Southeast Asian economies performed remarkably well in 2020 despite the pandemic. The Asian Development Bank (ADB) estimates a contraction of 3.8% for the region in 2020, a modest figure when compared to the eurozone at 7.9% and Britain at 10.1%.

In particular, Southeast Asia’s digital economy accelerated last year, hitting US$100 billion on the back of a booming e-commerce sector. According to the e-Conomy SEA Report 2020 released in November, 2020 saw the addition to 40 million new online customers, bringing the total number of Internet users in the region to 400 million. The region’s digital economy is on track to cross US$300 billion by 2025, it estimates.

Delving deeper into Southeast Asia’s fast-growing e-commerce industry, a new report by payment company PPRO looks at emerging e-commerce trends and shares customers’ preferred payment methods for online shopping in key markets, including Indonesia, Malaysia, the Philippines, Singapore and Vietnam.

Indonesians prefer card payments

In Indonesia, the pandemic has significantly accelerated the growth of online shopping, in particular in the areas of healthcare and grocery shopping. Online sales of products such as disinfectants and vitamins increased by 1,000% or more, while online grocery shopping was forecast to grow 400% in 2020.

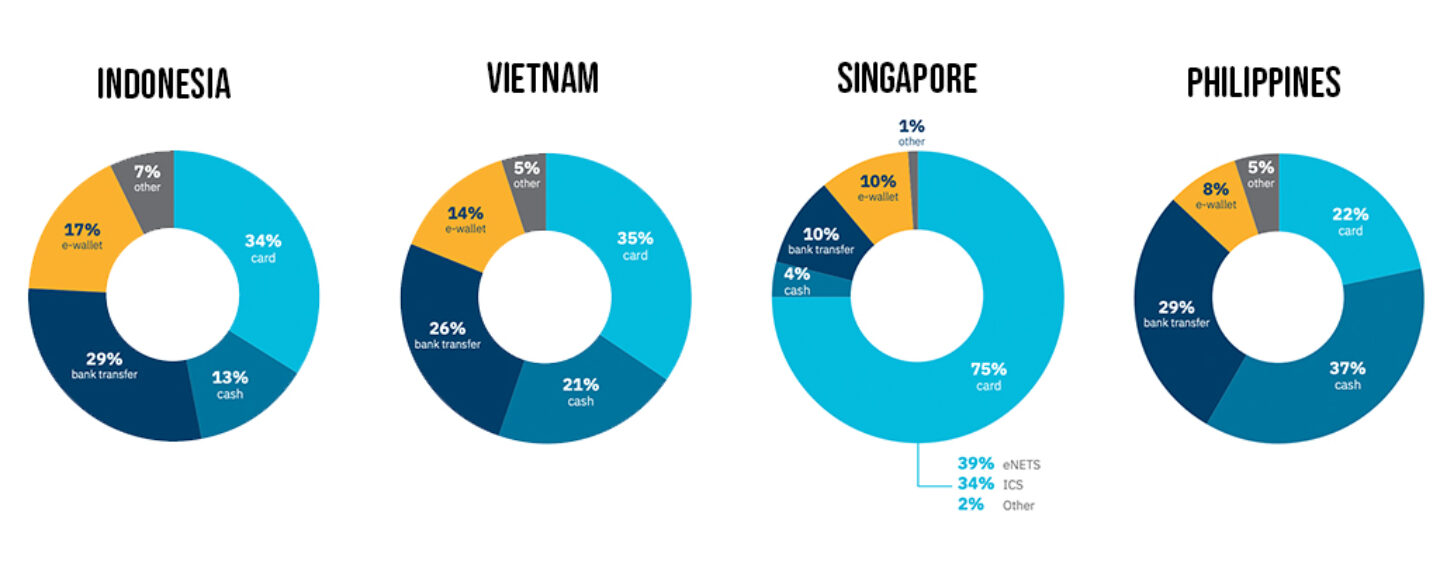

Cards are Indonesians’ preferred payment method for online purchases (34% of online purchases) with most transactions being done using local cards. Card payment is followed by bank transfer (29%), and e-wallet (17%).

Indonesians’ payment methods when shopping online, Southeast Asia: The New E-commerce Frontier, PPRO, Dec 2020

Popular local payment methods in Indonesia highlighted in the report include e-wallets GoPay by GoJek, OVO, DANA and DOKU.

