Siam Commercial Bank’s VC Arm Grabs 2nd Spot in Global Fintech Investor Ranking

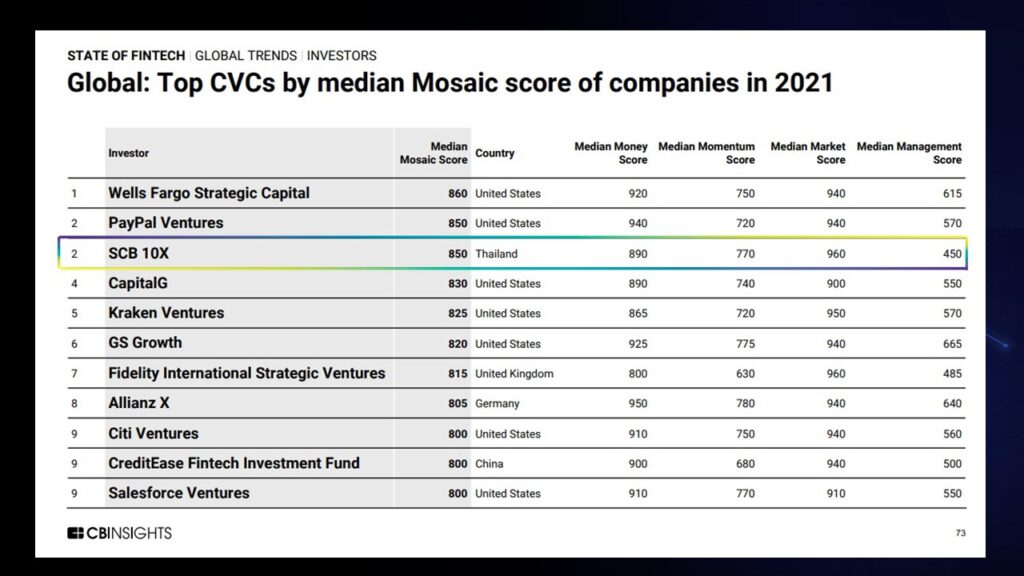

by Fintech News Singapore March 3, 2022SCB 10X, the venture arm of Siam Commercial Bank (SCB), was ranked second in Global Corporate Venture Capital (CVC) investing in fintech startups and eighth among global CVCs in a report published by CB Insights, a global analytics platform for venture capitals and startups.

The international recognition by the “CB Insights State of Fintech Global 2021” report will allow Thailand to attract new investment and innovation opportunities.

The venture arm has been actively investing in blockchain startups with its US$110 million fund that was announced last year in February.

Since then, SCB 10X has invested in decentralised finance (DeFi) asset aggregator Ape Board and New York-based digital asset custodian Fireblocks among others.

SCB 10X also revealed plans to set up a new US$600 million (approximately 19.8 billion baht) venture capital fund, with Charoen Pokphand Group (CP) to invest in disruptive technologies such as blockchain, digital assets, fintech, and other technologies with high growth potential worldwide.

The new fund is currently going through regulatory approval.

Dr. Arak Sutivong

Dr. Arak Sutivong, Siam Commercial Bank’s President and SCB 10X’s CEO said,

“SCB 10X focuses on investing in new businesses driven by digital technology, either on its own or in collaboration with strategic partners.

SCB 10X’s investment in high-potential tech companies and startups around the world will help the SCB Group bridge and build a global network of technology alliances. ”

Mukaya Panich

Mukaya Panich, Chief Venture and Investment Officer of SCB 10X said,

“As part of its “Moonshot Mission” to create long-term value through investing in high potential tech startups globally, SCB 10X focuses our investments on disruptive technologies, such as fintech, Blockchain-related to financial services, digital assets and Web 3.0.

We have invested in over 40 high-growth tech startups around the world. In addition to venture capital funding, SCB 10X has also participated in strategic investments with partners to bring their technological capabilities to build businesses for the financial world of the future. “