How Are SMEs in Singapore Supported on Their Digital Transformation Journey?

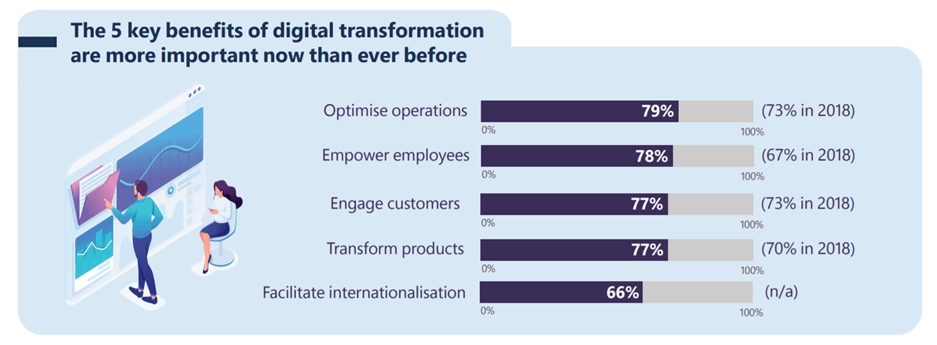

by Fintech News Singapore August 16, 2021The onset of the pandemic has highlighted the importance for companies to embrace a digital transformation process for their businesses to stay resilient. Digital transformation can be advantageous when it comes to optimising operations, transforming products, and empowering employees.

The UOB SME Outlook 2021 Study revealed that 40 per cent of SMEs that implemented digitalisation initiatives in 2020 reported stronger revenue growth. The survey, which was conducted with 782 local SMEs that have revenue of less than S$100 million, also showed that businesses that have digitalised their entire business, or more than one area of their business outperformed businesses that only digitalised a single area.

However, although 83 per cent of small and medium enterprises (SMEs) in Singapore now have digital transformation strategies in place, 54 per cent experienced delays in implementing their plans due to the pandemic, the 2020 SME Digital Transformation Study by Microsoft Singapore and the Association of Small and Medium Enterprises (ASME) reported. This delay can be attributed to the fact that the main priority for the businesses was to survive the pandemic, amidst rising costs and decreasing revenue.

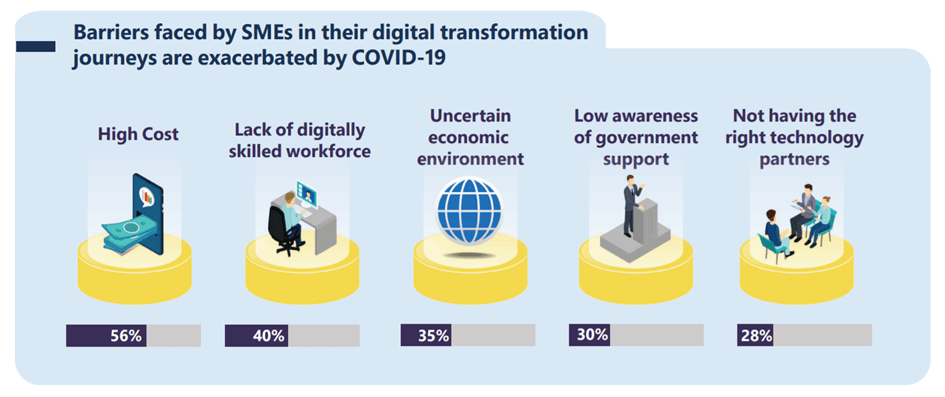

The study, which involved 400 business owners and key information technology (IT) decision-makers of Singapore SMEs from across 15 industries from March to June 2020, also showed that high implementation cost were the top challenge for these businesses. Other barriers include the lack of a digitally skilled workforce, uncertain economic environments, the lack of appropriate technology partners, and low awareness of government support.

However, despite this low level of awareness, more than 60% of SMEs are keen to leverage the various grants and schemes provided by the government. Therefore, this article will shed light on the existing initiatives to support Singaporean SMEs on their digital transformation journey, both from the Singaporean government and other organisations.

SMEs recognise these five key benefits of adopting digital transformation. Source: ASME-Microsoft SME Digital Transformation Study

Top barriers that SMEs face in their digital transformation journeys. Source: ASME-Microsoft SME Digital Transformation Study

Government Initiative: SMEs Go Digital Programme

In April 2017, the Infocomm Media Development Authority (IMDA) launched the SMEs Go Digital programme to help SMEs in their digital transformation journey. Under this programme, various supports are available for SMEs such as the Industry Digital Plans, Pre-Approved Solutions, Start Digital Pack, Grow Digital, Advanced Digital Solutions, and Consultancy Services.

Industry Digital Plans

Through the Industry Digital Plans (IDPs), SMEs will be supported by a step-by-step guide on digital solutions to use at each stage of growth, and related training programmes to improve their employees’ digital skills. Suitable for SMEs at any stage of growth, each SME will first need to take a self-test to ascertain how digital-ready the business is and identify opportunities to increase productivity. IMDA has developed IDPs for various sectors such as accountancy, food services, media, retail, and security.

Pre-Approved Solutions and Productivity Solutions Grant

IMDA provides a list of pre-approved solutions that have been assessed to be market-proven and cost-effective to help SMEs implement digital solutions that have been recommended in the IDPs. Furthermore, SMEs can apply for the Productivity Solutions Grant (PSG) for financial support in adopting these solutions. The maximum funding support level has been increased from 70% to 80% from 1 April 2020 to 31 March 2022. The PSG covers sector-specific solutions such as retail, food, and logistics and businesses may choose from a list of pre-scoped solutions eligible to their sectors.

