The wealthtech sector in India has been experiencing robust growth, thanks to the growing digital adoption and increasing investor interest in the segment. The wealthtech sector in India has over 300 startups focusing on robo-advisory, personal finance management, online brokerages, investment platforms, among other use-cases.

The fintech market in India is growing at an unprecedented rate, making India one of the fastest-growing fintech markets, ahead of the US. This includes a particularly significant growth of the wealthtech sector in India. Moreover, the internet penetration in India, fuelled by the pandemic, has soared by 8.2% since last year alone, leading to increased digital adoption. Additionally, increasing disposable incomes has also kindled a need for wealthtech solutions. These factors, along with increased investor participation in the wealthtech sector from Tier-II cities in India, is propelling the segment forward by leaps and bounds.

According to a recent report by Redseer, the Indian wealthtech market is expected to more than triple in value from around US$20 billion in 2020 to about US$63 billion by 2025. The report also pointed out the huge market potential for the wealthtech sector in the world’s largest democracy where only 2% of the population invests in stocks, compared to 55% in the US.

While the wealthtech sector is poised to grow, here’s a look at the major players in the market.

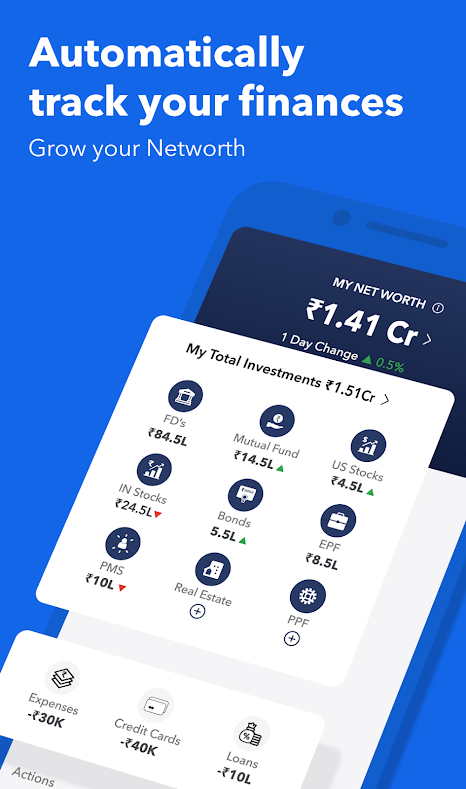

1. INDWealth

Launched in 2019, INDWealth enables customers to track, save and grow their money. The company’s SuperMoneyApp automatically organises a user’s money and suggests actions to grow savings and earnings across investments, loans, expenses and taxes. Its private wealth management offering INDWealth, on the other hand, focuses on providing services to private family offices, analysts, tax services, succession planning and trust services.

INDWealth’s platform allows users to maintain a structured record of their finances, covering aspects from loans, taxes and expenses to investment. The machine-learning algorithm then enables users to improve cash flows and reach financial goals accordingly.

The startup’s parent company, Finzoom Investment advisors, is registered as an investment advisor under the Securities and Exchange Board of India (SEBI). The company has bagged over US$58 million to date. Its investor base includes Tiger Global, Steadview Capital and Dragoneer.

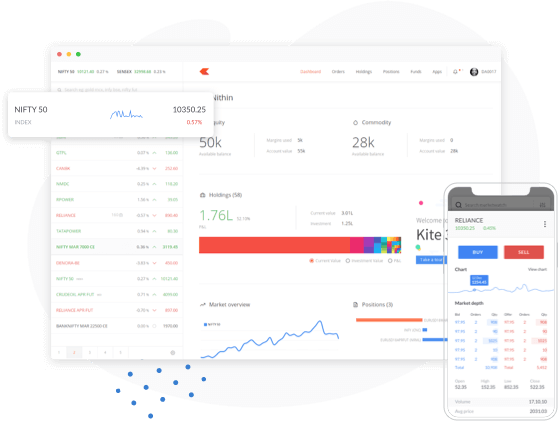

2. Zerodha

Zerodha is one of the first discount brokers in India and claims to be one of the largest stock brokers in India. Zerodha has over 5 million clients that contribute to over 15% of all retail order volumes in India daily by trading and investing in a myriad of products. Zerodha users can invest in futures and options, commodity and currency derivatives, stocks and IPOs, direct mutual funds as well as bonds and government securities.

