24 Upcoming Fintech Webinars and Online Events in Asia Pacific

by Fintech News Singapore May 4, 2021Fintech webinars and online events continue to attract a large audience of industry stakeholders and professionals looking to network and keep up with the rapidly evolving landscape, all the while remaining safe and healthy at a time when the COVID-19 pandemic continues to spread rapidly around the world.

For those located in Asia Pacific (APAC), we’ve compiled a list of 24 upcoming fintech webinars and online events that are being held in the coming months to watch live.

Digital Banking Asia Online Part 2

August 25, 2021, 10:00 – 12:30 PM SGT

Digital Banking Asia Part 1 was a huge success, bringing together over 450 senior professionals in the banking and financial services industry, where expert sharing and insights have shown that there is much more room for digital banking to grow in Asia. Transformation and disruption were the key components of change in 2020, with emerging and sustained trends of customer adoption, progressive regulation and ecosystem partnerships.

Building on the theme ‘Transformation and Disruption’ of Digital Banking Asia Part 1, Digital Banking Asia Part 2 will shed light on the digital capabilities and strategic partnerships needed to boost continuous innovation and ensure digital resilience.

Senior-level executives in the banking and financial services industry will share tactical insights and best practices on collaborating and competing in a post-pandemic world, as well as building digital resilience through the combination of infrastructure, tech and talent.

FinovateAsia Digital 2021

June 22, 2021, 9:30 – June 23, 2021, 15:50 (SGT)

FinovateAsia will return this year for a digital event that’s expected to bring together more than 500 senior decision makers, and feature 10+ innovative demos, 50+ speakers, and hundreds of meetings all delivered digitally.

Participants will get to learn from and network with the startups, tech platforms, financial institutions, regulators, and investors redefining financial services in Asia and beyond.

For more Information: FinovateAsia Digital 2021

Fintech Fireside Asia Ep #9: Digital Banks to Digital Currencies: Malaysia’s Regulatory Outlook ft. Suhaimi Ali, Director, BNM

June 17, 2021, 15:00 (SGT)

In Episode 9, we speak to Suhaimi Ali, Director, Financial Development and Innovation at BNM.

With the digital banking license deadline approaching and major trends like digital currencies emerging, we speak to the regulator to get a sense of Malaysia’s outlook.

Register here: https://bit.ly/3hRD3Pe

Insuretech Connect Asia

June 16 – 17, 2021

Suntec Convention Centre Singapore and virtually

Insuretech Connect Asia (ITC Asia) will bring together the most senior and diverse gathering of insurance industry executives, investors, and startups from across the APAC region from June 16 to 17, 2021 at the Suntec Singapore Convention and Exhibition Centre.

Attendees will have the opportunity to connect and explore partnerships, gain visibility into companies across the full range of stages and strategies, meet with thought leaders who shape the insurance industry and get insights across all major categories. Confirmed speakers include senior executives representing companies and organizations such as the Monetary Authority of Singapore (MAS), ZA Tech, OneConnect Financial Technology, Aviva Singlife, Singtel Innov8, AXA, CXA, and Grab.

This year’s event will be presented in both physical and digital formats, allowing for both in-person and online participation.

Register for ITC Asia 2021: http://bit.ly/31b0h9t

Seamless Asia 2021

June 16, 2021, 9:00 – June 17, 2021, 16:00 (SGT)

After an amazing virtual event in 2020, Asia’s leading event dedicated to the future of commerce is returning virtually in 2021.

Over two days, Seamless Asia 2021 virtual edition will bring participants insights from more than 120 banking, payments and e-commerce leaders across a series of live panel debates, presentations and no-holds barred unconference sessions.

Participants can join in live, or watch the sessions on-demand.

ACAMS Anti-Financial Crime Fintech Summit

June 15, 2021, 9:00 – June 17, 2021, 17:40 (SGT)

The fintech industry has changed the face of banking as we know it, making it quicker and more convenient, but also presenting the anti-financial crime community with significant challenges.

Over three days, the global community will come together virtually to look at the latest regulations and trends impacting the industry. Participants will be able to attend their regional day live (June 17 for APAC), re-watch their favorite sessions and watch any missed sessions until September 15, 2021.

MoneyLIVE APAC: The Digital Sessions

June 15, 2021, 14:00 – 16:40 SGT

Payments innovation in Asia’ will look at the digital payments landscape, building ecosystems, seamless and secure payments and how ISO20022 will transform international payments.

