Tag "Kredivo"

Mizuho Leads Kredivo Holdings’ US$270 Million Series D Fundraise

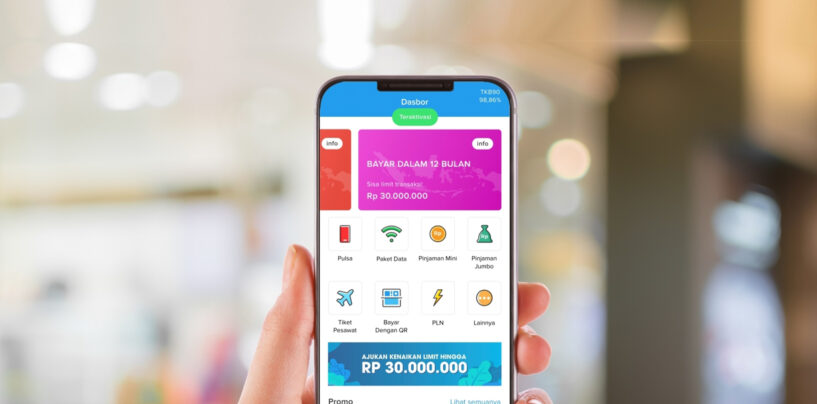

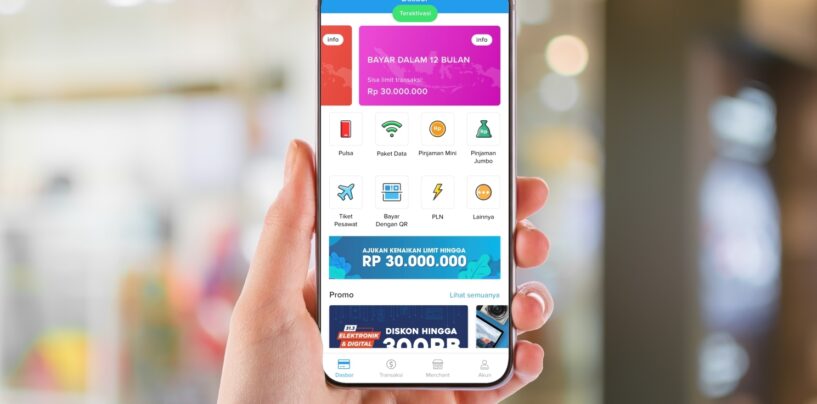

Kredivo Holdings, the parent company of Kredivo and Krom Bank Indonesia formerly known as FinAccel, announced the close of its US$270 million Series D fundraise led by Japanese global bank Mizuho Bank. The oversubscribed round was joined by Kredivo’s existing

Read MoreFinAccel Scraps SPAC Merger Deal With Victoria Park

FinAccel, the parent company of Indonesian Buy Now, Pay Later (BNPL) platform Kredivo, has scrapped its plans to merge with VPC Impact Acquisition Holdings II (VPCB), a publicly traded special purpose acquisition company sponsored by Victory Park Capital (VPC). Unfavorable

Read MoreFinAccel Raises Additional US$125 Million PIPE Investment Ahead of IPO Plans

FinAccel, the parent company of Buy Now, Pay Later (BNPL) platform Kredivo, announced that three of its existing investors has joined its PIPE deal which is in excess of US$125 million. The investors in the PIPE deal are MDI Ventures,

Read MoreRegulatory Tailwinds: A Look Into Indonesia’s New Digital Banking Framework

When Bank Indonesia released a new set of regulations for commercial banks last week, attention turned towards the long-awaited digital banking guidelines which were released alongside it. Indonesia joined its regional counterparts Singapore, Malaysia and the Philippines in issuing these

Read MoreIndonesian BNPL Kredivo Begins SE Asian Expansion Plans with Vietnamese Launch

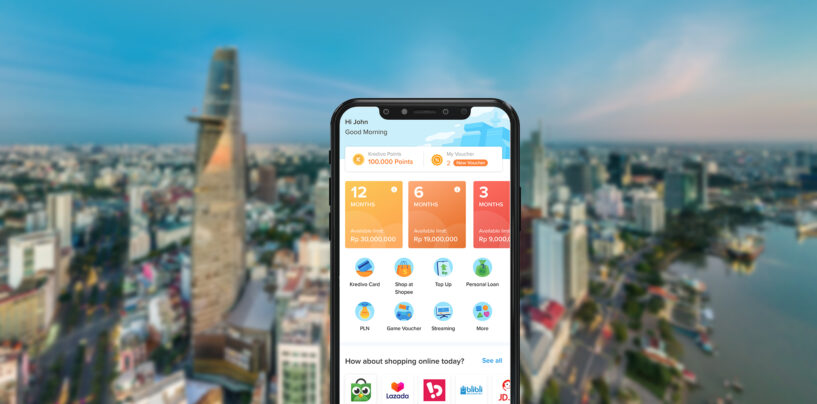

Kredivo, an Indonesian Buy Now, Pay Later (BNPL) platform, announced its expansion into Vietnam through a joint venture with Phoenix Holding, a family investment company based in the country. This move comes on the heels of the announcement by FinAccel,

Read MoreIndonesian BNPL Platform Kredivo Poised for an IPO Through US$2.5 Billion SPAC Deal

FinAccel, the parent company of Buy Now, Pay Later (BNPL) platform Kredivo, plans to go public through a special purpose acquisition company VPC Impact Acquisition Holdings II (VPCB) sponsored by Victory Park Capital (VPC), valuing it at US$2.5 billion. VPC,

Read MoreKredivo’s Parent FinAccel Raises US$90 Million; Doubles Down on Growth in South East Asia

Singapore-headquartered FinAccel, a fintech firm that enables Indonesian consumers to buy online and pay later under the brand Kredivo, has raised US$90 million in a Series C equity funding round to expand in Indonesia and the region. Since inception just

Read MoreKredivo Closes up to US$20m Credit Line with Partners for Growth

Jakarta-headquartered Kredivo, a digital credit platform for retail borrowers across Indonesia, and Partners for Growth V, L.P. (PFG), a venture debt firm in the U.S. and Australia, announced today the closing of a debt line of up to US$20m to

Read MoreBukalapak’s Fintech Could Outgrow its E-Commerce, Said Co-Founder

One cannot talk about startups in Indonesia without bringing up Bukalapak, arguably one of the biggest e-commerce platforms in the nation. Bukalapak has graduated from its startup roots and gained the coveted title of Indonesian unicorn. They are now in the

Read More10 Top Funded Fintech Companies in Indonesia

Indonesia’s fintech is probably one of the fastest growing tech sectors recently, thanks to the proliferation of peer-to-peer (P2P) lending. According to the Indonesian Financial Services Authority (OJK), transactions through P2P lending totaled US$951 million (Rp 13.8 trillion) in the

Read More