With 2021 behind us, fintech experts and industry participants are sharing their predictions for the year to come, looking at the trends that shaped 2021 to predict the top fintech trends in Asia in 2022

Funding activities, industry developments, public policies and consumer adoption are amongst the key forces driving the fintech sector. Delving into recent industry researches and interviews with fintech professionals, we’ve compiled a list of the top five trends that will define the fintech ecosystem in Asia in 2022.

Embracing embedded finance

With many consumers embracing a mobile-first approach, digital ecosystems have become prevalent in Asia. Today, highly integrated super apps like Grab, GoJek and Kakao offer a one-stop-shop for a range of services in China, India, Indonesia, South Korea and Singapore.

To take part in the new digital ecosystem, financial services players have started embracing embedded finance and banking-as-a-service (BaaS) platforms to become effective participants, a trend which industry observers believe will continue in 2022.

“Consumers are driving this,” Kanv Pandit, Group Managing Director, Asia Pacific, Banking Solutions at FIS, told Techwireasia in September 2021. “They want to have an integrated experience. They prefer discreet banking. Be it buy now, pay later (BNPL) or protection on products, there are now more opportunities to consume more simple payments compared to complex products. Banks and financial firms have noticed this.”

Venture capital (VCs) firms are seeing the value of modularizing banking and are pouring billions into startups in the space. Data provided to Reuters by PitchBook show that, as of October 2021, investors had injected US$4.25 billion into embedded finance startups year-to-date (YTD), almost three times the amount of 2020.

Embedded finance forecast SOURCE: LIGHTYEAR CAPITAL

In India, small and medium-sized enterprise (SME)-focused neobanking platform Open raised US$100 million in September 2021 to strengthen and accelerate its new product line, which includes an embedded finance platform Zwitch and a cloud-native banking platform BankingStack. Currently, BankingStack is deployed across 15 Indian banks, the company said.

In Singapore, business-to-business (B2B) payments platform Nium closed a US$200+ million Series D funding round in July, reaching unicorn status. Through a single API, Nium provides enterprises with access to payments infrastructure, including technologies for pay-outs, pay-ins, card issuance, and BaaS.

Data-driven personalization

Explosive growth in data creation and consumers’ openness to share their data to get personalized offers is predicted to propel the spread of personalization in Asia, McKinsey forcasts.

The International Data Corporation (IDC) expects data creation, capture and replication to triple between 2020 and 2025 in Asia.

Additionally, a 2021 Euromonitor survey found that consumers in Asia are more willing to share their personal data than their Western counterparts. In China, India, and Thailand, more than 45% of respondents said that they share their data for personalized offers and deals, compared with less than 30% in France, Germany, and the UK.

Public policy will play a big role in shaping the playing field. South Korea is preparing for the launch of the MyData project to enable licensed service providers, including both incumbent and fintech players, to collect and analyze personal data scattered across the financial sector, subject to consumers’ consent.

Similar initiatives are being launched in Singapore, notably the Singapore Financial Data Exchange (SGFinDex), a platform that allows data sharing to be conducted securely, in compliance with regulations, and with consumers’ consent.

Rise of sustainable finance

Around the world, environmental, social and governance (ESG) metrics are increasingly being integrated into business strategies, cultures and investment strategies as demand for sustainable finance and responsible investing continues to soar.

In APAC, ESG assets under management (AUM) hit US$93 billion as of the end of September 2021 with China accounting for more than two-thirds of that sum (US$49 billion), according to recent data from Morgan Stanley. About 120 new funds were launched in 2021 and over 500 sustainability funds were domiciled in APAC, as of October 2021.

APAC governments are putting sustainability as a priority and promoting ESG as part of their agendas for economic growth. Hong Kong and Singapore in particular are leading the pack.

Thriving to develop the city as a regional hub for sustainable banking and green finance, the Hong Kong Monetary Authority (HKMA) started introducing several measures in 2019, including the Greenness Baseline common framework, as well as the incorporation of ESG factors in its credit risk analysis of bond investment.

In Singapore, the Monetary Authority of Singapore (MAS) laid out plans in late 2019 to invest US$2 billion in developing the country as a green finance hub and promote sustainable financing in the financial sector. The central bank also earmarked S$50 million to support green fintech projects in Singapore. And like Hong Kong, Singapore’s stock exchange has introduced sustainability reporting guidelines for listed companies.