Start Digital Pack

The Start Digital initiative was launched by IMDA together with Enterprise Singapore (ESG) in January 2019. Targeting newly incorporated SMEs and SMEs that are new to digital solutions, these businesses can choose their Start Digital Packs from categories such as accounting, digital collaboration, cybersecurity, human resource management system (HRMS) & payroll, digital marketing, and digital transactions. SMEs can sign up for these Start Digital Packs through bank and telco partners such as DBS, M1, Maybank, OCBC, Singtel, and UOB. More than 30,000 SMEs have adopted these Smart Digital Packs from 2019 to 2020.

Grow Digital

Under the Grow Digital initiative, SMEs who want to tap into overseas markets can participate in Business-to-Business (B2B) and Business-to-Consumer (B2C) e-commerce platforms. Through this, SMEs can benefit from optimised listings on overseas e-marketplaces and have prompt access to financing offers facilitated via these platforms. Eligible SMEs can receive up to 70% funding support to participate in the platforms under the Grow Digital initiative. Adoption of these platforms does not count toward the PSG funding utilisation which is capped at a maximum of S$30,000 per SME per year.

Advanced Digital Solutions

These solutions aim to address common enterprise-level challenges at scale and further assist enterprises in implementing cutting-edge technologies to transact more seamlessly within or across sectors. However, each solution has its application period, which businesses must take note of. Eligible enterprises may apply to receive up to 80% funding support to cover the qualifying costs of digital solutions, including the cost of deploying these solutions.

Consultancy Services (SME Digital Tech Hub)

The SME Digital Tech Hub was established by IMDA and operated by ASME to provide digital advisory to SMEs in specialised areas such as data analytics and cybersecurity. It also helps to connect SMEs to information and communication technologies (ICT) vendors and consultants in addition to enhancing the digital capabilities of SMEs through workshops and seminars.

InvoiceNow

InvoiceNow is a nationwide E-invoicing method that enables direct transmission of invoices in a structured digital format from one financial system to another. This will help both SMEs and large enterprises to enjoy a smoother invoicing system with faster payments. InvoiceNow uses the Nationwide E-delivery network which is based on Peppol.

Chief Technology Officer as a Service (CTOaaS)

For SMEs requiring in-depth digital advisory services, the Chief Technology Officer, or CTO as a Service (CTOaaS) is an upcoming initiative that will give SMEs access to CTO-equivalents or digital consultants to assist them. After an initial self-assessment, the SME will be assigned to a digital consultant to help them identify their digital needs, select appropriate digital solutions, and project manage the solution implementation. SMEs can access these professional CTO services at no cost or at an affordable rate.

Other Government Initiatives

Apart from the SMEs Go Digital programme, there are also other initiatives that have been launched by the government of Singapore covering the areas of financing, talent development, and systems.

Financial Assistance: The 100% Investment Allowance Scheme

The 100% Investment Allowance scheme can help businesses with the cost of large-scale deployment of automation solutions. This scheme, which has been extended until 31 March 2023, is capped at S$10million per project (qualifying equipment costs net of grant).

Developing Talent: The Digital Leaders Programme

For enterprises who are keen to digitally transform their business models or strategies, the Digital Leaders Programme (DLP) will provide support for companies to build in-house digital capabilities. The programme aims to develop local leaders who can compete regionally and globally. Among the benefits for successful DLP applicants include funding support to hire a core digital team consisting of a Chief Technology Officer/Chief Digital Officer or equivalent, as well as a team of up to five digital talents.

The Utilisation of Data: The Better Data Driven Business (BDDB) Programme

The Better Data Driven Business (BDDB) programme aims to help SMEs better protect their customers’ data and expand their business by effectively using data. There are two types of SMEs that can benefit from BDDB, which are SMEs that are only starting to learn in using data for gathering insights, and SMEs who want to apply and share data for more complex purposes.

Enhancement to the Open Innovation Platform

The Open Innovation Platform is a virtual crowd-sourcing platform to support businesses in getting resources to meet their innovation needs. There are two new features to the platform, which are:

- Discovery Engine: Facilitates search and matching of technology solutions through automated recommendations.

- Digital Bench: Provides quick proof-of-concept (POC) testing through a virtual POC platform.

Initiatives by Other Organisations

In addition to the initiatives by the Singaporean government, there are also non-government initiatives such as the SME Digital Reboot Programme which aims to assist 500 SMEs to digitally transform their businesses by the end of 2022. It is a collaborative effort between National Trades Union Congress (NTUC) training arm LearningHub (NTUC LHub), NTUC’s U SME, The FinLab (UOB’s innovation accelerator) and Ngee Ann Polytechnic. The SMEs will be identified by NTUC’s U SME network and The FinLab will provide necessary resources to assist these businesses in drawing up a digitalisation plan. Ngee Ann Polytechnic and NTUC LHub will provide training in workflow automation, digital marketing and digital communication and collaboration.

Apart from the above, to encourage cloud adoption among SMEs, SMECEN, a wholly-owned subsidiary of ASME, developed DashBod, a cloud-based integrated software solution to help businesses streamline their accounting and human resources processes. Through this, businesses can use valuable time and resources on their core businesses, instead of being burdened by administrative matters.

Featured image credit: Photo by Jason Rost on Unsplash