Take a look at just three of the speakers who are set to give you insights into the payments industry in Asia:

- Jason Thompson, Chief Executive Officer, OVO – As CEO of one of Indonesia’s biggest digital wallets, Jason will be discussing how mobile payments are driving financial inclusion, providing new opportunities for merchants and generating data that is providing new insights into value added services.

- Rhidoi Krishnakumar, Executive Director, Head of Regional Cross Border & Digital Payments Group, DBS Bank. As a digital payments leader, Rhidoi will be sharing his insights into building ecosystems and partnerships that blend into customers’ lives and offer products, incentives and support when they need it.

- Rachelle Alexis Lim, Executive Director, 2C2P – Rachelle and 2C2P are helping merchants accept payments by providing support which allows customers to digitalize and continue business during times of difficulty. Rachelle will share case studies on seamless onboarding and secure payment processes.

Register Here: https://bit.ly/2Rpvoge

Boosting buy-side operational efficiency, resilience, and competitiveness in APAC

June 11, 2021, 11:00 – 12:00 (SGT)

Automation, cloud, and AI technologies are enabling financial institutions to reduce overhead, touchpoint, and risk of human error around middle- and back-office operations. The use of these technologies has taken on new relevance amid the coronavirus pandemic and accompanying shift to working online as financial institutions needed to completely re-think how to run their businesses. Now more than ever, the financial industry must use innovative solutions to enhance operational efficiency and competitiveness, while striving to enhance service levels offered to their customers and remain compliant.

Hosted by Kapronasia in partnership with SmartStream, this webinar will feature key industry leaders who will share their insights on how the COVID-19 pandemic is forcing buy-side participants to review how fit for purpose their current operational processes and technology infrastructure are.

How Banks Can Foster a Culture of Innovation

June 2, 2021, 11:00 (SGT)

At the heart of every bank that delights its customers is a culture of innovation.

Having a culture of innovation is more than just fancy fintech labs or hiring a chief innovation officer and calling it a day.

Tune in to our webinar and learn how banking leaders in Malaysia have attempted to create a cultural shift within their own organisations

- Getting buy-in from the top

- Shaping the right environment and attracting the right talent

- Creating innovation that matters to customers

Register here: https://bit.ly/3tvEmp3

Global Fintech Fest 2021

June 1, 2021, 10:30 – June 3, 2021, 22:30 (SGT)

The second edition of the Global Fintech Festival (GFF) aims to harness some of the best minds to deliver strategic insights on the current ecosystem globally, position strategic activations to attract higher investments, derive a future-proof road map and upscale the knowledge base.

GFF 2021 will provide an in-depth understanding of the latest business, policy, investment and technology developments within the fintech landscape globally, as well as startup engagement and networking opportunities.

Virtual Fintech Forum 2021

May 27, 2021, 10:30 – 20:00 (SGT)

Virtual Fintech Forum 2021, a full day fintech conference, will provide insights and curated thought leadership on the core themes of fintech for industry 4.0 and ESG (environmental, social and corporate governance).

This full day agenda will include panel discussions and workshops on how fintech can enable green and sustainable finance, in addition to the role it plays in risk management and governance.

It will also showcase innovative fintechs from Asia and beyond on how they are addressing the challenges to ESG factors, and explore how financial services firms are partnering with fintechs to achieve their ESG goals.

Securing Digital Connectivity in the New Era of Open/Digital Banking

May 26, 2021, 10:00 – 11:00 (SGT)

As regulation, competition, and customer expectations push financial institutions to increasingly collaborate with each other and third-party providers, FIs will be required to move from a monolithic, legacy architecture to a cloud-native, open API architecture. The shift to hybrid-/multi-cloud IT architectures and the building of such a collaborative ecosystem will need an increased focus on security solutions to ensure resiliency and compliance.

On May 26, a virtual expert panel hosted by Kapronasia in partnership with Equinix will feature key industry leaders who will share their insights on how financial institutions can securely leverage the collaborative ecosystem and emerging technologies such as edge computing to deliver on customer expectations and stay competitive in a challenging market.

Participants will gain exclusive insights on the drivers behind open/digital banking, the rise of collaborative ecosystems, the shift to agile, DevSecOps and cloud-native, open API architectures, infrastructure digitalization and automation, edge computing systems and their security implications, and more.