The firm allows users to trade free of cost in case of interday trades. Tt charges a nominal 0.03% of the trade or US$0.27 (INR 20), whichever is lower, for intraday trading of equity, currency, and commodity. It may be interesting to note that the startup, which has gained profitability, has been bootstrapped from its inception. The company’s revenue grew 11% to over US$127 million in FY2020 compared to the previous year. The startup is self-valued at US$1 billion.

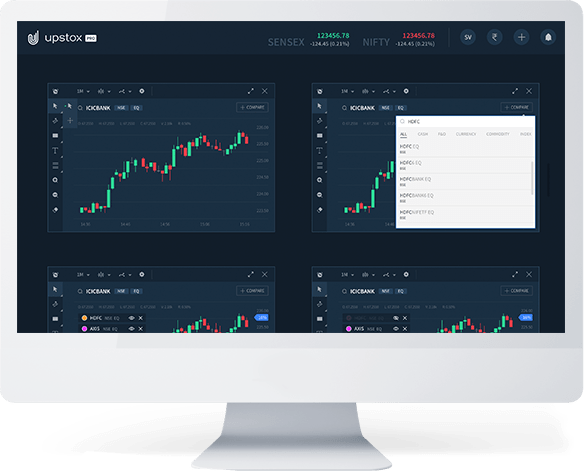

3. Upstox

Backed by Ratan Tata and Tiger Global, Upstox operates a desktop and mobile trading app with similar pricing as Zerodha. Founded in 2009, Upstox is registered under SEBI. Upstox allows its users to invest in stocks, commodities, digital gold, futures and options, mutual funds, IPOs and new fund offers (NFOs). Upstox has raised a total of US$29 million to date.

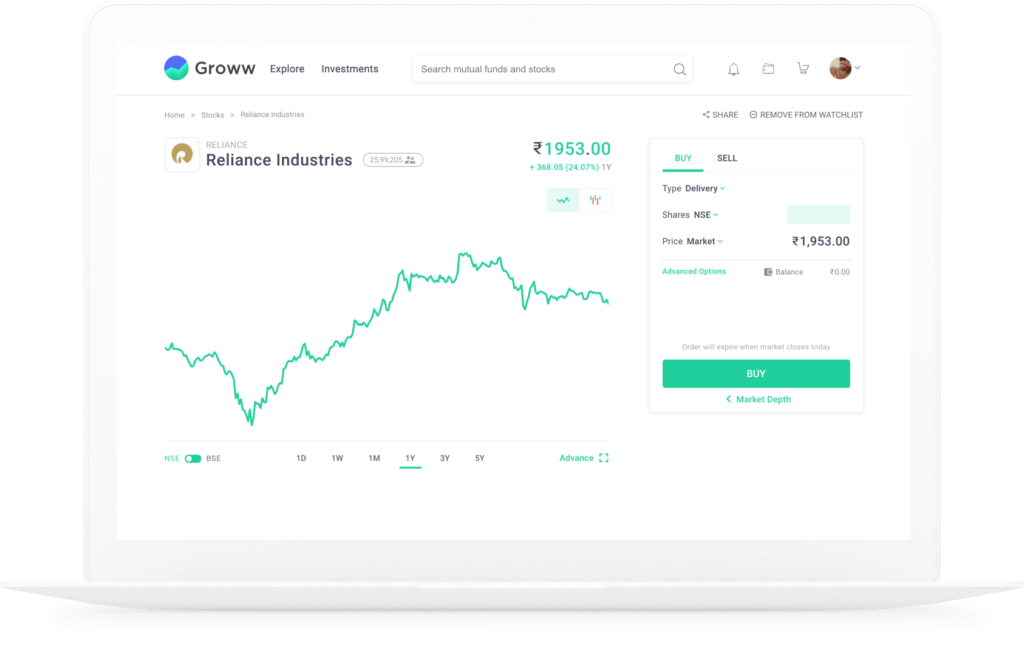

4. Groww

Like Zerodha and Upstox, Groww is an online investment platform in India. However, the chief difference in Groww’s offering is that it allows users to invest in US stocks, that were previously unavailable in the Indian market, in addition to other investment options offered by similar platforms.

