20 Upcoming Fintech Webinars and Virtual Events to Watch Live in Southeast Asian Time Zones

by Fintech News Singapore January 25, 2021With COVID-19 still spreading, online events, virtual conferences and webinars continue to attract fintech professionals, investors and other stakeholders looking to build meaning connections while remaining safe.

For those located in Southeast Asia, we’ve compiled a list of the top upcoming fintech webinars and virtual events taking place in the first half of 2021 to watch live.

Blockchain & Distributed Ledger Technology in Financial Services

January 06 – February 16, 2021 (on demand)

Join industry experts from R3, Sygnum, and Temasek in this session moderated by Zuhlke for key insights out of the distributed ledger technology (DLT) market.

This webinar is intended to provide business leaders in the financial sector with a perspective on the evolving DLT market and discuss how they can rethink business models and strategies, work with ecosystem partners, and leverage on DLT solutions to better serve their customers’ needs.

Topics covered will include:

- State of the DLT market in Asia and expert insights on key trends and developments;

- Technologies, solutions, and experience of building DLT solutions driving recent developments; and

- Use cases of DLT solutions within financial services, e.g. hedge funds and new product offerings, central bank digital currencies, arbitrage trading, ETF efficiency, etc.

AccessFintech, Blackrock & Goldman Sachs, Cash Payment Affirmation Webinar

January 27, 2021, 08:00 – 09:00 (GMT+7)

During this one-hour virtual event, participants will have the opportunity to hear from Brian Steele at Goldman Sachs, who will share insight into the benefits they’ve achieved following their recent transfer of this process onto the AFT system.

Anthony Medici at Blackrock will also join for a panel discussion on the challenges in managing cash payments and how automation is now revolutionizing the process.

Topics covered will include:

- Challenges relating to management of derivatives cash payments;

- How automation is revolutionizing the process;

- Operational transformation realized to date; and

- What’s next.

Singapore Crypto Trading Summit

January 27, 2021, 11:00 – 12:45 (GMT+8)

The Singapore Crypto Trading Summit, organized by blockchain startup Cindicator, will gather crypto traders from Singapore and across Southeast Asia to discuss the evolving cryptocurrency trading landscape.

Key topics will include:

- The market in 2021: perspectives from venture capitalists (VCs) and hedge funds;

- 2021 predictions from 156,000 analysts and artificial intelligence (AI); and

- Institutional players in crypto.

Speakers will include representatives from Bloomberg, Chinaccelerator and more.

What’s Next for Hong Kong’s Open Banking and Financial Ecosystem?

January 28, 2021, 11:00 (GMT+8)

A recent HKIMR’s research reported that innovations relating to open banking and open APIs have been commonly applied by over 50% of incumbent banks in Hong Kong.

Two years into HKMA’s Open API framework how far has Hong Kong come to Open Finance? What are the lessons learnt from the adoption of Open Banking API initiatives and How are the non-bank financial participants view the progress? How will the recent introduction of the Commercial Data Interchange CDI further impact the sector?

Join our webinar as we deep dive into the following topics:

Key Discussion Points

- Lesson learnt from Open Banking API Phase 1 and 2

- Looking ahead the opportunities and challenges of Open Banking API Phase 3 and 4 as well as CDI

- How Open Banking and Open Finance will evolve in Hong Kong

Register here: http://bit.ly/3pVIVHR

Harnessing the Power of APIs in the Lending Ecosystem

January 28, 2021, 15:30 – 16:30 (GMT+7)

APIs have become an essential medium that allows for seamless and controlled flow of data between the systems. With open banking facilitating personalized, tailored and connected services, API connectivity has become critical for organizations looking to enhance their customer processes.

In this webinar, experts will share insights on how lenders can unlock the power of APIs, offer hyper-connected digital experiences and plug seamlessly into the fast-evolving lending ecosystem to streamline their digital processes.

Key points to be covered in the webinar include:

- Make contactless user experience a reality;

- Benefit from the power of fintech ecosystem;

- Leverage the power of data in a digital world; and

- Manage and secure APIs effectively

Meet the VCs feat. Access Ventures

January 29, 2021, 15:00 – 17:00 (GMT+7)

In this fireside chat session of Meet the VC in Vietnam, BLOCK71 Saigon will be catching up with Long “Leo” Pham, manager of Access Ventures, a pre-seed/seed VC firm in Southeast Asia.