Malaysians favor bank-transfer apps

In Malaysia, e-commerce volumes expanded by 149% during the first months of the pandemic, and online sales in some categories, like cooking utensils and latex gloves, grew by 800% during lockdown.

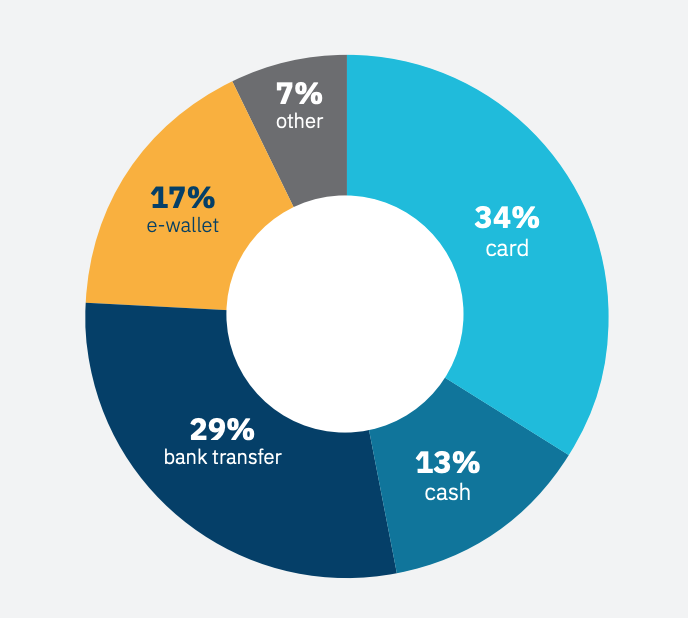

Bank transfer apps are currently the most popular payment option for online purchases, the report says, representing nearly half (46%) of Malaysians’ online purchases. It is followed by cards (32%), and cash (11%).

Popular local payment methods in Malaysia include Boost, a lifestyle e-wallet, GrabPay by Grab, Touch n Go, a digital wallet and online payment platform, and Financial Process Exchange (FPX), a bank-transfer method.

Cash remains king in the Philippines

In the Philippines, e-commerce volume grew by 376% in H1 2020, and evidence shows that brick-and-mortar businesses are quickly adapting to changing customer behavior with the number of registered online businesses surging by a factor of 40.

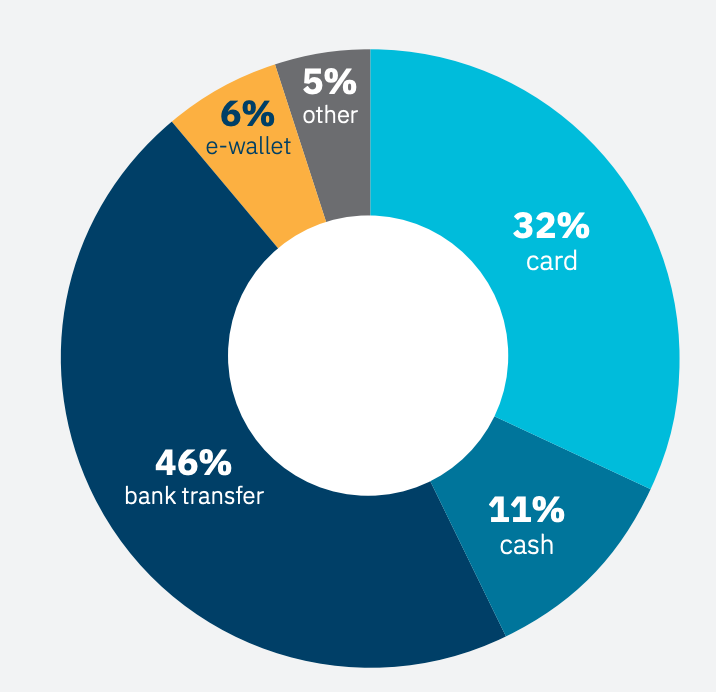

Despite rapid digitalization, habits are hard to break and cash remains customers’ preferred way of paying for online purchases. Cash is used in 37% of online purchases, followed by bank transfers at 29% and cards at 22%.

Filipinos’ payment methods when shopping online, Southeast Asia: The New E-commerce Frontier, PPRO, Dec 2020

Popular payment methods in the Philippines include Dragonpay, an online payment platform that allows merchants to accept payments via non-traditional methods such as cash or checks at physical payment counters, ATMs and mobile wallets. E-wallet GCash is another popular payment method, as well as PayMaya, a mobile banking app.