Booming crypto adoption

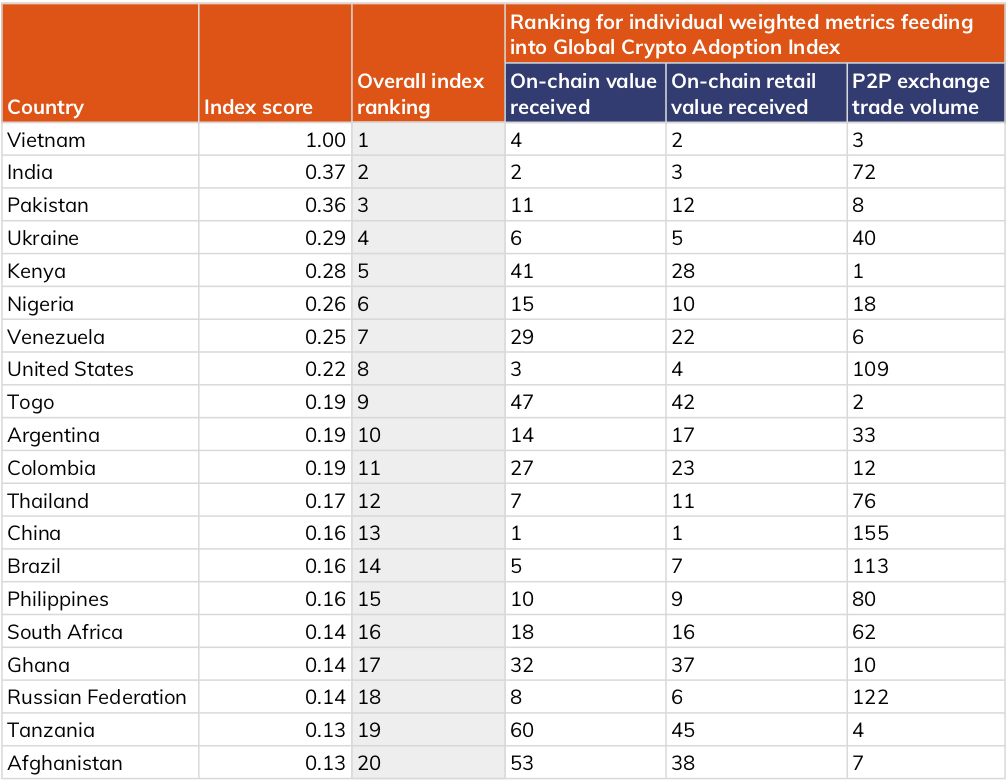

In 2021, the crypto frenzy continued sweeping through the world. According to the 2021 Chainalysis Global Crypto Adoption Index, released in October 2021, crypto adoption skyrocketed last year with emerging markets, including Vietnam, India, and Pakistan leading the pack.

The 2021 Global Crypto Adoption Index Top 20. Source: Chainalysis

In APAC, crypto transactions surged 706% in 2021 compared to 2020 in terms of raw value, the blockchain analytics firm estimates, a growth that was driven mainly by the entry of institutional investors and the adoption of decentralized finance (DeFi).

Chainalysis estimates the cryptocurrency market in the region is now worth over US$572 billion, representing 14% of the global transaction value.

Going forward, experts predict that the adoption of blockchain-powered products in Asia will become mainstream within the next few years. This will be built on robust developments in the space, where investors are remaining optimistic and continue pouring million into startups in the field. At least seven crypto unicorns were minted in APAC just last year:

- FTX, a crypto derivatives exchange originally headquartered in Hong Kong;

- Amber Group, an integrated crypto financial services firm from Hong Kong;

- Hyperchain, an enterprise blockchain and distributed ledger technology (DLT) company from China;

- Dunamu, the owner and operator of South Korea’s digital asset exchange Upbit;

- Sky Mavis, a Vietnam-based non-fungible token (NFT) game publisher;

- Bitkub, a Thai crypto exchange; and

- Matrixport, a Singapore-based crypto finance services provider.

Advancing digital payments

In 2021, governments and central banks in APAC continued to advance efforts to modernize their payment infrastructures and foster adoption of digital payments. In particular, three areas have been put into focus: real-time payment infrastructures, cross-border payment capabilities and central bank digital currencies (CBDCs).

In Japan, a consortium of firms aims to launch a yen-based digital currency in fiscal 2022 after beginning trials in late-2021. The digital currency, tentatively called DCJPY, will be backed by bank deposits and use a common platform to speed up large fund transfers and settlement among companies.

In Hong Kong, HKMA has been involved in projects looking at both retail and wholesale CBDCs. The central bank intends to come up with an initial view on issuing retail CBDC in Hong Kong by mid-2022.

And in Singapore, MAS unveiled last year more projects related to blockchain and CBDCs, including Project Orchid, which focuses on retail CBDCs, Partior, a blockchain-based interbank clearing and settlement network, and Project Dunbar, a partnership among MAS, the Bank for International Settlements (BIS)’ Innovation Hub, and other central banks around the world to use CBDCs for cross-border payments.

With BIS, MAS is also involved in Project Nexus, an initiative seeking to create a common blueprint for how countries can connect their real-time payment systems onto a single cross-border network.

Separately, MAS is pursuing its cross-border instant payments ambitions, announcing the linkage of its peer-to-peer (P2P) fund transfer service PayNow with Thailand’s PromptPay, Malaysia’s DuitNow, India’s Unified Payments Interface (UPI), and the Philippines’ real-time and QR payment systems.