Groww claims to have over 10 million customers. Founded in 2017, the startup has raised over US$142 million to date. It counts Y Combinator, Sequoia Capital India, Ribbit Capital and other established names among its investors.

5. Kuvera

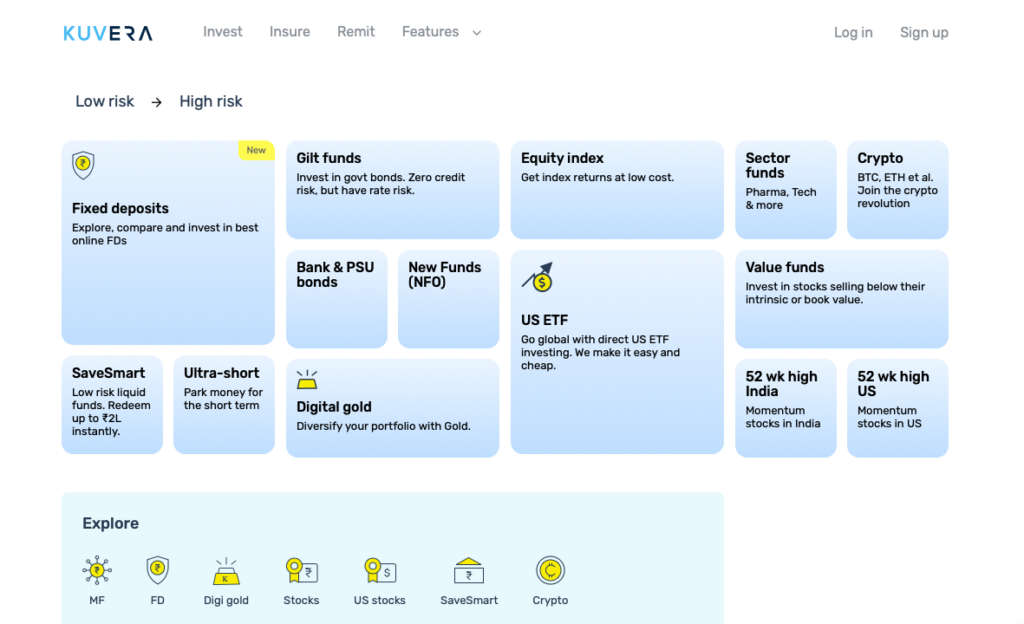

Robo-advisory players have rapidly gained prominence in India over the last few years. Assets under management (AUM) in the robo-advisory segment of the wealthtech sector in India has also been steadily growing, from about US$1.6 billion in 2017 to around US$8.8 billion in 2020. Founded in 2013, Kuvera has established a strong foothold for its fund-based robo-advisory services. The firm has AUM of approximately US$1.97 billion, making up a huge share of the market.

The company also enables users to easily invest in direct mutual funds and has diversified to offer investment in domestic and US stocks, cryptocurrencies, fixed deposits and gold. The firm has over 1.1 million investors on its platform. Kuvera prides itself on not pushing sales, but rather, providing valuable investment guidance and advice to investors. Moreover, the startup allows users to import external transactions, enabling them to keep track of all their investments in one place.