Trends in Fintech: Banking without Borders

May 25, 2021, 18:30 – 19:30 (SGT)

2020 was a year that became a wake-up call for digital innovators to improve their financial technology to serve customers globally.

In this panel discussion, Bjorn Lindfors, partner at Antler, Gavin Tan, CEO and co-founder of Brick, and Surendra Chaplot, head of product for cards at Wise, will discuss the most recent trends in fintech, covering digital banking, neobanking, blockchain, autonomous finance and more.

Fintech Fireside Asia Ep #8: Bootstrapping the World’s Best Crypto Aggregator ft. TM Lee, Co-Founder CoinGecko

May 25, 2021, 11:00 (SGT)

In the eighth episode of Fintech Fireside Asia, Vincent Fong of the Fintech News Network will speak to CoinGecko’s co-founder TM Lee about their journey in bootstrapping one of the world’s biggest crypto aggregators out of Kuala Lumpur.

With over 10 million users relying on them for the latest crypto insights, this episode will cover all things crypto.

Register here: https://bit.ly/3tr4QrI

Digital Finance Series: Cashless – China’s Digital Currency Revolution

May 21, 2021, 21:00 – 22:00 (SGT)

In this live session, participants will get to hear from Rich Turrin, author of Cashless – China’s Digital Currency Revolution, the first and only book that dives deep into the design and use of China’s new central bank digital currency.

China is changing the very nature of money and it is borrowing heavily from cryptocurrency to cement its role as the world’s financial technology leader. The Chinese example could represent a roadmap for how digital currencies will evolve across the globe and how they could offer a long-term threat to US dollar dominance.

Turrin, an international best-selling author and an award-winning executive with more than 20 years of experience in fintech innovation, spent the past decade in Shanghai where he experienced China going “cashless” first hand. A former banker and senior executive at IBM, he now focuses on writing and helping Western companies navigate China’s fast-paced tech marketplace.

He also provides commentary on China’s fintech marketplace to international media including print and TV. He has made appearances on the Wall Street Journal, South China Morning Post and CGTV’s Global Business.

Move Fast and Make Things: Big ideas, funds and confidence power Indonesia’s digital economy

May 19, 2021, 15:00 (SGT)

In this webinar organized by DealstreetAsia.com in partnership with Alpha JWC Ventures, Jefrey Joe (Alpha JWC Ventures), Dr Chatib Basri (former finance minister of Indonesia), Anderson Sumarli (Ajaib), JJ Ang (GudangAda), and Sreejita Deb (Raena) will discuss how Indonesian startups rewrote their recovery script through the pandemic and more.

The Australian Fintech Market

May 18, 2021, 15:00 – 16:00 (SGT)

In this panel discussion, experts representing KPMG, ASIC Innovation Hub and Fintech Aus will draw out key market information and insights critical for fintech companies considering expanding to Australia. Topics covered will include CDR, fintech industry trends, opportunities and regulation.

Participants will also hear from Swoop, a startup from the UK which has successfully established a presence in Australia, what attracted them to the market and how they have continued to grow their business.

Recent fintech fundraising and exit deals – assessing trends and opportunities

May 18, 2021, 10:00 – 11:00 (SGT)

In this session, experts from global law firm DLA Piper will give an overview of the Australian and international market trends in fundraising, and discuss the opportunities this offers fintech businesses.

For the past three years now, the DLA Piper team has been one of the most active legal advisors on tech transactions in Australia and New Zealand, averaging between 70-80 tech deals a year.

These deals include Series A and Series B raises (including flips to the US and growth equity fund transactions), tech listings on ASX, buy-side and sell-side tech merger and acquisition (M&A) deals and corporate venture capital transactions.

Australia’s Consumer Data Right and Market Opportunities for Singapore Fintech

May 06, 2021, 11:00 – 12:00 (SGT)

With the passing of the Consumer Data Right (CDR) Bill in August 2019, an open data economy has been introduced in Australia. CDR is a game changer and will give consumers greater control of their data and will encourage Accredited Data Recipient to build amazing innovative products for consumers.

Organized by the Australia Trade and Investment Commission in partnership with AustCham Singapore, this webinar will allow participants to understand the CDR regime, the benefits of becoming an Accredited Data Recipient, the commercial opportunities and use cases from current industry players, as well as the wider Australian fintech landscape and business opportunities.