Prior to his VC works, Long spent 5 years as a software engineer in the US and co-founded a startup in the Greater Boston area. In 2017, he returned to Vietnam and joined VIISA Accelerator as the company’s first Program Director, working closely with the founders of VIISA and the startup ecosystem.

Access Ventures has portfolio companies with origins in Silicon Valley, Korea, and Singapore. The vast majority of their portfolio companies are in business-to-business (B2B), AI, data analytics, commerce enablers, AR/VR, fintech and platform plays.

Binance Blockchain Week 2021

February 01 – 05, 2021, Daily 10:00 – 13:00 (UTC)

Binance Blockchain Week 2021 will bring together some of the blockchain and crypto community’s biggest names and most daring innovators. The event will feature 5 days of world-class programming. Participants will get the chance to learn how blockchain technology is transforming the way we live, work, and transact, and learn about the latest crypto trends driving mainstream adoption.

Binance Blockchain Week 2021 will feature live simultaneous language translations from English to Russian, Chinese and Turkish.

Artificial Intelligence in Financial Services

February 03 – 04, 2021

Over the course of two days, 150+ senior executives from leading financial institutions will gather to discuss current AI successes, how to leverage new tools, and when and where to use them for best effect.

Delegates will leave the event with insight on how the industry uptake of AI is evolving, especially as advances in processing power start to change what’s possible, and guidance on where the industry is headed to over the next decade.

Embracing a Mobile Culture: How to Satisfy Customers Without Compromising Security

February 9, 2021, 11:00 (GMT+8)

This webinar, hosted by Fintech News Singapore and organized in partnership with Onespan, will feature a team of mobile security experts who will share specific examples of challenges encountered by banks around the world and how financial institutions can strike the right balance between security and user experience.

Key topics covered will include:

- How financial institutions can leverage mobile to improve productivity, especially as contactless banking becomes the norm;

- Integrating multi-factor authentication options into mobile apps;

- Striking the right balance between security and user experience; and

- How to compete in today’s mobile app threat landscape and best practices for mitigating attacks.

Register here: https://form.jotform.com/210211716221437

Reducing Friction in Online Account Opening with Digital Identity Verification

February 16, 2021, 16:00 (CET)

COVID-19 has caused an accelerated shift from branch account opening to digital account opening. But the challenge for many financial institutions is that there is friction in the online account origination process, especially when it comes to identity and authentication. This friction often causes consumers to abandon the account opening process at a traditional financial institution for a digital-first institution with a more seamless experience.

In this OneSpan webinar, participants will get to hear experts from OneSpan and Cornerstone Advisory discuss how retail banks can eliminate friction in order to drop abandonment rates and increase account funding.

Topics will include:

- How financial institutions are experiencing the shift from branch-based to digital account opening;

- The impact of current identity verification methods on abandonment and funding rates; and

- Best practices for reducing friction in the digital account opening process.

Fintech Fireside Asia Ep #5: Indonesia’s Vibrant Fintech Scene, ft. Jason Thompson CEO, OVO

February 18, 2021, 11:00 (GMT+8)

Indonesia is considered by many who are expanding in South East Asia as the crown jewel of the region.

Being a populous and digitally connected nation that is backed with strong economic fundamentals it has all the right ingredients to thrive

We speak to Jason Thomson CEO of Indonesia’s fintech darling OVO to get an inside look at the scene and opportunities in Indonesia

Register here: http://bit.ly/3pMEiQY

MoneyLIVE APAC: The Digital Sessions

February 23, 2021

MoneyLIVE APAC: The Digital Sessions sets the scene for Asia’s leading professionals to connect and discuss the latest developments in banking, payments and FinTech online. Whether it’s virtual banking licences, new business models, partnerships, customer experience, agile operations, digital wallets or payments strategies, you’ll find it all here.

Sign up now to watch the recordings of the first 2 Sessions ‘Beyond banking – new models for success’ and ‘The next stage of digital banking transformation in Asia’, as well as being able to tune into the live broadcast of Session 3 ‘A new chapter in the evolution of payments’ on Tuesday 17 November.

