Regulatory Tailwinds: A Look Into Indonesia’s New Digital Banking Framework

by Tun Yong Yap August 31, 2021When Bank Indonesia released a new set of regulations for commercial banks last week, attention turned towards the long-awaited digital banking guidelines which were released alongside it. Indonesia joined its regional counterparts Singapore, Malaysia and the Philippines in issuing these guidelines as regulators warm to the prospect of digital-only banks.

The regulations unveiled will take effect at the end of October and set out requirements for digital banks, ranging from data protection for customers to employing executives versed in technology.

On the capital front, digital banks are required to maintain a minimum paid-up capital of IDR 10 trillion (US$ 694 million). However, a special regulation allows applicants to have a capital deposit of only IDR 3 trillion (US$208 million).

Foreign and local players

Meanwhile, foreign ownership rules have been eased, allowing for foreign entities to hold as much as 99 per cent stake in local banks. This move would be welcomed by foreign companies looking to seize the lucrative opportunity to provide digital banking in the world’s fourth most populous country.

Currently, Sea Group headlines the group of foreign investors after fully acquiring Bank BKE and naming it SeaBank. Meanwhile, Tencent and Google are investors in Go-Jek, which hold a 22 per cent stake in Bank Jago.

Besides foreign companies, local financial institutions also want in on this lucrative pie. BCA Digital, the digital arm of the country’s largest private lender Bank Central Asia, launched a mobile banking application last month.

Fintech unicorn Kredivo, part of FinAccel Group which announced its plans to list via a SPAC in the US, acquired a 24 per cent stake in publicly listed Bank Bisnis Indonesia as part of its plan to launch a digital bank called Lime.

It is easy to see why there is such great interest in Indonesian digital banks. With over 66 per cent of the population unbanked, there are over 180 million Indonesians without a bank account. However, Indonesians are digitally savvy and the country boasts an internet penetration rate of 71 per cent.

In 2020 alone, 27 million Indonesians came online, representing a 16 per cent increase from the year prior. Hence, there is a large addressable market ripe for digital banks to capture.

Demographic tailwinds

Furthermore, Southeast Asia’s most populous nation has half of its population aged 30 or younger. According to BCG, the middle and affluent class is also expected to grow 1.3x from 2019 to 2024.

Indonesians also demonstrate a growing appetite for digital financial services solutions, with digital transactions expanding 30 per cent to 50 per cent per annum between 2015 and 2018. As of the end of 2019, Indonesia boasted the second-highest e-payment penetration in Southeast Asia, next to Singapore.

Besides the opportunity presented by the high unbanked population, tech companies, particularly those with large ecosystems, recognise digital banking presents a lucrative revenue opportunity. In Go-Jek’s case, the combined GoTo ecosystem provides Bank Jago with a ready pipeline of 100 million monthly active users – constituting 37 per cent of the Indonesian population.

Besides significantly lowering customer acquisition costs, the GoTo ecosystem is also home to mountains of personal data which can be used to power credit scoring and to discover upcoming consumer trends.

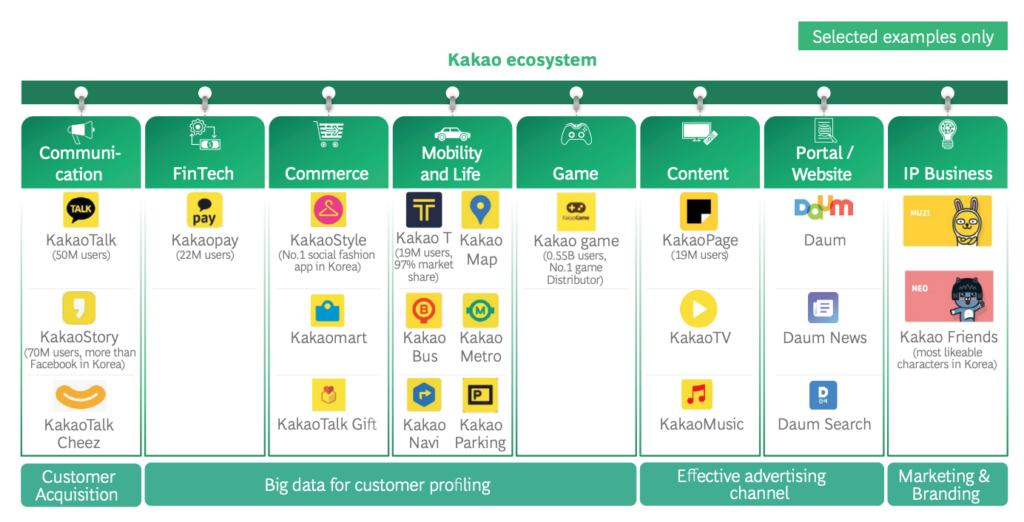

Hence, it is no surprise that the majority of profitable digital banks have large ecosystems to support their growth. China’s WeBank leverages the Tencent ecosystem while South Korea’s KakaoBank gained over 13 million customers within two years of its launch, supported by the Kakao platform.

The Kakao ecosystem (Image Credit: BCG)

Matter of execution

While digital banking guidelines have been released, obtaining a license is only the first step. Building out a digital bank is a mammoth task that requires a team with the necessary experience and a robust national digital infrastructure to support it.

Given digital banks have been envisioned to increase financial inclusion within Indonesia by enabling more people to access financial services, the government needs to ensure internet connectivity is equally distributed across the archipelago to give underserved portions of the population a chance to access digital banking services.

Only then, can digital banking flourish and leave a social impact beyond revenue figures on a balance sheet.

Featured image credit: Unsplash