Register now at Business Opportunities in Australia

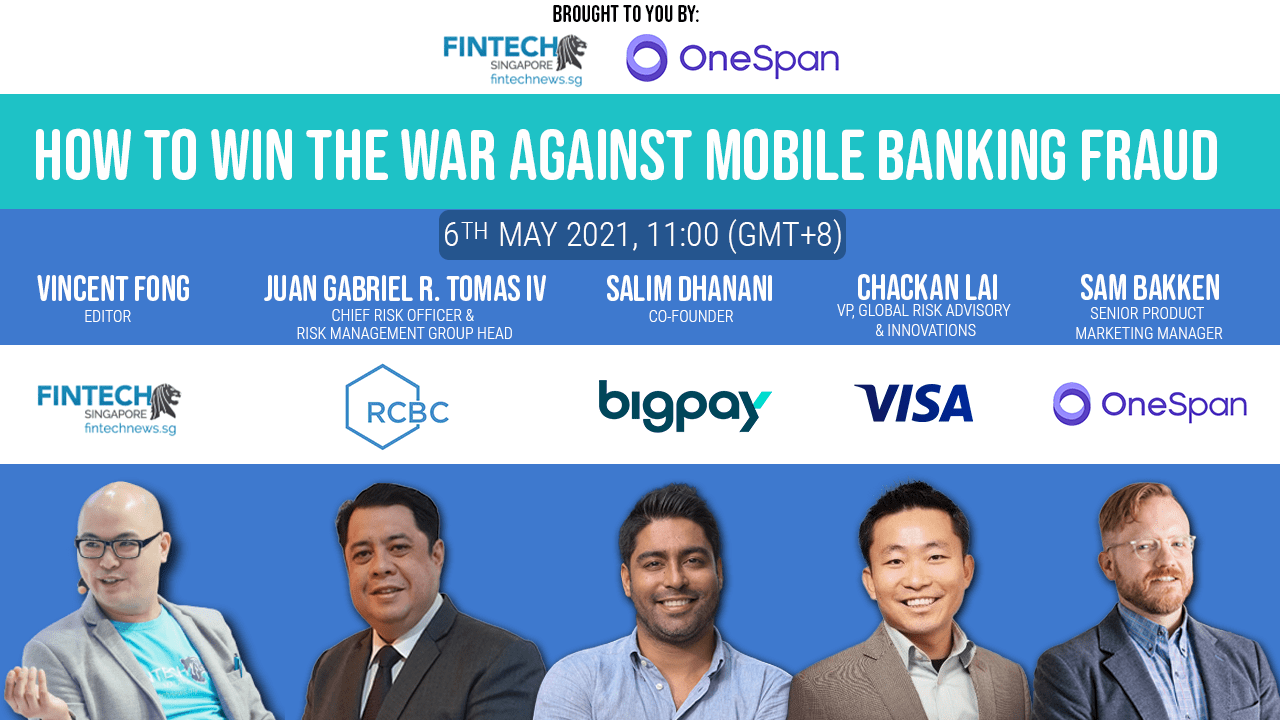

How to Win The War Against Mobile Banking Fraud

May 06, 2021, 11:00 (SGT)

As mobile banking use surges worldwide in response to COVID-19 and its associated lockdowns, a corresponding rise in mobile banking fraud continues to increase in prevalence and sophistication. As fraudsters hone their craft, how can financial institutions keep and protect its users?

In this webinar, experts from RCBC, BigPay, Visa and OneSpan, will explore approaches and strategies to eliminate the impact of increasingly sophisticated fraud threats. Topics covered will include the evolving mobile banking fraud landscape, using the latest technologies to prevent fraud, and industry best practices in user protection.

Confirmed speakers:

- Juan Gabriel R. Tomas IV, Chief Risk Officer and Risk Management Group Head at Rizal Commercial Banking Corporation (RCBC), Philippines

- Salim Dhanani, Co-Founder, BigPay, Malaysia

- Chackan Lai, VP, Global Risk Advisory and Innovations at Visa, USA

- Sam Bakken, Senior Product Marketing Manager, OneSpan, USA

Register here: https://bit.ly/3nqhTbr

CX for Financial Services Asia Virtual

May 06, 2021, 10:00 – 13:00 (SGT)

For financial services, digital transformation and disruptive innovation have gone from being vague futuristic concepts to immediate-term action items on senior leaders’ strategic agendas.

