SEA Internet economy GMV, Source: Bain Analysis, via e-Conomy SEA 2020, by Google, Temasek and Bain & Company

COVID-19 has been a catalyst for digital adoption in the region, with more than one in every three digital service consumers starting using the service due to the pandemic. The behavioral changes will be long-lasting as nine in ten new digital consumers intend to continue using digital services post-COVID-19.

Southeast Asia is now home to 400 million Internet users, representing 70% of the region’s population.