6. Scripbox

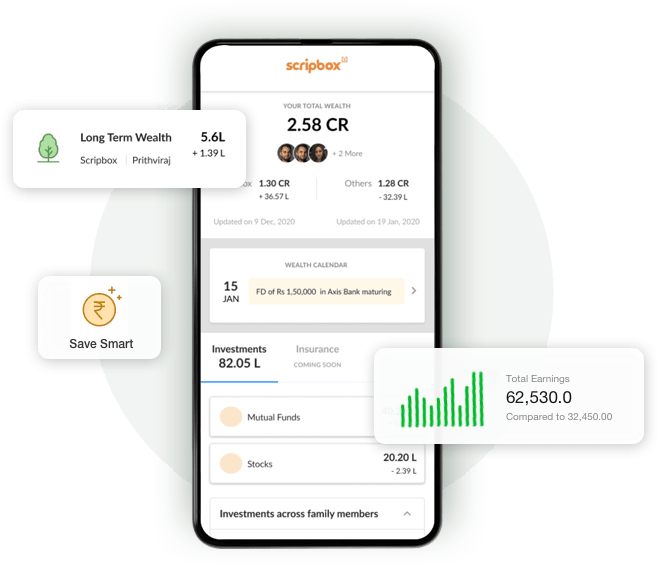

Like Kuvera, Scripbox is a dominant robo-advisor in the wealthtech segment in India. Founded in 2012, Scripbox allows its customers to invest in equity, debt, and tax-saving mutual funds. Additionally, the firm claims to use science and proprietary algorithms for portfolio management. Scripbox has over 4,500 customers who are millionaires and manages over US$450 million in investments. The company has raised over US$23 million from investors including Omidyar Network, Accel, Axcel Partners, NuVentures, among others.

7. ETMoney

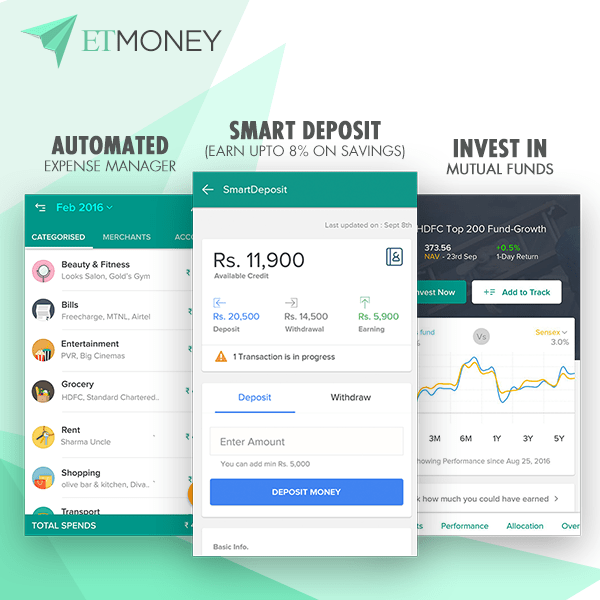

ETMoney is an online investment platform and a prominent wealthtech player in India. Founded in 2015, ETMoney offers a range of investment options in credit cards and loans, insurance, and financial tools. The company claims to be one of the fastest-growing fintech startups in the country. Over the last two years, ETMoney’s userbase has grown five times, while its transaction volume has seen 11x growth.