The pandemic, competitive threats, ongoing cost pressures, aging technology, increasing regulatory requirements and generally financial performance are among the forces that demand significant change and entirely new business models.

CX for Financial Services Asia Virtual will bring together customer experience professionals from banks, insurance, asset management to share best practices in transforming customer experience with new technologies.

Insurance Asia Digital Conference 2021

May 06, 2021, 10:00 – 12:00 (SGT)

On May 6, the Insurance Asia Digital Conference 2021 will take place virtually, welcoming senior executives from top insurance companies, subject-matter experts from the top consultancy firms, as well as business leaders from Asia’s insurance industry to discuss the latest insurance industry news in Asia and the hottest trends.

The two-hour digital conference aims to delve into the most pertinent issues, as well as the future of insurance in 2021. Participants will gain firsthand insights from notable speakers including Walter de Oude, deputy chairman of Aviva Singlife, and Dr. John Burton Morley, partner, insurance consulting, of EY.

Cryptobuzz Singapore 2021

May 04, 2021, 19:30 – 21:00 (SGT)

At Cryptobuzz Singapore 2021, participants will hear from expert speakers and panelists from companies and organizations such as Xfers, Coinhako, Tezos, and the Singapore Cryptocurrency and Blockchain Industry Association (ACCESS), who will be sharing their valuable insights on the latest trends and developments in the blockchain and crypto space happening now in 2021 and beyond.

Veteran traders will also be sharing macro price trends for bitcoin and how investors can gain tactical exposure to the exciting growth in the blockchain sector.

BlackRock x StashAway: The Evolution of the Wealth Management Industry

May 04, 2021, 19:00 – 21:00 SGT

On May 04, experts from BlackRock and StashAway will discuss the evolution of the wealth management industry and dive into ETFs.

Participants will hear from Michele Ferrario, CEO and co-founder of StashAway, Stephanie Leung, head of StashAway Hong Kong as they discuss the future of wealth management with Georgina Mitchell, vice president of iShares Asia ex-Japan Wealth Distribution, the family of ETFs managed by BlackRock, the world’s largest asset manager managing US$6.3 trillion.

Unlock Fintech with AI, Blockchain, Bitcoin and NFTs

May 04, 2021, 19:00 – 20:00 (SGT)

The financial market is shifting rapidly and creating exciting developments in the world. Fintech, artificial intelligence (AI) and blockchain are the latest buzzwords in the industry. These are trending topics that few people fully understand or know how to leverage. The tokenisation of non-fungible assets and crypto-currencies has created endless possibilities for blockchain asset digitization.

In this webinar, Henrique Centieiro, project manager of innovation at HSBC, will discuss:

- The challenges and opportunities in the fintech world;

- AI technology advancements in fintech;

- How does blockchain work?;

- Non-fungible tokens (NFTs);

- Cryptocurrencies;

- Cloud and data analytics;

- How cloud enables fast growth in fintech;

- The best cybersecurity practices in fintech; and more.

Centieiro is a best-selling author with more than 10 years of experience with cryptocurrencies and over four years of teaching experience at the HKU School of Professional and Continuing Education (HKU SPACE) in Hong Kong on fintech and blockchain.

MoneyLIVE APAC: The Digital Sessions – The future of digital banking in Indonesia

May 04, 2021, 13:00 (WIB)

On May 04, MoneyLIVE APAC: The Digital Sessions will hold its fifth live session ‘The future of digital banking in Indonesia’.

Users can also sign up to watch the recordings of the first four sessions – ‘Beyond banking – new models for success’, ‘The next stage of digital banking transformation in Asia’, ‘A new chapter in the evolution of payments’ and ‘Is 2021 the year of the digital bank in Asia?’.

Expert speakers include:

- Tjandra Gunawan, Chief Executive Officer, Bank Neo Commerce;

- Vishal Tulsian, President Director, Chief Executive Officer, Amar Bank;

- Numan Rayadi, Head of Digital Banking, BTN

- Andreas Kurniawan, Executive Vice President, Bank Danamon; and

- Adrian Gunadi, Co-Founder and Chief Executive Officer, Investree.

Sign up here for free: https://bit.ly/39Jpz3y