Mambu: Significant Misunderstanding Hampers Open Banking Adoption

by Fintech News Singapore April 20, 2021Most customers still don’t understand what open banking is and its benefits, a misunderstanding that’s hampering adoption, found a new survey by Mambu, a software-as-a-service (SaaS) banking platform provider.

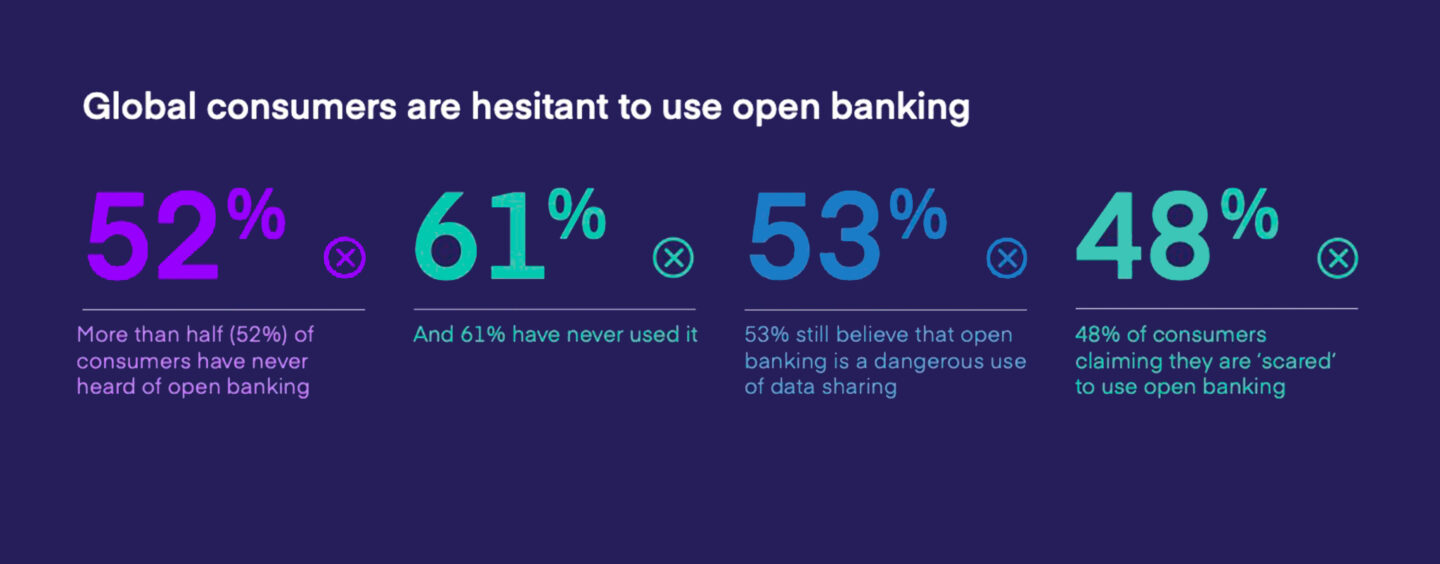

Out of 2,000 global banking customers surveyed, more than half (52%) said they have never heard of open banking and 61% said they have never used it, despite a large majority of respondents (80%) using one or more mobile finance apps and overall caring about receiving better financial services.

57% respondents cited data sharing as their main concern, with 43% of respondents believing that open banking is a dangerous use of data sharing.

Part of the reason for customers’ lack of understanding and skepticism could be due to banks’ doings. 49% of banking customers surveyed feel their bank did not explain the benefits of open banking when introduced or provide reassurance on the safety of open banking.

24% feel their bank could have done a better job at explaining open banking, and noteworthily, 57% said they would be more likely to use it if their bank had more successfully implemented and promoted it.

Mambu infographic of its open banking survey, April 2021

Europe is leading the open banking change, but it’s now being rolled out across Asia Pacific (APAC) at differing speeds with countries including Australia and Singapore well ahead of the pack. In APAC, many customers are already using open banking without even knowing, but fear and doubt still remain.

Considering the potential of open banking in APAC when it comes to financial inclusion, it’s imperative that banks and financial institutions in the region clearly communicate the benefits with their customers and alleviate any fears they have, particularly around data security, Myles Bertrand, Mambu’s managing director for APAC, said in a statement.