8. WealthDesk

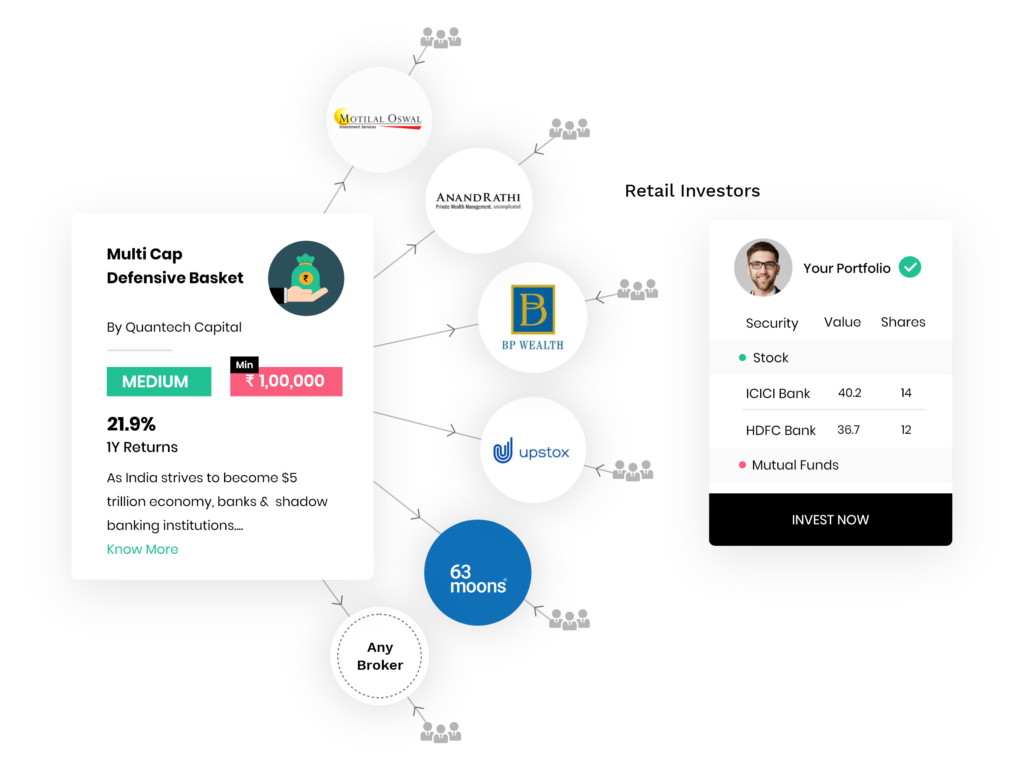

WealthDesk is an investment management and technology platform that manages the entire asset management and advisory value chain from portfolio creation to transforming those into investment products called WealthBaskets. Founded in 2016, WealthDesk operates in the B2B2C segment of wealthtech in India. It offers a Software-as-a-Service (SaaS) platform for businesses and multiple consumer-focused SaaS platforms (B2C) for brokers and advisors. It recently raised US$3.2 million in a seed funding round.

9. Cube Wealth

Cube Wealth was launched in 2018 by fintech veteran Satyen Kothari. He had previously established Citrus Pay, which got acquired by PayU in 2016. Cube Wealth is a digital wealth management platform that provides busy professionals with investment options on its app along with investment advice from experts. The app also helps investors create an investment portfolio with assistance from dedicated wealth advisors. On the Cube Wealth app, users can invest in domestic and US equities, mutual funds, gold and even charitable ventures for a well-diversified portfolio. Investors can also avail themselves of P2P lending and co-investment options.

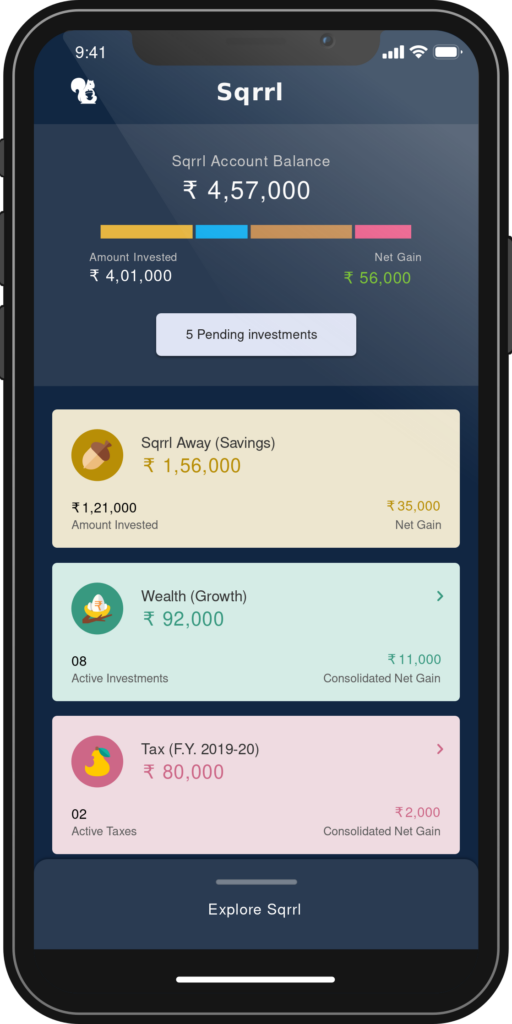

10. Sqrrl

Established in 2017, Sqrrl is a digital investment management platform focused solely on mutual funds. Sqrrl has cemented its position in the market by targeting the young generations – GenZ and millennials. Sqrrl enables users to automatically save money from as little as roughly US$ 1.38 (INR100), or every time they spend. The firm also helps users save for specific goals.

Moreover, Sqrrl helps users identify tax-saving investment options, one-time investment schemes, or set up monthly systematic investment plans (SIPs). The platform also offers personal loan options to users. The company is registered under SEBI and the Association of Mutual Funds in India.

While the list contains some of the most prominent wealthtech players in India, it is not exhaustive. As the wealthtech space in India grows more and more crowded, it is likely that more startups will gain market share. Some other wealthtech startups not featured on the list but that also enjoy considerable popularity include screener, Trendyline, 5paisa, MarketsMojo, to name a few.