You’ll hear from expert speakers, including:

- Jason Thompson, Chief Executive Officer, OVO

- Caecilia Chu, Co-Founder and Chief Executive Officer, YouTrip

- Brad Jones, Chief Executive Officer, Wave Money

- Vincent Lau, Head of International Payments, HSBC

- Judy Bei, Global Head of Payments and Receivables, Mobile Money, Standard Chartered Bank

Sign up here for free: https://bit.ly/39Jpz3y

Fintech Forum

February 23, 2021, 13:00 – 15:30 (GMT+7)

Fintech Forum is a half-day virtual conference organized by Tech in Asia in partnership with Amazon Web Services (AWS).

Through a fireside chat, a panel discussion, and a masterclass, participants will get to hear Asia’s best thought leaders discuss the region’s fintech landscape, how to build and scale fintech platforms, and more.

Topics to be covered include:

- Southeast Asia’s fintech landscape;

- The challenges and opportunities in scaling fintech platforms; and

- Breaking down fintech startup pitches and deals.

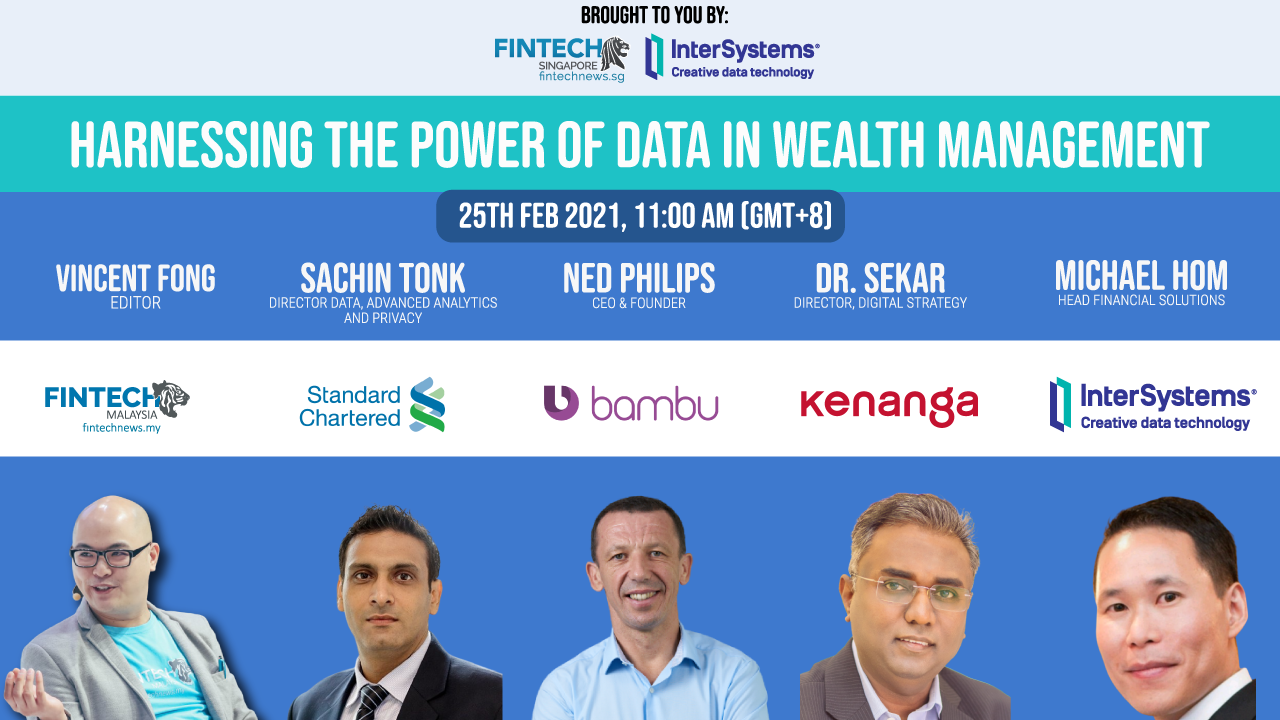

Harnessing the Power of Data in Wealth Management

February 25, 2021, 11:00 (GMT+8)

Traditional wealth managers are facing increased pressures to modernize as new entrants begin to offer wealth services at a fraction of the cost. Both incumbents and new entrants alike are turning to data analytics and AI to remain competitive. From automation the back office to front office processes, to providing personalized financial services we look at how data and AI is transforming the wealth sector

In this virtual event, participants will get to learn how to leverage data to gain a competitive edge, how to drive efficiencies with data, and how AI and machine learning (ML) are transforming wealth management.