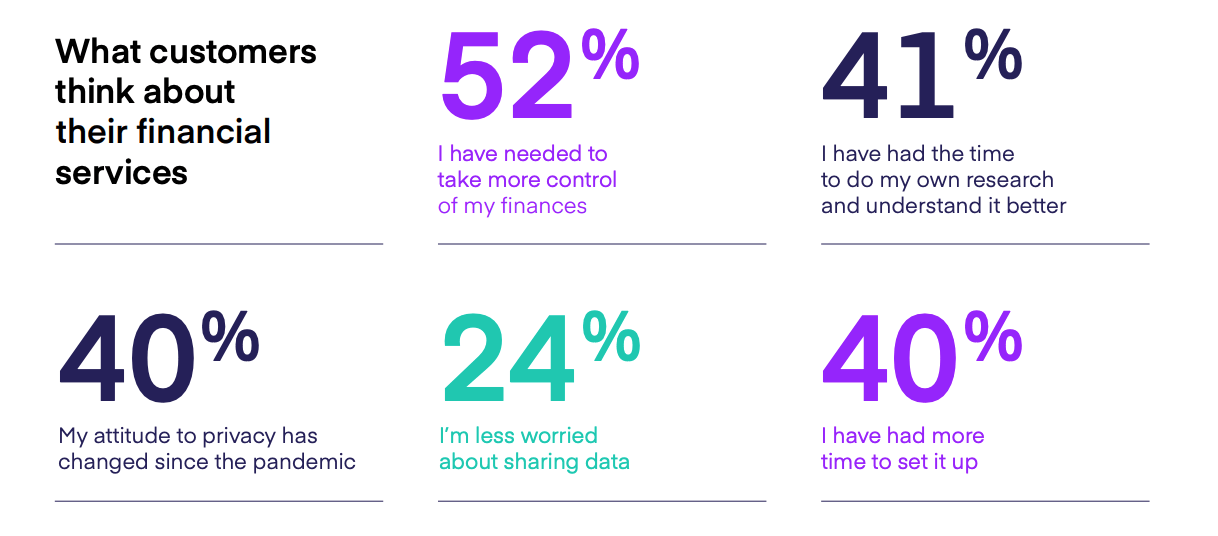

In addition to the opportunity for open banking to bring convenient and cheaper financial services to the financially excluded, the benefits of open banking also align with new customer expectations. According to the Mambu survey, 52% of global banking customers want more control over their finances, and 40% said the pandemic has changed their attitudes to privacy, and 24% to data sharing.

Mambu infographic of its open banking survey, April 2021

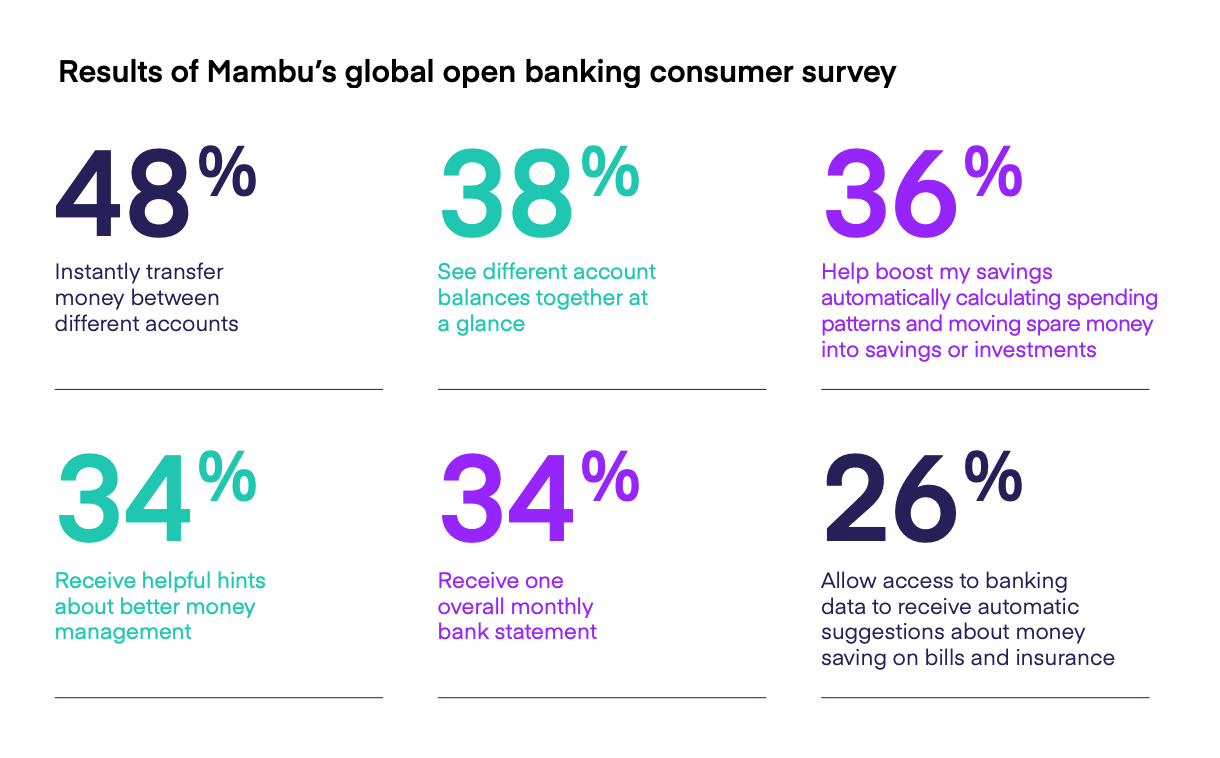

When asked what customers want from open banking, they cited instant money transfers (48%), the ability to see different account balances (38%), help them boost their savings automatically (36%) and receive advice on money management (34%).

Results of Mambu’s global open banking consumer survey, Mambu open banking survey, April 2021

Compared to Europe, open banking in APAC is still at an earlier stage and has mainly been driven by market forces. But a relatively greater willingness by individuals in the region to share their data could see rapid growth in the coming months and years.

A 2019 survey by Accenture found that six in ten consumers in Singapore were willing to share significant personal information like income, location data and lifestyle information with their bank and insurer in exchange for more affordable and personalized banking products.

As many as 87% of consumers were open to sharing income, location and lifestyle habit data for rapid loan approval, and 80% were willing to do so for personalized offers based on their location, such as discounts from a retailer.