The introduction of the Consumer Data Right (CRM) on July 1, 2020 saw the launch of the first phase of open banking in Australia, marking the debut of a new era in the domestic banking sector.

Now more than six months into CDR and open banking has yet to deliver substantial consumer benefits, illion’s general manager of consumer product Richard Atkinson told Savings.com.au. Part of the reason for that is the red tape and high costs associated with becoming an accredited data recipient.

“The current model imposes a significant cost on an organization to achieve accreditation,” Atkinson said. “There is a clear and present danger that the benefit of CDR will not be realized as the barrier to access the data (in the form of accreditation) is too high, evidenced by the fact that there are only six data recipients accredited after six months – two of which are illion.”

Under the CDR system, consumers consent to a transfer of their data from a data holder (e.g. a bank) to an accredited data recipient.

An accredited data recipient has been accredited by the Australian Competition and Consumer Commission (ACCC), the lead regulator of the CDR, to receive consumer data and use it to provide enhanced products and services, as long as they can adequately protect the data from misuse.

So far, the ACCC has granted accreditation to just six data recipients: Ezidox, Frollo, Intuit and Regional Australia Bank, in addition to the two illion brands, despite many companies showing interest in joining open banking. Commonwealth Bank (CommBank), one of Australia’s Big Four banks in Australia, revealed last week plans to become an accredited data recipient, a move which CEO Matt Comyn said will help the bank serve up “the most personalized and relevant and differentiated banking experiences to our customers.”

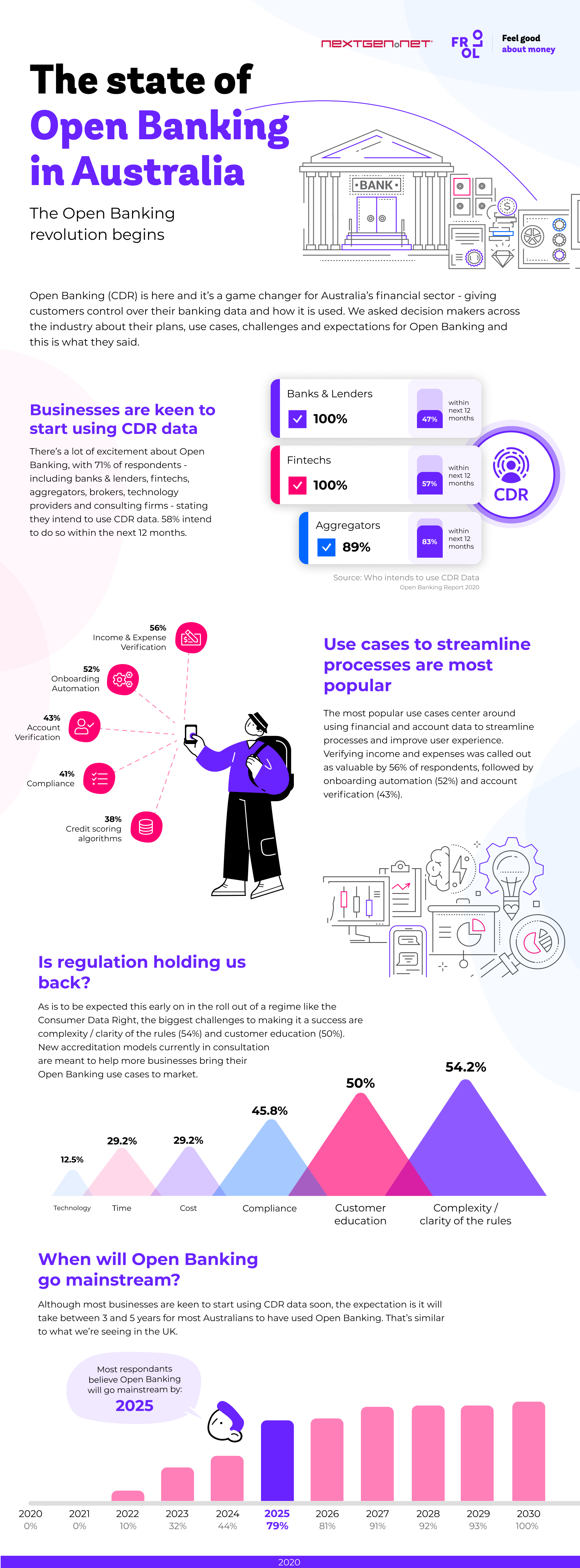

A 2020 study conducted by Australian fintech Frollo and lending technology provider NextGen.Net found a lot of excitement about open banking within Australia’s financial services industry with 71% of respondents, including banks, brokers and fintechs, stating that they intended to use CDR data.

Among the key challenges to making the CDR regime a success, respondents cited complexity/clarity of the rules (54.2%), customer education (50%), compliance (45.8%) and cost (29.2%).

Image Credit: https://frollo.com.au/open-banking/state-of-open-banking-report-2020/

Recently, the ACCC made provisions to the CRM rules to increase consumer benefit, but disregarded the introduction of new accreditations levels, one of the proposals made by the government’s Inquiry into Future Directions for the Consumer Data Right. The proposal suggests the creation of a tiered accreditation system that would enable a faster onboarding process and allow smaller players to be able to benefit from open banking data.

So far, it has not been made clear if further amendments are planned.

In Australia, the introduction of open banking is being done in phases. Consumer data relating to credit and debit cards, deposit accounts and transaction accounts have been available since July 1, 2020. Consumer data relating to mortgage and personal loan data followed suit on November 1, 2020. Banks other than the Big Four – CommBank, NAB, Westpac and ANZ – have until July 1, 2021 to provide access to open banking data. Open banking is expected to be fully implemented by November 1, 2022.

Australia’s open data economy ambitions

Australia launched open banking in a bid to increase innovation and competition in the sector, but the country’s ambitions for the CDR rules goes well beyond finance.

After banking, the CDR will be implemented into other sectors including energy, telecommunications, superannuation, as well as travel and leisure, to establish what has been referred to as the open data economy.

The main goal of the CDR regime is to help customers monitor their finances, utilities and other services and compare and switch between different offerings more easily. The system also aims to encourage competition between service providers, enabling customers to access products and services that better suit their specific needs.

Only businesses that have been accredited by the ACCC can provide services using the CDR system. Accredited providers must comply with a set of privacy safeguards, rules and IT system requirements that ensure that a customer’ privacy is protected and their data is transferred and managed securely.