Confirmed speakers include representatives from Kenanga Bank, Bambu, InterSystems, and Standard Chartered Bank.

Register here: http://bit.ly/3qAuMAq

ITC Digital Distribution & Ecosystems: Virtual Summit

February 25, 2021 13:00 – 14:00 (GMT +8)

Learn from insurance innovation leaders and engage with the Asian and international community at the Insuretech Connect Asia virtual summit on 25 February 2021. Deep dive into the key market trends and topics around Digital Distribution & Ecosystems Discussion points include: how you can effectively expand your ecosystem and distribution partnerships, the relevance of Bancassurance, the most effective distribution channels in the APAC and how to embrace new technologies to support digital sales forces and distribute micro-insurance.

Register today!

The Future of Money Summit

February 25, 2021, 15:30 – 21:00 (GMT+7)

The Future of Money Summit is a one day program of virtual conversations hosted by Tortoise. The summit will bring together 20-30 leading thinkers and commentators along with 2,000+ individuals from around the world.

The virtual event will look at this dynamic financial landscape and the implications of change for business, society and government.

The summit will bring together monetary experts, business leaders, fintech entrepreneurs, politicians, central bankers, activists and educationalists to discuss the big questions about the future of money.

Sessions will include:

- What’s next in the fintech revolution?

- Who are the winners and losers of a cashless society?

- Debt: do we want more of it, or less?

- Wealth: the case for a wealth tax (or for other radical thinking)

- Corruption: are financial regulators fit for purpose?

How to Build a Digital Bank from Scratch

March 3, 2021 11:00 (GMT+8)

With the Philippines introducing a digital banking framework, market observers are anticipating a wave of innovations brought on by this new breed of banks.

But how does one build a digital-first bank from scratch that caters to the unique circumstances of the Philippines?

Join experts from world-leading technology companies as they walk us through the essential tips in building a successful digital bank.

Key topics

- Designing a bank for the digital-first generation

- Building a modern, modular and scalable technology architecture

- Translating technology into business goals

Register here: https://bit.ly/BuildDigitalbank

UXDX APAC 2021

March 4 – 5, 2021

UXDX, the fastest growing conference on product in Europe, will be launching its inaugural UXDX APAC conference in March.

The event will deliver on-demand online content through keynote talks, workshops and panel discussions from global industry leaders. The goal of the conference is to deliver real change in teams, helping them take a full-systems view of software development.

Confirmed speakers include representatives from Ebay, Grab, Visa, Stripe, Shopify, Twitter, and more.