Singaporeans are avid card users

Like most other Southeast Asian countries, Singapore as well saw an increase in e-commerce activity with popular platforms all witnessing a surge in transaction volume. A research by Nielsen found that almost 40% of Singaporeans started doing more of their shopping online during the pandemic. 76% of Singaporeans do not expect to return to their pre-COVID-19 shopping habits.

In Singapore, 75% of all online purchases are paid using a credit or debit card, a striking contrast to other Southeast Asian markets. Cards are followed by e-wallets and bank transfers, both at 10%.

Singaporeans’ payment methods when shopping online, Southeast Asia: The New E-commerce Frontier, PPRO, Dec 2020

Popular payment methods in Singapore include GrabPay, PayNow, a real-time bank transfer payment method, and Hoolah, a buy now pay later payment solution.

Vietnam: a star performer of 2020

Out of the five Southeast Asian markets studied, Vietnam is the only country to record positive growth in the year of the pandemic at 1.8%. In 2020, Vietnam’s e-commerce sector grew, with online grocery shopping, cosmetics and healthcare in particular recording significant growth.

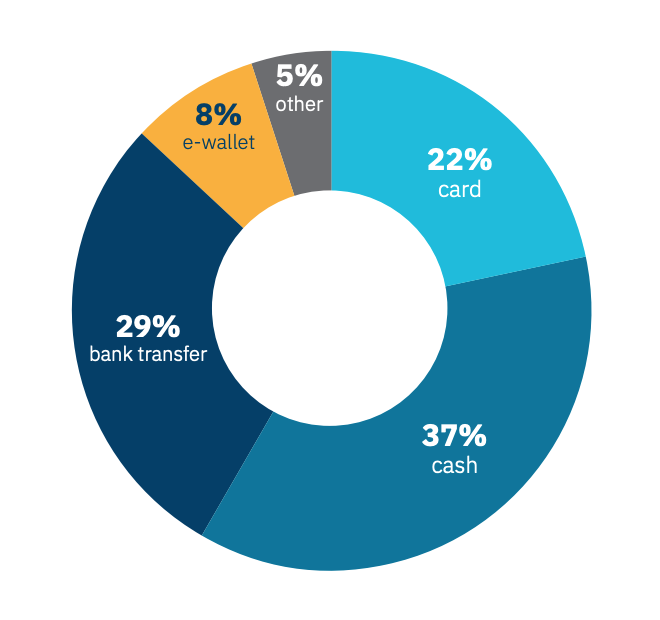

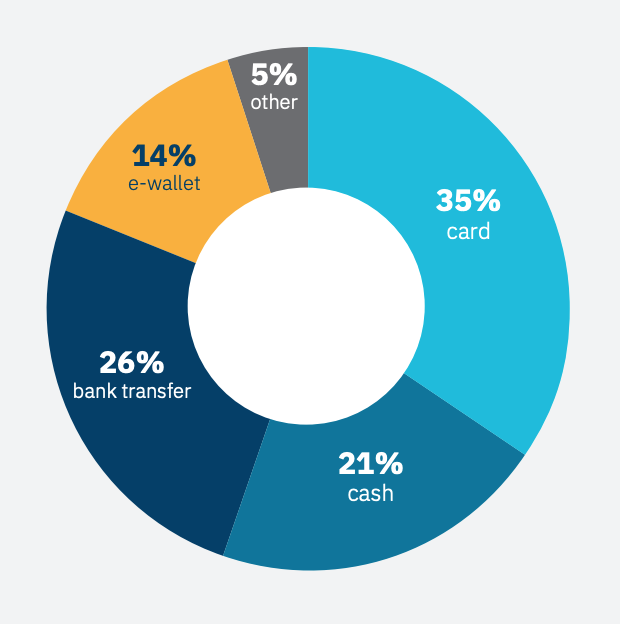

In terms of payment methods, Vietnamese people prefer paying for their online purchases with a credit or debit card (35%). Bank transfers and cash are not far behind though, representing 26% and 21% of all online purchases respectively.

Vietnamese consumers’ payment methods when shopping online, Southeast Asia: The New E-commerce Frontier, PPRO, Dec 2020

Popular payment methods in Vietnam include VTC Pay, which supports bank transfers, e-wallet transactions and international credit cards, MoMo, the country’s biggest e-wallet and over-the-counter remittance and payment platform, and Zalo Pay, a mobile wallet that runs on messaging app Zalo.