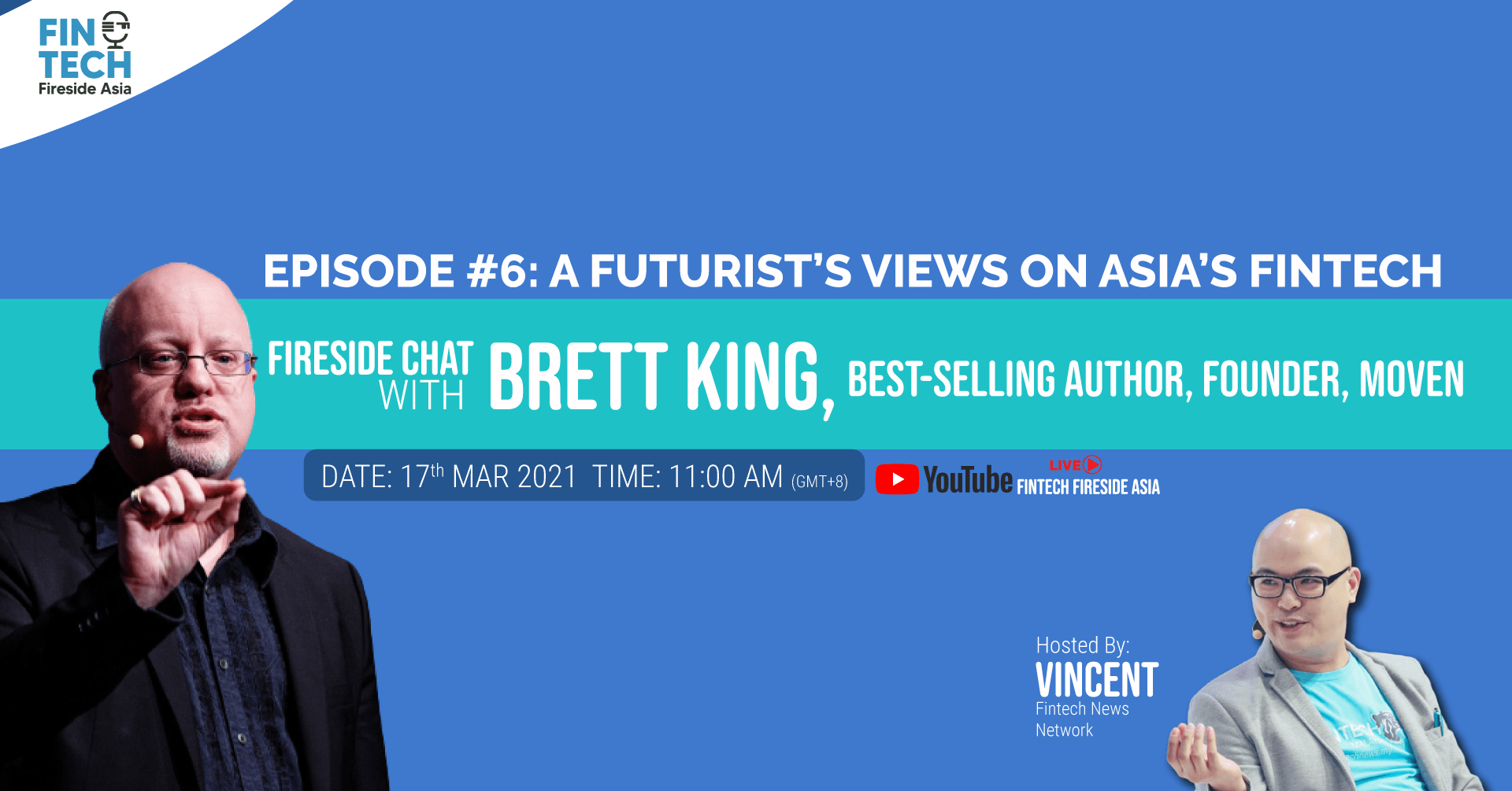

Fintech Fireside Asia Ep #6: A Futurist’s Views on Asia’s Fintech Scene

March 17, 2021 11:00 (GMT+8)

In Episode 6, we’re joined by Brett King, best-selling author and arguably one of fintech’s most influential figures, as he walks us through the key trends that will shape Asia’s fintech scene.

Register here: http://bit.ly/3c15zcG

Malaysia’s New Digital Banks, A Threat to Incumbents?

March 24, 2021 11:00 (GMT+8)

Following the unveiling of Bank Negara’s digital banking framework in December last year, about 40 players have announced their intentions of securing a digital bank license.

Will this move accelerate the pace of innovation in the Malaysian banking landscape?

Join experts from major Malaysian banks as they explore the implications of this new regulation on industry and how they are beefing up their digital offerings.

Key topics

•Exploring the impact of the digital banking framework and its implications

•Impact of bigtech / non-finance entities entering the race

•Should banks bolster their digital banking offerings or opt for the creation of a separate virtual banking entity?

Register here: http://bit.ly/3v2UEHT

BOOM21

March 31, 2021, 9:00 – 18:00 (GMT+8)

BOOM21, which stands for Bold, Original, Outstanding Minds, aims to identify and recognize 21 deserving individuals for their disruptive innovations within Southeast Asia’s tech space. BOOM21 does not distinguish between categories, and accepts verticals including healthtech, telecommunications, media, entertainment, defense, education, fintech, and more.

In addition to the list, BOOM21 will be held in conjunction with a one-day virtual conference featuring Wild Digital’s signature main stage program of fast-paced panel sessions and presentations.

Seamless Indonesia 2021

April 07 – 08, 2021

Indonesia’s only fully-online event on the future of commerce will take place in April 2021, featuring industry leaders from across Indonesia and beyond.

Over two days, Seamless Indonesia 2021 will bring participants insights from more than 80 banking, payments and e-commerce leaders across a series of live panel debates, presentations and sessions.

Advancing Data-Driven Insurance Solutions in the Digital Era

April 13, 2021, 11:00 (GMT+8)

In disrupting the insurance service industry, the COVID-19 pandemic and the emergence of InsureTechs validated the business case for not only reducing costs but also for protecting market share with accelerated digital transformation.

Insurers today recognize the competitive advantages of using the cloud to create enhanced experience for their customers, anytime, anywhere. At the same time, you are aware of the need to provide innovative products and services. For instance, through the use of telematics to reward good driving behavior with a lower car insurance premium, or using wearable devices to reward health insurance customers who share fitness information.

Join us in this webinar to learn how Dell Technologies can help you by:

- Accelerating your AI initiatives by leveraging these data sets in pre-designed, pre-validated hardware and software stacks without the complexities or costs associated with a ‘build it yourself’ approach

- Enabling rapid technical innovation to deliver a constant cycle of products and services by Modernizing, Automating and Transforming the Dell Technologies’ digital platform and services

Register now at http://bit.ly/3loZLxZ

Apidays Live Singapore 2021

April 21 – 22, 2021

This year’s Apidays Live Singapore will dig into both the business and technology of APIs: how firms are building partner ecosystems, implementing API-first architectures, and migrating from monoliths to microservices.

Southeast Asia’s digital ecosystem is growing fast. It’s also getting more complex. The lines are blurring between finance, e-commerce, telecommunications and travel.

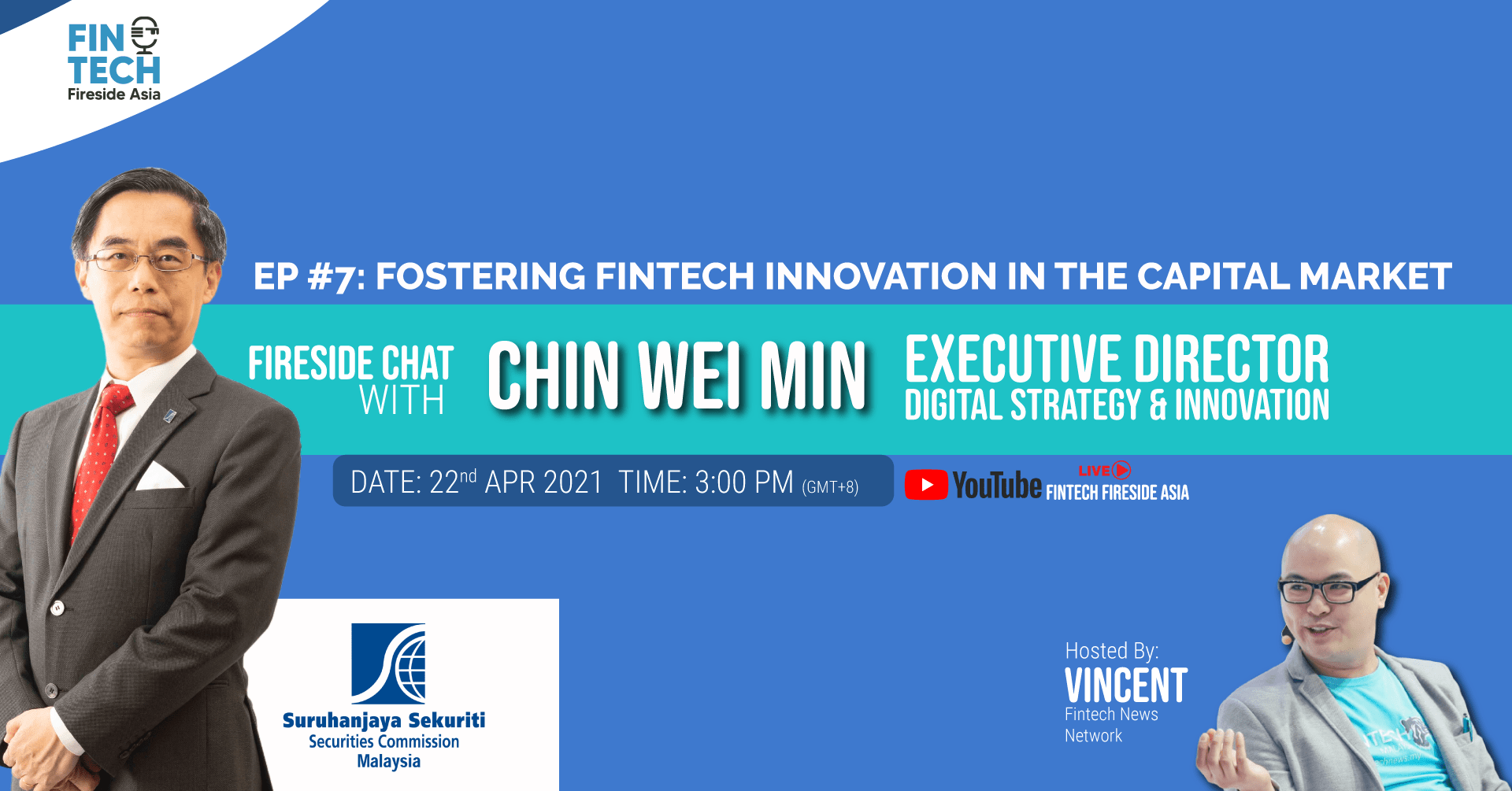

Fintech Fireside Asia Ep #7: Fostering Fintech Innovation in the Capital Market

April 22, 2021, 13:00 (GMT+8)

In Episode 7, we speak to Chin Wei Min, Executive Director of Digital Strategy and Innovation at Securities Commission Malaysia to deep dive into the regulator’s initiatives and future plans to foster fintech innovation in Malaysia’s capital market.

Register here: https://bit.ly/39tUEb3

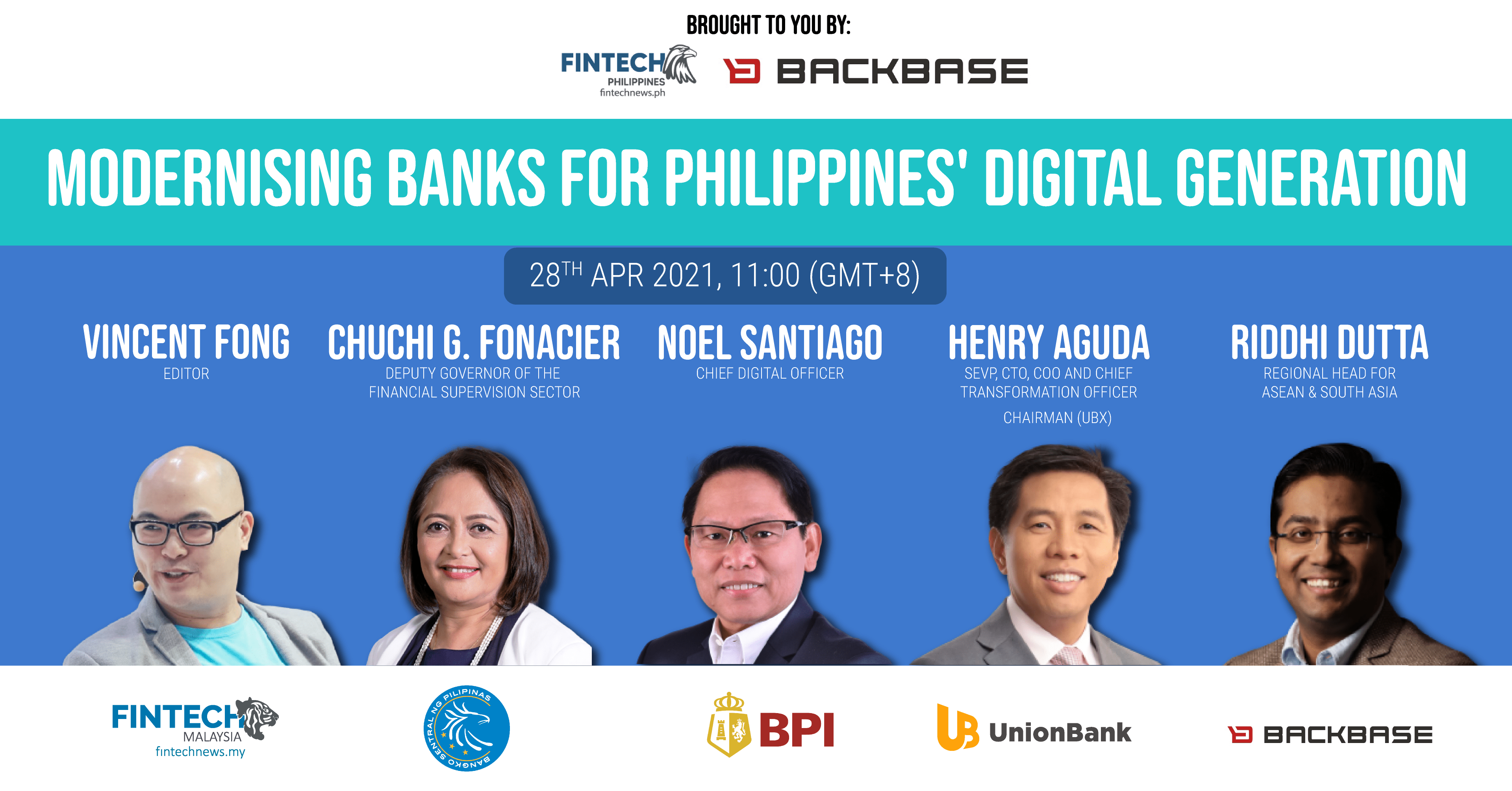

Modernising Banks for Philippines’ Digital Generation

April 23, 2021, 11:00 (GMT+8)

The Philippines banking industry has accelerated their digital transformation in the past year as contactless banking emerged as the new norm.

The need to fast track their transformation strategies and plans brings new hurdles and challenges.

Stay tuned as industry leaders provide us with rare insights on how the financial services industry can steer modernisation efforts for Philippines’ digital generation.

Register here: https://bit.ly/2OKfeMW

MoneyLIVE APAC: The Digital Sessions

May 04, 2021, 13:00 (UTC+7)

MoneyLIVE APAC: The Digital Sessions sets the scene for Asia’s leading professionals to connect and discuss the latest developments in banking, payments and FinTech online. Whether it’s virtual banking licences, new business models, partnerships, customer experience, agile operations, digital wallets or payments strategies, you’ll find it all here.

Sign up now to watch the recordings of the first 4 Sessions ‘Beyond banking – new models for success’, ‘The next stage of digital banking transformation in Asia’, ‘A new chapter in the evolution of payments’ and ‘Is 2021 the year of the digital bank in Asia?’ , as well as being able to tune into the live broadcast of Session 5, ‘The future of digital banking in Indonesia’ on Tuesday 4 May.

You’ll hear from expert speakers, including:

- Tjandra Gunawan, Chief Executive Officer, Bank Neo Commerce

- Vishal Tulsian, President Director, Chief Executive Officer, Amar Bank

- Numan Rayadi, Head of Digital Banking, BTN

- Andreas Kurniawan, Executive Vice President, Bank Danamon

- Adrian Gunadi, Co-Founder and Chief Executive Officer, Investree

Sign up here for free: https://bit.ly/39Jpz3y

Insuretech Connect Asia 2021

June 16 – 17, 2021

InsureTech Connect Asia will bring together the most senior and diverse gathering of insurance industry executives, investors, and start-ups from across the Asia Pacific Region from 16 – 17 June 2021 at Suntec Singapore Convention & Exhibition Centre. Attendees will have the opportunity to connect and explore partnerships, gain visibility into companies across the full range of stages and strategies, meet with thought leaders who shape the insurance industry and get insights across all major categories, including P&C, Life, Health, Small Business, and Specialty.

ITC Asia will be presented in both physical and digital formats and is designed to allow for both in-person and online attendee participation and networking to foster meaningful connections.

Register for ITC Asia 2021: http://bit.ly/31b0h9t

FinovateAsia Digital 2021

June 22 – 23, 2021

FinovateAsia will return this year for a digital event that’s expected to bring together more than 500 senior decision makers. The event will feature 10+ innovative demos, 50+ speakers, and hundreds of meetings all delivered digitally.

For more Information: FinovateAsia Digital 2021.